jetcityimage

Siemens Healthineers (OTCPK:SEMHF), the leading medical technology (MedTech) supplier for the in vitro and in vivo diagnostic markets, has become the latest to suffer an earnings disappointment due to inflationary cost pressures. Looking past the near-term hiccups, Siemens Healthineers remains a compelling long-term investment, in my view, given its exposure to global structural trends such as aging demographics and rising government spending on healthcare, as well as its presence in high barrier to entry segments in the relatively non-cyclical MedTech industry. Plus, the company looks set to be a key beneficiary of the ramped-up investment cycle in hospitals post-COVID, while its disciplined M&A strategy (e.g., the acquisition of Varian) is helping to unlock valuable synergies. With the stock trading at a historical discount despite a strong order book as well, I see ample room for re-rating as the company executes through the transitory headwinds.

Recapping the Mixed Revenue Performance

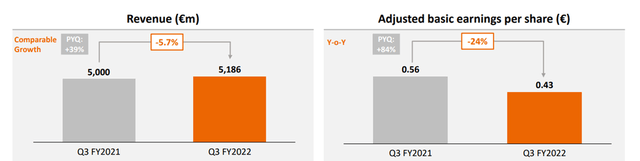

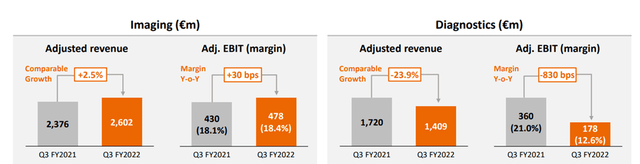

Revenue trends have been a mixed bag for Siemens Healthineers – on the one hand, Q3 2022 saw resilient sales growth of ~4% YoY to EUR5.2bn, but on the other hand, the ~6% YoY organic decline was well below expectations. Of note, this is the first time that the company has reported being constrained by supply chain challenges in its ability to serve customers. Beyond the supply side issues, however, demand trends appear intact, with the order book growth at a strong +16%, reflecting the healthy underlying demand for medical equipment globally. By segment, Imaging organic revenue growth was a muted 2.5%, negatively impacted by the China lockdowns and related supply chain delays. This was offset by healthy demand for Magnetic resonance and strong sales growth numbers at Varian (+8%) and Advanced Therapies (+6%), despite suffering site access delays in China as well.

The biggest revenue disappointment for the quarter, though, was the underlying Diagnostics business (excluding COVID antigen tests), which reported a decline of 24%. This was mainly due to a lockdown-driven decline in antigen testing volumes in China, although even on an ex-antigen basis, sales were still down ~8%. The continued decline in the Diagnostics business is a concern – while fundamentals have improved post-IPO, the path to achieving the mid-term FY25 target looks to be further out than initially anticipated. That said, the benefits from the successful Atellica platform roll-out could be a timely offset to logistics headwinds in the coming quarters.

Margins Disappoint, but There are Silver Linings

In addition to the organic revenue growth decline, the company also posted a steep drop in its adj EBIT margin. While the short-term headwinds were largely anticipated, the extent of the margin decline was a surprise – to recap, adj EBIT margin fell to prior COVID lows at 14.7% (well below the 18.8% in the prior year). The headwinds that affected Q3 2022 margins stood at ~400bps, with roughly half of the impact coming from transitory supply chain challenges due to the China lockdowns, while the other half was due to the resulting decline in antigen test sales. Outside of the Imaging business (+30bps YoY), all other segments reported a YoY margin decline, with Diagnostics leading the way at -8.3%pt YoY, followed by Varian at -3.3%pts YoY, and Advanced Therapies at -1.6%pt YoY.

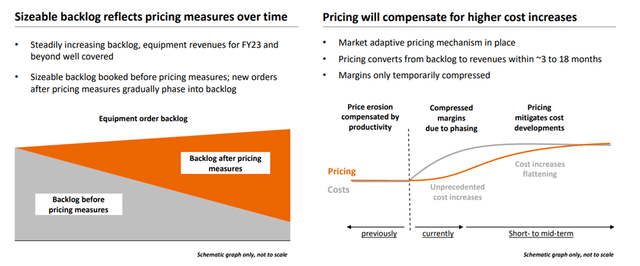

That said, context is important – given the higher book-to-bill ratios at 1.31 in Q3 2022 (vs. 1.18 in Q3 2021) and the wide range of book-to-bill periods (from three to eighteen months), the benefit from price increases takes time to be reflected in the P&L. On the other hand, supply-side headwinds such as higher freight costs and the volatility of materials spot prices, as well as supply chain disruptions, impact margins almost immediately, exacerbating the margin decline. Still, management commentary indicates that pricing within the order backlog has been improving, and this should progressively reduce the margin headwinds heading into the coming year. The outperformance relative to peer Philips is worth noting as well, as Siemens looks to be gaining share in Europe and benefiting from a better product mix despite the quarterly miss.

Puts and Takes from the Updated Guidance

Given the underwhelming results, the reiterated headline guidance for organic revenue growth of 5.5%-7.5% and adj EPS of EUR2.25-2.35 for the full year was a positive outcome. That said, revenue guidance was lowered for the Imaging business (down to 5%-7% from the prior 6%-8%), although antigen sales growth was guided higher at EUR1.5bn (vs. EUR 1.3bn earlier). Margin guidance, on the other end, was cut across the board for Imaging (-100bps), Advanced Therapies (-300 to -400bps), and Varian (-100 to -200bps). The silver lining is that the guidance still implies revenue improvements in Q4 2022, supported by expectations for another quarter of strong order intake in the coming quarter. As management also has the option of pricing up the new order intake to pass through any inflationary cost pressures, I see a clear path to an eventual recovery.

