Gyro/iStock via Getty Images

To many investors, the packaging industry may not seem all that exciting. However, the fact of the matter is that some of the cheapest companies can be seen in this space. Though it’s not the cheapest player in its industry, Sealed Air Corporation (NYSE:SEE) is definitely worth looking at. Historically speaking, the company has exhibited volatility from year to year. But recent financial performance has been encouraging. Although I wouldn’t call the company a deep value prospect, I do believe it definitely fits into the value category. Because of this, I have decided to retain my ‘buy’ rating on the stock for now.

An iconic packaging firm on the cheap

With major brands like Cryovac, Bubble Wrap, Autobag, and Sealed Air under its belt, Sealed Air is undeniably one of the most iconic, if not the most iconic, of the packaging companies on the planet today. This was what initially led me to write about the company in an article published in January of this year. In that article, I acknowledged that the company’s financial performance had been volatile over time. It was then that I reiterated my earlier ‘buy’ rating for the stock. However, I still believed that, after seeing its share price rise significantly in the months leading up to that, the business offered further upside potential. This was due in part because of how the company was priced relative to its peers, combined with how cheap it was on an absolute basis. At first glance, investors may view performance since then as bad. However, I view things in a different light. When I rate a company a ‘buy’, my conclusion is that it’s likely to outperform the market moving forward. And Sealed Air did just that. Since the publication of my latest article, shares are down 10.1%. That compares to the 17.9% decline experienced by the S&P 500 over the same window of time.

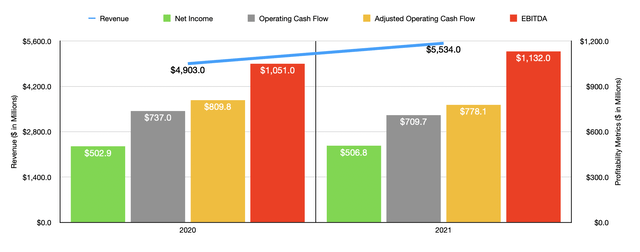

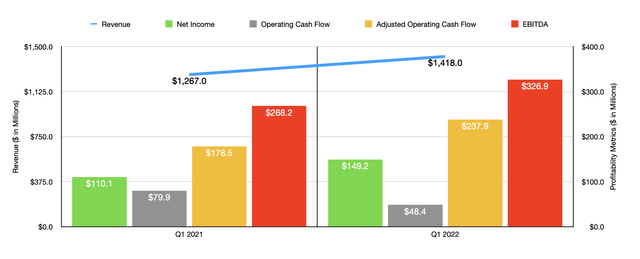

This outperformance comes at a time when the company’s top and bottom lines continue to look positive. When I last wrote about the firm, we only had data covering through the third quarter of its 2021 fiscal year. Today, we now have two additional quarters worth of data. Let’s start with how the company ended last year. According to management, revenue for the 2021 fiscal year came in at $5.53 billion. That represents an increase of 12.9% over the $4.90 billion generated in 2020. But performance for the company continued to improve into the 2022 fiscal year. Revenue in the first quarter came in at $1.42 billion. That’s 11.9% above the $1.27 billion generated the same time one year earlier. The increase in the latest quarter compared to the same time one year earlier was driven in large part by a 15% rise in sales associated with the Food segment. This was in spite of the 3% hit the segment experienced because of foreign currency fluctuations. Meanwhile, the Protective segment saw revenue increase a more modest 8%.

When it comes to the company’s bottom line, performance also continues to look mostly positive. Net income in the 2021 fiscal year came in at $506.8 million. That’s slightly above the $502.9 million generated one year earlier. Operating cash flow did decline, dropping from $737 million to $709.7 million. If we adjust for changes in working capital, the picture looks similar, with the metric declining from $809.8 million to $778.1 million. Meanwhile, EBITDA managed to increase, climbing from $1.05 billion to $1.13 billion. Mixed financial results did continue into the current fiscal year. Net income of $149.2 million dwarfed the $110.1 million generated the same time one year earlier. Operating cash flow did fall, dropping from $79.9 million to $48.4 million. But if we adjust for changes in working capital, it would have risen from $178.5 million to $237.9 million. And finally, EBITDA for the company expanded from $268.2 million to $326.9 million.

