Sean Gallup

Introduction

My thesis is that Shopify (NYSE:SHOP) is adjusting to a challenging landscape. Amazon (AMZN) is a formidable competitor but it focuses on customers while Shopify focuses on merchants. There is rhetoric on Shopify “arming the rebels” to take on Amazon but the fact of the matter is that there is a lot of overlap between Shopify and Amazon; both companies continue to benefit from the shift to digital. Many Shopify merchants use the Amazon marketplace as a channel and many of the sales dollars in Amazon’s marketplace come from Shopify merchants.

Buy With Prime Challenges And Opportunities

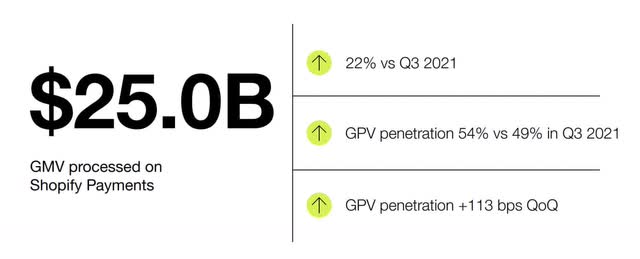

At the time of this writing, Amazon’s new Buy with Prime program is available to select merchants by invitation only. This program is a threat to Shopify in several respects; in some ways it will take away from Shopify Payments and SFN. Investors will need to keep an eye on Shopify Payments as Buy with Prime continues to roll out. Gross payment volume (“GPV”) as a % of gross merchandise volume (“GMV”) was better than ever at 54% for 3Q22:

Shopify GPV (3Q22 presentation)

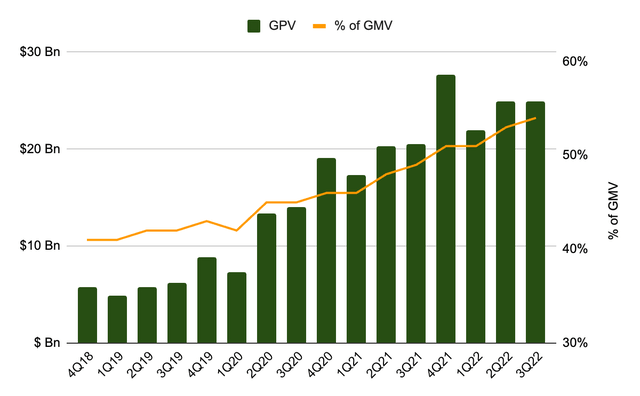

GPV as a % of GMV has climbed prodigiously over the years:

GPV as a % of GMV (Author’s spreadsheet)

It is clear that Buy with Prime will increase the portion of Amazon’s revenue that is tied to fulfillment. Less obvious is the fact that this program can hurt Amazon with revenue tied to referral fees which means it can boost companies like Shopify who have opportunities to help merchants find customers more economically through initiatives like Shopify Audiences. Another less obvious aspect about the Buy with Prime button is that it can boost sales of all products on a given website – not just the Buy with Prime products.

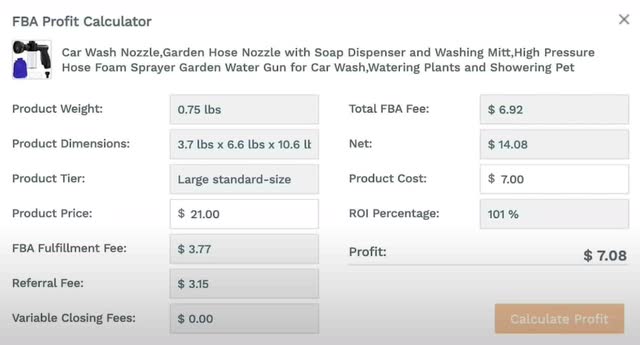

A video by Jungle Scout explaining Fulfillment by Amazon (“FBA”) helps show the various types of Amazon fees. In the example below, the FBA fulfillment fee is $3.77 and the referral fee is $3.15 such that the total fees to Amazon are $6.92:

Amazon fees (Amazon FBA selling video by Jungle Scout)

