Lemon_tm

I’m very bullish on REITs because they essentially allow you to buy real estate at 50 cents on the dollar with the added benefits of professional management, liquidity, and diversification.

BSR REIT

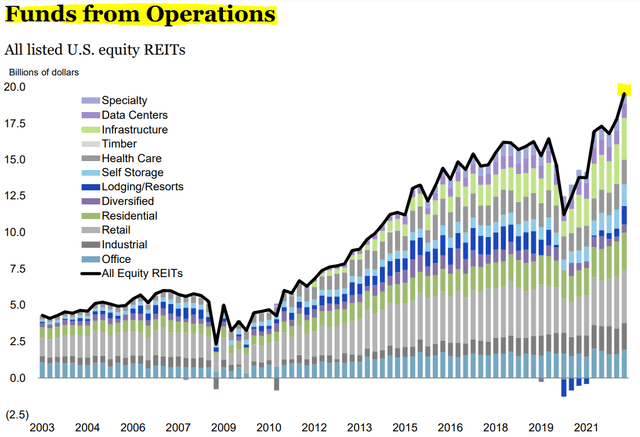

They’re historically cheap due to fears of rising interest rates, but the market appears to have overlooked that REIT balance sheets are the strongest they have ever been with low leverage, fixed-rate debt, and long maturities.

Besides, interest rates are only rising because of inflation, which leads to rapidly-growing rents.

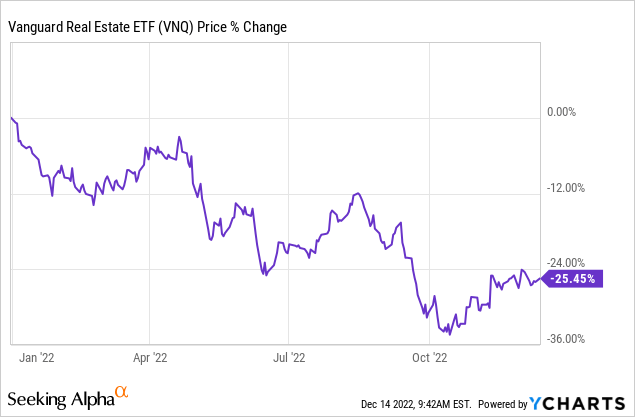

As a result, the negative impact of rising rates is much lower than the positive impact of inflation, and this explains why REIT cash flows have kept rising rapidly even as their share prices collapsed in 2022.

Just look at the huge disparity between these two charts:

NAREIT

Historically, REITs always have recovered from such sell-offs and richly rewarded those who had the courage to buy them when they were discounted.

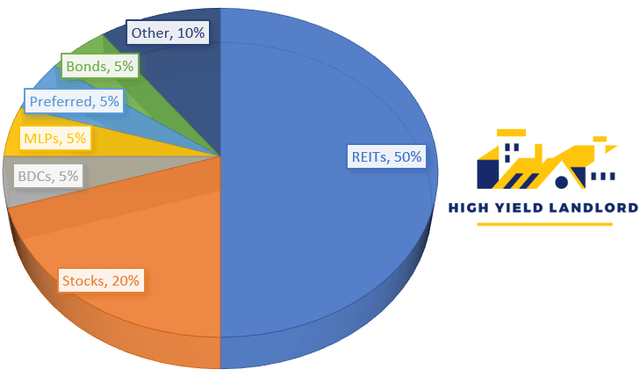

I don’t think that this time will be any different and this is why I have about 50% of my net worth invested in the portfolio of REITs that we highlight at High Yield Landlord:

High Yield Landlord

But that does not mean that I’m bullish on every REIT.

In fact, we only invest in one REIT out of 10 on average and there are many REITs that I would stay away from.

In what follows, I will highlight two REITs that aren’t worth the risk in my opinion:

Global Net Lease (GNL)

GNL is one of the favorite REITs of individual investors on Seeking Alpha.

This is largely because it pays an 11.8% dividend yield.

That’s nearly 1% per month!

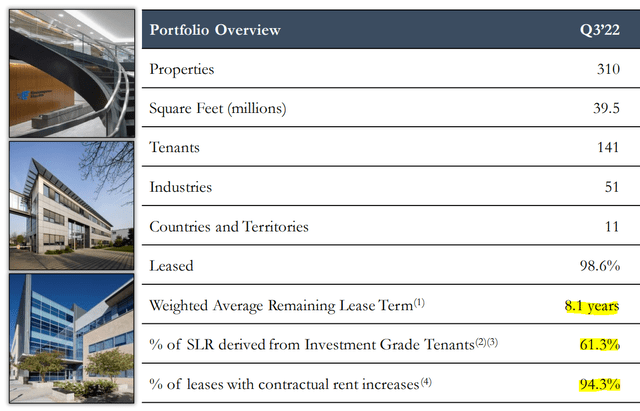

Moreover, 61% of its rent comes from investment-grade rated tenants, which is one of the highest in its peer group. They also have eight years left on their leases and practically all of them have contractual rent increases.

This should assure steady and growing cash flow even as we head into a recession.

Global Net Lease

Where’s the catch?

Well, there are three of them.

The most important one is the management. GNL is externally managed, which means that the management is outsourced to an external company that takes care of it in exchange for fees. This management structure is uncommon these days because it leads to significant conflicts of interest.

The manager earns fees that are based on the total volume of assets under management, and as a result, they’re incentivized to grow as much as possible, even if it comes at the cost of dilution to shareholders.

