blinow61

Thesis

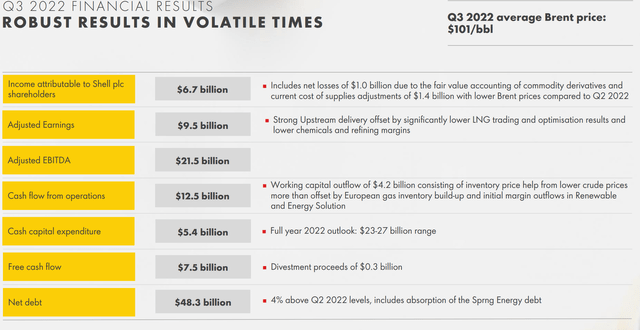

Following another strong Q3 quarter, Royal Dutch Shell (NYSE:SHEL) is on track to retire the 2008 FY earnings record, when the energy giant accumulated profits of $31 billion. In the September quarter, Europe’s largest energy firm generated net earnings of $6.74 billion, bringing cumulative income YTD to $30 billion. Moreover, for the past 3 months, Shell distributed $6.8 billion to shareholders and has voiced a commitment to further step-up distributions.

Looking at Shell’s exceptional Q3 results, it is hard to dislike an investment. I continue to be ‘Buy’ rated and I upgrade my base-case target price to $99.52/share, from $70.22/share earlier.

Shell’s September Quarter Results

On the backdrop of high energy prices, Shell continues to enjoy exceptional profitability. From July to end of September, the energy giant generated total revenues of $98.8 billion, which was slightly ahead of analyst consensus, but lower than the $103.1 billion achieved in the same period one year earlier.

Adjusted EBITDA almost doubled versus Q3 2021, growing to $12.5 billion versus $6.8 billion prior. Net income for the September period jumped to $6.7 billion (versus an approximate $500 million loss in Q3 2021).

CEO Ben van Beurden commented:

We are delivering robust results at a time of ongoing volatility in global energy markets. We continue to strengthen Shell’s portfolio through disciplined investment and transform the company for a low-carbon future. At the same time we are working closely with governments and customers to address their short and long-term energy needs.

Shell Q3 results

Profitability Still At Record Levels

Investors should note that Shell’s 2022 FY earnings, which have now reached about $30 billion for the trailing nine months already, are poised to smash the company’s 2008 record, when the energy giant generated $31 billion of net income.

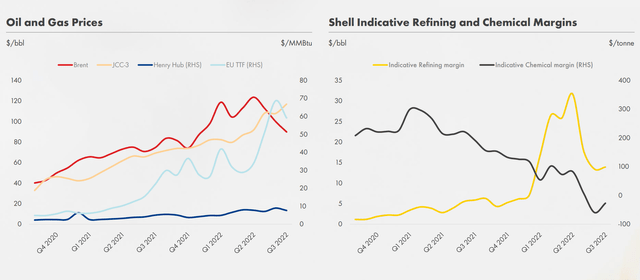

Shell’s exceptional profitability is driven by high energy prices, which continue to be between x2 – x3 the 2020 levels (see Henry Hub Nat Gas and Brent Oil reference). And although refining margins are coming down versus record Q3 2022, they remain elevated at close to $100/tonne (after being close to zero in the same period one year earlier).

And personally, I do not see that Shell’s profitability is challenged in the near-/mid-term future, as OPEC+ has taken action to keep oil close to $100/barrel.

Shell Q3 results

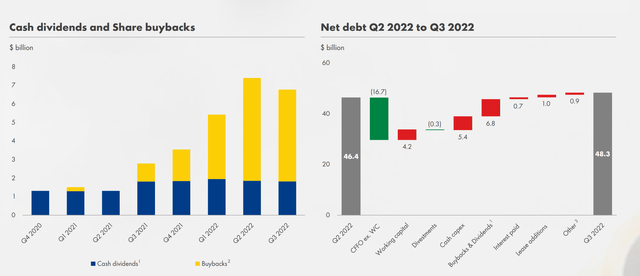

Attractive Shareholder Distributions

Investors are delighted to learn that most of Shell’s record profitability has been and will continue to be distributed to shareholders, with total distributions in excess of 30% CFFO. In Q2, Shell repurchased about $6 billion worth of stock, and distributed close to $2 billion in dividends.

