Morsa Images/DigitalVision via Getty Images

A Quick Take On Shuttle Pharmaceuticals

Shuttle Pharmaceuticals Holdings (SHPH) has filed to raise $14.25 million in an IPO of its common stock, according to an S-1 registration statement.

The biopharma firm is developing treatments that enhance the effectiveness of radiation therapies.

SHPH is thinly capitalized, has no institutional investors, and the IPO appears to be aimed at short-term, retail investors rather than longer-term, quality institutional firms.

My outlook on the IPO is on Hold.

Shuttle Pharma Overview

Rockville, Maryland-based Shuttle was founded to sensitize cancer cells through direct action or through enhancing the body’s immune system.

Management is headed by Chairman and CEO, Anatoly Dritschilo, M.D., who has been with the firm since inception in 2012 and was previously Department Chair at the Georgetown University Medical School

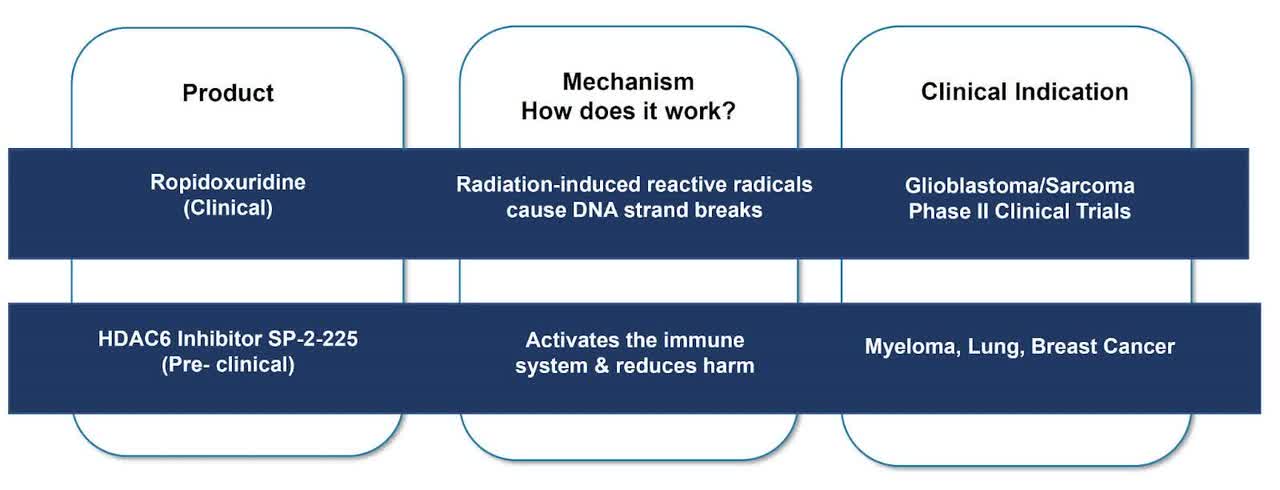

The firm’s lead candidate, Ropidoxuridine, is a small molecule drug that seeks to enter rapidly growing cancer cells after it is metabolized, working to increase their sensitivity to radiation treatment-instigated cell death.

Below is the current status of the company’s drug development pipeline:

Drug Candidate Pipeline (SEC EDGAR)

Shuttle has booked fair market value investment of $4.7 million as of March 31, 2022 from investors including Bayern Capital, Amir F. Hesmatpour and others.

Shuttle’s Market & Competition

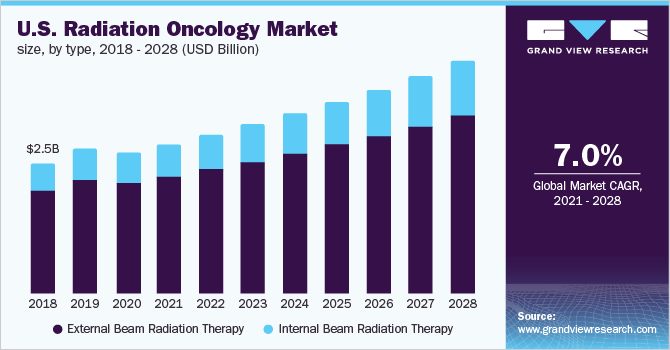

According to a 2021 market research report by Grand View Research, the global market for radiation oncology therapy was an estimated $6.8 billion in 2020 and is forecast to reach $11.7 billion by 2028.

This represents a forecast CAGR (Compounded Annual Growth Rate) of 7.0% from 2021 to 2028. Shuttle’s drug candidates essentially act as pre-treatment adjuvants to radiation therapies.

Key elements driving this expected growth are an increasing incidence of cancer among an aging global population and advancements in cancer detection and radiotherapy equipment and treatment regimens.

