urbazon/E+ via Getty Images

Elevator Pitch

Between Shopify Inc. (NYSE:SHOP) and Block, Inc. (SQ), I think that SHOP is the better of the two and warrants a Buy rating. Previously, I wrote about Shopify in a March 10, 2022 article. Subsequently, I also published an article for Block on March 11, 2022. Comparing the two stocks in this latest article, I come to the conclusion that SHOP is a more appealing investment candidate vis-a-vis Block in view of their respective long-term outlooks. Shopify boasts superior expected revenue and earnings growth rates as compared to Block, and the former is more focused and less diversified than the latter in my opinion.

How Are Shopify And Block Different?

Investors often do a comparison of Shopify and Block, because they do compete with each other in promoting their respective POS or Point-Of-Sales systems to merchants. Specifically, it is Block’s B2B payments business, Square, which is in direct competition with Shopify.

How Shopify Compares Itself With Square

Shopify

Where Square Thinks It Is Different From Shopify

Square

The charts above show the key differences between Square and Shopify. As the information provided by both Shopify and Square suggests, they have their own differentiating features. Square does not charge for its POS software, but makes money from transaction fees on payments. On the other hand, Shopify appears to be more focused on the “selling” aspect of POS in terms of offering more sales channels and e-commerce features.

How Have Shopify And Block Stocks Performed?

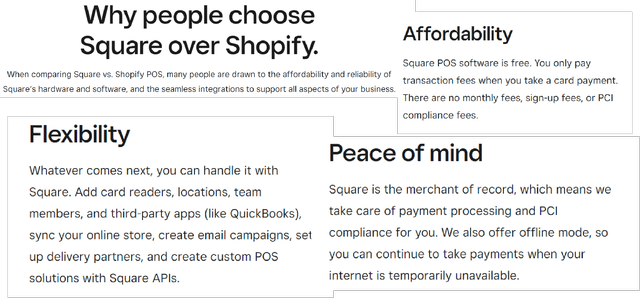

Both Shopify and Block have not done well in terms of share price performance for the past year. The S&P 500 rose by +15.6% in the last twelve months, while Block’s and Shopify’s shares fell by -41.8% and -37.1%, respectively over this period.

Stock Price Performance For SHOP And SQ In The Last One Year

Seeking Alpha

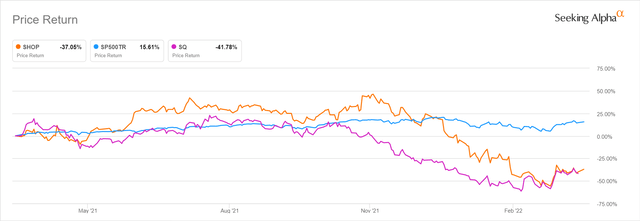

But Shopify’s underperformance is more recent, as its shares were down by -47.2% in 2022 thus far. In comparison, Block’s stock price decreased by a relatively narrower -17.3% year-to-date. As per the chart, SQ’s shares have staged a strong recovery since late-February 2022.

Block’s And Shopify’s 2022 Year-to-Date Share Price Performance

Seeking Alpha

I explain the difference in the share price performance for SQ and SHOP in the next section.

SHOP and SQ Stock Key Metrics

There are a number of key metrics that make it clear why Block has outperformed Shopify in the first few months of 2022.

Firstly, Block did better than Shopify in terms of earnings for the most recent quarter. SQ’s Q4 2021 EPS beat market expectations by +16%, while SHOP delivered a modest earnings beat to the tune of +4% in the final quarter of last year.

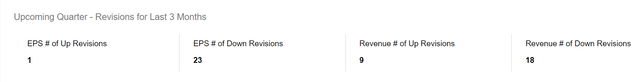

Secondly, the sell-side has become more bearish on both Block and Shopify in recent months as seen with the number of analysts who have revised their financial forecasts downwards. Between the two, Shopify has it worse with 23 analysts cutting their bottom line estimates for the stock, and only a single analyst raised his or her earnings forecasts for SHOP. In comparison, there were still five analysts who increased their EPS projections for SQ in the past three months.

Sell-side Analysts’ Revisions To Upcoming Quarter’s EPS And Revenue Forecasts For SHOP In The Last Three Months

Seeking Alpha

Wall Street Analysts’ Revisions To Upcoming Quarter’s EPS And Revenue Forecasts For SQ In The Past Three Months

Seeking Alpha

Thirdly, the reduction in the consensus sell-side target price for Shopify is more severe as compared to that of Block. According to data sourced from S&P Capital IQ, SHOP’s average price target was slashed by -44% from $1,691.73 as of December 31, 2021 to $954.48 now. In contrast, the mean target price for SQ was cut by -36% from $281.95 as of end-2021 to $181.00.

