Black_Kira

Sigma Lithium (NASDAQ:SGML) is a Canadian-headquartered lithium producer focused on developing a spodumene mine in Brazil. The company is near to commissioning its first mine in the late fourth quarter of this year. The company’s shares are still incredibly cheap relative to its expected net income once the mine begins producing. Additionally, Sigma Lithium has a strong pipeline of future growth as it expands production and examines its other properties.

Project Overview and Timeline

Sigma Lithium is a near-term lithium producer with interests in four properties. The company is currently focusing on its Groto do Cirilo property and working to bring it to production.

According to the company’s most recent estimates, it could be producing 531,000 tonnes per annum (tpa) of lithium between phases 1 and 2, for a mine life of 13 years. Additionally, the company’s most recent update points to phase 3 production –a Preliminary Economic Assessment of the potential of phase 3 is expected in the early third quarter.

Phase 1 production is expected to begin in the fourth quarter of 2022 or the first quarter of 2023 at a level of around 270,000 tpa. The company will then work on expanding to phase 2 production, tentatively beginning in 2024. The cost of phase 1 development is more than fully covered by the company’s cash balance of $112 million as of March.

Phase 2 could potentially be covered by the free cash flow from phase 1 production, but the April conference call also suggested that debt or equity could be employed to raise the projected $75.7 million needed:

We still have the debt as an extra financing tool, because we plan to release equity to potentially initiate Phase 2 on equity, if feasibility for Phase 2 warrants.

In addition to this current development project, the company has future growth potential with its other formerly producing mines and mineral interests in the region.

So What Exactly is Sigma Lithium Producing?

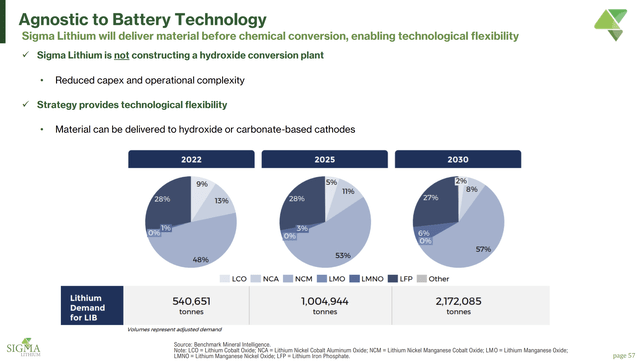

Well, it might be a bit confusing if you’ve just glanced at the company’s presentations. They give prices for “LOM lithium concentrate” (sometimes specified at “Li2O Battery-Grade Lithium Concentrate”), lithium carbonate (LCE), and lithium hydroxide (which is used to project future prices for concentrate also). This page from the company’s July presentation appears to offer some clarity, stating that the company is “not constructing a hydroxide conversion plant”:

Sigma Lithium July Presentation

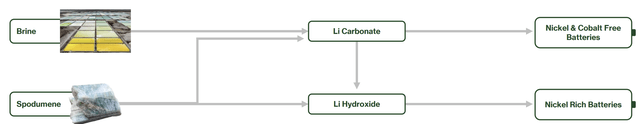

However, that phrasing doesn’t rule out a lithium carbonate final product. As the next slide helpfully reminds us, lithium carbonate can be converted into lithium hydroxide.

Sigma Lithium July Presentation

However, upon close examination of company documents and a careful reading of the April conference call transcript (which also gives LCE equivalents), it becomes apparent that the company is mining spodumene to produce lithium concentrate. The quality of Sigma Lithium’s deposit is high according to the company’s reports—but as the conference call mentions, there’s no premium for 6% versus 5.5% concentrate (in fact, the company’s most recent 270k tpa projections assume 5.5%).

So, I’ll answer another question. The optionality to selling 242 at 6%, it’s strength already, at 6% to be clear. And then 265 or 5.2%, how much extra worker cost, zero work, zero costs, map. It’s essentially addressed in the DMS and this is why we brought it up. Today in Australia, the producers are shipping 5.2, 5.5, that has become a standard. So, we want to highlight that we’re doing the math from 6%, even though the clients are saying send us more material to lower lithium oxide content, which is kind of what’s going on in Australia. There’s no premium for quality.

