AndreaObzerova

Co-produced with Treading Softly.

I get asked a lot of different questions about high-yielding investments, it makes sense as that is the area on which I focus my research and attention.

One frequent question is “How can they cover X% yield?”

It makes sense I’d get asked that since sometimes we see sky-high yields on investments, and it sends off warning sirens in the minds of would-be investors.

Often the higher the yield, the louder the siren.

We’ve been educated and had it instilled for years that a high yield is always indicative of a high level of risk. This axiom is repeated blindly again and again, and it can lead to a blind following without research or due diligence into why something is sporting a high yield.

I like to use the term “accidental high yields” as a company with no fundamental reason to sport such a high yield but seems to have stumbled into the high-yield space.

These firms can often be completely misunderstood, the target of a short attack, surrounded by falsehoods shared openly, facing extreme negative sentiment, or a combination of them all.

Today, I want to discuss recent earning updates on two accidental high-yielders to see if they still qualify as such.

Let’s dive in!

Pick #1: NLY – Yield 19.5%

Annaly Capital Management, Inc. (NLY) followed in the footsteps of AGNC and “surprised” the market with EAD (Earnings Available for Distribution) of $1.06/share, covering the dividend by 120%.

Like all agency mREITs, NLY’s book value is down a significant amount. We’ve seen some authors on SA making silly claims, saying things like, “these mREITs will be forced to sell at low prices to meet margin calls!”. The reality is the opposite. NLY is not selling, they are buying.

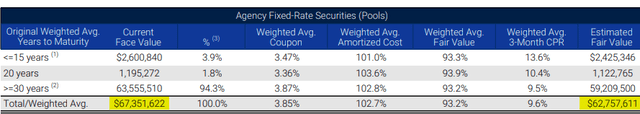

Here is NLY’s agency portfolio by face value. (Source: NLY Q3 2022 Supplement.)

At $67 billion, this is 17.5% higher than it was last quarter:

Face value is what NLY will eventually receive. Whether investors are willing to pay 100%, 103%, or 93%, the amount of principal and interest that the borrowers will pay is unchanged.

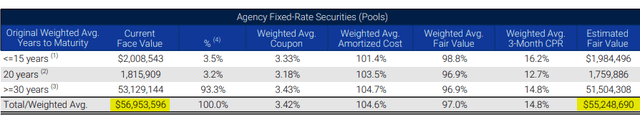

This is what we’ve been talking about over the past year. Since COVID, NLY stopped buying MBS. MBS prices were very high. Here is what NLY had two years ago, in Q3 2020.

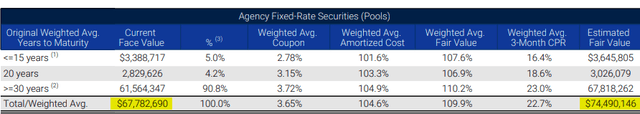

Note, the face value of $67 billion was very close to what NLY has today. The market value was $74.5 billion, as opposed to $62.7 billion. When prices were high, NLY let its balance sheet run-off. As borrowers repaid, NLY did not reinvest the full principal. Instead, choosing to build up cash.

Now, prices are very low. The same principal amount has a market value that is 16% lower than in 2020! NLY came into this price crash after having built up cash and is now a buyer.

NLY collected repayments while prices were high, and now they are buying when prices are low. When someone is managing your capital, isn’t that exactly what you want them to do?

The MBS market has traditionally followed 10-year Treasury Rates, however, over the past year, MBS has sold off more aggressively than Treasuries. As a result, mortgage yields are higher relative to Treasuries than they have been since the 1980s. What does this mean in English? It means buyers today will get much higher future returns than buyers before.

NLY sat on the sidelines, building up cash and waiting for a decline in prices. Today, NLY is buying. Are MBS prices at the bottom? We can’t say for sure, but the price and return going forward is a lot higher than it was last year. So in hindsight, holding off was a very wise move. The market is starting to realize that, which is why NLY is up over 15% from its bottom four weeks ago.

Pick #2: MPW – Yield 10.3%

Medical Properties Trust, Inc. (MPW) reported solid earnings. Our favored metric for MPW is AFFO (adjusted funds from operations), since it backs out “straight line” rent, which is non-cash revenue and makes up a significant portion of FFO. As we covered in our recent report on non-GAAP measures, AFFO is the best way to measure MPW’s dividend safety. AFFO came in at $0.36/share, covering the $0.29 dividend by 124%.

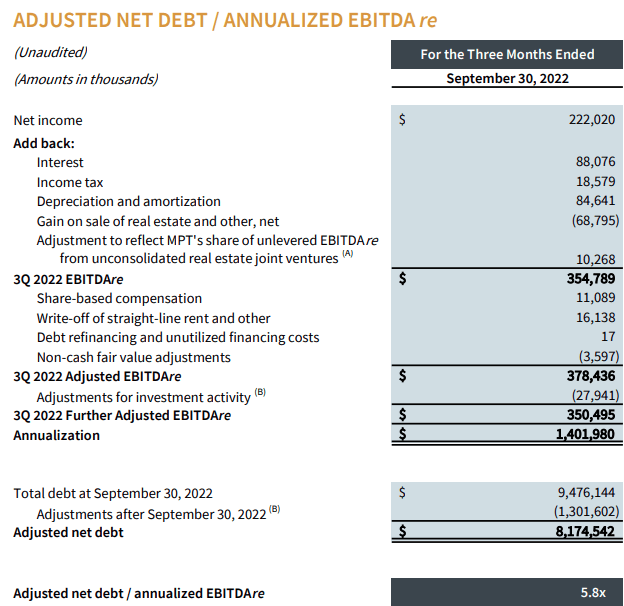

Notably, MPW made some significant progress in deleveraging during the quarter. Ending the quarter with $9.5 billion in debt, down from $10.1 billion in Q2. Taking into consideration the announced sales of Springstone and the 3 Prospect hospitals in Connecticut and the payoff of the debt associated with those properties, MPW will have approximately $8.2 billion in debt.