Amazon Accelerate 2022 has an excellent Art of E-commerce Reach session that helps explain the potential scope, threats and opportunities that are coming from Buy with Prime. The session stresses the fact that Buy with Prime is just one of many channels and merchants need an operating system like Shopify to help bring customers directly to their websites as opposed to the Amazon marketplace. GreatCircleUS Marketing Manager Patrick Sean Briseno explained that Amazon’s referral fees are considerable and he alluded to the fact that merchants might experiment by taking products out of Amazon’s marketplace now that Buy with Prime is becoming available. This could be beneficial to Shopify if it increases the use of their Shopify Audiences program:

I’m sure every, a lot of people know, um, the margins on your DTC sites are probably a lot better [than] on Amazon. You pay for what you get on Amazon, you know, you get [a] ton of traffic, ton of views, but, you know, there’s certainly fees associated with that. But, you know on our DTC site, you know, they’re a lot less. So for us, we try to pass that down to our consumer. So we do price things lower in general on our site. And actually with the Buy with Prime, button, we’re actually able to have custom pricing for that as well. So what we’ve done on our website to help kind of drive traffic to the button and help ease people into it and help people engage with it is offer a discount just for Buy with Prime. So, we have a promo running right now where, um, if you use Buy with Prime, you get an additional 10% off of the normal sales price on top of fast free shipping.

It is noteworthy that the GreatCircleUS website has a “Powered by Shopify” message in the lower left corner of their footer:

Shopify footer (GreatCircleUS)

Later in the Art of E-commerce Reach session, Wyze Labs Head of Growth Logan Dunn (“@logdun”) repeated the theme that Amazon’s referral fees are substantial and that sometimes customers are acquired through channels like Instagram (META) instead of the Amazon marketplace:

You both kind of alluded to the fact that Buy with Prime is actually cheaper than selling on Amazon, right? I mean, it’s your traffic, you’re doing the Instagram live. And so when you do the Instagram live, this is your audience that you’ve made through, you know, years of hard work and how many countless Instagram lives.

@logdun stresses that one of the reasons merchants like the DTC channel over the Amazon marketplace is that the fee structure is better:

if I’m directing people to Buy with Prime I need to know that I’m getting a better price than Amazon. And you kind of see that actually in the general, uh, DTC world, you see a little bit of conflict sometimes between DTC, like you want to direct people [to] DTC instead [of] Amazon. And, and like what you’re saying, like you are doing to your audience live stream, and you’re saying, go Buy with Prime. Right. And may I guess you probably do tell your audience, like, Hey, you can go to Amazon, you can get it here. You can get it there, but you really want them on your site. Like you said, that brand story. And I love that. It’s like, and you don’t have to worry now about giving up that seller fee because it’s a different fee structure.

Bossy Cosmetics CEO Aishetu Fatima Dozie (“@TheAishetu”) joins the discussion with @logdun, saying Buy with Prime is not a panacea; it is one of many channels:

I think the way we think about our customer, I mean, for all of us, you know, you have no brand, you have no company, if you don’t have a customer. Yeah. So for me, this is literally just a channel. not to make you feel bad about it, but it’s like, it’s nothing personal. I am offering something unique to my customer. So when I’m on the [Instagram] live, I’m thinking about how can I make her life better?

Like GreatCircleUS, Bossy Cosmetics has “Powered by Shopify” in the website footer:

Shopify footer (Bossy Cosmetics)

@TheAishetu goes on to clarify that they provide options for all types of customers. Folks living near the mall can buy Bossy products at JCPenney. Other customers who want products delivered quickly can go through the Buy with Prime channel:

You want it in two days, are you a Prime customer? Buy it on, Buy with Prime. So it’s less about my love for Amazon or not. It’s more about my love for my customer and how do I give her as many options as possible so that she feels like Bossy Cosmetics actually really cares about her.

@logdun mentioned that they work hard to drive traffic and that they direct it to their own site as opposed to the Amazon marketplace where there are high fees and limitations on customer data:

So we drive most of our traffic through owned channels, like so email, um, in-app messages, push messages social, things like that. And so for me, I control these channels for DTC and so whenever I can, I’m sure you’re the same, but whenever I can, I’m directing back to my site.

Taking it a step further, @logdun says they always favor their DTC over channels like the Amazon marketplace:

I will always favor my DTC over all my channels. And now I can also in my emails to customers be like, Hey, get it with Prime and take them to my site and not take them to Amazon. Because I very rarely will use my email list to promote on Amazon.

