Morsa Images/E+ via Getty Images

Co-produced with Beyond Saving

In 2020, we saw an influx of new investors into the stock markets. The combination of staying home and getting stimulus checks had inspired many to start investing. People who had never invested a single dollar were suddenly experimenting. Neighbors and relatives who hadn’t shown the slightest interest in my work were suddenly asking me for stock picks.

We saw the rise of “meme” investing and the “Reddit” crowd passing along stock tips. The stocks that became popular would soar in price, well beyond any reasonable value. If you were able to pick which stock would be the next big meme and pushed by Wall Street Bets, you could make incredible returns.

People are often attracted to “get rich quick” schemes. They want to make a lot of money, they want to make it tomorrow and they want it to be easy. This is why the lottery is able to generate so much revenue. The fantasy of waking up one day a multi-millionaire, rich beyond your wildest dreams, is seductive. It is also a fantasy – most people who try to “get rich quick,” go broke quicker.

I’ve heard many people comparing the stock market to “a casino.” If it feels like a casino, you aren’t investing. Let’s take a look at some common mistakes that newer investors make, and how to avoid them.

Mistake #1: Swinging For The Fences

Most of us have been there. The stock market can be an addicting place, and that first time you get a massive return in a short period, it just makes you want to do it again.

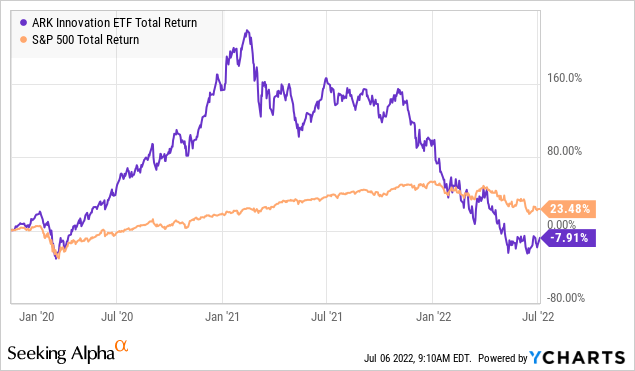

We saw a lot of this in the past couple of years as investments with very weak fundamentals shot up in price. Investors would pile into the newest cryptocurrencies, looking to “strike it rich.” Companies with little to no earnings would shoot up to nosebleed valuations. Anything that was considered “innovative” was bought blindly.

The thing about swinging for home runs is that a lot of those fly balls come back to earth.

This isn’t the first time I’ve seen this happen, and it won’t be the last. Investors are attracted to “outsized returns” like moths to a flame. In the short term, they look brilliant, some of them might even manage to walk away realizing large gains, but most get burned.

In the long run, slow and steady wins the race. Your goal with a particular investment should be reasonable. Don’t expect 100% returns every year, it isn’t going to happen. In the long run, the S&P 500 has a CAGR (compound annual growth rate) of around 9%.

Maybe you want to have a few home-run swings in your portfolio, and that is fine. However, make sure your portfolio is also hitting a lot of singles and doubles.

Mistake #2: Not Doing Due Diligence

Behind every stock ticker, is a company. That company does something and is either earning a profit or not. That company will either earn more in the future, or it won’t.

Many investors were buying companies without understanding what the company did, what its balance sheet looked like, or what its plan was. Is the company making a profit? Is it likely to make a profit in the future?

Investing without knowing these things is like throwing darts at a wall of names and just buying it. In the short term, whether a company is making money or not often does not matter. I’ve seen share prices of companies that never made a penny rocketing up. In the long run, profits are the only thing that matters. Either earnings will catch up with the valuation or the valuation will come down to earnings.

Often, some of the best opportunities in the market are found when earnings are going higher, but the price of the stock is falling anyway.

Mistake #3: Not Having Patience

Patience is a virtue, but it is one that investors don’t foster enough. Good investing is like watching paint dry. You buy companies that are undervalued, and then you have to wait. Sometimes, you have to wait for a long time. There is nothing special about your buy. The market isn’t going to suddenly realize that the stock you bought is a great deal and bid it up just because you bought it. The price might even keep going down.

If you own good companies that are producing higher earnings, the share price will eventually rise. For the same reason, poor companies that are not producing earnings and have no prospect of producing earnings will eventually fall.

When prices fall, I hear a lot of investors saying things like “That’s it, this stock does nothing but go down, I’m selling.” Even if the earnings for the company are going up, they will sell it at a loss.

Now, sometimes it is necessary to sell at a loss, yet every sale should be for a reason. Is the company earning less than you expected? Has something changed to make you believe it will earn less in the future? These are good reasons to sell.

Selling simply because the price has fallen is often jumping from the frying pan into the fire. They will sell something that has fallen, and then buy something different. Only to see the price of the new investment falling!

