blinow61

Thesis

A few weeks ago, I published a bearish analysis on Exxon (XOM) as I believe the oil price will likely trade considerably lower by year end. However, my Sell recommendation on XOM was strongly influenced by the company’s relative valuation versus European industry peers, where I believe valuations still imply significant upside even with an oil price of < $70/barrel. That said, I like Royal Dutch Shell (OTCPK:RYDAF) (NYSE:SHEL). Shell trades at a one-year forward P/E of < x5 and an EV/Sales of < x1. Notably, this is an approximate 100% discount as compared to XOM.

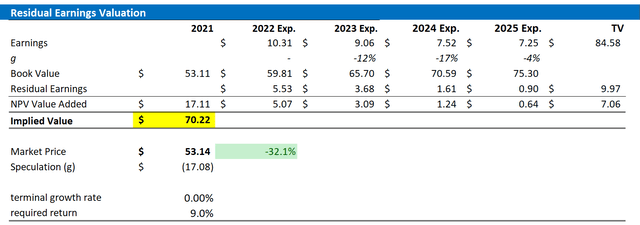

Personally, I value Shell at $70.22/share. I anchor my valuation on a residual earnings framework and EPS analyst consensus EPS.

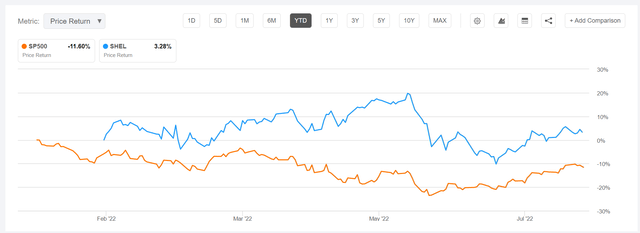

For reference, Shell stock is up by about 3% YTD, versus a loss of almost 12% for the S&P 500 (SPY).

About Shell

Shell is a European Oil & Gas major with headquarters in London, UK. The company’s asset are connected by about 75% to upstream oil & gas, with strong exposure to Brazil, the Gulf of Mexico and the EMEA region. The rest, about 20%, is connected to refining and marketing. That said, Royal Dutch Shell pumps about 3.5 million barrels of oil a day and is thereby larger than Exxon Mobil and Chevron. In addition, Royal Dutch Shell also operates oil refineries, an oil and gas trading business and develops renewable energy. Most notably, Shell operates the largest consumer facing marketing arm with about 46,000 fuel stations. With regards to market capitalization, Shell is Europe’s most valuable business.

Shell operates five major five segments: Oil Products, Integrated Gas, Upstream, Chemicals and Corporate. With regards to revenue exposure, the oil business is by far the largest segment, accounting for about 70% of Shell sales. This is followed by Integrated Gas, with about 20% of sales and Chemicals representing 5% of Shell sales. Geographically, Shell generates about 35% of Shell sales in Asia Pacific and about 30% in NAM and Europe each. The rest of world accounts for the remaining 5%.

The Opportunity

I am bullish on Shell, as I like the company’s strong cash-flow outlook and cheap relative valuation as compared to both US peers and the company’s own historical trading range. It is no secret that, given the rapid price acceleration for oil, E&P majors such as Shell have seen an explosion of sales and profitability numbers. For the trailing past 12 months Shell generated more than $329.58 billion of revenues, which represents an increase of about 70% as compared to the prior period. Respectively, net-income was recorded at $36 billion, up about 80% respectively. Shell’s cash from operations is even more attractive: $57.66 billion for the trailing 12 months.

Given the energy price tailwind, Shell managed to quickly delever its balance sheet. As of June 30, net-debt was recorded at $44.8 billion, versus $78.4 billion in 2020 (a decrease of about 45%). Accordingly, Shell is arguably ‘free’ to distribute capital to shareholders with less constraints and the TTM dividend yield of almost 4% appears sustainable. Please also consider that Shell is also distributing capital through share buybacks, which are arguably more volatile, but nevertheless a highly significant component of the capital allocation strategy.

That said, Shell has not been the only oil major to benefit from higher energy prices. But on a relative basis, Shell stands out as particularly cheap. As compared to Exxon Mobil for example, Shell trades at a 30% P/E discount and a 38% P/B discount. Based on the Shell’s own 5-year historical trading range, Shell currently trades at a 60% P/E and EV/EBIT discount, which implies a 2 sigma deviation (Source: Bloomberg as of August 15).

Residual Earnings Valuation

Let us now look at the valuation. What could be a fair per-share value for the company’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise. That said, EPS are estimated at $10.36, $9.06 and $7.52 for 2022, 2023 and 2024 respectively.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the FTSE to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of August 15, 2022. My calculation indicates a fair required return of 9%.

- To derive Shell’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply a 0 percentage points to reflect the balance of a secular decline for oil and gas business and the transition towards green energy.

Based on the above assumptions, my calculation returns a base-case target price for Shell of $70.22/share, implying material upside of about 30%.

Analyst Consensus EPS; Author’s Calculation

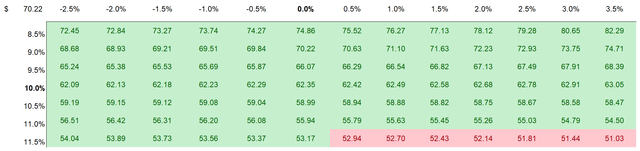

I understand that investors might have different assumptions with regards to Shell’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus EPS; Author’s Calculation

Risks To My Thesis

My thesis is connected to the implication that there are no structural differences between European and US oil majors. This, however, is not necessarily true since the respective regulatory exposure is somewhat different. Arguably, the European Union is slightly more aggressive with regards to the green energy push and US stocks generally trade at a premium. Nevertheless, a 100% relative valuation discrepancy is not justified, in my opinion. In addition, investors should note that I assume a sustainable oil price of about $60/barrel. While this might seem bearish for some readers, others might argue that the fair value for oil is much lower. As the 2020 COVID-19 induced sell-off has shown, oil can even trade at negative price-levels. If oil would break considerably below $60/share and does not recover within a sensible time-period, the bull thesis for Shell would break.

Conclusion

The risk/reward for investing in Shell is very attractive. As a quick pitch, investors should consider that SHEL stock is trading at an approximate 100% discount to US peers, which I think is excessive. Shell and US peers equally share the benefits/risks related to oil price volatility and their capital allocation strategy with regards to shareholder distributions are competitive. Personally, I value SHEL stock at $70.22/share and thus see more than 30% upside. Buy.

Be the first to comment