krblokhin/iStock Editorial via Getty Images

One company that has held up surprisingly well during the recent economic uncertainty has been theme park operator SeaWorld Entertainment (NYSE:SEAS). This might be shocking when you consider that one of the first things consumers might cut back on during difficult times is expensive entertainment spending. But the company continues to defy expectations to the benefit of shareholders. On top of this, shares have fared well in the current environment and, even after rising nicely, they still seem to be trading at fundamentally attractive levels. Given these factors, I do believe that upside potential for the firm still exists. And as a result, I am electing to keep my ‘buy’ rating on its stock for now.

A great ride

Back in May of this year, I wrote an article detailing why I was bullish on SeaWorld Entertainment. In that article, I talked about how shares of the company had been hammered over the prior few months, even as fundamental performance reported by management came in at robust levels. I found myself impressed by the fact that management was buying back stock and had even tried to acquire Cedar Fair (FUN) in order to grow further. Add in how cheap shares were at that time, and I could not help myself from rating the company a ‘buy’, reflecting my belief then that the stock should outperform the broader market for the foreseeable future.

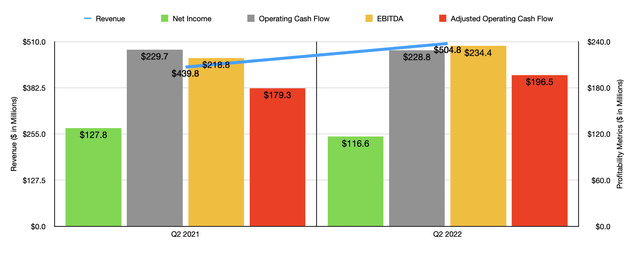

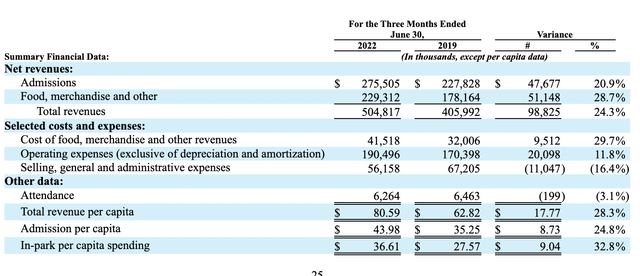

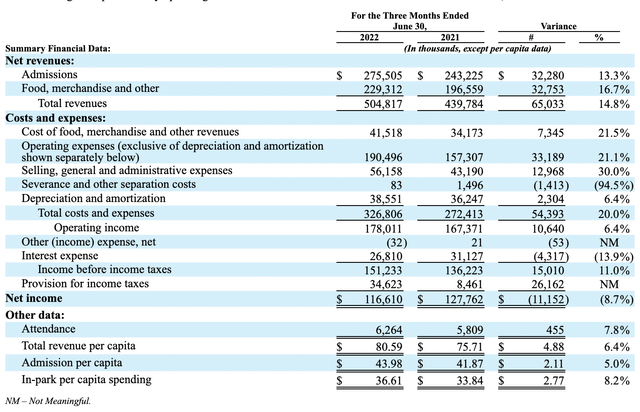

So far, that call is playing out pretty well. While the S&P 500 is down by 9.2%, shares of SeaWorld Entertainment have generated a return for investors of 5.1%. Finally, it seems as though the market is starting to recognize just how strong an operation this business is. To see what I mean, we need only look at data covering the second quarter of the company’s 2022 fiscal year. This is the only quarter for which we now have data that we did not have data for when I last wrote about it. During that time, revenue came in strong at $504.8 million. That represents an increase of 14.8% over the $439.8 million the company generated the same quarter one year earlier. At the end of the day, this increase in sales was driven by two primary factors. First and foremost, attendance at its theme parks increased nicely, rising by 7.8% from 5.81 million to 6.26 million. And second, the company benefited from an increase in the average revenue per customer, with that metric climbing from $75.71 to $80.59. While this may not seem like a significant change, the difference applied to the attendance the company had in the second quarter alone was responsible for an additional $30.6 million in revenue.