In the long run, the market trends upward. Most sectors will trend upwards. The economy will be larger in the future than it is today, and you should want to own more of it. Even recessions become mere blips in the big picture.

We Have All Been There

You have probably made these mistakes. Maybe you are still making them, that is ok. We all have. It is so easy to get wrapped up in the emotions of the market. Especially if you are following the day-to-day drama.

If you spend time on the internet reading up on stocks, you are inundated with advertisements for stock picks that are sure to go up 300%! There is no shortage of people who are happy to announce they are up 40% in a down market. You too can easily “beat the market” with their system!

Investors are systematically encouraged to focus on short-term returns. If a stock underperforms the market averages, they believe there must be “something wrong” with the company.

As a result, most retail investors trade too much. They will often buy or sell based on the price action, rather than the fundamentals of the underlying company.

Stop Running In Circles

Too many investors have portfolios that look like the old cartoons of the rabbit trying to steal cereal from the kids. There is a lot of action as they trade in and out. They celebrate their unrealized gains and despair over their unrealized losses. They sell, unnecessarily locking in those returns. They are tied to their cell phones, constantly watching, worrying, and sweating over the market. Trying to chase the crowd, and all too often finding out they are the one holding the bag as prices crash, or the sucker who sold right before the price took off. Then at the end of the day, they have nothing to show for it. Yet even as most investors fail to “beat the market,” they keep running in circles trying only to be foiled again and again. Just like the rabbit, they never learn.

My focus isn’t on beating the market. Sometimes I do, other times I don’t, it isn’t a particularly relevant metric for me. I can’t tell you what number the S&P 500 index will be at next month, and I don’t care.

Focus On The Dividends

Instead of worrying about what other folks are paying for stocks, I focus on the companies. I buy companies that make profits, if a company isn’t generating profits, then I don’t need it. Furthermore, I only buy companies that share a portion of those profits with shareholders. These are called dividends.

I’ve always been a bit mystified at the people who are tripping all over themselves to buy shares in companies that are hoarding all the money for themselves. Yet some of the most popular investments are companies that are not paying a penny and are unlikely to ever pay a dividend. This means that the only way you can profit from holding it is by finding a buyer who will pay more than you did for an asset that pays nothing to shareholders.

My portfolio is full of companies that pay me on a regular basis. Some pay quarterly, others pay monthly, some pay a fixed amount, and others pay a variable amount. All of them pay me a portion of their profits. I don’t need to care what the share prices will be next month, next quarter, or even next year. All I need to do is focus on the company, keep an eye on their financials and determine whether that company will be able to continue paying me.

Over the years, the vast majority of my total returns have come from dividends. Cash, deposited into my account, is mine to do with as I please. I don’t chase after the market. I let it run in its circles, and eventually, it will find its way to me. I don’t chase capital gains, I simply realize them when the market gives me an offer I can’t refuse.

Shutterstock

Silly Market, Dividends Are For Adults!

Some people like the mayhem. They like to treat the market as a casino, swinging for big multi-bagger returns and are fine with the reality that most of those swings are misses. Some people like trading every day, trying to squeeze out small returns off of short-term price movements, if that is you, enjoy it. I suggest doing so only with the money that you can afford to lose. Maybe you will be part of that small percentage that strikes it big. If taking that shot excites you, go for it. Do it with the same money you might consider bringing to the casino.

When it comes to your retirement, it’s time to be more conservative. In retirement, you don’t need a portfolio with huge paper gains. What you need is a steady, reliable stream of income that is providing enough for you to meet your needs. You need to have a lot of confidence that your income stream will be enough to meet your needs today, tomorrow, next year, and in 10 years.

This is why I focus on income and focus on building it up one dividend at a time. As the market decides to throw its fits and run in circles, I don’t have to chase it around. I can sit back, knowing with confidence that the companies I invested in are still producing profits and are still passing those profits along to me. In time, the market will recover and will go on to reach new highs. When it does, I won’t have sold a share. Instead, I will own even more shares in the companies that are paying me to own them!

Look at the S&P over the years, and remember that during each one of those dips in the past investors were panicking. They were selling – a dip can only happen if investors are selling. In the big picture, you can see that in every single one of those cases, selling was a huge mistake. The market bounced back even higher!

Through every single one of these dips, I sat back and collected my dividends. Using a portion of them to buy more shares as the market fell around me and my colleagues ran in circles.

This time is no different. I’m buying with the confidence that in time the market will come back and will go on to reach even higher highs. As I watch others fear that it “might get worse”, they run to cash, selling their ownership of the U.S. economy. They are selling their stake in the greatest wealth generator in the history of mankind!

It so much reminds me of that rabbit, always trying to grasp what always slipped from his reach.

All I can do is think to myself:

Silly Market, dividends are for adults.

Be the first to comment