JuSun

Seagate Technology (NASDAQ:STX) tumbled 10% on July 21, 2022 after the hard-disk drive maker posted fourth quarter results that missed estimates and gave weak guidance. Seagate’s chief executive officer Dave Mosley said the continuation of macro issues is continuing and the company is reducing production to maintain “supply discipline.” The company is also managing expenses, Mosley added.

STX and other data storage/memory companies have been beaten down in the past month. It started after the company’s June 30, 2022 earnings call, when Micron (MU) shares were battered on weak guidance.

To make matters worse, in a stroke of genius, on August 9, 2022, MU issued a follow-up warning that:

“Our expectations for CY22 industry bit demand growth for DRAM and NAND have declined since our June 30, 2022 earnings call, and we expect a challenging market environment in FQ4 22 and FQ1 23.”

Following MU’s June 30 earnings call, I detailed three miscues that the company made during the call in a July 18, 2022 Seeking Alpha article entitled “Post-Micron Earnings Call: What Samsung’s Pre-Announcement Tells Us.” I noted:

“Mistake #2 – Micron’s Q3 Guidance for Q4 was $7.2 billion +/- $400 million. But the Street Q4 Consensus was $9.2 billion. MU stock was pummeled after the earnings call because of the weak guidance, and it impacted numerous other semiconductor stocks. That raises a question – why wasn’t the Street Q4 consensus at $9.2 billion lowered before the call when there was talk since March 30 about slowing PC and smartphone sales by none other than renowned TSMC Chairman Liu.”

I doubt if Micron read this article, but this guidance of August 9 is exactly what I wrote they should have done before the June 30 earnings.

As a result, MU dropped more than 4% on the guidance and STX more than 5%.

A Catalyst for Seagate Amid Macroeconomic Headwinds

The headwinds facing Seagate, data storage competitor Western Digital (WDC) and other related companies in the past five weeks have been primarily macroeconomic, with inflation and recessionary fears the cause. As a result, it has currently impacted the consumer electronics sector, primarily PCs and smartphones using memory storage. When consumers weigh a new smartphone purchase versus $5 gasoline or 9.1% inflation, the highest in 40 years, they don’t buy a smartphone.

What these poor guidance numbers don’t say is that consumers, whose spending contributes almost 70% of the total US economic output, will continue to use the consumer items they have, although not buying upgrades nor discontinuing using them.

Of the remainder of economic output, 18% was from business investment and 17% government spending, which is obviously increasing. As the demand for data increases, the data center has not been impacted by the slowdown in consumer products.

As cloud computing steadily increases in importance throughout the economy, data center upgrades are ramping up to keep pace. As an example, NVIDIA (NVDA) said its gaming business (a consumer product) revenue fell 44% sequentially and 33% year-over-year to $2.04 billion but its data center revenue rose 1% sequentially and 61% year-over-year to $3.81 billion. Advanced Micro Devices’ (AMD) data center sales were up 83% to $1.49 billion, driven once again by AMD’s EPYC processors for servers.

In Q2, US hyperscaler public cloud sales increased on average 6.8% QoQ and 35.8% YoY. Azure (Microsoft (MSFT) increased 40% YoY, AWS Amazon (AMZN) increased 33.3%, and Google Cloud (GOOGL) increased 35.6%.

The Hard Disk Drive Data Storage Business

Hard Disk Drives (HDDs) compete against SSDs (solid state devices) based on NAND memory.

- HDDs for PCs have been replaced by SDDs, particularly for notebooks because unlike HDDs with a spinning disk, SDDs are more immune to damage because they have no moving parts. In other words, there are few if any notebooks that contain an HDD, and that has been the norm for many years

- HDDs for Consumer applications have dropped at nearly the same rate. These include gaming and external drives. HDDs and SSDs both work well for gaming, but HDDs do not do as well as SDDs for gaming because of longer load times.