Also, below is a chart showing the historical and projected future market trajectory for the U.S. radiation oncology markets:

U.S. Radiation Oncology Market (Grand View Research)

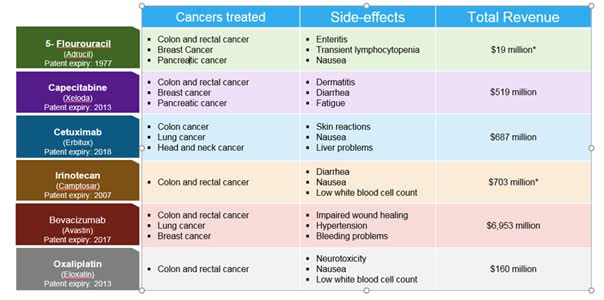

Major competitive drugs that provide or are developing related actions include:

Competitive Drugs (SEC EDGAR)

Shuttle Pharmaceuticals Financial Status

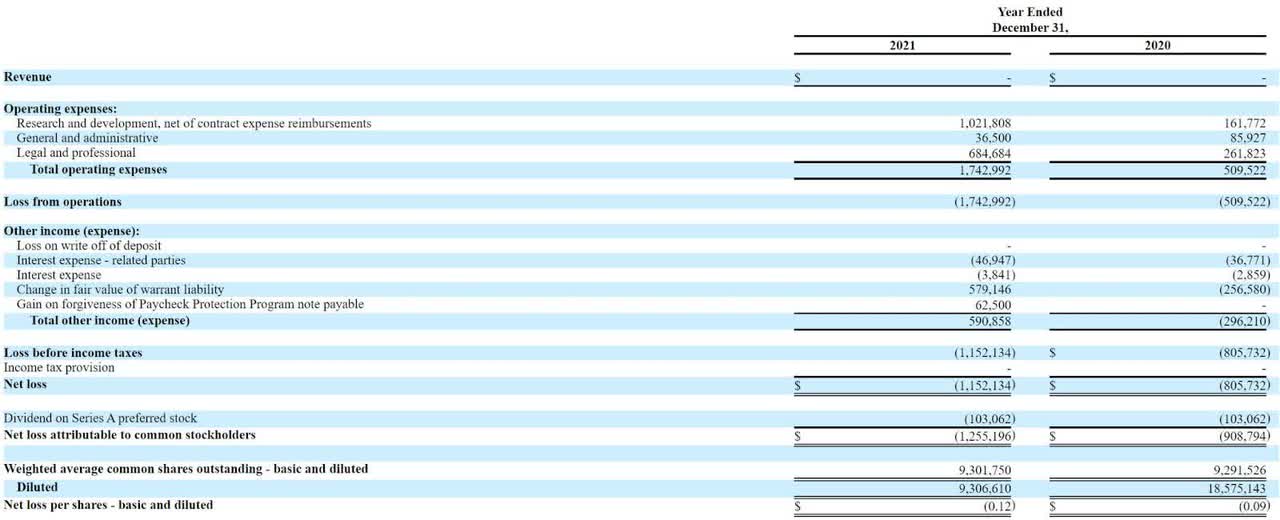

The firm’s recent financial results are typical of a development stage biopharma in that they feature no revenue and material R&D and G&A costs associated with its pipeline development.

Below are the company’s financial results for the past two calendar years:

Statement of Operations (SEC EDGAR)

As of March 31, 2022, the company had $405,857 in cash and $2.4 million in total liabilities.

Shuttle Pharmaceuticals IPO Details

Shuttle intends to raise $14.25 million in gross proceeds from an IPO of its common stock, offering 2.75 million company-owned shares and 250,000 from selling stockholders at a proposed midpoint price of $4.75 per share.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $53 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 22.52%. A figure under 10% is generally considered a ‘low float’ stock, which can be subject to significant price volatility.

Management says it will use the net proceeds from the IPO as follows:

approximately $10 million will be used for product development and operational costs, including the drug manufacturing costs and the costs related to performing the Phase II clinical trials of Ropidoxuridine; and

approximately $5 million will be used to fund drug manufacturing and perform pre-IND testing, obtain IND and initiate Phase I clinicals trials of our selective HDAC6 inhibitor.

We believe that the net proceeds from this offering, together with our existing cash on hand, cash equivalents and investments, will enable us to fund our operations and continued growth and development through at least the next 12 months.

(Source)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says there are no legal proceedings or threats of such against the company.

The sole-listed book runner of the IPO is Boustead Securities.

Commentary About Shuttle’s IPO

SHPH is seeking public investment capital to fund the advancement of its pipeline of radiation treatment enhancement drug candidates.

The firm’s lead candidate, Ropidoxuridine, is a small molecule drug that seeks to enter rapidly growing cancer cells after it is metabolized, working to increase their sensitivity to radiation treatment-instigated cell death.

The market opportunity for radiation therapy is large and expected to grow at a reasonably strong CAGR of 7.0% through 2028, so by extrapolation, demand for radiation enhancing drugs may also grow at a strong rate of growth.

Management has not disclosed any major pharma firm collaboration relationships.

The company’s investor syndicate does not include any well-known institutional venture capital firms or big pharma strategic investors; only private investors and funds from Small Business Innovation Research grants from the National Institutes of Health.

Boustead Securities is the sole underwriter and IPOs led by the firm over the last 12-month period have generated an average return of 3.8% since their IPO. This is an upper-tier performance for all major underwriters during the period.

As for valuation, management is asking investors to pay an Enterprise Value that is well below the past typical range for biopharma firms at IPO.

While I wish SHPH well, the company is thinly capitalized and has no real external validation of its approach by highly regarded institutional VCs or big pharma firms.

Additionally, with the IPO’s proposed pricing at a midpoint of $4.75, it appears management is seeking to attract short-term retail investors rather than a $15.00 share price that is typical of main-line biopharma firms seeking institutional, long-term hold investors.

My outlook on the SHPH is on Hold.

Expected IPO Pricing Date: To be announced.

Be the first to comment