The operating leverage from a growth recovery should help margins as well. Despite the recent guide down, the Imaging segment EBIT margin is positioned to deliver meaningful improvements in Q4 and should eventually regain the prior year’s level. Despite a weak margin this time around, delayed revenues should be a tailwind for Varian in Q3 as well, keeping the business well on track to reach the FY22 guidance of EUR2.9-3.1bn. Varian’s surprisingly robust growth numbers, despite the headwinds, bode well for the coming quarters, particularly as cross-selling synergies also start to kick in. Additionally, COVID antigen test tailwinds add further earnings support over the winter months, while the near-term margin pressure from external headwinds seems unlikely to detract from a compelling long-term investment case. Thus, my FY23 base case remains for a more robust supply chain backdrop and no further lockdowns in China, supporting a further margin improvement on the path to Siemens’ mid-term targets.

Looking Through the Short-Term Headwinds

Siemens Healthineers’ earnings report may have fallen short but this was largely in line with the industry, as a perfect storm of challenges such as the prolonged China lockdowns, increased spot prices of key materials, and high freight costs all weighed on earnings. While these near-term headwinds are material, the company has the pricing power to offset these impacts – even if its price increases take time to translate to P&L gains due to its longer product order cycles. In the meantime, the resilient Imaging and Diagnostics segments should support profitability, while the successful integration of the Varian acquisition should unlock incremental synergies.

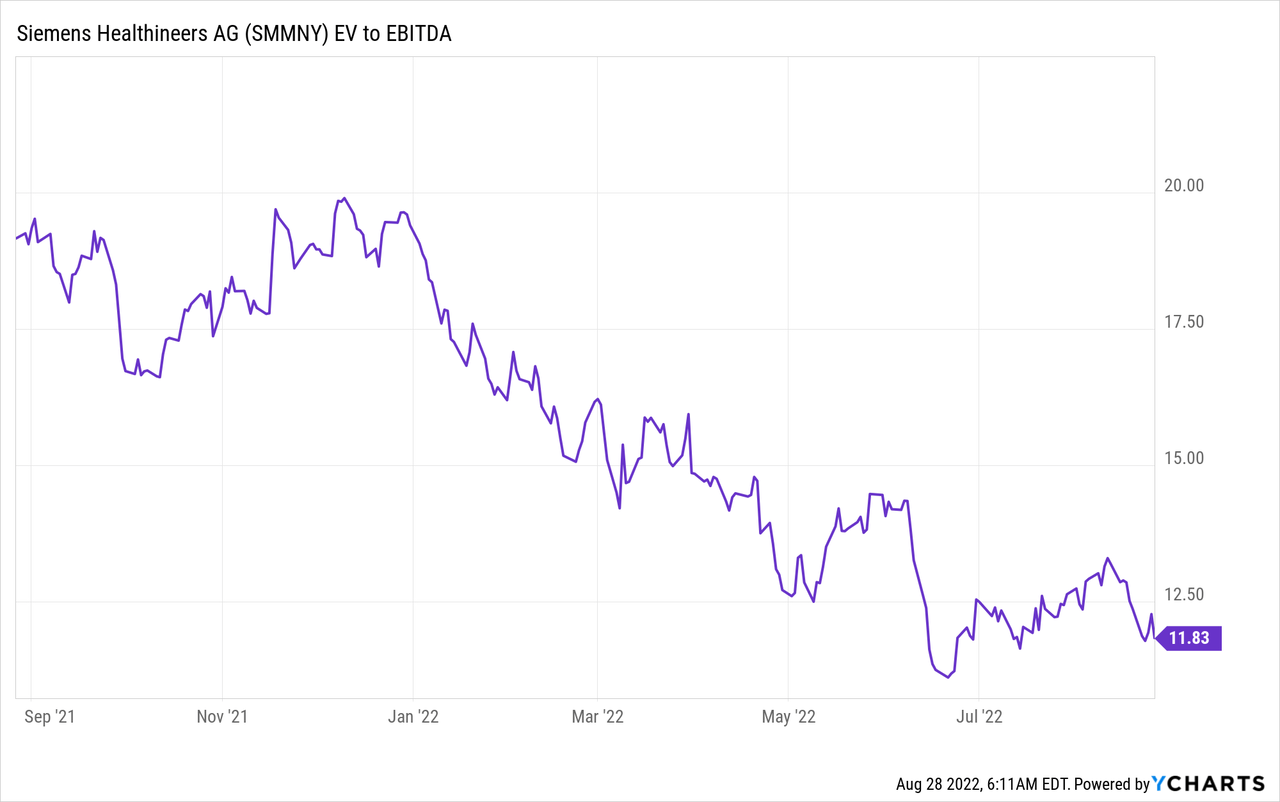

Net, the long-term investment case remains compelling, as the company is as well-positioned as ever to capitalize on secular megatrends such as aging demographics in developed markets and increased healthcare spending. The stock currently trades at a discounted EV/EBITDA of 11-12x, which strikes me as unwarranted given the strong order book and incremental upside potential from Varian. With the company also still on track to achieve its mid-term targets (12-15% adj. EPS growth through FY25), I see a clear re-rating path from here.

Be the first to comment