Andreas Rentz/Getty Images News

The Thesis

Facing an identity crisis, Shell (NYSE:SHEL) is hated by many traditional and ESG investors. European pension funds are dumping shares at enormous discounts, citing ESG concerns, while others are complaining about Shell’s upstream divestments and net-zero goals. Meanwhile, Shell’s gushing cash flow and investing in the hyper-growth green energy of the future.

We agree with CEO Ben van Beurden, who called the company “significantly underpriced.” In the decade ahead, we estimate a market-crushing return of 13% per annum.

A Leader In The Energy Transition

As oil reserves decline, many investors worry about Shell’s long-term plan. The world is projected to run out of oil by 2052, meaning every upstream business globally could be headed for secular decline.

If you’re a Shell shareholder, don’t fret, you’re ahead of the curb in the energy transition. Shell is building a green energy empire. Let’s see what’s in store.

Hydrogen Refuelling (Shell USA)

Shell is positioned to operate 500,000 electric vehicle (EV) charge points by 2025. Benefiting from strong tailwinds, the EV market should grow at 17.5% per annum through to 2030. The company’s also acquired a number of solar and wind assets over the years. On top of this, Shell is about to build the largest green hydrogen plant in Europe. The green hydrogen market is expected to experience hyper-growth of 54% per annum through to 2030.

Awash With Cash

As cash flow gushes into the world’s largest oil companies, their debt is slowly being wiped out, and they’re awash with cash. Shell has $39 billion of working capital on its balance sheet and is about to report record profits. Shell trades at a forward PE of just 5x earnings, and is expected to reverse asset write-downs, boosting book value.

A Global Brand

Shell is a 100-year-old, globally recognized brand that we think leads the industry. The logo is reminiscent of McDonald’s, with its bright yellow colour and simple design. The best part is, Shell’s brand will carry over to the energy transition, continuing as a symbol of global energy.

Electrive.com

China’s Still Offline

Lost decades, like big oil experienced from 2010-2020, often lead to underinvestment and consolidation. Ironically, enormous profits tend to follow. Over the next 5 years, Shell’s portfolio is positioned to print upstream profits. Remember, the world’s largest consumer of energy, China, is still offline.

China’s been in lockdown, sidelining 1.4 billion people and perhaps the world’s largest consumer of energy. The country will eventually re-open, and if Russian sanctions persist, you can expect oil prices to remain elevated. Perhaps this is what Warren Buffett’s seeing; oil’s been his largest bet of 2022.

What To Keep An Eye On

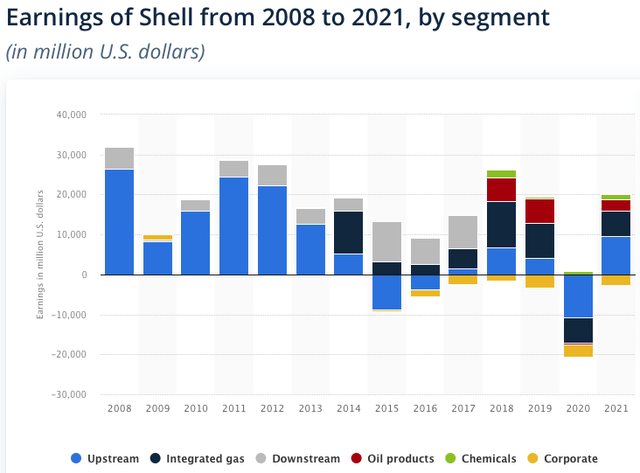

In the short term, Shell is heavily affected by what the price of oil does. In 2020, Shell cut its dividend to reduce its breakeven price to approximately $36 per barrel. Around this range, Shell can experience negative net income. The upstream segment accounted for nearly 50% of the company’s net income in 2021. While Shell has a terrific downstream business, there’s no question the company makes more money when oil prices are high.

