pigphoto SFL Corp. logo (NYSE:SFL)

Investment thesis

SFL Corporation (SFL) continues to deliver solid results with stable long-term income generation.

Their opportunistic deal-making continues and it broadens their customer base and further diversification. If you do not like the large swings in spot market in the maritime industry but would like to have exposure to the sector, we still prefer SFL to some of the popular names seen here on SA.

Their latest quarter is just out. Let us examine how they did in the third quarter of 2022.

Third Quarter 2022 Financial Results

SFL delivered a net income of around $50 million in the quarter or $0.39 per share. This includes contributions from profit share arrangements and also positive mark-to-market on interest rate swaps and equity and bond investments.

From this, they maintained the quarterly dividend of $0.23 per share

Based on a share price of USD 10.72 it gives investors a pretty good dividend yield of around 8.3%

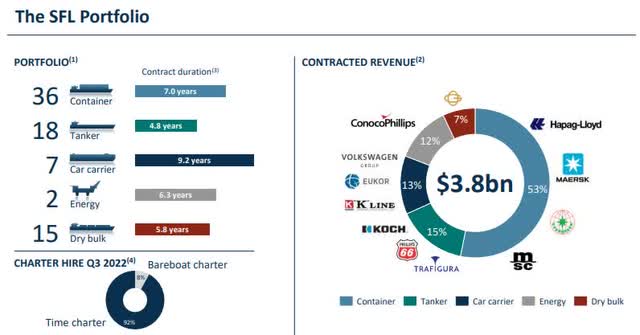

More important, is the fact that it is the 75th consecutive dividend payment which management has the right to brag about. They have paid out more than $28 per share, and they do have a strong charter backlog of USD 3.8 billion which will support continued dividend capacity going forward.

The company generated gross charter hire of approximately USD 178 million in Q3, including USD 1.3 million of profit sharing.

This profit sharing is quite significant. Over the last 12 months, SFL has received USD 28.5 million from it.

Regarding their balance sheet, long-term interest-bearing debt went down from USD 1.20 billion at the end of Q2 to USD 1.06 billion at the end of Q3. On the other hand, short-term debt increased by USD 202 million.

Cash, and cash equivalent, reduced from USD 224 million to USD 179 million.

And the end of Q3, about 70% of SFL’s financing was on a fixed rate or swap-to-fixed basis by financial hedging instruments. This conservative approach is prudent now that we experience rate hikes on a regular basis.

They estimate that 100 basis points increase in interest rates from their current levels equals about USD 0.02 per share in lower distributable cash flow per quarter and vice versa.

Update on their fleet

In the last quarter, the liner fleet generated a total charter hire of USD $98 million, including USD 10 million in profit share contribution related to fuel savings.

The outfitting of scrubbers has been a good investment over the last couple of years. In our last article on Frontline (FRO) you can see the huge difference in earnings between scrubber-fitted vessels and those that are not.

The remaining charter term for the liners is 4.7 years or 7.4 years if weighted by charter hire. This includes the remaining charter of their Pure Car Carriers.

-

Crude & Product/Chemical tankers

The tanker market has been on an upward trajectory lately and SFL has benefited from this to some extent.

With a fleet of 18 crude oil products and chemical tankers, with the majority employed on long-term charters, their tanker fleet generated approximately $42 million in gross charter hire during Q3, compared to $35 million in the previous quarter from these period charters.

In the spot market, they also have 2 Suezmax tankers and 2 small chemical tankers. These generated total charter hire of about USD 11.5 million in Q3 compared to about USD 6.6 million in Q2.

To balance out the positivity from the tankers, the dry bulk market went from great to not-so-great. That is why a diverse fleet is so important.

SFL has 15 dry bulk carriers, of which 9 were employed on long-term charters during Q3. They generated about USD 27 million in gross charter hire including USD 1.2 million in profit sharing

That is USD 3 million lower than the USD 30 million it generated in Q2.

In earlier articles, we pointed out that these offshore drilling assets could become quite profitable to SFL.

In Q3, SFL received a total charter hire of USD 10 million from these two rigs.

The charter rate for “West Linus” is adjusted semi-annually. And currently, the charter rate is approximately USD $199,000 per day, up from $193,000 per day from May through October. Operating expenses are said to be about USD 125,000 per day.

