NicoElNino

Recent policies, especially the Inflation Reduction Act, have begun to show a spotlight on the carbon capture, utilization, and sequestration (CCUS) industry. I have been actively involved in the sector for over a decade, so I decided to take the time to analyze the major players. My first article provided detailed background on the CCUS market and its growth, how it will be affected by the newly passed legislation, why carbon capture truly is necessary in our quest to reach net zero, some thermodynamic background, and a framework for what would qualify a company to be a good investment. It then covered Occidental Petroleum’s (OXY) main CCUS technologies and how they stack up. I highly encourage anyone who needs that background to go read that article first (you can just skip the OXY part if it isn’t interesting to you). I plan to provide a little bit more color on the market at the beginning of each new article followed by some detailed analysis on one company. Today we are going to talk about CO2 market prices and then dive into Shell’s (NYSE:NYSE:SHEL) CANSOLV carbon capture technology. I’ll be continuing to release an article every week or two covering a new company’s technology.

The market for CO2

Some of the comments on that article asked about why I ignored the fact that CO2 can be sold as a product to be used in other processes, the biggest of which is for use in enhanced oil recovery (EOR). That article was already lengthy and there is only so much I can address at one time, but I will cover that topic briefly because it is important. The first reason I didn’t mention it is because virtually all CO2 is being sold into the same end market. Yes, there are niche utilization markets that might end up paying $200+ per tonne of CO2 in the next few years, but those are few and far between and those markets will be saturated almost immediately as soon as we start capturing CO2 in large amounts.

CO2 utilization is the business of making useful products out of CO2. There are plenty of people working utilization but they all face the same reality. CO2 is literally the lowest energy form that carbon can take. By the time it gets there, every bit of useful energy has been extracted. You have to put energy into the process to make anything useful out of the CO2. That energy may come in the form of chemical energy, heat, electricity, or something else. But things from CO2 is energy intensive and therefore often expensive.

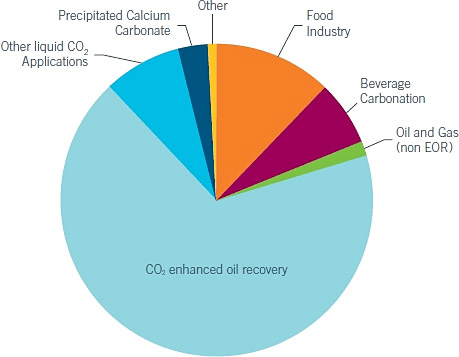

EOR represents by far the largest market for CO2, and it is not even close. As of 2011, the global CO2 market was about 80 million tons per annum (Mtpa). EOR represented 50 Mtpa of that total, and almost all of that was in North America. The US Chamber of Commerce says that a fully saturated EOR market would use between 410-530 Mtpa in the USA. The USA emits about 5,000 Mtpa. The math ends up being pretty simple from there. If we start capturing CO2 in the amounts needed to make a dent in climate change, we quickly saturate every potential CO2 market, even EOR. If the world is serious about decreasing CO2 emissions enough to mitigate global climate change, the end use for 95%+ of that CO2 will have to be permanent sequestration.

Approximate proportion of current CO2 demand by end use in 2011 (Department of Energy)

In the end, the reason I ignored the end value of the CO2 beyond the 45Q tax credit is because a) every technology has the same market to sell into in the short term and b) once we start capturing in earnest, the commercial CO2 market will never be supply constrained. At that point the CO2 infrastructure will exist to cheaply transport the CO2 wherever it needs to go and there will be so much of it that its cost will plummet in all but the most niche markets. I think the market for CO2 will therefore be determined not by traditional market forces because supply will be 10x demand, but by whatever price the world decides it is worth to mitigate the hazards its release represents. I don’t pretend to be smart enough or have the foresight to prognosticate that price. Exxon Mobil (XOM) believes that the carbon capture market will total $4T by 2050. Considering it is only a $2B-$10B market right now, depending on which source you trust, that’s incredible projected growth. Time will tell what price CO2 ends up at and how big the opportunity will eventually become, but it is safe to assume this is a sector where continued growth will be the norm for decades.

Basic criteria for investing in carbon capture

As established in my previous article (read there for more details on why I chose these criteria), in order for carbon capture to impact a company’s stock, it’s going to have to hit on each of these criteria:

-

Market cap – The CO2 market will be in the tens of billions in this decade. A company needs a market cap small enough for this to make a meaningful impact on revenues and profits

-

Scale – Technology Readiness Level of 6 or higher or with a currently funded project to reach that scale

-

Economic viability with 45Q – Have to be able to produce CO2 at or under $85/tonne for point source capture, or $180/tonne for direct air capture.

Amine Absorption Carbon Capture

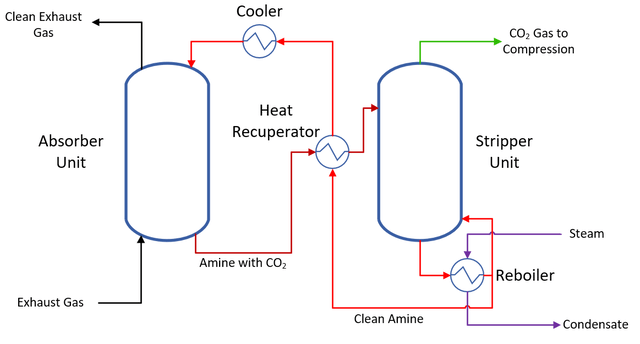

Simplified process flow diagram of amine capture unit (Author)

Before we dive into CANSOLV, I will describe the largest class of carbon capture technologies: amine absorption. These technologies share common traits. They use a type of chemical, called an amine, that they dissolve into water. Flue gas enters an absorber tower where the gas comes into contact with the water-amine mixture. The dissolved amines chemically bind CO2. Breaking this bond takes energy, so the water-amine-CO2 mixture is pumped into another tower, called a stripper unit, that heats up the mixture until the chemical bond between the amine and the CO2 breaks. This “strips” the CO2 from the amine. The CO2 leaves that unit as a gas with some water vapor and a very small amount of amine. The regenerated water-amine mixture is then ready to be cooled back down and put into the absorber unit and pick up more CO2. The gaseous CO2 must then be compressed to high pressure before it is put in a pipeline for transportation.