That additional production can also be attained for “Zero additional costs” according to the company’s management, hence the projections for varying levels of production in their presentations at different quality levels. In the end, what percentage concentration the mine ends up shipping will depend on the off-take agreements and how those final negotiations solidify (the company still has to negotiate the price at the time of shipping).

How Profitable Will Sigma Lithium Be?

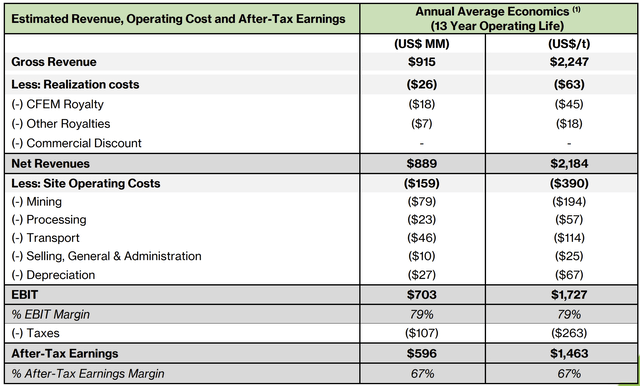

Well, to figure out how profitable Sigma Lithium is likely to be, we need to first figure out the company’s cost of production. Their cash cost of production per tonne is $340, but that doesn’t quite capture the full picture. The company’s realization + operating costs per tonne are around $453 per tonne, plus tax, according to this chart recently provided by the company.

Sigma Lithium July Presentation

If we conservatively assume $300 per tonne in taxes, that brings the total cost of production per tonne to around $753—still low by industry standards and perhaps an overestimate since we lack specific tax details. The company will also have a higher free cash flow (functionally debt free so far!) since this figure includes several non-cash costs.

So, if we have the cost of production, how much will that concentrate be selling for? The company itself has been using a projection of around $2,247 per tonne. But that seems way lower than what miners are achieving for their current production.

From a recent auction by Pilbara Minerals (OTCPK:PILBF) for its lithium concentrate, we can see prices are currently around triple what Sigma Lithium is using for its projections. Demand is also clearly high, with 41 bids placed in a 30-minute window.

The lithium miner said its latest spot cargo auction for 5000 dry metric tonnes of spodumene concentrate from its Pilgangoora operations south of Port Hedland had achieved a price of $US6841 a tonne.

“Strong interest continues to be received in both participation and bidding by a broad range of qualified buyers with a total of 41 bids received online during the 30-minute auction window,” the company said.

The price secured on the company’s digital battery material exchange platform on Wednesday afternoon was slightly lower than the record price of $US7017 reach in the previous auction late last month.

(emphasis by author)

Similarly high prices have been recorded elsewhere, with Allkem Limited (OTCPK:OROCF) earning an average price of $4,992 per tonne for its 5.4% spodumene concentrate this past quarter. SMM data reported an average spot price for spodumene concentrate of $5,000 per tonne in China.

Though I think these prices may still hold for the next few quarters as supply remains tight and demand remains high, they may fall some before Sigma Lithium’s production begins in the fourth quarter. Even then, I think the company will earn well above its projected price for at least 2023. Perhaps around $4,000 per tonne on average.

The company may not quite reach the full phase 1 level of production of 270,000 tonnes for 2023, given that production will be just ramping up and there could yet be a few hiccups. But assuming that they do, the company is looking at massive revenue (not that 10% less would not still be an enormous sum).

|

Spodumene Concentrate Price ($/tonne) |

Sigma Lithium 2023 Revenue |

Sigma Lithium 2023 Net Income |

|

$2000 |

$540 million |

$336.69 million |

|

$3000 |

$810 million |

$606.69 million |

|

$4000 |

$1.08 billion |

$876.69 million |

|

$5000 |

$1.35 billion |

$1.15 billion |

As we can see, even at the $2,000 per tonne level, Sigma Lithium could post net income of $336 million—equivalent to $3.34 per share based on current shares outstanding.

