baona/iStock via Getty Images

Senstar (NASDAQ:SNT) is a designer of perimeter security systems for civilian applications. The company divested its defense related segment last year, posting record earnings on the transaction.

Back in January, I wrote an article on SNT warning about the non-recurring nature of record profits, and the less than spectacular earnings and conditions of the perimeter security system. Since then, the stock has fallen 32%, against 22% for the Russell 2000 and 17% for the Israeli TA AllShares Index.

Despite the recent discounts, SNT’s stock is still expensive, considering its capacity for generating net income, and its lack of growth for much of the past decade. Recent quarterly data and restated yearly data, without the distorting effect of the divested operations, show that the perimeter security business is much smaller than believed.

Note: Unless otherwise stated, all information has been obtained from SNT’s filings with the SEC.

Competitive position and profitability

In my latest article on Senstar, I commented that the company’s perimeter security business is well regarded among civilian applications. Proof of that is that a simple Google search for your local civilian security provider will probably list Senstar as one of the brands offered. The company has also obtained contracts in several high-sensitivity civilian applications.

In that article I also mentioned that Senstar’s business, after divestment, has stable characteristics, given that it is less dependent on non-recurring projects, more common in high-sensitivity security and defense applications. The company’s more civilian oriented products and video surveillance suite can be sold to regular customers through distributors, providing recurring revenue. Senstar mentions on its investors deck that it plans to orient its business to civilian high-sensitivity applications, like utilities, prisons, O&G, etc. These could definitely prove much less recurring.

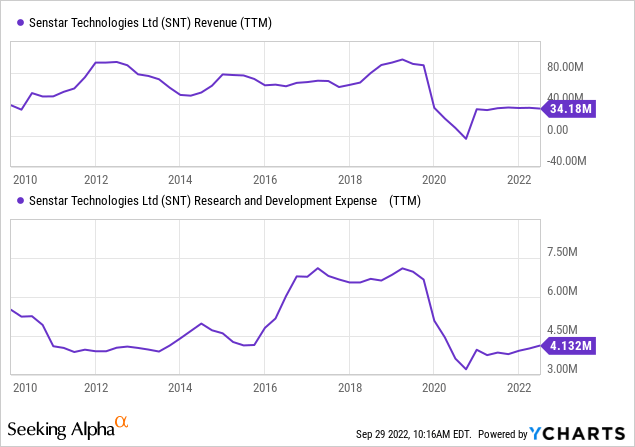

By compiling segment information from 2012, I speculated that the civilian segment would be able to generate between $35 and $45 million in yearly revenue, and that it would maintain a 10% operating margin, with 10% of revenue dedicated to R&D activities. This was speculation because Senstar segments mixed civilian and defense applications. I also considered that the company had not shown a capability to grow the business beyond the $45 million mark during the past decade.

Finally, One of the most problematic aspects that I found for Senstar was its tax treatment. Operating in many countries, and exposed to Israel’s relatively broad interpretation of Israeli-based income, Senstar had suffered from extremely high effective tax rates that severely damaged profitability. I speculated that after the divestment, Senstar would move its corporate seat to Canada, where it has its main R&D and manufacturing facilities. This has not happened yet and may not happen at all.

Recent data confirms projections

Senstar has provided very valuable financial data during these months.

First and foremost, the company published a post-divestment 20-F annual report for FY21 where it restated previous years’ operations to reflect the divested segments.

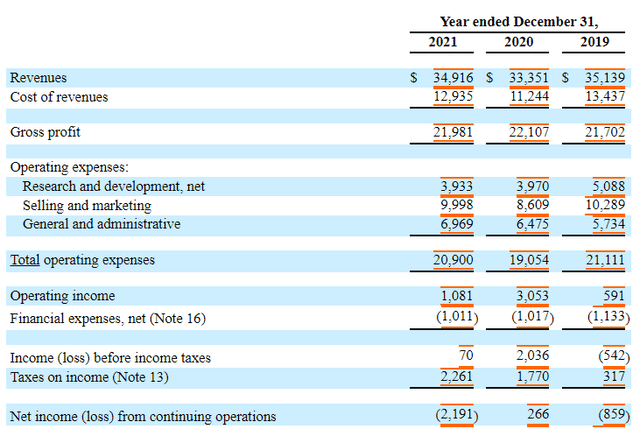

This information confirmed several of my speculations. First, the non-divested operations have generated around $35 million in revenues, with no growth. Unfortunately, the data also shows that operating margins are much lower than I expected. This may be related to non-recurring projects that require significant sales effort. The data also confirms Senstar’s terrible tax treatment, whereas the company is constantly paying taxes, even on pre-tax losses.

Senstar’s financial statements for FY21, 20 and 19, restated to reflect recent divestments (Senstar’s FY21 20-F annual report filed with the SEC)

Recent quarterly data, for 1H22, shows a similar situation. The company has not grown revenues and has been unable to post operating profits.

This has reduced Senstar’s cash holdings, from $26.5 million in December 2021 to $18 million as of June 2022. Truth is though, that most of that cash was used to build working capital and pay current liabilities.

Finally, an important aspect to consider is R&D expenses. Usually, R&D heavy companies are at a disadvantage compared to physical asset heavy companies, because R&D cannot be capitalized. Using information from FY20’s 20-F report shows that Senstar’s remaining segments account for 80% or more of the R&D expenses of the pre-divestment company. These amount to $4 million a year on a restated basis, and 1H22 figures show a similar situation.

The question is whether R&D expenses are a form of capital building that should not be expensed or if they are a required recurrent expense just to remain in business? The answer usually comes from the top-line. If the company can grow revenues, then R&D (or advertising for the same reason) can be considered an investment, not an expense. If not, then R&D is just a requirement for doing business in the industry.

In Senstar’s case, I tend to believe that R&D is just an expense. Despite investing enormous amounts for more than a decade, the company has been unable to grow its revenues.

However, the investor should bear in mind that Senstar’s lack of profitability is definitely affected by the $4 million yearly expenditures in R&D.

Conclusions

In my opinion, there is no way to justify SNT’s current market cap of $44 million on the basis of its historical income generation capacity, now that investors can understand the post-divestment company.

The future does not provide a justification either, considering that Senstar has been unable to grow revenues, even despite being well regarded in its industry and spending a considerable amount in R&D.

In the future, important developments would include moving the company’s seat to a country where effective taxes are lower (for example to Canada where an important portion of expenses are generated); and growth in the recurring side of the business. The investor should be wary of quarter to quarter increases in revenue that are generated by non-recurring projects.

Be the first to comment