GreatCircleUS Marketing Manager Briseno mentioned another hidden opportunity for Shopify as the session started winding down. He mentioned that the Buy with Prime addition to their website has not only increased sales of Buy with Prime products, regular Shopify add to cart products have gone up as well! I would conjecture that the Buy with Prime button may give customers some peace of mind about shipping speeds in general. In other words, it may be that when consumers see that button on a given site, they assume the merchant is serious about the shipping speed for all the products offered:

Since we’ve added the [Buy with Prime] button, we’ve seen not only a lift in Buy with Prime sales, we’ve seen a lift in our regular Shopify add to cart sales. That’s gone tremendously. And in talking with the team, you know you guys have shown that you guys love that. You know, it’s not, it’s not something where you just want to steal all the sales, you know, we’re seeing that, you know, this is a tool to just help businesses grow in general, whether it’s using Buy with Prime, whether it’s using add to cart. You know, it’s just like what Aishetu said, you know, just being able to supply your customers with the options available.

Towards the end of the session, @TheAishetu mentioned a meaningful limitation for Buy with Prime. She repeated that merchants focus on quality traffic, conversions and the average order value (“AOV”). Stressing the AOV part of the equation, she said merchants want customers to put many items in the shopping cart without friction and cart abandonments:

I want people to come to my site and I want them to buy a whole bunch of stuff and run away and be happy. The only issue with Buy with Prime is that you have to transact at the product level. So you can’t build a cart and then have five products and then buy all of that with Prime. You would have to buy each of the five items with Buy with Prime separately, which causes friction. And we know friction is how you know, cart abandonments right.

Supply Chain Challenges

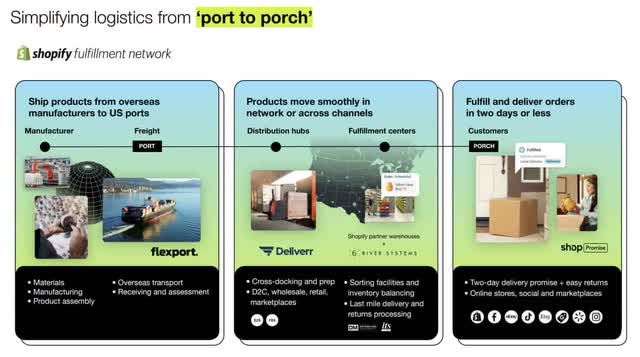

Heavy investments have been made in Fulfillment by Amazon (“FBA”) while Shopify takes an asset-light approach. There is much more to the supply chain than just fulfillment and Shopify is working hard to provide excellent solutions for merchants:

Port to porch (3Q22 presentation)

Amazon opened up FBA to merchants outside their marketplace with MCF but this is only part of the supply chain. Headlines focus on FBA but the Streamline Inbounding For Fulfillment by Amazon presentation at Amazon Accelerate 2022 shows that there is much more to the supply chain than just FBA:

Amazon supply chain (Amazon Accelerate 2022: Streamline Inbounding For Fulfillment by Amazon)

If Amazon was the only logistics ballgame in town, then executive Dave Clark wouldn’t have left to become CEO of Shopify’s SFN partner, Flexport:

Valuation

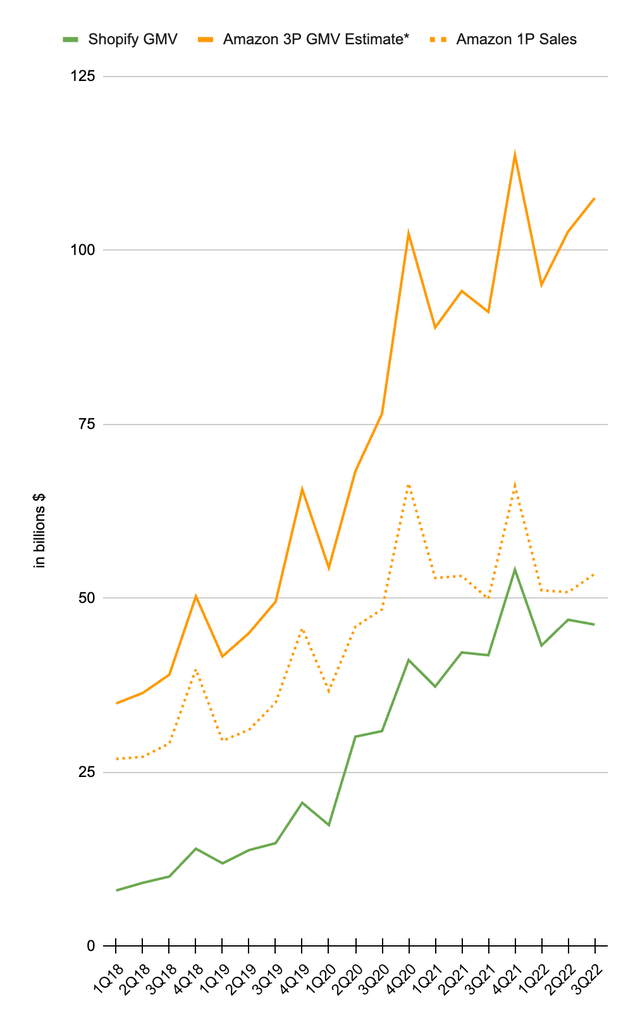

Many channels for Shopify merchants are now growing slower including Amazon 3P:

Shopify GMV (Author’s spreadsheet)

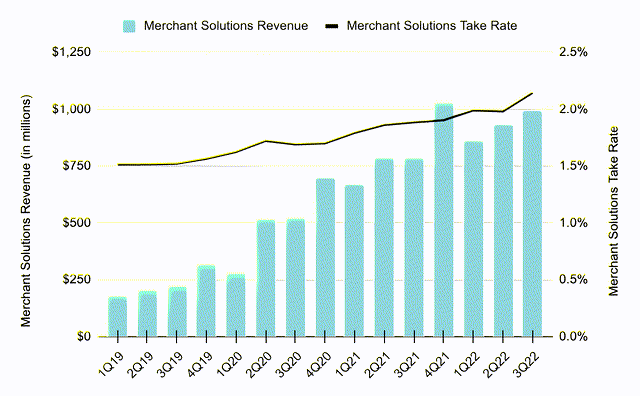

One bright spot is that the merchant solutions take rate or “attach rate” reached a new high of 2.14% in 3Q22:

Take rate (Author’s spreadsheet)

TTM revenue for merchant solutions is $3.8 billion or $2,777,381 thousand + $3,269,522 thousand – $2,240,706 thousand. TTM cost of revenues for merchant solutions is $2.3 billion or $1,664,179 thousand + $1,866,361 thousand – $1,254,583 thousand such that the TTM gross profit is a little over $1.5 billion. This is remarkable considering the fact that as recently as 2019, the annual merchant solutions gross profit was just $352 million. The merchant solutions segment has a lower gross margin than the subscription solutions segment but the merchant solutions segment has little in the way of steady-state operating expenses.

There was a time when Shopify’s market cap was about the same as their annual GMV whereas now it is closer to their quarterly GMV. It was a different world when the stock traded higher. We didn’t know at the time that much of the growth was pull-forward from Covid. Interest rates were much lower. Apple (AAPL) hadn’t yet hurt the digital advertising market under the guise of privacy protection.

Including the subscription solutions segment, Shopify has an overall TTM gross profit of $2.65 billion or $1,955,611 thousand + $2,481,144 thousand – $1,788,485 thousand on TTM revenue of $5.24 billion or $3,864,886 thousand + $4,611,856 thousand – $3,231,832 thousand. I am optimistic that half of Shopify’s gross profit can make its way to the bottom line when growth investments are taken out. Today that is a little over $1.3 billion. It is hard to put a multiple on this given the extreme growth on one hand and the rising interest rate environment on the other hand. It might sound inexplicable to some but I can see a multiple of 35 to 45x for a valuation range of $46 to $59 billion.

The market cap is a little over $44 billion based on the 1,269,425,226 shares in the 3Q22 release times the November 1st share price of $34.79. Given the cash and marketable securities on the balance sheet, the enterprise value is lower than the market cap. The market cap and enterprise value are less than my valuation range and I think the stock is a buy for long-term investors.

Forward-looking investors should keep an eye on the merchant count, GMV, GPV and gross profit on a per-share basis.

Be the first to comment