Insider and Institutional Ownership Analysis

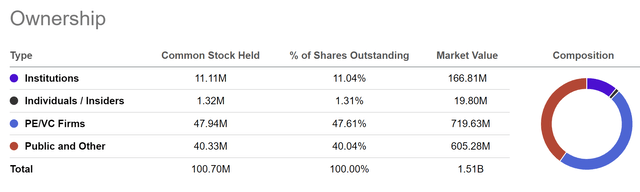

Sigma Lithium has extremely high insider ownership and very low institutional ownership. This might be slightly confusing if you’ve only looked at Seeking Alpha’s Ownership graph for the company that reflects a very high PE/VC share.

Seeking Alpha

However, that private equity share is really insider ownership through A10 Investimentos (five out of six partners at A10 are in Sigma Lithium’s corporate office, including co-CEO Ana Cabral). With around 48% insider ownership, there is clearly a strong alignment between shareholders’ and managers’ interests.

As for institutional ownership, despite the attractive financial picture, few funds or institutional investors have yet taken a bite out of Sigma Lithium.

Compared to other near-term lithium producers like Lithium Americas (LAC), Sigma Lithium clearly has the potential to attract vastly more institutional investors and simply has yet to do so. Lithium Americas has 360 institutions holding shares whereas Sigma Lithium has 40. Sigma Lithium is also only held by four mutual/index funds while Lithium Americas is in more than a dozen.

There is one fund that has both companies roughly equally weighted at ~$10 million—Invesco ETF Tr-Invesco WilderHill Clean Energy ETF (PBW). If a few other funds decide to bring Sigma Lithium into their portfolio, that could be a significant boon to shares. And that could be catalyzed by commissioning in the fourth quarter, followed by a solid earnings report in the first quarter of 2023.

Risks

There are several risks to Sigma Lithium, but with the construction of its processing plant and mine commissioning so far along, none of the risks seem to outweigh the upside. One of the main risks that could wipe out some value in Sigma Lithium’s shares would be if the company fails to execute the commissioning of the plant on time. Given the recent construction update, this seems unlikely, but with Omicron BA.5 soaring and supply chains remaining snarled, delays could yet occur.

The announcement of Brazil loosening export controls on lithium was positively portrayed by the company (though it doesn’t seem to have a huge effect on Sigma Lithium itself). However, this was announced via unilateral executive order by President Bolsonaro. With upcoming elections in October, that polls suggest Bolsonaro will lose, markets may react negatively to the re-election of Lula de Silva given similar reactions to even moderately left-leaning South American heads of state within the past year.

The company is also obviously exposed to any downside in lithium prices. While not an imminent risk, if a recession materializes (some might say it is already here), clean energy plans could be cut back on and demand for lithium may fall, bringing the price per tonne down with it. However, in the long-term, a transition to EVs and renewable energy that requires lithium for battery storage solutions (-ion or otherwise) seems largely inevitable given the current capital invested and government incentives provided. Additionally, Sigma Lithium’s offtake agreements offer some security in being able to sell its production.

Valuation

Sigma Lithium has very strong upside potential. Using our most conservative projection for 2023 earnings, the company could still bring in $3.34 per share for a current valuation of only 4.5 times forward earnings. I think that we can assume with some safety that the company will achieve at least $3,000 per tonne in 2023. At that level, Sigma Lithium’s earnings per share for the year will be $6.03 for a P/E ratio of 2.5. This makes shares extraordinarily cheap given that we are only six months away from beginning production. Once the income starts rolling in, I think Sigma Lithium could easily be valued at 8-10x earnings (and that’s even below other lithium names like Albemarle’s (ALB) five-year average PE of 27.7). At 8 times 2023 earnings, Sigma Lithium would be valued at $48 per share—for an upside of 220%. And that’s just the near-term, Sigma Lithium has much more potential based on phase 2 and 3 growth.

Conclusion

Sigma Lithium has immense and underappreciated potential based on a production target in the first quarter of 2023. The company has shown excellent execution so far. Lithium prices are far and above the levels used in the projections for Sigma Lithium’s mine and will make the company immensely profitable from the first tonne offloaded, especially given the company’s low cost of production. High insider and low institutional ownership mean that management is aligned with shareholders and there is a lot of money to drive shares higher that is still on the sidelines. Overall, Sigma Lithium is a very attractive play on the lithium super cycle and energy transition that has clear near-term catalysts preparing to unlock value for shareholders.

Be the first to comment