Baris-Ozer

Rising interest rates have led to capital losses for bond and bond fund investors in the past, but present something of an opportunity moving forward. I thought of a strategy to capitalize on rising interest rates which seems particularly compelling for long-term dividend and dividend growth investors.

Some context first.

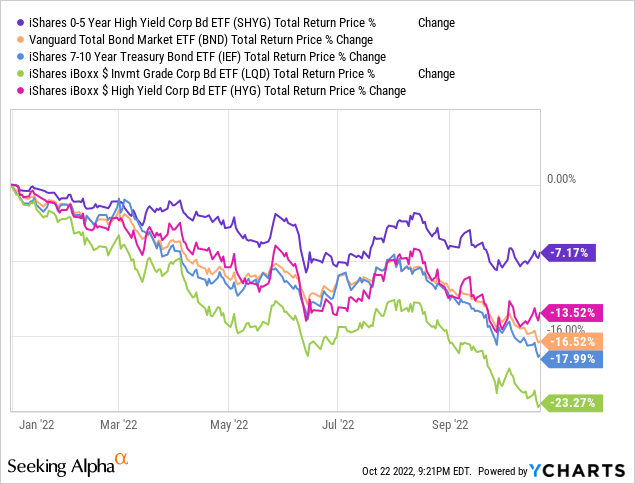

Higher interest rates lead to lower bond fund share prices.

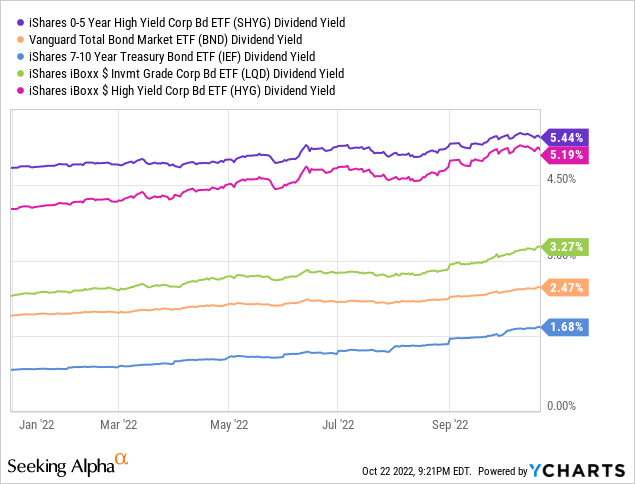

Higher interest rates lead to higher bond fund dividends.

As rates rise, bond fund investors can leverage their strong, growing dividends by reinvesting them in their bond funds at lower share prices, leading to outsized dividend growth. The more prices drop, the more dividends investors receive, leading to even greater dividend growth. Very few investments will provide you with growing dividends as asset prices drop, but bond funds do, at least under current economic conditions.

Thought to do an analysis of what investors can expect from following this strategy, using the iShares 0-5 Year High Yield Corporate Bond ETF (NYSEARCA:SHYG) as an example.

The strategy would have led to +50% dividend growth last time rates rose, from 2014 to 2017.

The strategy could, potentially, lead to dividend growth upwards of 100% during the current hiking cycle, although results are strongly dependent on future interest rate movements.

SHYG currently yields 5.4%, so reaching double-digit yield on costs in a couple of years seems doable, contingent on interest rates remaining elevated.

The strategy is more effective for higher-yielding, shorter-term ETFs, less so for lower-yielding, longer-term funds, as well as CEFs. SHYG seemed liked the best fund to try this out, due to its focus on short-term high-yield corporate bonds. Still, the strategy should prove reasonably effective for most bond funds.

SHYG – Quick Overview

SHYG is a simple short-term high-yield corporate bond index ETF.

SHYG focuses on short-term bonds, with low maturity, duration, and interest rate risk. Expect below-average losses during a rising rates environment, as has been the case YTD.

SHYG focuses on high-yield corporate bonds, leading to an above-average 5.4% dividend yield.

