Vertigo3d/E+ via Getty Images

Thesis Summary

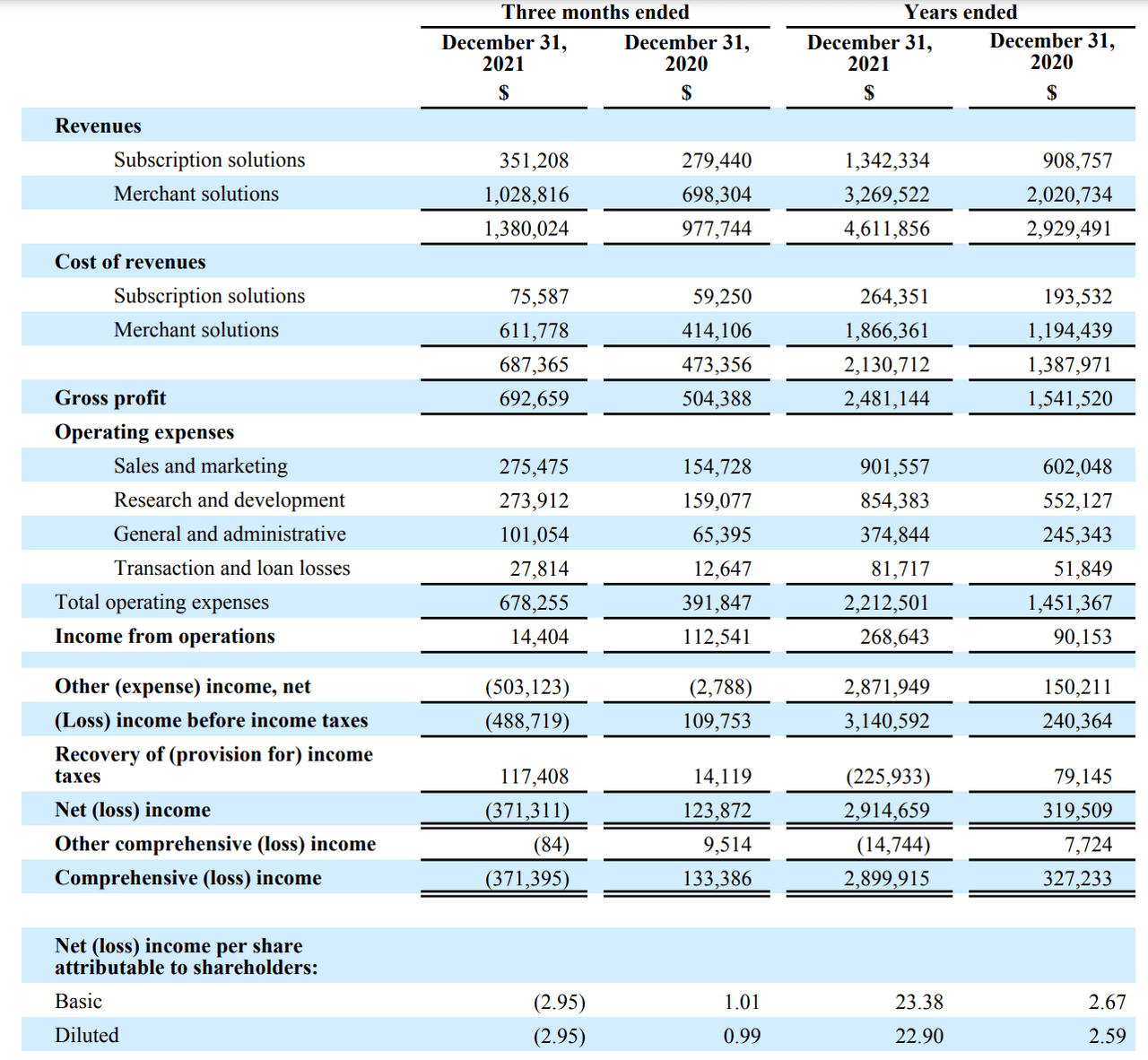

In this article, I look at Shopify Inc.’s (SHOP) latest results, which triggered a selloff that saw stock prices plummet by 16%. This is just the latest in a long list of growth stock casualties. We can pinpoint key reasons why this happened, but the fundamental story hasn’t changed with Shopify. Furthermore, something has to be said about the fact that Shopify produced nearly $3 billion in net income.

I’ll be looking to add some SHOP if it falls any further from here.

Why Did SHOP Fall?

Shopify Inc announced its fourth-quarter results on Feb 16th, beating on both revenue and EPS. However, the stock plummeted by over 16%, given that forward guidance was underwhelming.

There are two key factors we can point to that have concerned investors; Post-Covid growth and increased investment in the fulfilment business.

For 2022, no exact guidance was given. In the press release, it was mentioned that they expected a slow start, with growth picking up by the fourth quarter. This is due to a reduction in Covid related tailwinds, changes in the terms of their revenue share agreement with merchants, and investments initiatives not paying off until the end of the year.

The second factor is that Shopify will be sinking $1 billion in CAPEX in 2023 and 2024 to ramp up its fulfilment network. The problem is that this is already a very competitive market, and while it can add significant value to Shopify’s customers, investors prefer the idea of investing in an asset-light SaaS company with high margins.

SHOP’s Equity Investments

Another interesting insight from the latest quarter is that Shopify produced a whopping +$3 billion in net income, though this was due to investments and not the core business.

Shopify Q4 results (Q4 Financials)

“Other income”, which added $2,8 billion to the bottom line can be attributed to equity investments. Although the company isn’t completely transparent about this, we know that Shopify has been actively investing in other companies and early-stage startups. Shopify, for example, has a stake in Global-e Online Ltd. (GLBE) and also in Affirm Holdings, Inc. (AFRM). We also know it has invested in early-stage companies like Yotpo and Loop Returns.

Shopify has greatly benefitted from leveraging its size and position to invest in up and coming startups that it wishes to partner with, and this is something investors shouldn’t disregard.

Why I Like SHOP

Despite all the negativity, there’s a lot to like about this stock. Shopify is a fast-growing company in the digital commerce space. As someone familiar with their offerings, I know first-hand that they always put the merchant’s needs first, which is why they have been so successful.

As I already talked about in this article, Shopify is a platform, which gives it limitless potential to offer value. Unlike Amazon, which benefits from aggregation and puts the consumer first, Shopify creates an ecosystem to support sellers, and this is where we will see more growth.

The world is moving towards decentralization and entrepreneurship, which Shopify is enabling through its platform. It is doing so by creating a strong ecosystem of developers, merchants and partners, and it continues to gain market share thanks to this.

But is Shopify a good buy at this point? Valuing a company like this is certainly hard. By historical standards, it is trading at a discount, with a P/S of around 20. Interestingly, the GAAP P/E is only around 27, given the fact that Shopify had such a high net income due to investments. And with a PEG of 0.02, this looks incredibly attractive.

Of course, those metrics are arguably not “real”, but why should we not consider Shopify’s intelligent equity investments when building an investment thesis?

Even following numerous target price cuts, the current price is below most analyst estimates.

Risks

The biggest risk for Shopify at this point is macroeconomic. Higher rates are on the horizon, and not only does this affect valuations, but it could also initiate a correction in home prices, which reduces home equity and takes a real toll on consumers’ spending power.

However, I believe that worst-case scenarios have been priced in at this point, and what we might in fact see is a “surprising” slowdown in rate hikes, much like we saw in 2018.

Takeaway

All in all, Shopify is a good long-term investment. The current climate does not support its valuation, but you have to buy when there’s blood on the street. Layering in over the next 3-6 months would be my preferred course of action.

Be the first to comment