The “West Hercules” will be delivered back to SFL in Norway in December. This rig is one of only a handful of rigs fully equipped to drill in the harshest Arctic environment, and according to SFL’s management, they stated that market analysts are positive about the market prospects based on recent tender activity and a tight supply-demand balance. The market for deepwater drilling rigs has risen quickly but it is expected that the harsh environment rig market for 2024 and 2025 is promising.

In our last SFL article, we mentioned that we hoped SFL would give some guidance as to what it will cost to put “West Hercules” through the next scheduled comprehensive special periodic survey. SFL now estimates the cost to be about USD 50 million plus potential contract-specific upgrades.

The rig will be available for new contracts from the middle of the Q2 of 2023 and we look forward to getting news on the next drilling contract.

One positive thing about SFL’s whole fleet that we would like to point out is the fact that 90% of their vessels are on time-charter with only about 8% on bareboat-charter. You may ask yourself why this is so important.

The answer to that is that when you charter a vessel out on bareboat-charter, the technical management and maintenance of the vessel is done by the charterer. Just like you never wash and maintain your rental car, the charterers generally do as little as possible. SFL wants to ensure that its fleet is maintained and managed properly. By doing this they look after the assets well which usually reflects better second-hand values when the assets finally get sold.

Deal making continues

SFL is surely not resting on its laurels.

Every quarter they do new deals adding to their existing earning power going forward.

During Q3 they bought 4 modern eco-design Suezmax tankers in combination with long-term charters to Koch Industries. With the vessels now being delivered, SFL will receive the full cash flow effect from Q1 of 2023. This deal added USD 250 million to their charter backlog and adds to an already diverse mix of customers.

In September, they also bought 2 feeder container vessels just being delivered from a shipyard in China. The first vessel was delivered and entered service for Maersk in September and the second vessel is due shortly.

The duration of the initial charter is 7 years at a rate of about USD 23,400 per day per vessel. SFL’s business philosophy means that the vessels will have been amortized down to levels where they believe they can either be sold at a profit or chartered further out at a competitive level.

The risks obviously lie in what the market is seven years from now. More on this in our assessment of the risks to the thesis.

However, as time has proved over the years, their diversification has worked as some categories of vessels could be in a slump and others could be doing quite well.

As if these six vessels were not enough, they also bought a 2010-built midsized Pure Car Carrier with a 6 years charter to the leading Ro/Ro operator Eukor, which is based in Korea. That company is 20% owned by Hyundai Motor and Kia with the balance owned by Wallenius Wilhelmsen which owns and operates around 130 vessels.

In addition to the charter rate of about USD 29,600 per day, there is also the potential of significant benefits from profit sharing as the vessel is installed with a scrubber where most of the benefits go to SFL.

Risks to the thesis

Over the years, the risks have changed, as they often do.

SFL started out with just one customer, namely Frontline. Their fleet was just crude oil tankers. Their fleet composition has varied from 100% tankers to nearly 60% offshore 10 years ago and now to container vessels being the largest segment with 53% of the backlog.

SFL’s diverse fleet and customer base (SFL Q3 2022 Presentation)

At one point in time, when the offshore drilling market crashed, there were concerns about SFL’s exposure to that segment of the business.

Over the years they managed to reduce this exposure and did take some losses along the way from the assets but never to the extent that it caused much concern to shareholders.

In terms of their present risks, we have stated that it is now very reliant on the container market with 36 vessels in that segment, so it is good to see that they are balancing out the fleet profile.

The other point we would like to see addressed is the fact that SFL do rely heavily on leverage. As we know, leverage does wonders when all goes well, but it can lead to pain when things are not going so well.

SFL’s book equity ratio of approximately 29% based on Q3 numbers is quite low. We know that it is tied to a large charter backlog and many years of visible earnings. Hence, the likelihood of the risk turning into a problem is small, in our opinion.

Charter rates for container vessels have come down from very high levels. Many new-building deliveries are expected and if we are going to have a prolonged economic slowdown, liner companies will have to adjust their fleet.

Conclusion

SFL has been a good place to be invested in during 2022.

SFL’s 1 year share price versus SPY (SA)

Apart from the 24% rise in the share price against the S&P500 index dropping 15.8% you will also have received a steady dividend income.

That income is set to continue. Their 75 consecutive quarters are a testament to that.

Could the share price go down to the USD 9 level again?

Sure, anything can happen. However, the likelihood is quite small, in our opinion. We would certainly not wait for it to happen.

SFL is still a Buy here at this level.

Be the first to comment