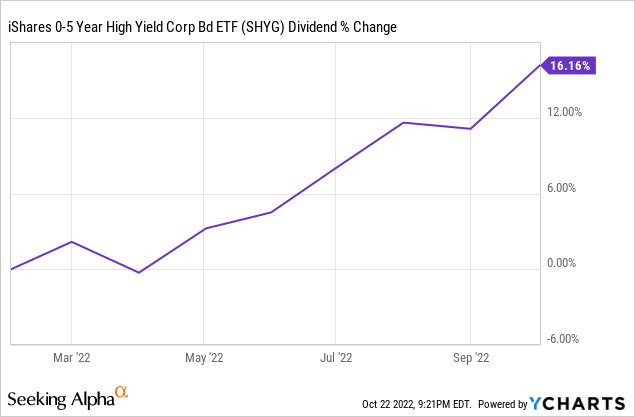

SHYG’s dividends have seen strong growth YTD, as higher interest rates lead to higher bond yields.

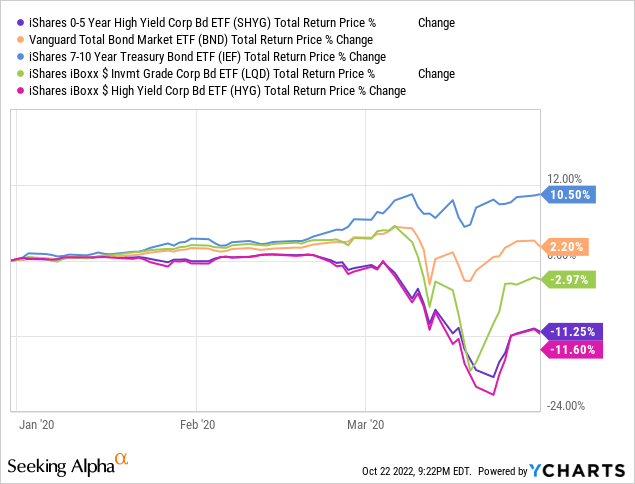

SHYG’s holdings are relatively risky, and so see above-average losses during downturns and recessions. This was last the case during 1Q2020, the onset of the coronavirus pandemic.

I’ve covered SHYG in more detail here. Let’s now have a look at the aforementioned bond dividend re-investment strategy.

Bond Dividend Reinvestment Strategy Overview

Some context first.

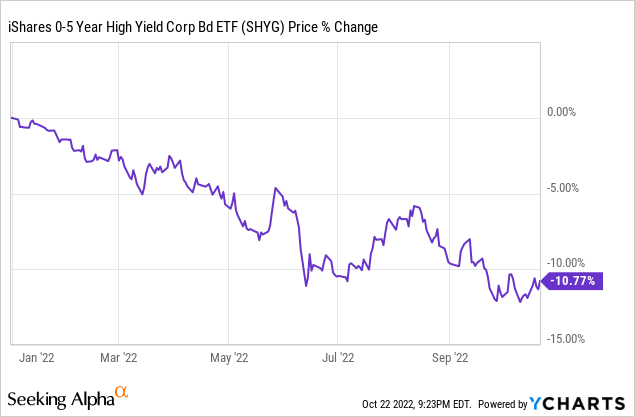

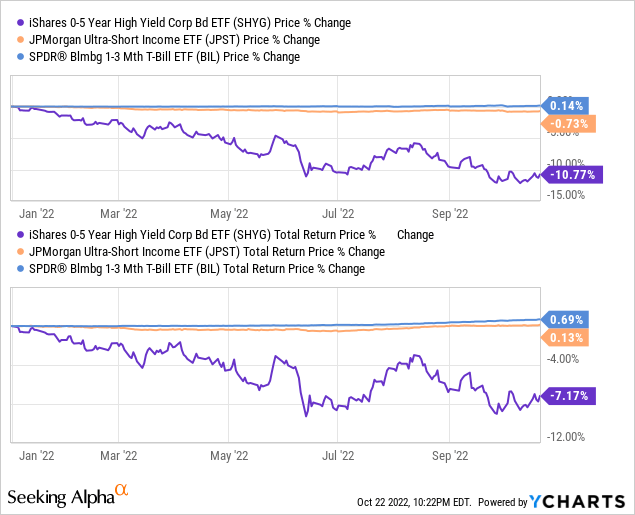

Higher interest rates lead to lower bond fund share prices, as measured by duration. SHYG’s share price has declined 10.8% YTD, a period of rising interest rates, as expected.