Absorption-based technologies use steam to provide the necessary heat to release the captured CO2. On paper, this is easy to get at a power plant since they generate steam to make electricity. In practice, it is significantly more complicated than first imagined, as will be discussed below. There are dozens of different flavors of proprietary amines that different companies have engineered to compete against each other. Each claim to have benefits over the others (amine stability, affinity for CO2, heat required to break the CO2 bond, higher solubility in water, etc.). I’ll cover a few of the major players in this and upcoming articles. Today we’ll talk in depth about Shell’s CANSOLV process.

Shell’s First Mover Advantage Turns Slightly Sour

CANSOLV was the technology used for the Boundary Dam Power Station, the first ever carbon capture project at a full-scale coal-fired power plant. The project was heralded as the dawn of a new era for coal. It was supposed to pave the way for dozens of similar future plants.

It ended up being more than 20% over budget, and has had some significant operational issues since being commissioned in 2014. A lot of that is to be expected for a first-of-a-kind plant at this scale. However, there are two major takeaways from operation that inform the use of their technology moving forward.

SaskPower Boundary Dam generating station (Wikipedia)

Retrofit Costs Higher Than Expected

The main reason for the inflated project capital costs was not actually the carbon capture plant, but rather due to the complexity of pulling steam from the existing power plant. It caused so many headaches that the next time someone chose to build a full-scale absorption carbon capture plant on a coal-fired power plant (the Petra Nova project in Texas), they chose to build a brand new natural gas-fired plant to provide steam instead of trying to integrate with the existing steam cycle.

This raises questions when we are thinking about how easy it is to retrofit existing plants with carbon capture technology. Whether power plants, steel plants, or cement kilns, steam or some form of heat is required for these absorption systems. Any implementation needs not only a carbon capture plant to be built, but it appears to also need a separate plant dedicated to providing the required steam. This raises capital costs above the nominal cost you will read on marketing materials.

High Amine Degradation

The second takeaway is that the alkali particulate matter in the flue gas at Boundary Dam caused a lot of issues with degradation of the amine chemical. The raw cost of the amine chemical is an expensive part of the process, and if that chemical degrades faster than assumed, you end up with higher operating costs. This is not a problem when capturing CO2 from cleaner gasses, such as the exhaust from natural gas-fired plants. However, industrial facilities like cement and steel are notorious for being laden with this type of particulate, casting doubt upon how well this technology will perform in the industrial sector.

CANSOLV’s Big Win in Europe

Shell has taken steps to engineer improved amine chemicals with the data they got from Boundary Dam, making them more robust and energy efficient. While the Boundary Dam project is a black eye, Shell’s CANSOLV was recently chosen as the technology for a 400,000 tonnes per year capture plant in Norway at a waste-to-energy plant. That’s a big deal for a number of reasons. First, it will make Shell the first company to have built two full-scale plants. Second, it gives Shell a chance to correct their mistakes and prove the technology has advanced. Third, this is a waste-to-energy plant, and approximately half the emissions are from combustion of biomass, making this a negative emissions plant.

Rendering of the new Shell CANSOLV capture plant (Technip Energies)

I spoke briefly in my last article about how point source capture projects have the capability of not just breaking even, but actively removing CO2 from the atmosphere, similar to direct air capture technologies, only at a fraction of the cost. Waste-to-energy plants use solid municipal waste as their fuel. This includes stuff like paper, plastics, yard waste, and other products made from wood. Shell will be able claim to have built the first large-scale negative emissions point source capture plant, which will be great for PR. Details haven’t been released, but I will be very interested to see from where they are planning on sourcing their steam.

Conclusion

Of the oil majors, Shell has put the most money into CCUS and stands the best chance of capitalizing on that market. In terms of investability I will rate it according to the criteria I set forth above. Shell’s market cap of ~$180B disqualifies it as being able to significantly benefit from CCUS in the near term, so it fails the first criteria. It has already achieved significant scale, and is the only tech to boast two full-scale funded projects. It not only passes the second criteria, but ranks highest of all the technologies I will be reviewing.

Cost is a mixed bag. There are question marks around cost including steam generation and ability to be used in industrial systems. These obstacles are surmountable but it remains to be seen if the economics make sense with 45Q. Their new commercial-scale offering in Norway will shed a lot of light on how much they learned from Boundary Dam and how well they will be able to compete moving forward. Shell has the capital, technology, and expertise to be a major player in the CCUS market in the future, but due to its size it does not qualify as an investment on the strength of carbon capture alone. If the new plant can solve the retrofit issue that plagued them at Boundary Dam and shows improved efficiency, they could be a major winner in the future. Until they prove that out, Shell and its CANSOLV technology will remain a hold for me.

Be the first to comment