David McNew

Investing in companies that facilitate the long march towards decarbonization now forms one of my most dominant investment strategies. This shift away from fossil fuels looks set to play out over the next decade and has become an intrinsic part of the post-pandemic economic zeitgeist of countries like the US and the UK. Essentially, the climate economy has never looked better from a macro context with valuations also having pulled back markedly year-to-date.

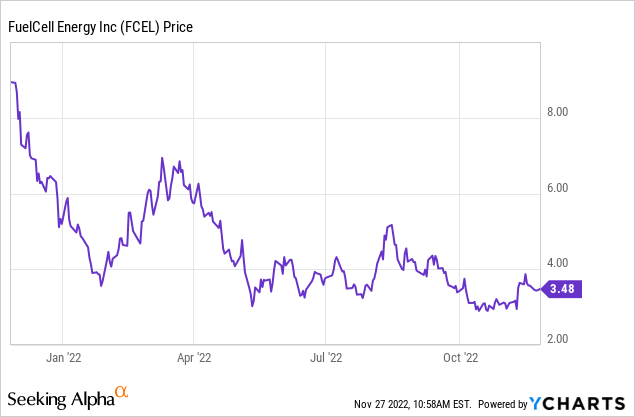

This set the tone for whether an investment in FuelCell Energy (NASDAQ:FCEL), a Danbury, Connecticut-based hydrogen fuel cell company, would be a good move for a climate economy-focused investment strategy. Answering this will focus on three core factors. Firstly, the long-term driver of hydrogen demand growth, the company’s financial health, and then its relative valuation against a 40% year-to-date pullback of its common shares.

The commons are now trading at their lowest level in two years with FuelCell at a market cap of $1.4 billion with around 387.5 million shares outstanding.

The 2022 Inflation Reduction Act

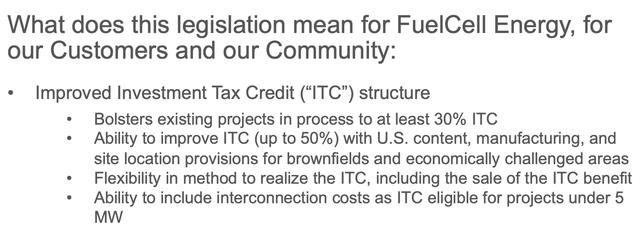

The Inflation Reduction Act will form a core driver of hydrogen demand growth over the next decade. The US government is set to allocate at least $370 billion over the next decade until 2032 to decarbonization initiatives. This will target nearly all parts of the climate economy with subsidies and tax credits. Utility-scale solar and wind energy projects, short and long-duration energy storage systems and EVs are all in the running for money from what Credit Suisse analysts have stated will be entirely uncapped tax credits. The IRA will award credits as long as a project meets its terms.

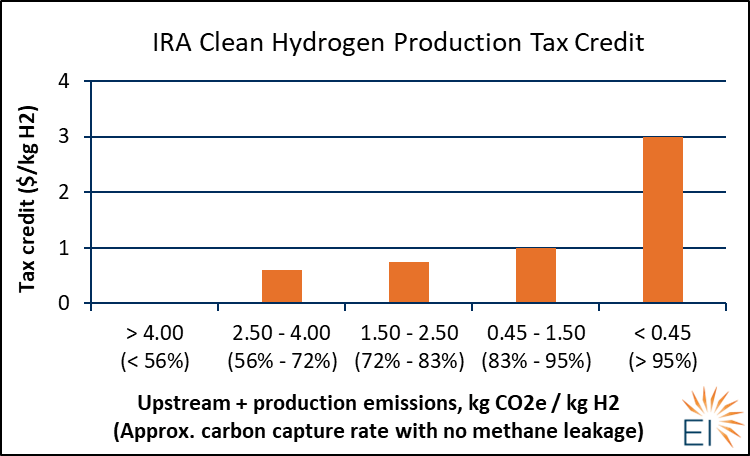

For FuelCell the IRA will bring in a blend of investment and production tax credits. The former will range from 30% to 50% with the upper band reflecting the heavy domestic tilt of the IRA. The latter will apply to clean hydrogen production facilities with production tax credits beginning at $0.60/kg for blue hydrogen production that captures at least half of carbon emissions from steam-methane reforming. It radically rises to $3/kg for green hydrogen.

Utility Dive

There is no upper ceiling, no budget, and no restrictions. Hence, the IRA will quickly form a blank check to the low-emissions industries and the most material climate-focused act likely ever passed by the US government.