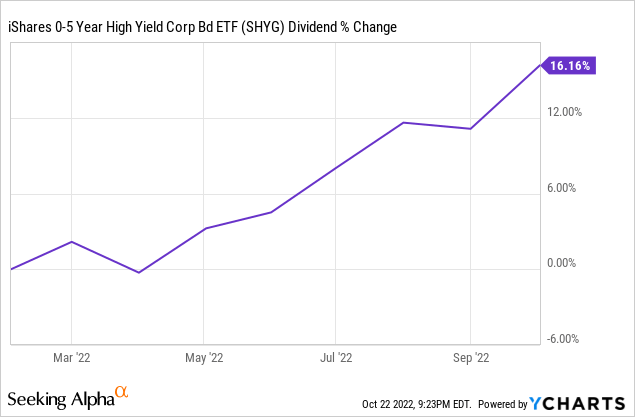

Higher interest rates lead to higher yields on newly issued bonds, and on rising dividends for bond funds. It can take years for the entire process to play out, but effects should be noticeable in a couple of months. SHYG’s dividends have grown 16.2% YTD, a period of rising interest rates, as expected.

The situation above presents a very clear, compelling investment strategy: reinvest your growing dividends in an asset with declining prices, turbocharging dividend growth. The more prices drop the more dividends you receive, leading to even greater dividend growth.

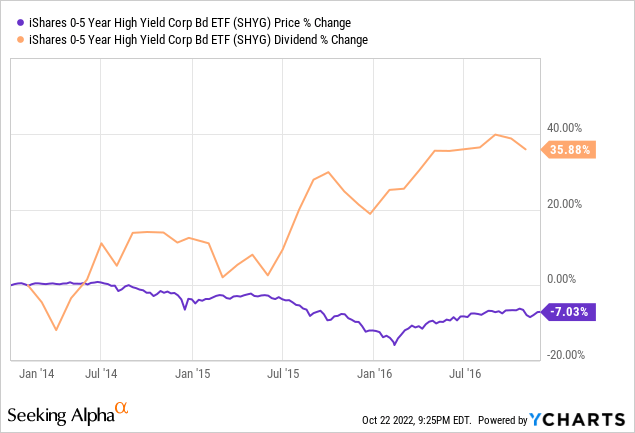

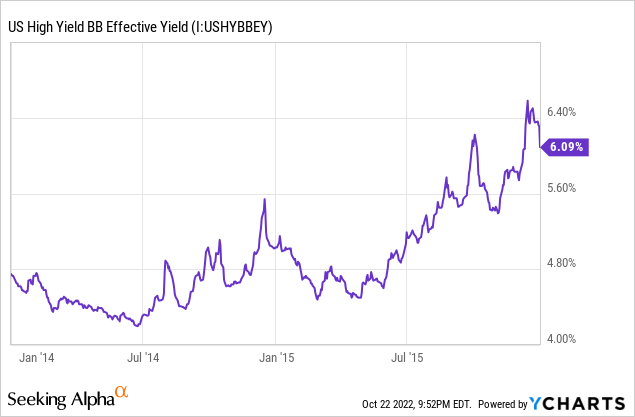

Let’s estimate the exact magnitude of dividend growth that investors might expect from following said strategy. I’ll start by analyzing the last time interest rates rose, as that rate cycle has since finished, so we can more accurately analyse / estimate the impact of the strategy from start to finish. High-yield corporate bond interest rates last rose from early 2014 to mid-2016, stabilizing in late 2016. SHYG’s dividends grew while its share price decreased during said time period, as expected.

