blinow61

Shell (NYSE:SHEL) is a $190 billion market cap company. It trades at 4.7x forward earnings and only yields 2.79%. It lowered its dividend through the last oil crash and hasn’t cranked it back to the typical oil-major territory. Shell has around $46 billion in net debt. It spends $23-$27 billion on CapEx for 2022.

Shell just announced Wael Sawan, Director of Integrated Gas, Renewables and Energy Solutions, will succeed CEO Ben van Beurden at the start of next year. Sawan was born in Beirut and enjoyed a U.S. (Harvard) education. This gives me hope that an understanding of why shareholder returns are paramount will improve. In my experience, the importance of shareholder returns is generally better appreciated in the U.S. than in mainland Europe.

Much has improved, in that respect, over the last nine years, I’ve been following this company (since my first article on Shell in 2013). But these have been challenging years and outgoing CEO Ben van Beurden was dealt a few very tough hands. The future remains as uncertain as ever, but the starting situation is highly attractive. Both to an incoming CEO and investors.

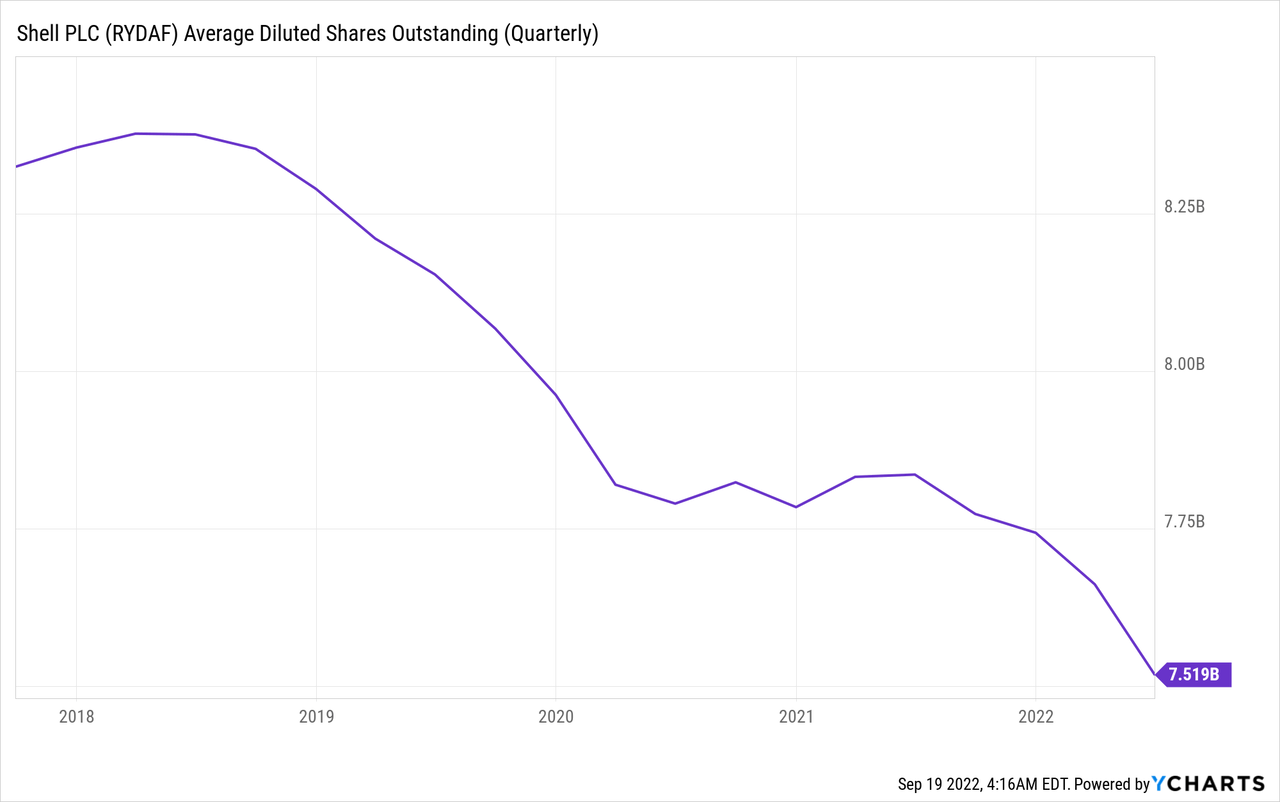

The company is currently producing $60 billion in EBITDA. $36 billion in net income. This quarter it is retiring $6 billion worth of shares. Shell is returning shares at a pretty rapid clip, although it has been on the right path since 18′.

