Nastasic

A Quick Take On Shift4 Payments

Shift4 Payments (NYSE:FOUR) went public in early 2020, raising approximately $345 million in gross proceeds from an IPO priced at $23.00 per share.

The firm provides a range of payment processing and related services to businesses worldwide.

Although it is reasonable to be cautious about a slowdown in 2023, I’m more positive about the indicators of strong volume growth and further expansion plans by management.

My outlook on FOUR is a Buy at its current level of around $52.00.

Shift4 Payments Overview

Allentown, Pennsylvania-based Shift4 was founded to create an integrated payments platform serving businesses located primarily in the United States.

Management is headed by founder and Chief Executive Officer Jared Isaacman, who was previously founder of Draken International, an air services provider.

The company’s primary offerings include:

-

End-to-end payment processing

-

Merchant acquisition

-

Omni-channel gateway

-

350 integrations

-

Fixed and mobile POS solutions

-

Security and risk management tools

-

Reporting and analytics

Shift4’s Market & Competition

According to a 2019 market research report, the market for payment processing services is expected to reach $62.3 billion by 2024.

This represents a forecast CAGR of 9.9% from 2019 to 2024.

The main drivers for this expected growth are continued growth in the number of merchants seeking integrated payment processing solutions and the entrance of new market participants with new technology offerings.

Major competitive vendors include:

-

PayPal (PYPL)

-

Global Payments (GPN)

-

Block (SQ)

-

Wirecard (OTC:WRCDF)

-

Visa (V)

-

Jack Henry & Associates (JKHY)

-

Paysafe Group (PSFE)

-

Naspers Limited (OTCPK:NPSNY)

Management says its system not only provides payment processing but integrates with a large number of third-party ‘commerce enabling’ software to offer a more seamless set of solutions.

Shift4’s Recent Financial Performance

-

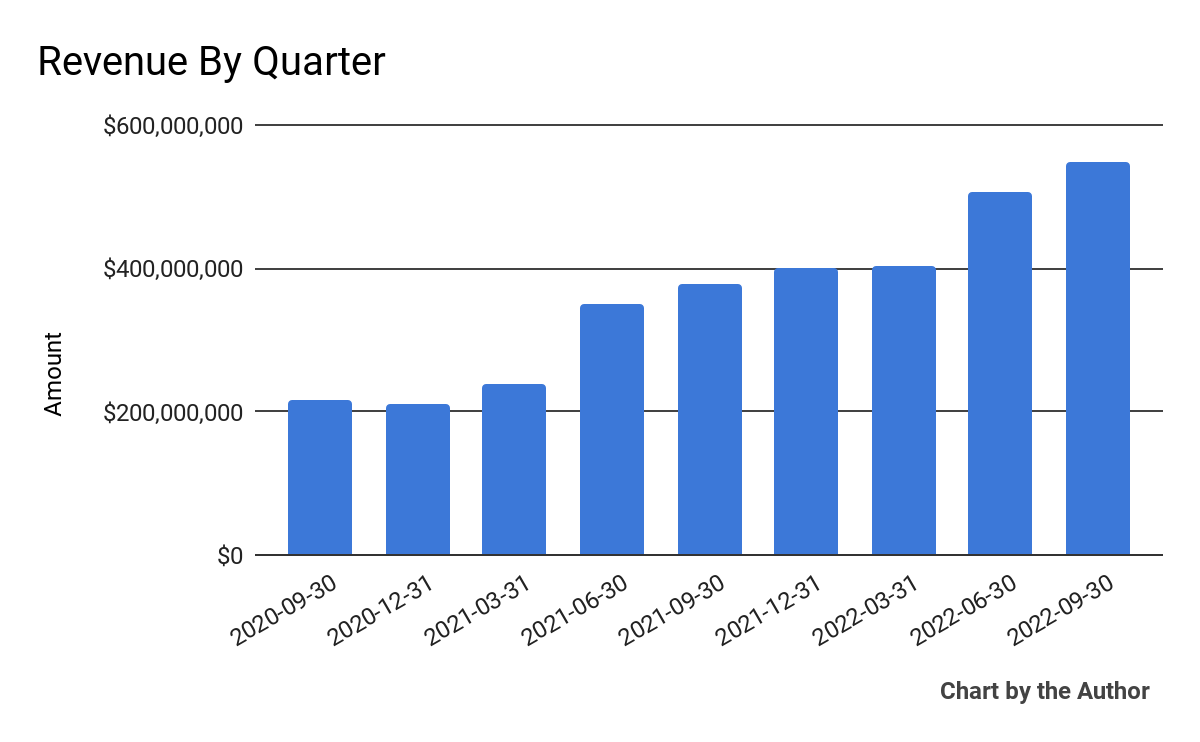

Total revenue by quarter has risen significantly as the chart shows below:

9 Quarter Total Revenue (Financial Modeling Prep)

-

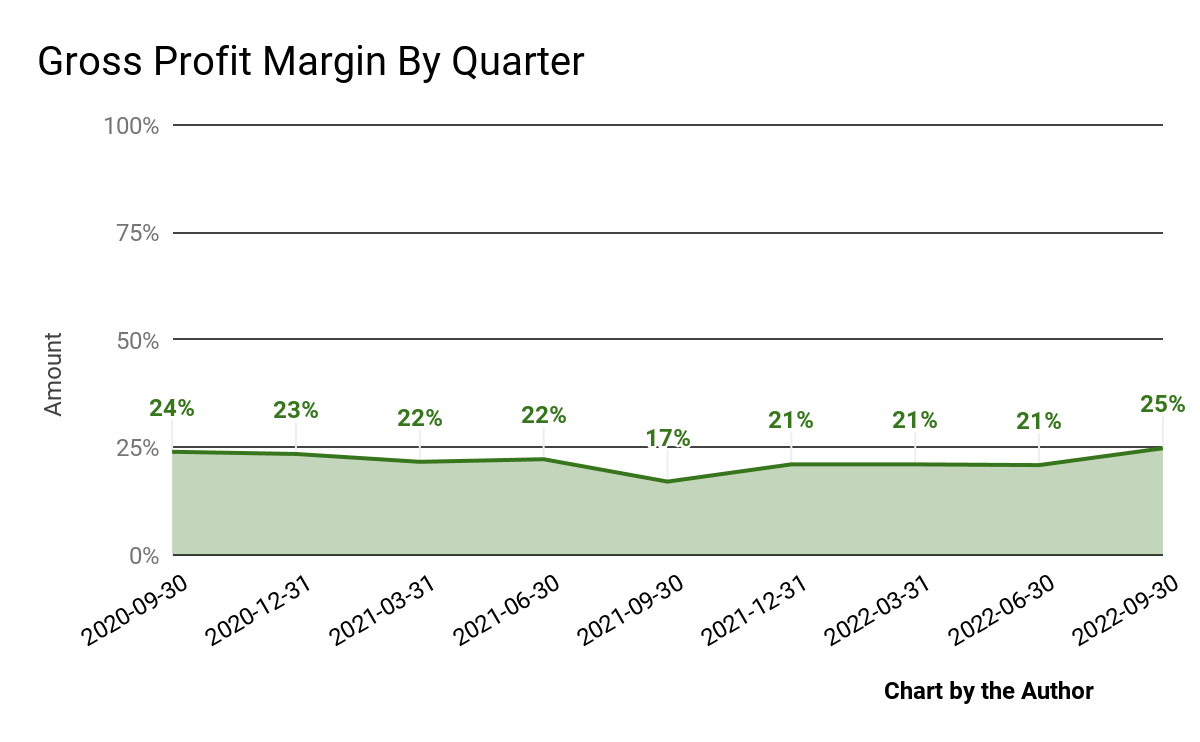

Gross profit margin by quarter has increased in the most recent quarter:

9 Quarter Gross Profit Margin (Financial Modeling Prep)

-

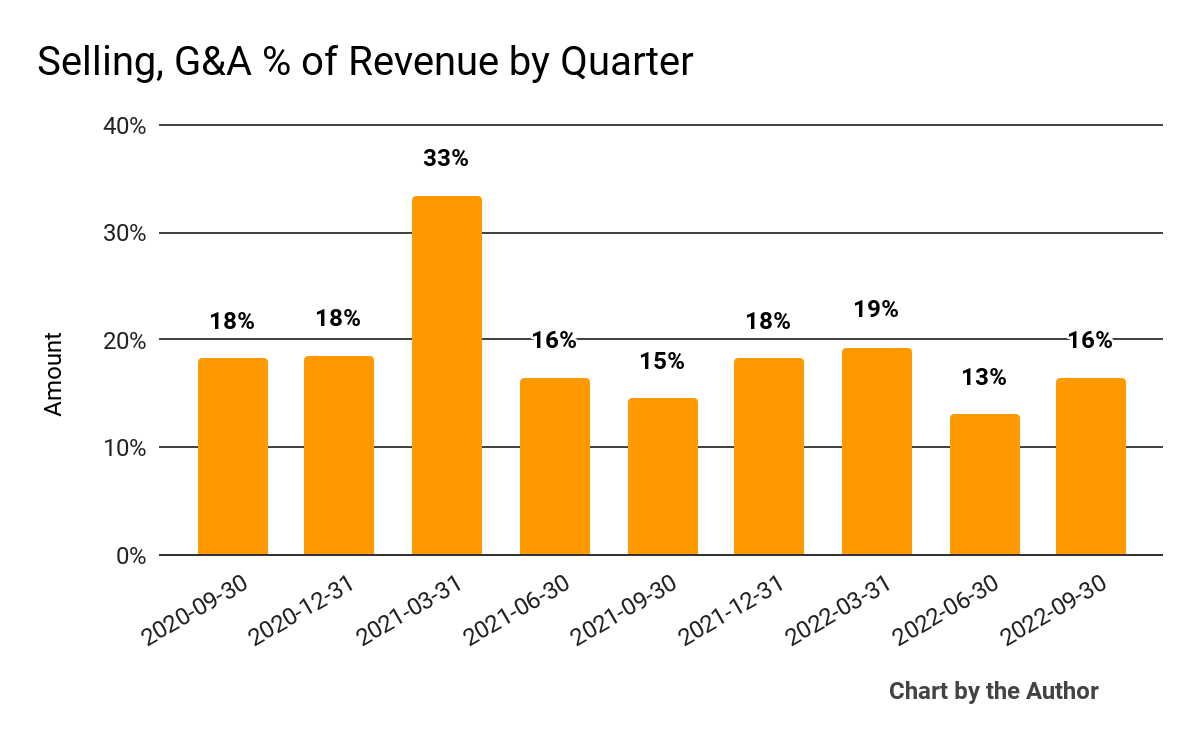

Selling, G&A expenses as a percentage of total revenue by quarter have proceeded according to the following trajectory:

9 Quarter Selling, G&A % Of Revenue (Financial Modeling Prep)

-

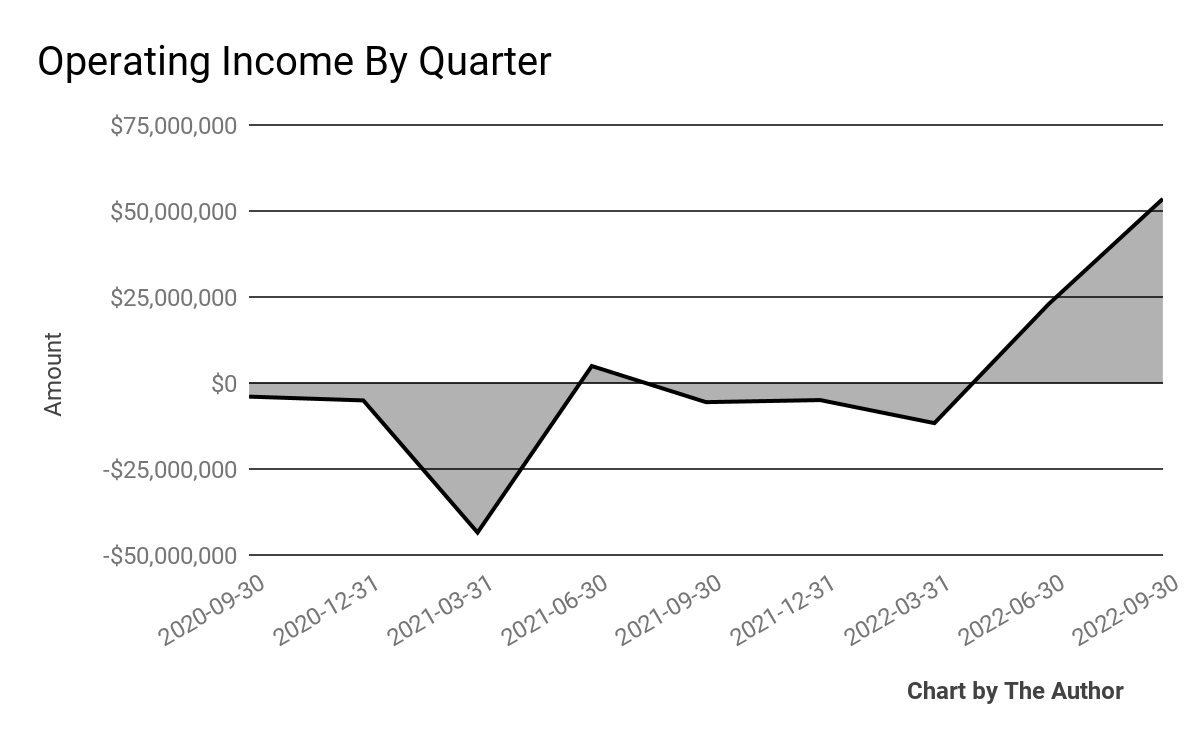

Operating income by quarter has increased sharply in recent quarters:

9 Quarter Operating Income (Financial Modeling Prep)

-

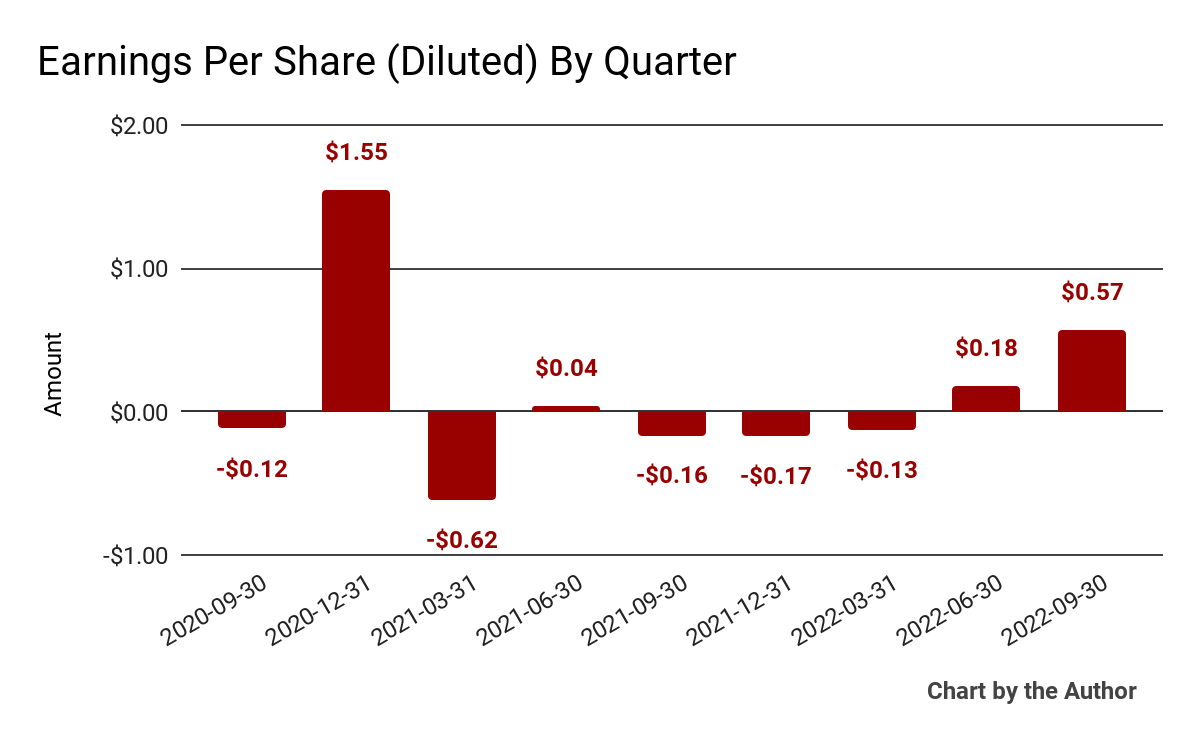

Earnings per share (Diluted) have also moved sharply positive recently:

9 Quarter Earnings Per Share (Financial Modeling Prep)

(All data in the above charts is GAAP)

