Nikada/iStock Unreleased via Getty Images

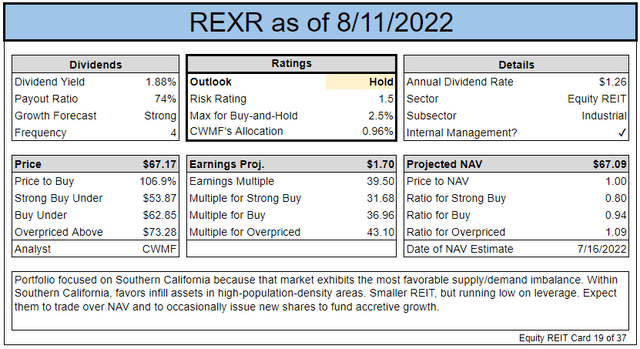

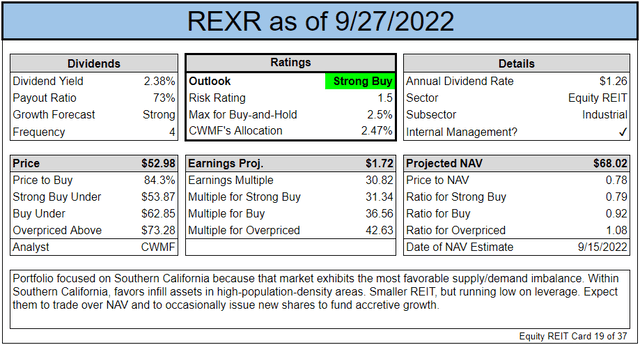

Rexford Industrial (NYSE:REXR) is expected to deliver strong results. The bar is automatically high. When we’re setting our “buy under” target at more than 36 times consensus AFFO, investors should expect massive growth. However, REXR outperformed my expectations in the Q2 2022 earnings release and earned an increased price target.

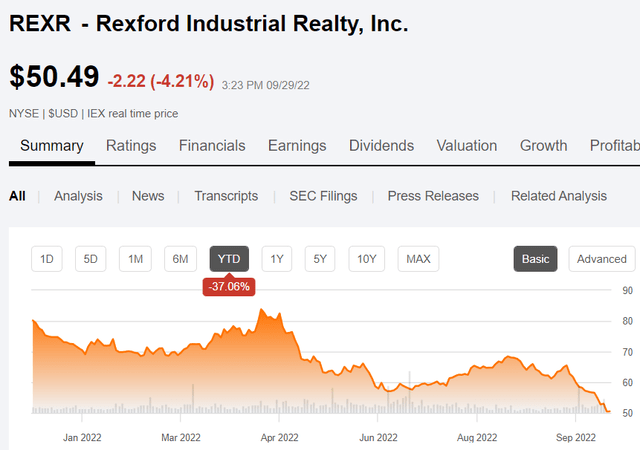

Shares plunged recently and dipped into our “Strong Buy” range.

Since fundamentals look great and the price is plunging, I responded by purchasing shares. Now I want to share a large part of our REXR report for subscribers.

How Did REXR Outperform

We’ve got several factors to consider:

- Core FFO per share for Q2 was up 25.6% year-over-year. That’s just slightly ahead of expectations. When you’re looking at AFFO multiples, just remember that this kind of growth can break models.

- Same property NOI was up 7%. Same property cash NOI was up 10.1%. That’s excellent. This is driving growth in Core FFO.

- Comparable rental rates for new and renewed leases were up 83% on a GAAP basis (not our preferred metric) and 61.5% on a cash basis (our preferred metric). We expect strong growth in rental rates. It needs to be strong to drive this long-term growth in NOI, Core FFO per share, and AFFO per share. However, 61.5% is off the charts. Since these leases didn’t commence on April 1st, only part of the benefit is included in the Q2 2022 results.

- Net debt to enterprise value (which measures net debt + market cap of the stock) was only 13.5%. That is up from 10.3% at the end of Q1 2022, but investors should remember that industrial REITs were hammered so far this year. They were near their lows for the year on 6/30/2022. Since this equation uses market cap, it treats the stock price as one of the inputs.