It is apparent that the near-term investor sentiment for Shopify is weaker as compared to that of Block. But this has no meaningful impact on the long-term outlooks for both companies as I will detail in the subsequent section.

Are SHOP And SQ Stocks Good Long-Term Investments?

Both SHOP and SQ are good long-term investments, but I have a more favorable view of Shopify’s future growth prospects. It is also noteworthy that the current sell-side average price targets suggest that Shopify and Block have potential capital appreciation upside of +31% and +25%, respectively as compared to their closing prices as of April 4, 2022.

From a quantitative perspective, SHOP is forecasted to expand the company’s top line and normalized earnings per share by CAGRs of +30.6% and +28.7%, respectively for the FY 2022-2026 financial period as per S&P Capital IQ data. On the other hand, Wall Street analysts expect SQ to increase its revenue by a CAGR of +13.6% between FY 2022 and FY 2026, while its bottom line is projected to grow by +16.7% over the same period. While Block’s estimated consensus growth rates are relatively lower as compared to Shopify, they are still decent in absolute terms.

Assessing both companies from a qualitative angle, Shopify appears to be more focused as compared to Block.

Shopify has simply set its sights on becoming the top partner for merchants by offering the best e-commerce platform and POS system. The key growth drivers for SHOP are pretty straightforward, Shopify has to expand further in foreign markets and improve the profit margins for merchant solutions going forward.

According to its 2021 annual report, SHOP derived as much as 71.4% of its top line from North America last year. Shopify highlighted at its Q4 2021 earnings call that it will be “stepping up marketing efforts internationally” in 2022. Separately, SHOP’s merchant solutions and subscriptions solutions contributed 70.9% and 20.1% of the company’s FY 2021 revenue, but the former’s profitability is much lower than that of the latter. The direct costs relating to merchant solutions were equivalent to 40.5% of Shopify’s overall revenue, while subscriptions solutions’ expenses only accounted for 5.7% of SHOP’s total sales. As the penetration rate of merchant solutions grows over time for SHOP, the company should be able to increase merchant solutions revenue on a per-merchant basis, and gradually improve the monetization rate and profitability of this revenue stream.

A recent key development for Shopify is the company’s plans to increase its investments in Shopify Fulfillment Network or SFN at a faster pace. SFN is expected to be “short term pain, long-term gain” for Shopify. I noted in my March 10, 2022 update for SHOP that “it is necessary for Shopify to invest in SFN to continue to offer value to its merchants (two-day delivery window achieved at a reasonable cost) and drive future long-term revenue growth.”

Also, the higher capital outlay relating to SFN will be a drag on SHOP’s short-term cash flow and margins, but it might not be as bad as feared. Notably, a March 16, 2022 sell-side research report (not publicly available) titled “Highlights from our 3PL expert call” published by Deutsche Bank (DB) noted that the $1 billion capital expenditures for SFN in FY 2023/2024 might only account for “a single-digit proportion of Shopify’s GMV” considering “where the scale of the business will be in 2-3 years.” This is based on insights shared by “fulfillment expert Matt Hertz” who was quoted in the DB research report.

In contrast, Block owns and operates multiple businesses. These include the “B2C (Cash App) and B2B (Square) payments”, “music platform (TIDAL) and Bitcoin/blockchain (TBD)” businesses, as mentioned in my March 11, 2022 article for SQ. Both payments and Bitcoin/blockchain have good growth potential, and there are synergies between the two as well. But I find Block “too diversified” for my liking. There are other payments-focused stocks like PayPal (PYPL) and cryptocurrency plays such as Coinbase Global (COIN), if investors are bullish on either payments or crypto and prefer pure-play proxies for such themes.

Moreover, SQ’s payments business might face significant threats from a formidable rival, Apple (AAPL). A March 30, 2022 Seeking Alpha News article citing a Bloomberg report noted that AAPL is “working on a multi-year plan that would reduce its reliance over time on third parties for financial services, including processing payments and infrastructure.” In my March 2022 article for SQ, I cautioned that “Apple’s new Tap To Pay service or feature serves as an example of the potential competitive threats that Block could face in the coming years.” With payments being a key touchpoint for consumers, it is inevitable that more companies will venture into this segment, and SQ’s payments business might face stiffer competition going forward.

Is SHOP or SQ The Better Buy?

SHOP is the better Buy as compared to SQ. Shopify has a more promising long-term outlook in both quantitative and qualitative terms; and consensus sell-side price targets imply greater potential upside for SHOP too.

Be the first to comment