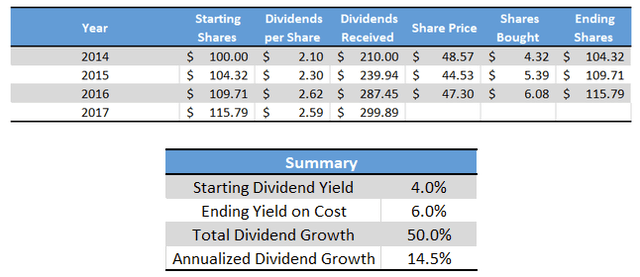

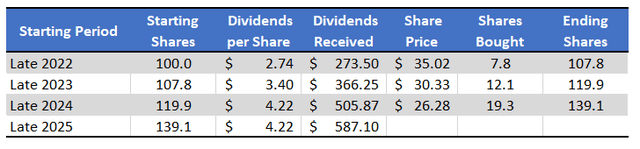

Assuming an investor in SHYG had re-invested their yearly dividends at year’s end from 2014 to 2016, they would have seen dividend growth of around 50%. Slightly over half of that growth was organic, product of rising interest rates. Slightly less than half of that growth was due to re-investing the dividends at comparatively low prices. A quick summary of the results is as follows. I assumed an initial investment of 100 shares, to simplify the math.

Seeking Alpha – Chart and Calculations by Author

Expected dividend growth from the current rate cycle hike is a bit more difficult to estimate, as conditions remain in flux. Still, one can analyze the situation, and make some educated guesses.

High-yield corporate bond yields rose by about 1.3% last cycle, from 4.8% to 6.1%.

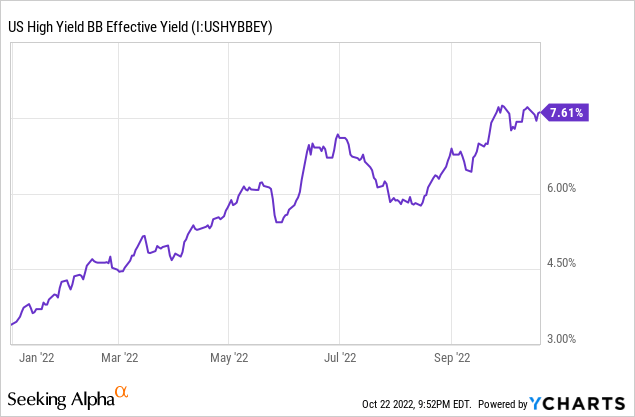

High-yield corporate bond yields have risen by about 4.2% YTD, from 3.4% to 7.6%.

Recent interest rate increases have been much more aggressive than those in the past, which should lead to even stronger dividend growth.

Interest rates have risen by about three times as much YTD as they did from early 2014 to mid-2016. Assuming dividend growth follows a similar trajectory to interest rates, re-investing SHYG’s dividends for the next three years could lead to dividend growth of 150%, a staggering amount. SHYG currently yields 5.44%, so that would lead to a yield on cost of 13.6% in just three years.

The figures above do seem a tad high, but interest rates have rarely risen as much as they have these past few months.

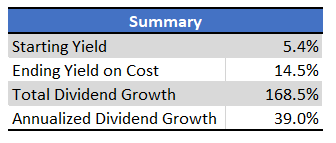

I also estimated the expected dividend growth from following said strategy, assuming SHYG’s dividends grow at their current pace for the next three years, similarly for the fund’s share price. I arrive at an expected dividend growth of 169% in total, or a 39% CAGR. Outstanding results, although contingent on interest rates continuing to increase, and very sensitive to starting conditions.

Seeking Alpha – Chart and calculations by Author Seeking Alpha – Chart and calculations by Author

The strategy seems to work, in theory at least.

Bond Dividend Reinvestment Strategy – Other Considerations

The strategy described above should work for most bond funds, but it should prove more effective for bond funds with certain characteristics. In my opinion, yields, maturity, and structure are the key factors.

The strategy works better for higher yielding bond funds, for obvious reasons. Higher yields mean more dividends, which means greater dividend re-investment, leading to higher dividend growth.

