Nikola Stojadinovic/E+ via Getty Images

When it comes to the death care industry, the 800-pound gorilla in the room is undoubtedly Service Corporation International (NYSE:SCI). Despite operating in an industry that many might view as boring and perhaps even morbid, the company has demonstrated tremendous stability in recent months. While the broader market is down this year, shares of this enterprise are up rather nicely. This serves as a testament to the quality of the operation and it’s likely that its stability will persist moving forward. Having said that, shares of the firm do now look more expensive than they were previously. Even so, investors who are looking for a quality company at a fair price might want to consider a stake in this prospect.

Stable returns during unstable times

Back in January of this year, I wrote an article that looked favorably upon Service Corporation International. In that article, I said that the company continued to benefit from elevated death levels that were occurring in the US as a result of the COVID-19 pandemic. I said that shares of the firm were attractively priced but it was unclear how long elevated deaths would persist. Ultimately, I ended up rating the company a ‘buy’, indicating my belief that it would outperform the broader market for the foreseeable future. Since then, my view has proven to be accurate. While the S&P 500 is down by 17.3%, shares of Service Corporation International have generated a return for investors of 4.7%.

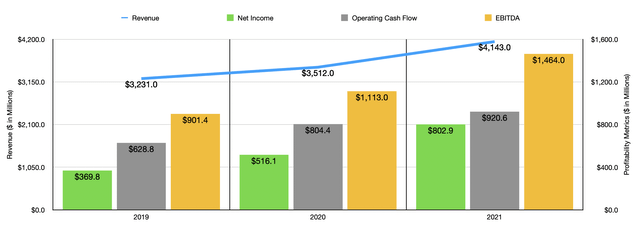

This return disparity was not without cause. For starters, let’s see how the company performed in its 2021 fiscal year compared to 2020. Revenue in 2021 came in at $4.14 billion. This translated to a year-over-year increase of 18%, up from the $3.51 billion generated in 2020. On the funeral side of things, the company saw revenue rise 14.2%, largely due to a 13.5% rise that came from a 4.4% increase in funeral services performed because of COVID-19-related deaths, as well as a 7.1% increase in average revenue per funeral service Following a year in which social distancing negatively impacted sales. The company also benefited to the tune of $21 million from acquired and newly constructed properties under this operation. Under the cemetery category, meanwhile, revenue jumped by 23.4% because of a 24.2% rise and recognized pre-need revenue as a result of strong comparable pre-need cemetery property sales production for that time frame, as well as because of a 23.5% rise incomparable cemetery at need revenue because of both higher sales prices and other miscellaneous factors. Higher endowment care trust fund income also contributed $18.1 million to this unit’s top line.

On the bottom line, things were equally positive. Net income of $802.9 million dwarfed the $516.1 million generated in 2020. Operating cash flow went from $804.4 million in 2020 to $920.6 million last year. Meanwhile, EBITDA increased from $1.11 billion to $1.46 billion. When you consider the nature of the business, which relies heavily on a significant investment in assets, and you factor in the heightened demand caused by COVID-19, it makes sense that profitability could rise by so much in such a short timeframe. This has emboldened the company to recently increase its share buyback program by $394 million up to a total of $600 million. That announcement was made in May of this year.

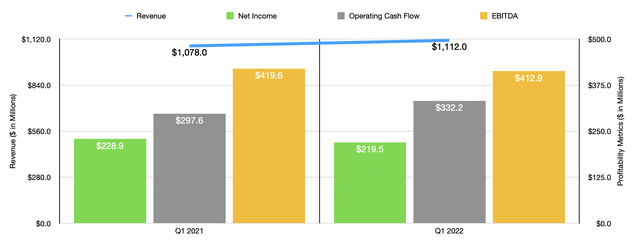

When it comes to the current fiscal year, the picture has been a bit more mixed. Revenue did increase, rising by 3.2% from $1.08 billion in the first quarter of 2021 to $1.11 billion the same time this year. On the other hand, net income worsened, dipping from $228.9 million to $219.5 million. Although this may be painful, operating cash flow jumped from $297.6 million to $332.2 million. But this was, unfortunately, overshadowed by the fact that EBITDA also fell year over year, declining from $419.6 million to $412.9 million. When it comes to the 2022 fiscal year as a whole, management has provided some guidance. They currently anticipate earnings per share of between $2.80 and $3.20. That would imply net income of $555.6 million. Clearly higher costs will hit the company later on this year. This should also reflect in operating cash flow, which management expects, at the midpoint, to come in at just $775 million for the year. If we apply the same year-over-year decline for it to EBITDA, then EBITDA should come in at about $1.23 billion for the year.

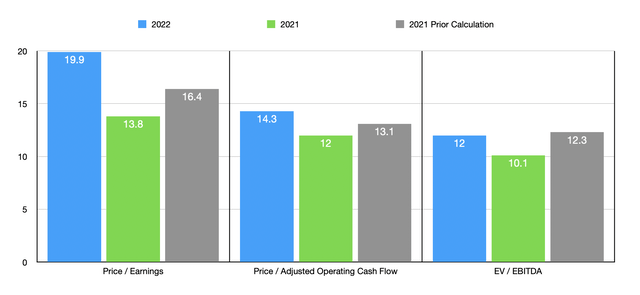

Taking these figures, we can see that the company is trading at a forward price-to-earnings multiple of 19.9. That’s up from the 13.8 reading that we get using our 2021 results. The price to adjusted operating cash flow multiple should be 14.3 compared to the 12 that we get from 2021. And the EV to EBITDA multiple should be about 12. That compares to the 10.1 that we get if we rely on 2021 results. These multiples also compared to the prior 2021 figures that I calculated for the company in my last article, with those figures being 16.4, 13.1, and 12.3, respectively. To put the pricing of the company into perspective, I decided to compare it to four similar firms. On a price-to-earnings basis, these companies ranged from a low of 15.2 to a high of 456. Two of the four that had positive results were lower than our prospect. Using the price to operating cash flow approach, the range was from 6.1 to 60.5, with three of the five companies being cheaper than our target. And when it comes to the EV to EBITDA approach, the range was from 7.5 to 12.6, with three of the four companies having positive results and our prospect being the most expensive of them.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Service Corporation International | 23.2 | 15.8 | 13.3 |

| Carriage Services (CSV) | 19.2 | 10.0 | 12.6 |

| Matthews International Corporation (MATW) | 456.0 | 6.1 | 11.8 |

| StoneMor (STON) | N/A | 60.5 | N/A |

| Hillenbrand (HI) | 15.2 | 8.4 | 7.5 |

Takeaway

Based on the data provided, it looks to me as though Service Corporation International is still a pretty healthy company. Sales continue to grow but it does look like profitability will be an issue this year. But that doesn’t change the fact that it’s a quality operator that is set up for long-term success. Ultimately, I don’t think the firm would be a bad prospect for long-term investors, leading to my decision to retain my ‘buy’ rating on the business.

Be the first to comment