Tom Cooper

After the bell on Tuesday, we received third quarter results from theater giant AMC Entertainment (AMC). With domestic box office figures being reported daily, we had a general idea of where things would finish, but the full report is always helpful for investors. After another quarter of large cash burn, the key here today is that investors need to continue selling their AMC Preferred Units (APE), which are likely to keep falling in value.

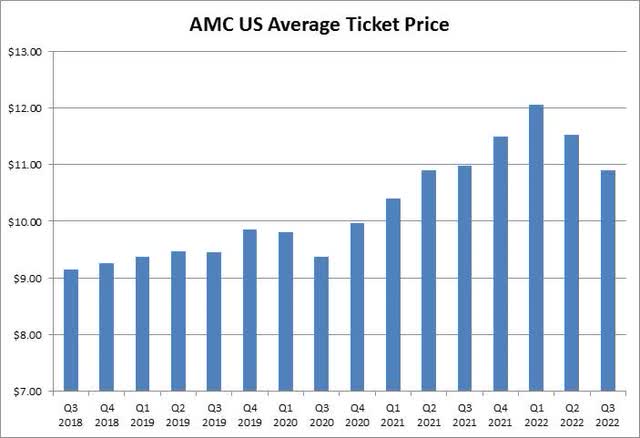

For the third quarter, total revenues of $968 million came in ahead of street estimates and were up about 27% over last year’s pandemic impacted quarter. Since we get box office data daily, and AMC has only missed analyst estimates on the top line twice in the past five years, I’m not too concerned with the revenue headline. What’s really interesting is that the beat could have potentially been larger if AMC had stronger pricing, as the average ticket price in the U.S. was down over 5% sequentially as seen below. This was the first time in two years that the average price was down over the prior year period.

AMC US Average Ticket Price (Company Earnings Reports)

For AMC though, the more important item here is the bottom line. After nearly reporting an operating profit in Q2, the company saw its operating loss balloon by almost $100 million sequentially. Despite the surge in revenues, AMC actually lost more money than the year ago period, although this was partly due to a write-down of its investment in Hycroft Mining (HYMC). Rising interest rates are also hurting, as the company’s credit facility has seen its interest rate jump by 2.65 percentage points so far in 2022, and that adds up on nearly $2 billion in borrowings there.

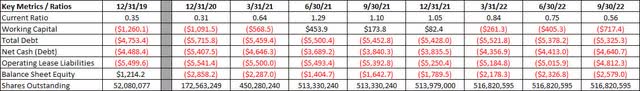

With large losses continuing, AMC saw another quarter of significant cash burn, almost $280 million in this three month period. The company ended Q3 with its lowest amount of cash on the balance sheet since the end of 2020, and negative working capital increased by more than $312 million. In the table below, you can see a number of key balance sheet metrics, and they all paint a very troubling picture. As a point of reference, the shares outstanding number is only for the Class A shares that trade with the AMC ticker. Dollar values are in millions.

AMC Key Balance Sheet Metrics (Company Filings)

I mentioned back in August that the company likely needed a capital raise, and that process has begun albeit very slowly. As of November 8, 2022, AMC has sold approximately 14.9 million shares of its AMC Preferred Equity Units (the “APE” shares) and has raised net proceeds of approximately $36.4 million. Unfortunately, this is just a drop in the bucket with more than $5.3 billion in total debt. In fact, the company’s 10-Q filing detailed that another nearly $147 million in cash was used in October during the company’s latest debt swap.

With the AMC ticker brushing up against its authorized number of outstanding shares, the primary way to raise capital currently is to sell those APE shares. Unfortunately, the “split” that the company underwent a few months back did not go well. As the chart below shows, it’s been all downhill for the APE ticker since then, closing Tuesday just above $1.60, but down another 30 cents Wednesday morning.

APE Share Chart (Yahoo! Finance)

Even if AMC management were to sell the rest of the 450 million plus APE shares it currently could into the market, it wouldn’t even raise a billion dollars at current levels. Of course, the number could be much lower than that, because trading volumes in APE remain quite low, only averaging 19 million shares recently despite trading at that very low price. Only so many shares can be sold at a time as a result, and AMC is not likely to match the nearly $2.50 per share it grossed to this point on the next 15 million shares it sells.

As a reminder, there currently are 1 billion preferred units authorized, meaning 4 billion more would need to be eventually authorized by the board before they could be utilized. In the company’s FAQ document about the split, management said the board has no plans current to authorize the remaining 4 billion this year or next, but plans could change. That 4 billion may be needed to help with the balance sheet, but if the stock has done this bad with just 15 million shares being sold, imagine what happens when you try to sell the next roughly 4.475 billion shares.

In the end, AMC’s third quarter results were not pretty, and it reinforces the notion that the company’s APE ticker will likely go substantially lower. The theater chain beat on the top and bottom lines like it usually does, but losses still piled up and tremendous cash burn weakened the balance sheet further. If the company wants to work on its debt pile in a meaningful way, it’s going to have to sell a lot more of those APE shares, and that likely means they are going to drop in value significantly from here.

Be the first to comment