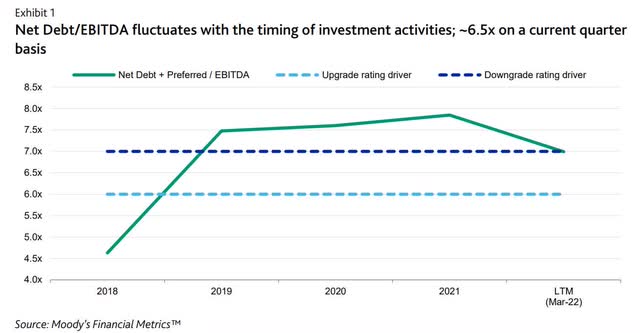

This will get its net debt to EBITDAre below 6.0x. (Source: MPW Q3 2022 Supplement.)

MPW Q3 2022 Supplement

This is below MPW’s target and, more importantly, below where the rating agencies want MPW to consider a rating upgrade.

An upgrade would give MPW an “investment grade” rating, which would positively impact the price of future debt capital.

MPW is trading at a bargain price of under 8x AFFO – MPWs lowest and most conservative metric. We’ve talked a lot about the various bearish theories, and the big focus has been on tenant safety.

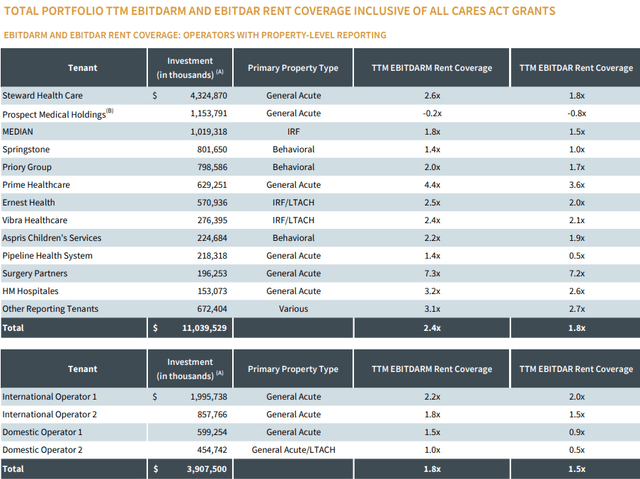

MPW provides significantly more information on specific tenants than most REITs. Notably, the tenant everyone loves to worry about, Steward has rent coverage that is about average.

The tenants of concern are Prospect, Pipeline, and a third unnamed tenant. Prospect has sold its Connecticut properties, and MPW will receive $457 million for the properties.

Pipeline has filed for bankruptcy yet paid full rent in Q3, and management expects that Pipeline will continue to pay rent throughout the bankruptcy process. In Pipeline’s bankruptcy filing, it noted (emphasis added):

Due to the financial state of the Illinois Facilities, the Company’s California- and Texas-based healthcare operations have effectively subsidized the Illinois operations. This subsidization, however, has destabilized the Company’s overall healthcare network. Adequately addressing the Company’s financial difficulties with a goal to reach profitability again while maintaining a high level of patient care requires further financial investment and a sale of the Illinois Facilities.

MPW owns only the California facilities – the profitable ones which were subsidizing the Illinois properties.

This is the strength of being a real estate investment trust (“REIT”). If the properties are profitable at the property level, even if the tenant files for bankruptcy, rent will often continue uninterrupted. If tenants choose to keep the property open, they must pay rent.

There is no doubt that 2022 has been a very difficult year for hospital operators. They faced very high labor costs, having to repay advance payments from the government, reimbursements failing to keep pace with inflation, and intermittent disruptions from spikes in COVID cases. Staffing issues are slowly being improved, the advance payments are now repaid, and we’re all learning to live with COVID.

Hospitals are getting to the other side, and MPW went through the whole thing without significant rent disruption. MPW is positioning itself for a better future by preparing its balance sheet for an “investment grade” rating. In 2023, its escalators that are tied to inflation will provide for a significant rent increase. The bears keep sowing fears, but every quarter MPW keeps showing up with positive results. Let’s see when some of these shorts get squeezed out.

Conclusion

NLY is an extremely misunderstood company. MPW is the target of falsehood-filled short attacks. Both qualify as “accidental high-yielders” when we look at their fundamental strengths and high dividend coverage.

NLY and MPW both have expert management teams who are steering ships through extremely negative sentiment. One thing we can be sure of, sentiment is like the sand of a desert, it shifts rapidly and frequently.

So what are investors and retirees to do?

If you’re an income investor, you can climb aboard the ship and enjoy the exceptionally high yields while kicking back and letting sentiment sort itself out. We’ve seen traders jump ship and jump back on board, only to continue repeating this pattern over and over. All the while, we keep on getting excellent income while they keep getting wet.

We measure success differently. I like the ease of collecting income and letting the ship take its course over the span of years, while others like to guess when the ship will rise or fall with the ocean’s waves. I wonder if this is how they would take a real-life cruise – hopping off before the ship crests each wave to try and hop back on.

If I was on a cruise, I’d take it like my retirement portfolio. I’d sit on the deck, enjoy the sunshine and collect the goodies that come my way. Kicking back, relaxing, and enjoying my favorite beverage.

That sounds wonderful to me. How does it sound to you?

Be the first to comment