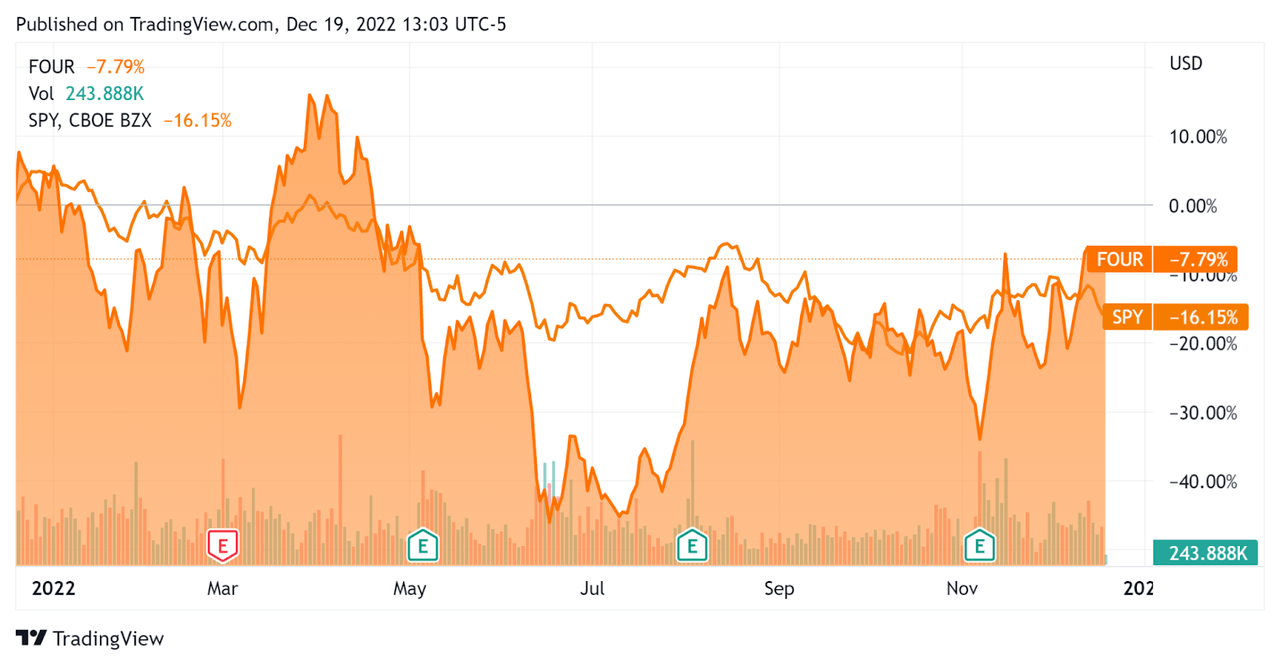

In the past 12 months, FOUR’s stock price has dropped only 7.8% vs. the U.S. S&P 500 index’s drop of around 16.2%, as the chart below indicates:

2-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Shift4 Payments

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.1 |

|

Enterprise Value / EBITDA |

20.3 |

|

Revenue Growth Rate |

57.4% |

|

Net Income Margin |

2.0% |

|

GAAP EBITDA % |

10.5% |

|

Market Capitalization |

$2,752,622,352 |

|

Enterprise Value |

$3,951,612,462 |

|

Operating Cash Flow |

$139,500,000 |

|

Earnings Per Share (Fully Diluted) |

$0.45 |

(Source – Financial Modeling Prep)

As a reference, a relevant partial public comparable would be Block; shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

Block |

Shift4 Payments, Inc. |

Variance |

|

Enterprise Value / Sales |

2.2 |

2.1 |

-3.6% |

|

Revenue Growth Rate |

1.3% |

57.4% |

4312.5% |

|

Net Income Margin |

-3.0% |

2.0% |

— |

|

Operating Cash Flow |

$324,890,000 |

$139,500,000 |

-57.1% |

(Source – Seeking Alpha and Financial Modeling Prep)

Commentary On Shift4 Payments

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted the increasing role that the firm’s newer verticals and recently released products are contributing to revenue growth.

The company expanded its international and e-commerce capabilities and launched its SkyTab POS system to its restaurant merchant base.

FOUR completed its first international acquisition for a European payments service provider.

As to its financial results, revenue less network fees grew by 33% year-over-year and the company exceeded $20 billion in quarterly volume for the first time.

Gross profit margin ticked up substantially and operating income made a big jump up during the quarter, resulting in much higher earnings per share.

For the balance sheet, the firm finished the quarter with $672.7 million in cash and equivalents and $1.7 billion in long-term debt.

Over the trailing twelve months, free cash flow was $99.9 million, of which capital expenditures accounted for $58.9 million.

Looking ahead, management raised forward guidance across numerous KPIs as it appears the company is taking volumes from competitors and is currently at 349% of quarterly volume versus pre-pandemic levels, a significant achievement.

Regarding valuation, the market is valuing FOUR at about the same EV/Revenue multiple as that of Block, despite Shift4’s much higher revenue growth rate, which leads me to wonder if it is currently underappreciated by the market.

The primary risk to the company’s outlook would be slowing business activity going into 2023 as there are many signs of slowing macroeconomic growth in the wake of near-record rises in the cost of capital over the past 12 months.

A potential upside catalyst to the stock could include continued volume growth at the expense of its peers, potentially due to its e-commerce, international and POS expansions.

Although it is reasonable to be cautious about a slowdown in 2023, I’m more positive about the indicators of strong volume growth and further expansion plans by management.

My outlook on FOUR is a Buy at its current level of around $52.00.

Be the first to comment