Underlying how bullish I am on the climate economy, total spending by the IRA is likely to be 2x the initial estimates at more than $800 billion. Further, when you adjust for the crowding-in of private capital, the total allocated capital investments into the broader climate economy could top $1.7 trillion over the next decade. The Boston Consulting Group has estimated that the IRA’s incentives could indeed increase the deployment of zero-carbon energy to up to 80% of US electricity production by 2030.

The Financials Are A Tough Sell But Valuation More Grounded

The use case of hydrogen has been questioned by bears against the growth of zero-carbon renewable energy and the potential held by small modular reactors. The production of hydrogen consumes energy either from renewables or fossil fuels so its use cases have coalesced around providing long-duration energy storage for excess energy produced from solar and wind projects, heavy-duty trucking, and industrial processes. Critically, LDES helps to partially solve the intermittency of renewables to enable a more stable power grid.

Further, there is potential for hydrogen to be blended with natural gas supplied to the existing public natural gas network. A recently completed pilot in the UK saw 668 houses receive gas with a 20% hydrogen blend. The pilot was successful with no changes required to existing home appliances. This blend could potentially also rise to as much as 23% and opens up the prospect of green hydrogen being used to displace residential natural gas demand.

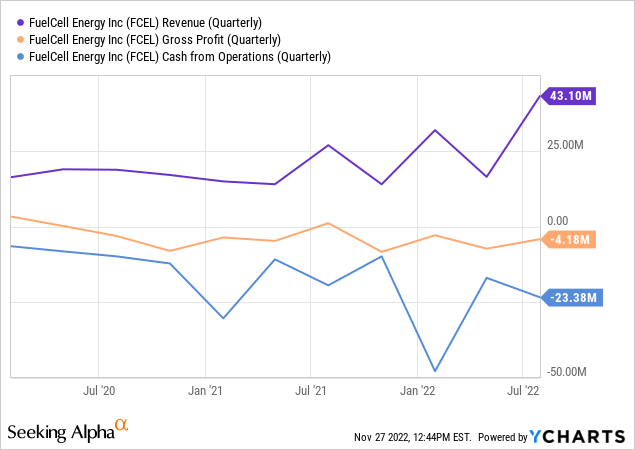

FuelCell last reported earnings for its fiscal 2022 third quarter ending July 31. The company financials were mixed with revenue coming in at $43.10 million, up by 60.8% over the year-ago quarter and a beat by $7.95 million on consensus estimates. Revenue growth during the quarter was driven by product sales with management highlighting sales of six fuel cell modules to Korea Fuel Cell Co.

This wasn’t sufficient to drive a positive gross margin with gross profit during the quarter coming in negative at $4.18 million. The negative gross margin of 9.75% was a material deterioration from a positive gross margin of 4.10% in the year-ago quarter. This also meant the company’s cash burn from operations ramped up to $23.38 million from $17 million in the second quarter. Total free cash outflow during the third quarter was $33.8 million with CapEx at $10.4 million. Not only was this 78% of revenue during the quarter it was also 8x more than the quarter’s negative gross profit. But cash and equivalents at the end of the quarter stood at $456.5 million supported by an at-the-market offering program for up to 95 million shares.

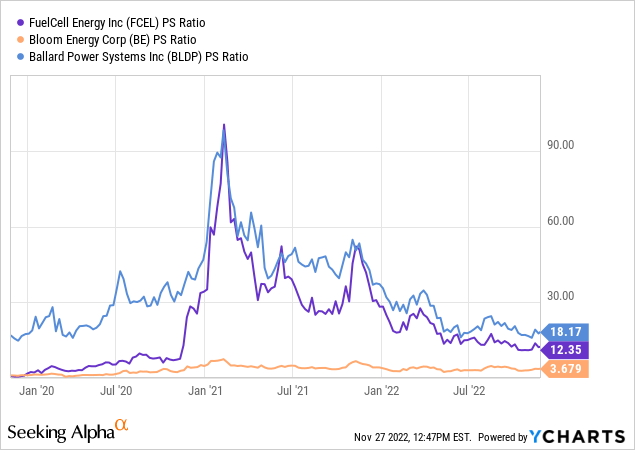

However, some bulls and bears would be right to flag two points in terms of valuation. Firstly, FuelCell is trading at its cheapest since 2020 with a price-to-sales multiple lower than peer Ballard Power (BLDP). The second point is that the company is trading at a double-digit multiple even after the marked destruction 2022 brought to risky assets. This highlights a level of overvaluation and the extent of expectations attached to the hydrogen company and its long-term growth story. As the valuation is far too rich for me to buy shares, FuelCell shouldn’t be considered at this time for your first hydrogen play.

Be the first to comment