Here’s what CFO Gorman had to say about the company’s options to return cash to shareholders:

And the way we looked at it was from an excess cash point of view, we want to allocate it according to value. And that’s very important to us. And frankly speaking, where the share price is at the moment, it made sense to therefore go for the share buybacks. And that $6 billion, just because you added the question there, is specifically for Q3. And we expect that $6 billion buyback to be executed by the Q3 results, so by the time we come out with it then.

As an investor, I happen to be pretty fond of profitable companies that are shrinking their asset bases. Shell is both. The company is highly profitable but it is the subject of a rather awkward and landmark court judgment to reduce emissions (I’ve reviewed it extensively here).

Shell is more or less compelled to reduce its emissions, and I don’t see any other reasonable likely route to achieve this that doesn’t include some significant asset sales. Shell has already made a few divestments and in one of its latest moves, seems to be getting rid of projects where the social license isn’t really there.

Shell’s plan for the energy transition is to focus on the customer. Shell wants the networks and contacts to trade energy (hydrogen, energy, green energy) and add value to that chain. I’m skeptical of this model. If Shell could somehow pivot towards an asset-light trading model that would be amazing. However, I fear this could also result in a hodge-podge of subscale commodified businesses and Shell lacking economies of scale to be a top competitor. No doubt, Shell’s strategic direction will become more clear under incoming CEO Sawan as the energy transition progresses.

The outlook for oil is pretty interesting from an investor’s standpoint. Here’s current CEO van Beurden on the last earnings call:

So we are — particularly if you look at the energy outlook, we are actually quite bullish. If you look at where we are today with supply-demand balances, the market is very tight. And there’s not a lot of spare capacity around. OPEC hardly has an spare capacity. You could think of a little bit more coming out of shales. Strangely enough, the SBR release has actually helped, but that’s hardly a price management tool, of course. So we are running out of steam a little bit in coming with supply-side solutions. And on the demand side, we haven’t even seen a full recovery to 2019 type of demand.

So my concern is that we will have a very tight situation, a lot of volatility. Now sometimes we can benefit a lot from volatility. But I think that will continue to persist. But the other thing to bear in mind, which may not be a very popular thing to say, but it is a fact is that the impact on Russia in terms of self-sanctioning and all sorts of other actions that have been taken has actually been quite minimal. The volume of crude coming out of Russia has been diminished, but only with a few hundreds of thousands of barrels a day, not a sort of 2 million or 3 million that were originally foreseen. That might actually change in the new year when the real sanctions are starting to bite. So I think we’re going to see a tight situation for some time to come. And then I haven’t spoken yet about gas in Europe, and the impact that it has on the global LNG market. So all together, I think there is more upside risk than downside risk.

The European sanctions will ban seaborne imports of Russian crude oil as of December 5, 2022, and petroleum product imports as of February 5, 2023. It is possible this will have a tremendous impact on global oil prices.

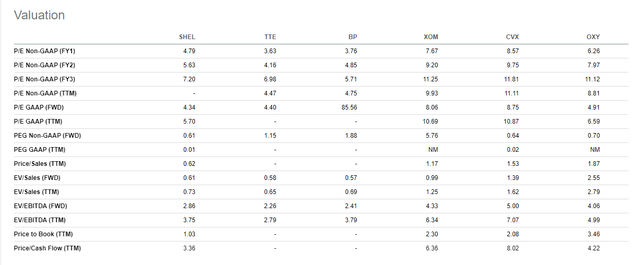

If I look at Shell’s valuation and compare it to competitors like Exxon Mobil (XOM), Chevron (CVX), and Occidental Petroleum (OXY) it looks very attractively valued. Shell trades in-line with European peers like TotalEnergies (TTE) and BP (BP).

oil major valuations (Seeking Alpha)

At this point, it’s still wishful thinking the new CEO could amplify the shareholder friendliness here. Maybe the major U.S. companies deserve a bit of a premium. The U.S. companies also stick to their knitting more and have less expansive plans for renewable energies. However, Shell will likely be forced to continue divesting. That’s with energy prices and the outlook at a level where managements could otherwise start thinking about acquisitions and investment. I don’t have to fear these actions as much here. Shell also returns a lot of cash, and management considers its shares undervalued. At last quarter’s rate, it is retiring over 10% of shares annually. That’s in addition to a “small” dividend of 2.79%. But the dividend is slightly deceptive. Given the level of buybacks, you could also view the total shareholder yield as above 10%. I don’t see energy prices dropping to levels where Shell becomes unprofitable, and think this is an attractive energy major to hold through the coming winter and see what happens.

Be the first to comment