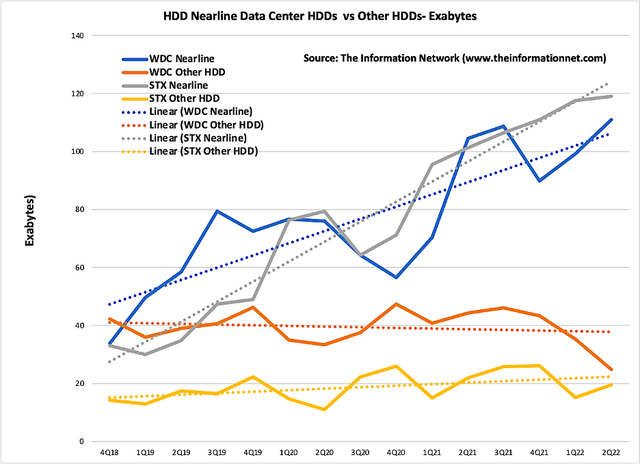

- The real growth in HDDs is in the data center, as shown in Chart 1, for WDC and STX, where HDDs are a mainstay for inexpensive, reliable bulk storage. Nearline HDDs are utilized by nearly all enterprise market segments, including servers, network or external storage and hyperscale or cloud service providers.

Chart 1

Over the period C4Q 2018 to C1Q 2022, STX has been outperforming WDC in the strong Nearline subsegment as well as the non-nearline subsegment (client and consumer).

HDDs vs SSDs

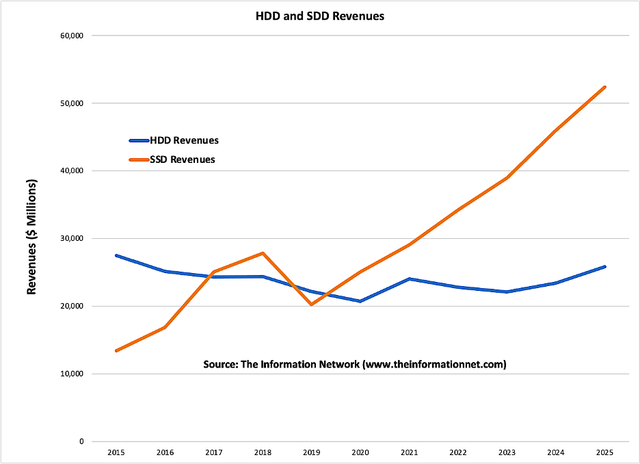

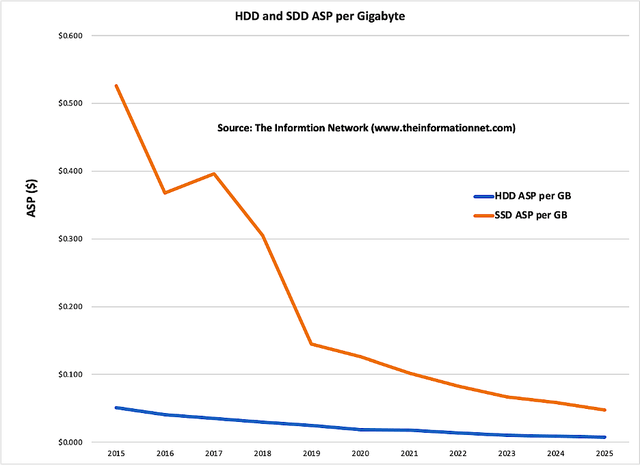

Chart 2 shows HDD and SSD ASPs, which I forecast on a yearly basis to 2025, according to The Information Network’s report, entitled “The Hard Disk Drive (“HDD”) and Solid State Drive (“SSD”) Industries: Market Analysis And Processing Trends.”

Chart 2

Chart 3 shows ASPs for HDDs and SSDs per gigabyte (“GB”) of data for HDD companies STX, Western Digital (WDC), and Toshiba. SSDs are more expensive than hard drives in terms of dollar per gigabyte. But SSD prices have been dropping significantly. In 2015 the SSD/HDD ASP ratio was 10X, dropping to 6X in 2021.

Chart 3

HDDs currently dominate the cloud exabyte market-offering the lowest cost per gigabyte based on a combination of factors including price, cost, capacity, power, performance, reliability, and data retention. HDDs represent the predominant storage for cloud data centers because they provide the best TCO (total cost of ownership) for the vast majority of cloud workloads.

SSDs, with their performance and latency metrics, provide an appropriate value proposition for performance-sensitive, highly transactional workloads closer to compute nodes.