Below is a breakdown of Shell’s net income over time:

Earnings By Segment (Statista)

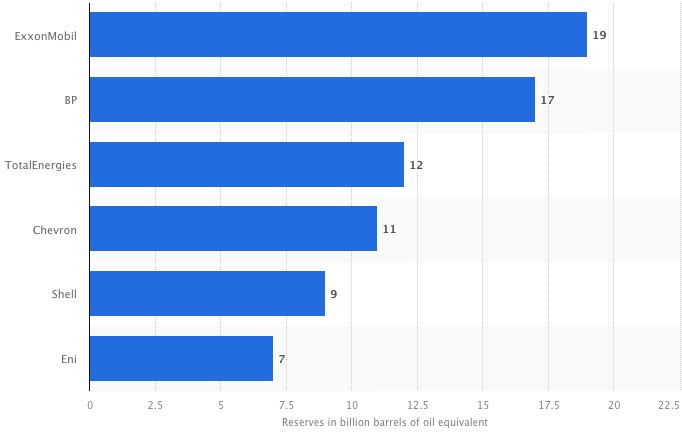

Over time, Shell’s upstream business will shrink. Shell will continue to invest opportunistically in exploration through to 2026. Despite this, the company expects its oil production to shrink by 1-2% per annum through to 2030, and that could be an understatement. Shell trails the pack in proven reserves:

Proven Oil Reserves By Company (Statista)

While this may seem troubling, we’re not too concerned about Shell replacing its upstream business over time. The company’s a world leader in liquified natural gas, and still investing heavily, aiming to have a 20% market share by 2030. Meanwhile, green hydrogen, renewables, and EV charging will likely generate significant profits in the long term.

Shell’s Normalized Earnings

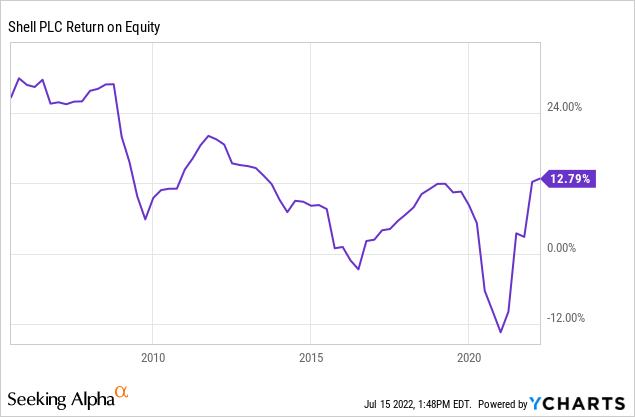

Shell’s averaged a 12% return on equity over time:

If we apply this to Shell’s shareholder’s equity of $176 billion, we get normalized earnings of $21 billion ($5.70 per share), giving Shell a normalized PE of 9.

Long-term Returns

We expect Shell’s rapidly growing renewables business and stalwart LNG business to replace its upstream business over time. Renewables should benefit from government credits and industry tailwinds. This should cause the world to take notice, and we expect pension funds to buy back in. The world needs Shell’s energy and technology.

Below, we’ve estimated the company’s future earnings by segment:

| Total | $29.5 Billion |

| Shell’s 2032 Earnings By Segment (Estimate) | |

| Integrated Gas | $9.3 Billion |

| Renewables | $8.7 Billion |

| Upstream | $8.3 Billion |

| Chemicals | $2.1 Billion |

| Traditional Oil Products | $1.1 Billion |

We’re quite pessimistic on the upstream segment, expecting production to decline by 5% per annum. Shell should see slow and steady growth in integrated gas and chemicals. For renewables, however, hyper-growth of around 25% per annum could be in the cards. We expect Shell to invest heavily here.

Our 2032 price target is $128 per share, implying a return of 13% per annum with dividends reinvested.

- Even after investing in the business, Shell should have ample cash to buy back shares at 2% per annum and pay a growing dividend. If we assume 3 billion shares outstanding in 2032, we get EPS of $9.83. Shell’s upstream business will continue to decline as reserves dwindle, but the other businesses have robust long-term prospects. We’ve assigned a terminal multiple of 13.

Conclusion

Shell is well positioned to print upstream profits today and rapidly scale its renewables business tomorrow. In the short term, Shell will benefit from enormous cash flows, reduced debt, and the re-opening of China. In the future, Shell plans to replace its upstream profits with industry-leading LNG, green hydrogen, EV charging, and renewable energy. The brand is timeless and should continue as a symbol of global energy for decades to come. With 13% prospective returns, we have a “strong buy” rating on the shares.

Be the first to comment