- REXR is building this REIT like a fortress. They were already on the road to a reduction in risk rating, but this solidified it. The primary factor “increasing” the leverage on that metric was the drop in the share price. The risk rating is dropping from 2.0 to 1.5. It won’t go to a 1.0, as we could see debt increase moderately (not dramatically) in Q3.

One Area of Weakness

There was only one bad part in the earnings release, and it took a while to piece it together. In the bullet points for the press release, REXR states:

Issued a total of 6.0 million shares of common stock for total net proceeds of $419.4 million.

That gives us an average price of about $69.90 per share. I’d consider that slightly above average for the quarter. Far from perfect, but that wouldn’t appear to be a weakness.

The issue is that on the third page it says:

During the second quarter, the Company executed on its prior and renewed ATM programs, selling 12,002,480 shares of common stock subject to forward sale agreements at an average price of 62.55 per share for a gross value of $750.8 million. On June 29, 2022, the Company partially settled these forward equity sale agreements and outstanding forward equity sale agreement from the prior quarter by issuing 5,967,783 shares of common stock for net proceeds of $419.4 million.

Allow me to break that down into a story that will make sense to people who don’t have an accounting background.

Before Q2 2022, REXR used a “forward equity offering” to lock in the price for issuing some shares in the future. Specifically, they had $232.2 million locked in. During Q2 2022, they issued those shares at the price they had locked in. However, during Q2 2022, they had another “forward equity offering”.

During Q2 2022, locked in the price for another 12 million shares at a weighted average price of $62.55. They issued about 25% of these shares prior to the end of Q2 2022. The other 75%, about 9 million shares, have not been issued yet. However, the price is locked in.

Therefore, the average price of $69.90 per share was a mix of prices locked in before Q2 2022 and prices locked during Q2 2022.

Meanwhile, the next 9 million shares to be issued have a locked-in price of only $62.55 per share, which is clearly on the low end of what we think REXR should accept for their stock.

That’s the negative part of REXR’s release. Since they already have these shares issued, they may use them to fund a significant portion of their upcoming acquisitions. However, it still wouldn’t cover all of the acquisitions expected for the rest of 2022.

Acquisitions

REXR was aggressively putting cash to use:

- During Q2 2022, REXR purchased 18 properties for a total price of $598.9 million.

- Subsequent to quarter end (but already occurring), they bought another $587 million.

- REXR also has another $500 million either under contract or an accepted offer.

REXR only had $34.3 million of cash on hand, but they had about $1.5 billion in liquidity at the end of Q2 2022. That comes from combining:

- Cash of $34.3 million.

- $875 million available on their credit facility.

- $552 of “forward equity proceeds”.

The forward equity proceeds refer to shares REXR agreed to sell in the future at a predetermined price, $62.55.

Since cash on hand and forward equity proceeds were about equal to the total of $587 million in transactions that already occurred early in Q3 2022, REXR either needs to be issuing additional shares or using their credit facility. During Q2 2022, REXR increased the capacity on their credit facility from $700 million to $1.0 billion. I think they may put some of that to work in Q3 2022 as part of their financing strategy, but it wouldn’t surprise me at all if REXR is also issuing additional shares. I don’t expect the $500 million that had not closed yet to all be funded with debt.

To be clear, these acquisitions are generally accretive. Management has done a great job of selecting individual properties for the portfolio. Their selection of properties enabled them to enhance growth in AFFO per share by issuing new equity and putting the capital to work efficiently. The fact that REXR agreed to issue equity at a mediocre price suggests that management believes they are getting a great deal on their acquisitions. Based on their record, it would be wise to assume they are right.

The acquisitions have a weighted average unlevered initial yield (cash rent divided by purchase price, same as cap rate) of 2.5%. However, management estimates the stabilized yield on their investment will be 5.1%. Clearly, the properties should see dramatic rental rate increases in the near future. These acquisitions don’t look accretive to AFFO per share right now because of the low 2.5% yield. However, when it jumps to 5.1% it would become quite accretive.

