AleksandarGeorgiev

Thesis

Despite being undervalued compared to peers on a multiple basis, Seneca Foods Corporation (NASDAQ:SENEA) does not necessarily have potential upside in the share price due to a continued decline in the quality of the company’s earnings, as profit margins gradually decline due to increases in input costs, thanks to inflation. Therefore, we recommend holding until improvements are made to the financials.

Intro

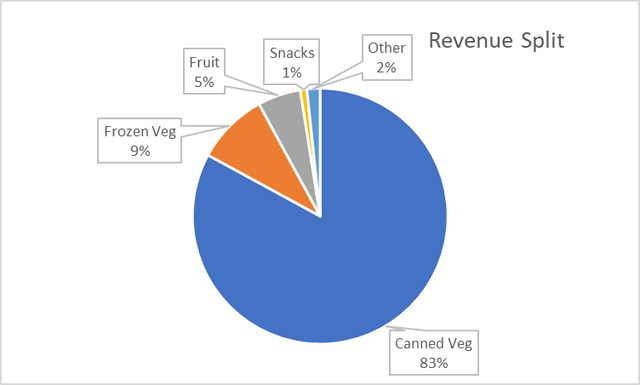

SENEA is a producer of packaged fruit and vegetables in the US (canned, frozen, etc.), that operates 26 sites across the country and sells their product through retail as well as food service. The products are sold under both branded and private label. Revenue is split across 5 divisions, illustrated below.

SENEA’s share price has performed well in the past year, opposite to market performance, as the stock is up almost 50%.

Financial Analysis

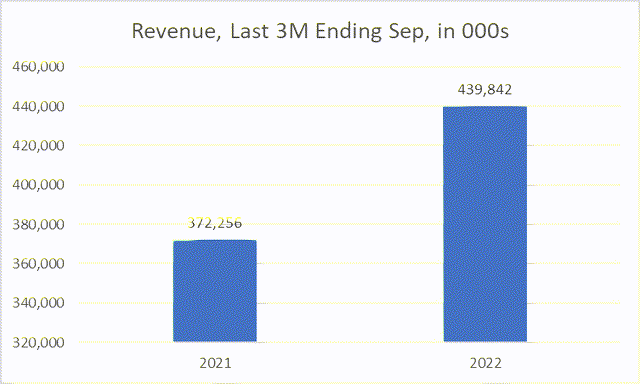

Sales for the quarter grew by more than 18% compared to the same quarter in the year prior. While this is excellent growth in a time of economic trouble, it was all driven by price growth (due to inflationary pressures), as volume was essentially flat during the year, implying that demand has stalled. While it is clearly positive that the company is able to push costs on consumers, it is not all a bright picture if demand may begin to fall off in the near future and volume declines begin tapering sales growth.

The primary division driver for the growth was canned vegetables, the largest segment of the business, which contributed almost all growth in the quarter. Volume sales for the other segments declined, and sales were only held up by price increases.

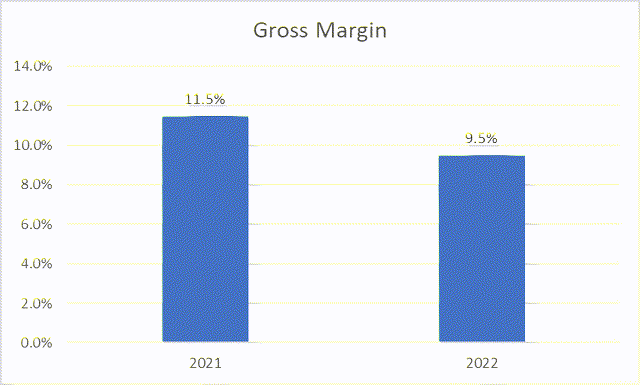

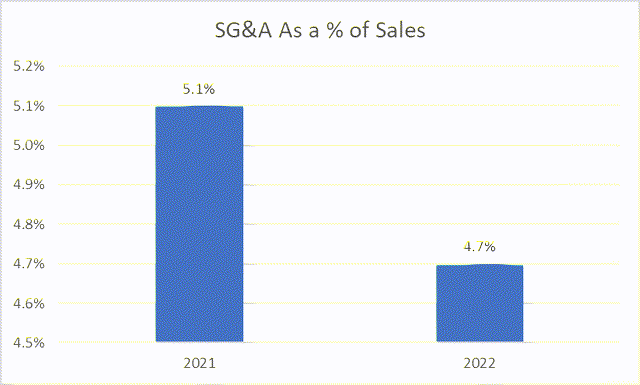

However, as we expected, costs have also risen with prices. Gross Margin has unfortunately dropped by 2 percentage points, from 11.5% to 9.5% in the quarter for the year prior, which was simply due to higher expected costs for raw materials due to the inflationary pressures and supply chain disruptions in the economy. However, a positive is a decline in SG&A as a % of sales, albeit a small one, as SG&A is only a fraction of total costs given this is a food-producing company (costs are generally above gross margins). SG&A as a % of sales dropped from 5.1% to 4.7% for the current quarter, a small but well-needed improvement even as labor costs are on the rise.