The strategy works better for shorter-bond funds, as these funds quickly replace their older, lower-yielding bonds with newer, higher-yielding alternatives when rates rise.

The strategy works best for ETFs, as these funds tend to distribute any and all income to investors as dividends and nothing else, so issues concerning distribution policies, sustainability, timing, and the like can more or less be ignored. CEFs tend to have managed distribution policies, so investors need to consider these to gauge the effectiveness of the aforementioned bond dividend reinvestment strategy. Most bond ETFs have seen rising dividends YTD, while this has not been the case for most CEFs, so these are very real, very important issues presently.

Bond Dividend Reinvestment Strategy Overview – Risks and Drawbacks

Re-investing a bond fund’s dividends as interest rates rise should lead to significant dividend growth, an important benefit for shareholders. The strategy does have its risks and drawbacks, however.

Chief among these is the simple fact that holding cash or cash alternatives would almost certainly outperform said strategy during a period of rapid interest rate movements, due to reduced capital losses. That has been the case YTD, as expected.

As dividends grow and get reinvested SHYG would start to outperform, but the point above remains.

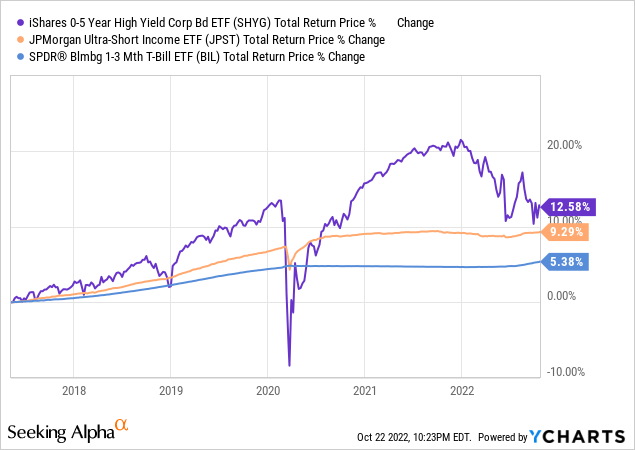

On the other hand, do consider the fact that SHYG would almost certainly outperform cash long-term, as has been the case since the fund’s inception.

A well-timed rotation from cash to higher-yielding bonds would be the best possible strategy to follow, but that is easier said than done.

Second risk to consider when investing in bond funds / re-investing bond fund dividends is credit risk. Higher interest rates lead to higher bond yields and bond fund dividend yields. Higher interest rates also slow down the economy, negatively impacting corporate revenues and earnings. Sufficiently high interest rates would lead to a recession, and to a spate of corporate bond defaults. Bond defaults means reduced / non-existent interest rate payments, leading to lower bond fund dividends. Worsening economic conditions make this a very real, important risk for these funds, and for this strategy. Focusing on investment-grade bond funds would significantly reduce these issues and risks, but yields would also be significantly reduced.

On a more positive note, economic conditions would have to severely worsen before defaults start to outweigh the massive increase in interest rates of the past few months. Worsening economic fundamentals have not led to lower dividends in the recent past either. As long as economic conditions remain, well, better than disastrous, bond funds should see rising dividends from increased interest rates.

Finally, I’ve been assuming that interest rates continue to increase, leading to further bond fund dividend growth. There is no guarantee that this will be the case, as the Federal Reserve might be forced to halt its planned rate hikes if the economy deteriorates faster than expected. Doing so would almost certainly lead to higher bond prices, resulting in higher bond fund share prices, a short-term benefit for investors. The longer-term impact would almost certainly be negative, due to lower dividends and yields.

Conclusion

Rates have risen all year.

Higher interest rates lead to lower bond fund share prices.

Higher interest rates lead to higher bond fund dividends.

Bond fund investors can choose to take advantage of the situation above by re-investing their growing dividends at lower share prices, turbocharging dividend growth. The strategy has been reasonably effective in the past for SHYG and will, I believe, prove effective in the future, for SHYG, and for most other bond funds as well.

Be the first to comment