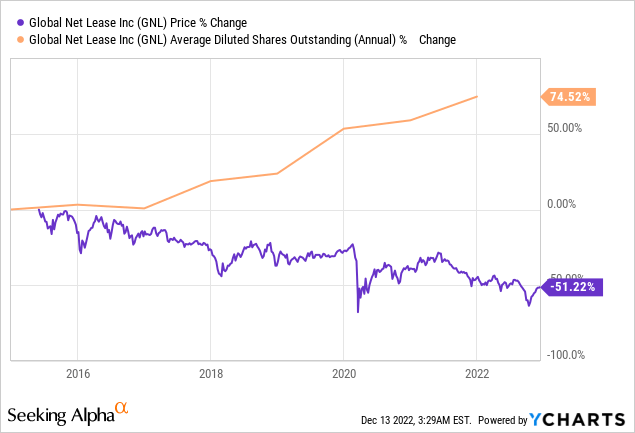

Just take a look at the growth in the share count and the impact that it has had on the share price:

This on its own makes GNL uninvestable because the management is conflicted and more interested in earning fees than anything else. Even if the portfolio performed well, this would be overshadowed by the constant dilution.

The second catch is the portfolio composition. GNL’s portfolio is 41% office, and these are single-tenant net lease office buildings. They’re arguably some of the worst impacted by the growing trend of remote working, which was made possible by technologies like Zoom (ZM). If your tenant vacates your property, you end up with a 100% vacancy rate, and the cost to remodel and release the property can be very high for this type of office building. I used to work in private equity real estate and we would avoid these properties because of this exact reason.

Global Net Lease

Finally, the last catch is the dividend. It’s high, but it isn’t sustainable and will likely get cut again. The payout ratio is right around 100%, which is not sustainable for a REIT with an office-heavy portfolio. These are capex-heavy assets that will inevitably suffer some setbacks as leases gradually expire. Moreover, GNL also owns a lot of industrial properties, which is seen as a good thing by many investors, but these are not high-quality industrial assets such as those owned by Prologis (PLD). They’re high cap rate, high-risk properties that are likely to suffer in a coming recession. The management also will keep issuing more shares, putting even more pressure on the dividend.

They have cut it before and will likely cut it again. There are far better opportunities out there and the risk just isn’t worth it here. GNL has always paid a high yield, and despite that, it has always disappointed in the long run.

Tanger Factory Outlet (SKT)

SKT is another REIT that’s very popular on Seeking Alpha.

The company has great management, a good balance sheet, and its portfolio of outlet centers is currently profiting from the retail rejuvenescence.

Sales per square foot, rents, and occupancy are all rising at a good pace, resulting in strong FFO per share growth.

They recently even hiked their dividend by 10%!

Tanger Factory Outlet

That sounds quite bullish.

Why am I not buying it then?

There are two main reasons:

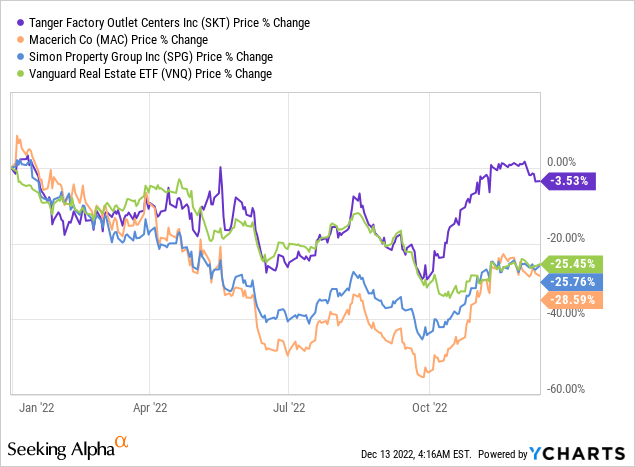

The first one is its valuation. Year-to-date, SKT has massively outperformed the broader REIT market (VNQ) and its close peers Macerich (MAC) and Simon Property Group (SPG):

As a result, its valuation has become a lot less opportunistic, relatively speaking. Its FFO multiple is not particularly high at 10.5x FFO, but it’s a lot higher than the 6x of Macerich. Right now, it trades at the same multiple as Simon Property Group, which owns much better properties in my opinion. So SKT appears to be fully valued, but its peers are still discounted.

Secondly, I fear that outlet centers will be the worst impacted by the growth of e-commerce companies like Amazon (AMZN) and discount retailers like TJ Maxx (TJX). I think that Class A malls such as those owned by Macerich and Simon Property Group will do just fine in the long run because they’re located in urban, high-barrier-to-entry locations with strong demographics, and they’re slowly becoming mixed-use destinations.

But outlet centers are typically located outside of big cities where land is cheap and abundant, and their unique layouts are difficult to adapt for anything else than retail. So far, people have made the drive because they would get larger discounts, but in a world with 24-hour free shipping, the drive is getting longer and longer.

Tanger Factory Outlet

Moreover, TJ Maxx-type discount retailers are growing rapidly and opening stores in more convenient locations, increasing the competition for outlet centers.

The impact will be slow, but in the long run, I fear that outlet centers will be the worst impacted by the growth of e-commerce and discount retailers, and despite that, SKT is today priced at a higher valuation than its peers that focus on Class A malls.

I believe that it should be the opposite and this is why I wouldn’t own SKT at today’s prices.

Bottom Line

I’m very bullish on REITs, but that doesn’t mean that I would own all of them.

I’m very selective with my REIT investments because some are poorly managed, others are overleveraged, and some own properties with questionable long-term prospects.

The key is to find high-quality REITs that are heavily discounted. That’s what we do at High Yield Landlord.

Be the first to comment