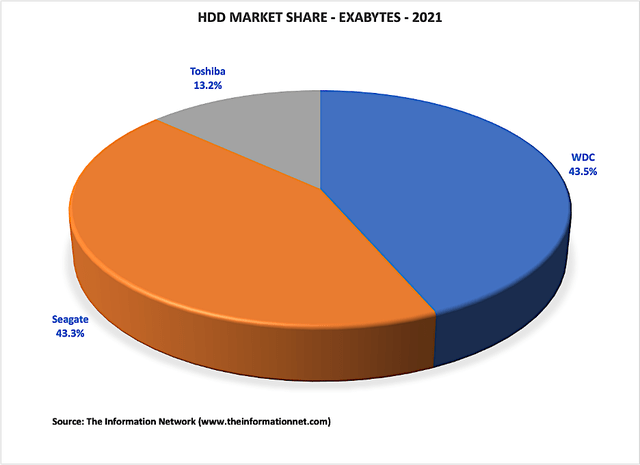

Chart 4 shows market share for 2021 for HDD suppliers based on Exabytes of data. WDC and STX are statistically equal, but STX is stronger in the nearline subsegment with a 45% share (not shown).

Chart 4

Revolutionary New Technology for Seagate

Looking ahead, HDDs are expected to maintain market share, thanks in part to advances that continue to increase capacities while maintaining performance. I forecast that HDDs are well-positioned to dominate data centers for the next 10 years.

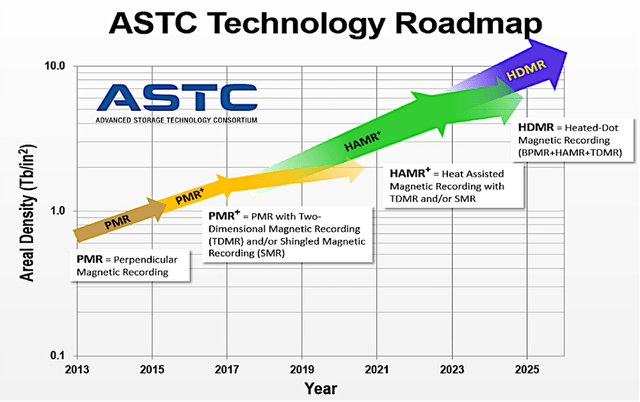

HDD capacity continues to increase, with 18TB drives now widely available. Increased capacity is driving down the cost per terabyte. Moreover, Seagate’s new HAMR (heat assisted magnetic recording technology) drives were rolled out in 2020, with an initial capacity of 20TB and are forecasted to increase to 50TB by 2026. Higher capacity HDDs change the dynamics of data center storage.

Seagate’s current 20TB have an areal density of 1.116 Tb/inch2. With HAMR, it can be increased more than twofold to 2.6 Tb/inch2. Eventually it expects to hit 6 Tb/inch2 by 2030, as shown in Chart 5.

Chart 5

HAMR, uses a laser diode for heating up the media area where data should be written to, supporting the writing process through the selective use of heat energy. This allows writing with less magnetic energy and the use of a smaller write head, achieving a higher storage density as a result.

Hard disk manufacturers are beginning to favor HAMR and roadmaps for high-capacity unit releases of 40+ TB of storage by 2026 have been released, threatening demand for ruthenium in the long term. Substantial growth in cloud storage solutions is forecast to positively impact ruthenium demand in hard disks, potentially helping to offset the losses from technology switches.

Investor Takeaway

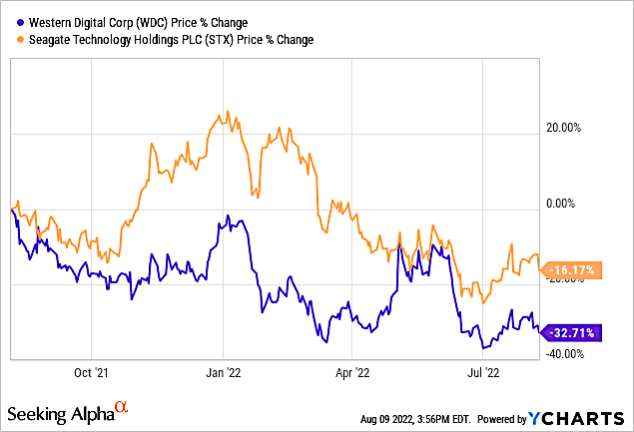

Seagate’s share price has outperformed main competitor WDC in the past 1-year period, as shown in Chart 6, although the share percentage change of both companies is negative.