And with Q3 results, Shell announced that the company is targeting another $4 billion of buybacks by end of Q4 2022, as well as plans to increase dividends (by March 2023), by an expected 15% – subject to Board approval.

Meanwhile, Shell did not pay back debt in Q3 2022. In fact, net debt slightly increased by about $1.7 billion, to $48.3 billion.

Shell Q3 results

Valuation Still Attractive

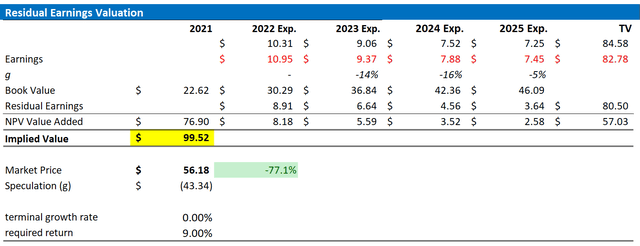

Following another very strong quarter, I upgrade my residual earnings model for SHEL to account for preliminary consensus EPS upgrades. However, I continue to anchor on an 9% cost of equity and a 0%, terminal growth rate (which I continue to regard as very conservative).

Given the EPS upgrades as highlighted below, I now calculate a fair implied share price for SHEL of $99.52, as compared to $70.22/share prior. (SHEL reference)

Analyst Consensus EPS; Author’s Calculation

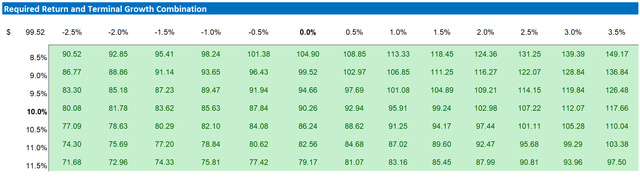

Below is also the updated sensitivity table.

Analyst Consensus EPS; Author’s Calculation

Risks

As I see it, there has been no major risk-updated since I have last covered SHEL stock. Thus, I would like to highlight what I have written before:

My thesis is connected to the implication that there are no structural differences between European and US oil majors. This, however, is not necessarily true since the respective regulatory exposure is somewhat different. Arguably, the European Union is slightly more aggressive with regards to the green energy push and US stocks generally trade at a premium. Nevertheless, a 100% relative valuation discrepancy is not justified, in my opinion.

In addition, investors should note that I assume a sustainable oil price of about $60/barrel. While this might seem bearish for some readers, others might argue that the fair value for oil is much lower. As the 2020 COVID-19 induced sell-off has shown, oil can even trade at negative price-levels. If oil would break considerably below $60/share and does not recover within a sensible time-period, the bull thesis for Shell would break.

In addition, I would also like to highlight that Shell might suffer from higher tax rates, as European governments are stepping up their ‘windfall tax’ ambitions. And Shell CEO Ben van Beurden signaled that his company would be ready to ’embrace’ higher tax rates:

We should be prepared and accept that also our industry will be looked at for raising taxes in order to fund the transfers to those who need it most in these very difficult times … We have to embrace it.

While the ‘incremental tax risk’ cannot yet be quantified, investors should monitor the situation closely.

Conclusion

The value thesis for Shell remains very strong, as the energy giant continues to enjoy record profitability and distributes much of the ‘windfall earning’ to shareholders. Personally, I am confident to reiterate a ‘Buy’ rating for SHEL stock. And on the backdrop of EPS upgrades, I now calculate a fair implied share price of $99.52 (SHEL reference).

Be the first to comment