When it comes to the 2022 fiscal year, management expects revenue to continue climbing. Sales should come in at between $5.85 billion and $6.05 billion. Management believes that EBITDA should be between $1.22 billion and $1.25 billion, while adjusted net income should be, using midpoint expectations, roughly $614.6 million. No guidance was given when it came to operating cash flow. But if we assume that it will increase at the same rate that EBITDA is forecasted to, then investors can expect a reading for it of roughly $848.9 million.

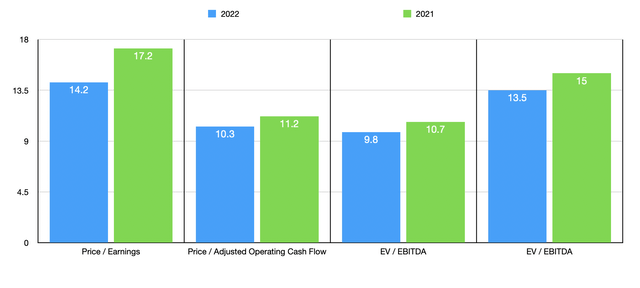

Using this data, we can easily price the company. Using the 2022 estimates, the firm is trading at a forward price to earnings multiple of 14.2. This compares to the 17.2 that it’s trading for if we rely on 2021 figures. The price to adjusted operating cash flow multiple of 10.3 should be lower than the 11.2 that we get using the 2021 results. And the EV to EBITDA multiple should drop from 10.7 to 9.8. To put this in perspective, I decided to compare the company to five similar firms. On a price-to-earnings basis, four of the five companies had positive results, with multiples ranging from 14.5 to 37. Using the price to operating cash flow approach, the range was from 10.9 to 79.5. And using the EV to EBITDA approach, the range was from 8.3 to 22.1. In all three cases, only one of the companies was cheaper than Sealed Air.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Sealed Air | 17.2 | 11.2 | 10.7 |

| Ranpak Holdings (PACK) | N/A | 18.9 | 13.7 |

| Packaging Corporation of America (PKG) | 14.5 | 10.9 | 8.3 |

| UFP Technologies (UFPT) | 37.0 | 79.5 | 22.1 |

| Amcor (AMCR) | 19.9 | 13.2 | 12.4 |

| Avery Dennison Corporation (AVY) | 19.1 | 14.5 | 12.5 |

It is also worth noting that management is making some rather interesting moves. For starters, management announced that, in the first quarter of this year alone, they bought back 3 million shares for roughly $200 million. That’s a significant move, even for a company with a market capitalization of $8.71 billion. Even more interesting, to me at least, was the announcement on April 28th of this year of the launch of prismiq, a digital packaging brand created by the business. Management has already invested around $100 million in digital packaging. This particular service provides three main features. The first of these is Smart Packaging, which is a cloud-based platform that generates package-specific digital IDs that collect and manage data along the value chain. Under the Design Services feature, the company offers a team of nearly 200 design specialists that work with customers in order to create custom graphics, design new concepts, and conduct performance testing. And finally, the offering provides Digital Printing. Through this, customers can run multiple designs on a single order, print serialized or digitized codes and images that are package-specific, and even have flexible order quantities and faster turnaround times on specific orders.

Takeaway

Right now, I find Sealed Air to be an intriguing opportunity in the packaging space. The company continues to innovate in order to create value for its investors and its customers. Overall, shares in the business look fairly cheap, especially relative to similar players. Add on top of this the expectation of even stronger performance moving forward, and I cannot help but to retain my ‘buy’ rating on the business.

Be the first to comment