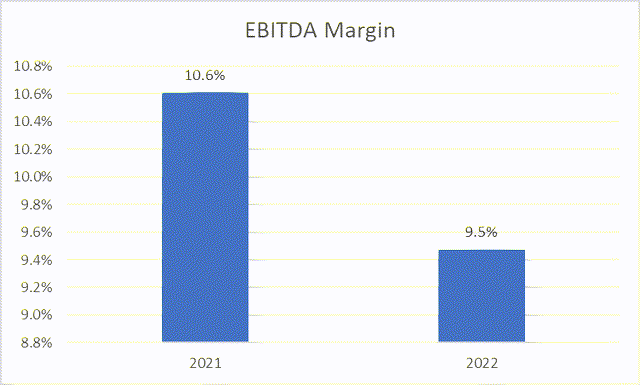

Overall, these changes lead to a decline in the EBITDA margin. While EBITDA itself grew almost 6% in the quarter compared to the year prior, EBITDA margin fell from around 10.6% to 9.5%, down to single digits, which is primarily due to the decreased gross margin from the higher input costs.

Seeking Alpha

Valuation

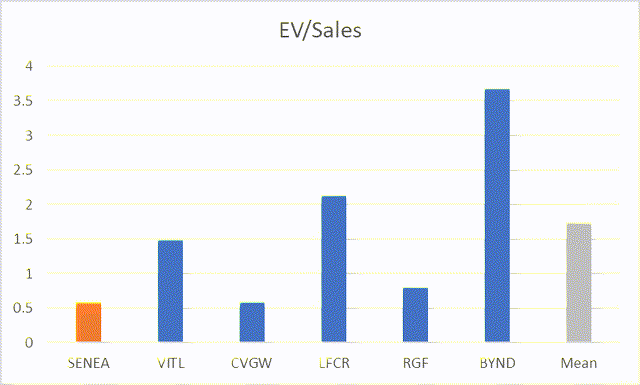

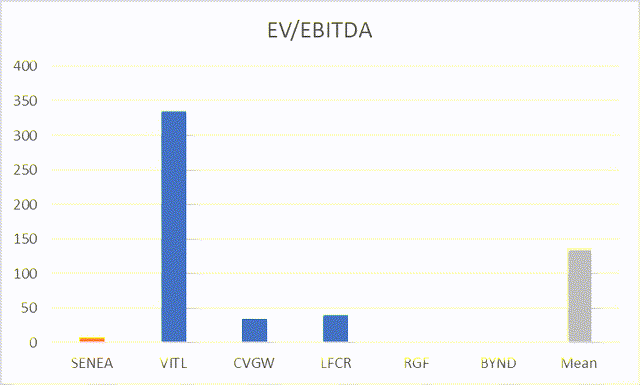

If we collate a set of peers to compare against SENEA and look at different valuation methodologies, we can get an idea about whether SENEA is fairly valued, overvalued, or potentially undervalued.

If we look at EV/Revenue, SENEA looks to be undervalued compared to peers, and potentially by a large margin. On one hand, BYND is included in the analysis, which skews the data considering it is a plant-based food company, so is within a fast-growing segment, but on the other hand, even if we exclude BYND, SENEA remains undervalued.

When we look at EV/EBITDA, it is more difficult to analyze given that we are looking at food-producing companies, so profit margins are already very low and typically swing year-on-year, so it is hard to compare profit levels. But if we compare SENEA on an EV/EBITDA basis, again, they seem to be undervalued. Even if we exclude the clear outlier of VITL, SENEA still has plenty of potential upside if it were to be on the same valuation level as peers. However, one could argue that all these figures are skewed given that margins have been hit badly recently, which gives ridiculous numbers that are more difficult to compare.

Despite this, SENEA looks potentially undervalued compared to peers. However, SENEA’s financials are also worsening in recent quarters, as costs, due to inflation, are outpacing rises in price, which leads to a decreasing profit margin. Furthermore, volume sales have stalled, and given that continued price rises are unsustainable, volume sales are expected to decline in the near future and lead to a potential decline in sales. Given this information, it is hard to agree that SENEA is undervalued compared to its peers.

Risks

- One risk to the thesis would be that these profit margin declines are temporary and that costs are expected to normalize in the near future, and sales outpace costs, which leads to an improvement in profit margins. This would be the case if COGS are tied to the input cost markets for grains and energy costs, as these are currently elevated and expected to go back down in the near future as rates continue to rise and supply chains continue to normalize. However, inflation is expected to continue through 2023, so while cost rises may slow, I believe they will continue to rise over the next 12 months.

- A second risk would be if volume sales were to rebound and begin increasing. If this were to occur, then revenue growth would outpace growth in costs, and this would result in an improvement in profit margins, which gives a potential upside to the share price.

Conclusion

Overall, if we look at SENEA and value the company on multiples compared to peers alone, then the share price looks to be undervalued with plenty of potential upside. But unfortunately, the financials of the company tell us otherwise. Costs are rising at a significant pace and volume sales have stalled (implying that demand will potentially decline, as sales are only being held up by price rises which are not sustainable in the long run). If we see material improvements in the PnL in the near future, then we may recommend a buy, given that the company is undervalued compared to peers. But as financials are expected to continue to worsen, we don’t necessarily see a case to buy right now as the risk is too high, as there is also a potential downside as well as an upside. Therefore, we recommend holding until we see material gains made.

Be the first to comment