YCharts

Chart 6

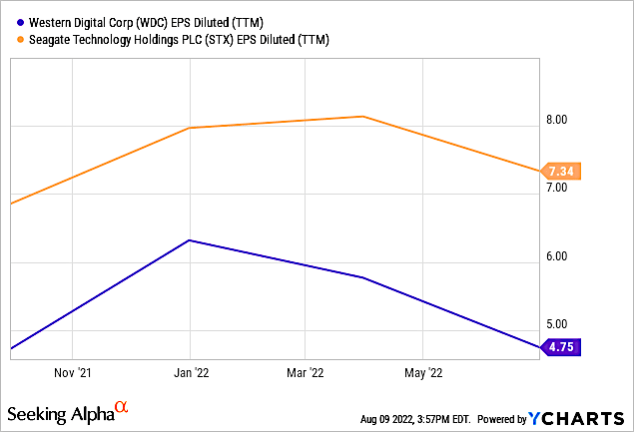

Chart 7 shows Seagate’s EPS over the 1-year period, nearly 2X that of WDC.

YCharts

Chart 7

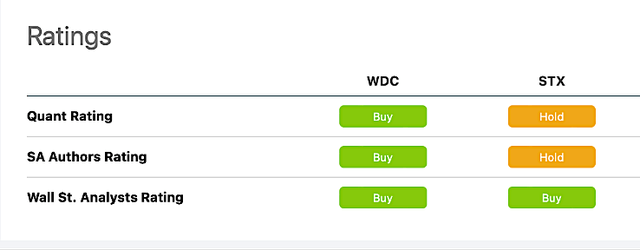

Ratings for the two companies are vastly different, with a Buy rating across the board for WDC but only a Buy from Wall Street analysts for STX, as show in Chart 8.

Chart 8

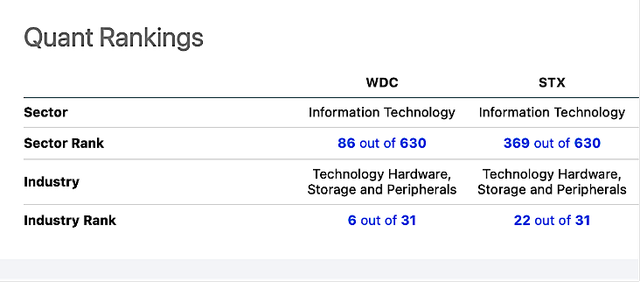

Based on Seeking Alpha’s Quant Rankings, WDC has significantly higher rankings than STX as shown in Chart 9.

Chart 9

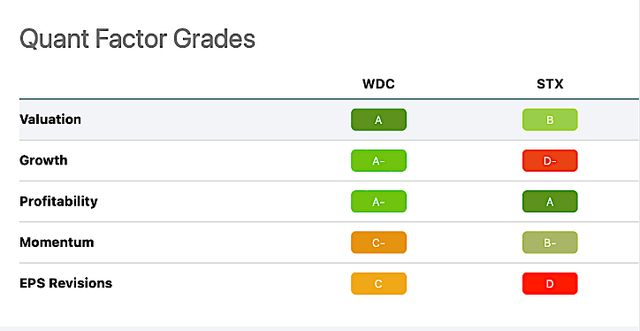

Likewise, Seeking Alpha’s Quant Factor Grades for WDC are significantly greater than those of STX as shown in Chart 10, particularly for Growth.

Chart 10

Seagate has outperformed Western Digital in the nearline HDD subsegment, which continues to outperform the rest of the HDD sector, particularly with the slowdown in consumer products.

As the HDD industry moves to advanced technology, Seagate’s HAMR appears to be ahead of Western Digital’s MAMR advanced HDD.

Indeed, STX in its earnings call reported that its 30-plus terabyte family of drives based on HAMR technology is expected to begin customer shipments of these products by this time next year, which is C2Q 2023. WDC made no mention of its schedule for MAMR in its earnings call.

Be the first to comment