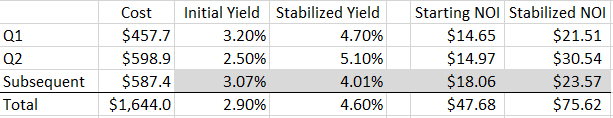

Year-to-date through the earnings release, total acquisitions are $1,644 million. REXR provided the initial yield and stabilized yield for transactions in Q1 2022, in Q2 2022, and in total year-to-date. They didn’t break out the initial yield or stabilized yield for their transactions subsequent to Q2 2022. However, they gave us all the parts necessary to calculate it (subject to rounding errors):

Author Calculations, data from REXR press release

The stabilized yield on the subsequent transactions is lower than I would’ve expected, given that REXR was willing to issue shares at $62.55. However, there could be very good reasons for that. For instance, REXR may have been purchasing properties where it expects rental rates to grow at a higher compounding rate over the next decade. That would certainly justify having a lower stabilized yield in the near future.

Conclusion

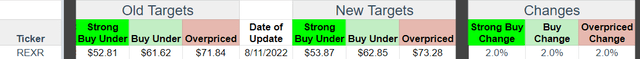

Mixing the positive surprise on leasing spreads and increased guidance for same property NOI with the negative surprise on so many shares being sold at $62.55, targets for REXR are only increased by 2%. If REXR’s forward equity offerings came in around $68.00 per share or higher, targets would be getting a bigger boost.

Our outlook as of 8/11/2022 was only neutral, but it ripped higher.

Update

The initial part of the article was sent to our members on 08/11/2022. Our targets for REXR remain at the same level as indicated above. However, shares plunged dramatically.

This resulted in shares moving into the Strong Buy range:

You may also notice our allocation increased from 0.96% to 2.47%.

That’s because we picked up more shares.

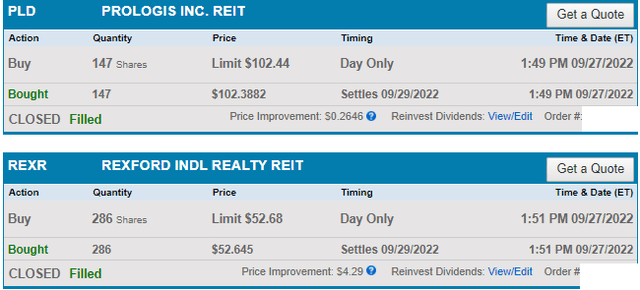

We added 286 shares of REXR at $52.68 and 147 shares of Prologis (PLD) at $102.3882:

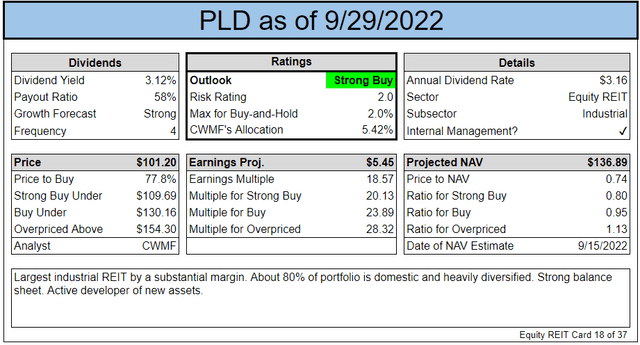

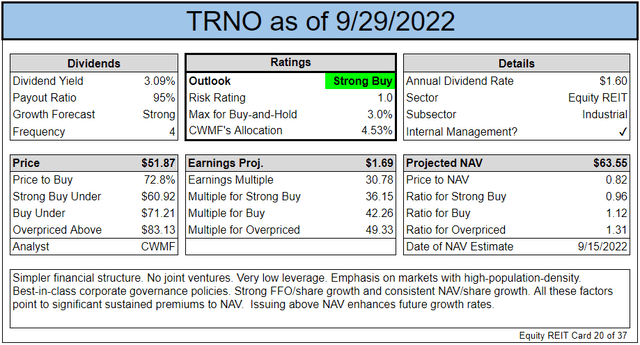

As usual, my money and mouth go together. In my opinion, PLD and REXR both deserve the strong buy rating here. However, I think Terreno Realty (TRNO) also deserves a strong buy rating. TRNO is one of our other industrial REIT positions. We added to TRNO 3 times since the start of May. Those purchases were at $63.40, $57.81, and $55.83. Today, shares are $54.25.

Here are the index cards for PLD and TRNO:

- Ratings: Strong Buy on REXR, PLD, and TRNO

Be the first to comment