Even though revenue increased soundly, some of the company’s bottom line results showed a bit of weakening. Net income in the second quarter totaled $116.6 million. That was actually down modestly from the $127.8 million reported the same quarter one year earlier. This pain came from a few different factors. For instance, the cost of food, merchandise, and other revenues increased from 7.8% of sales in the second quarter last year to 8.2% the same time this year. Operating expenses, excluding depreciation and amortization, grew from 35.8% of sales to 37.7%. And selling, general, and administrative costs jumped from 9.8% of sales to 11.1%. Contributed these cost increases to a variety of factors, such as inflationary pressures, increased labor costs as the company returns to more normalized operations, and increased marketing efforts, third-party vendor costs, and a legal settlement charge that the company had to pay.

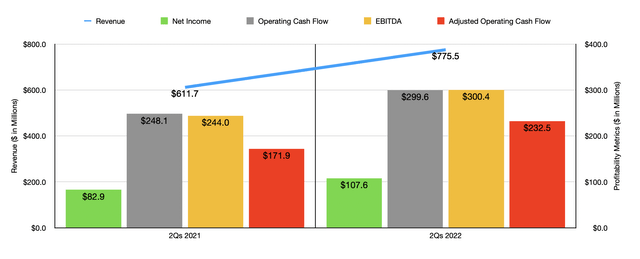

Author – SEC EDGAR Data SeaWorld Entertainment

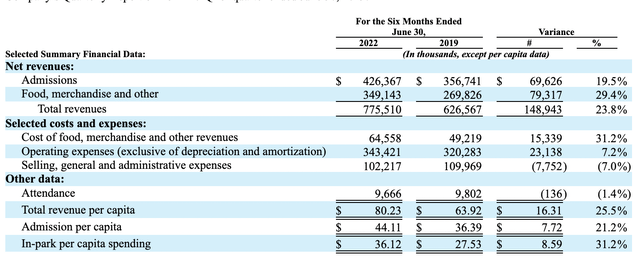

Although the bottom line results in the second quarter alone were problematic, results for the first half of the 2022 fiscal year in its entirety remain robust. Revenue of $775.5 million beat out the $611.7 million reported one year earlier. Profits went from $82.9 million to $107.6 million. Operating cash flow grew from $248.1 million to $299.6 million, while the adjusted figure for this increased from $171.9 million to $232.5 million. Another metric that improved year over year was EBITDA, climbing from $244 million in the first half of 2021 to $300.4 million the same time this year. Using these robust profits and cash flows, and relying on the fact that shares of the company are fundamentally cheap, management has so far repurchased $500 million worth of stock. They also, in August of this year, initiated a new $250 million share buyback program. But it’s unsure how much stock has been acquired under that.

Truth be told, we don’t really know what to expect when it comes to the 2022 fiscal year in its entirety. But if we annualize results experienced so far, we should anticipate net income of $332.9 million, adjusted operating cash flow of $680.3 million, and EBITDA of $815 million. Based on these figures, the company would be trading at a forward price-to-earnings multiple of 11.5. The forward price to adjusted operating cash flow multiple would be 5.6, while the forward EV to EBITDA multiple would come in at 7.1. Using instead the data from the 2021 fiscal year, these multiples would be 14.9, 7.6, and 8.7, respectively. To put this in perspective, I also compared the company to two similar businesses. On a price-to-earnings basis, these companies ranged from a low of 13.7 to a high of 27. And when it comes to the EV to EBITDA approach, the range was between 9.4 and 9.8. In both cases, SeaWorld Entertainment was the cheapest of the group. Meanwhile, using the price to operating cash flow approach, the range was between 5.6 and 6.8, with our prospect tied as the cheapest.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| SeaWorld Entertainment | 11.5 | 5.6 | 7.1 |

| Cedar Fair | 27.0 | 5.6 | 9.8 |

| Six Flags Entertainment (SIX) | 13.7 | 6.8 | 9.4 |

Takeaway

2022 is proving to be a fascinating year for the investment community. When it comes to SeaWorld Entertainment in particular, the picture in recent months has been encouraging. Yes, the company is facing margin pressure. But overall, sales are rising nicely and the stock is trading at incredibly cheap levels. Management has recognized this and is using every opportunity to buy back additional shares. Add all of these together, and I cannot help but to keep the ‘buy’ rating I have on the stock previously.

Be the first to comment