HeliRy/E+ via Getty Images

SEACOR Marine Holdings (NYSE:SMHI) or “SEACOR” is a leading provider of marine and support transportation services to the offshore energy industry.

Introducing SEACOR Marine Holdings

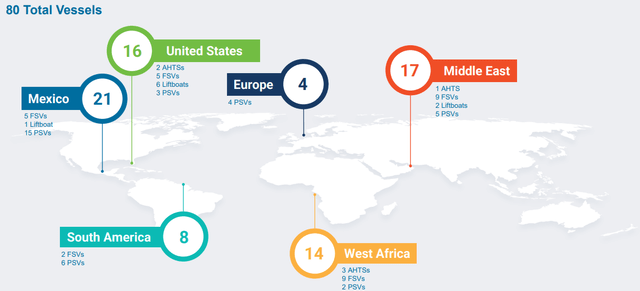

As of June 30, 2022, the company and its joint ventures operated a diverse fleet of 80 support vessels, of which 58 were owned or leased-in, 20 were joint-ventured, and two were managed on behalf of unaffiliated third-parties.

The company’s main services are:

- delivering cargo and personnel to offshore installations including wind farms

- handling anchors and mooring equipment required to tether rigs to the seabed, and assist in placing them on location and moving them between regions

- providing construction, well work-over, maintenance and decommissioning support

- carrying and launching equipment used underwater in drilling and well installation, maintenance, inspection and repair

- providing accommodations for technicians and specialists

SEACOR’s closest publicly-traded peer is Tidewater (TDW), a company I have been very positive on for quite some time now based on the ongoing recovery in offshore drilling markets and new tailwinds from recent geopolitical events.

While Tidewater cleaned up its balance sheet in bankruptcy five years ago, SEACOR has managed to avoid chapter 11 at the expense of ongoing debt and liquidity issues very similar to offshore drilling industry leader Transocean (RIG).

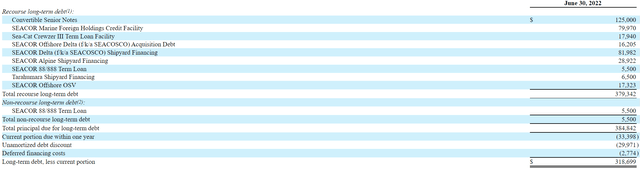

At the end of Q2, unrestricted cash was down to $22.6 million while long-term debt amounted to approximately $385 million:

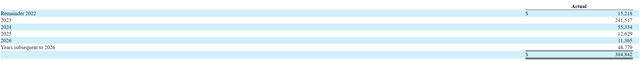

With liquidity running low and approximately $257 million in debt scheduled to mature over the next 15 months, SEACOR recently started to take a new round of debt management actions to amend covenants and extend maturities.

Earlier this week, the company succeeded in addressing key near-term debt maturities while at the same time bolstering liquidity and simplifying SEACOR’s corporate structure:

- entered into an agreement with affiliates of Proyectos Globales de Energía CME, S.A. de C.V. (“CME”) for the sale of the company’s minority equity interests in its unconsolidated joint ventures in Mexico and a series of related asset swaps for aggregate cash consideration of $66 million.

- acquired 100% of the core joint venture Mantenimiento Express Marítimo SAPI de CV’s (“MEXMAR”) outstanding secured loan from MEXMAR’s existing lenders for $28.8 million. MEXMAR immediately paid down $8.8 million of the loan and the remaining $20 million will be fully repaid in four equal quarterly installments of $5.0 million over the next year.

- entered into an amendment to its senior secured term loan facility. In connection with the amendment, the facility will have an extended tranche of $54.9 million, maturing in March 2026. The extended tranche will bear interest at a rate of 4.75% plus SOFR. The remaining $19.8 million of the loan will maintain its existing terms and mature in September 2023. In connection with this transaction, SEACOR made a pre-payment of $5.3 million, reducing the total amount outstanding under the facility to $74.7 million.

- entered into an exchange transaction with certain funds affiliated with The Carlyle Group Inc. pursuant to which the entire $125.0 million of the Company’s 4.25% Convertible Senior Notes due 2023 were exchanged for (i) $90.0 million in aggregate principal amount of the Company’s new 8.0% / 9.5% Senior PIK Toggle Notes due 2026 and (ii) $35.0 million in aggregate principal amount of new 4.25% Convertible Senior Notes due 2026 with a conversion price of $11.75.

After accounting for the acquisition of the MEXMAR term loan facility and the required prepayment under the company’s senior secured term loan facility, the company’s cash position improved by more than $40 million.

The refinancing transactions we announced today address our main 2023 maturities, demonstrate our ability to finance the Company at reasonable terms and provide the Company with the capital structure it needs to navigate an improving cycle for its business.

Quite frankly, I am nothing short of impressed by management’s ability to get a handle on the company’s near-term debt and liquidity issues without diluting common shareholders.

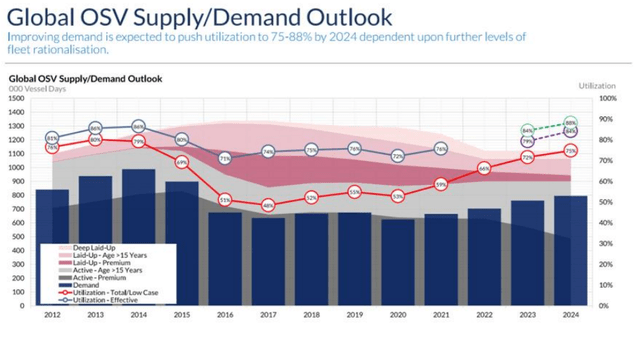

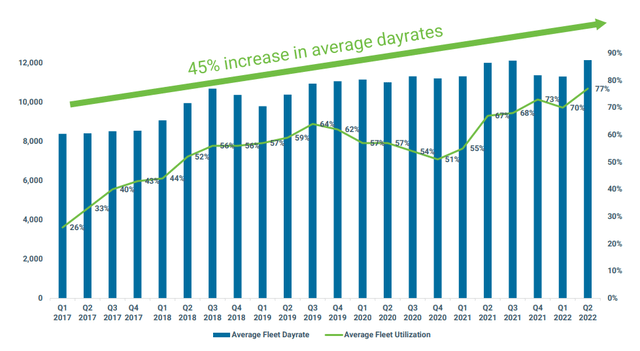

With average dayrates improving quickly and fleet utilization at multi-year highs, SEACOR should finally return to free cash flow generation next year.

Assuming the company achieving an annual EBITDA run rate of $125 million by the end of next year and assigning a modest 5x EV/EBITDA multiple to the business would result in a price target of approximately $12.

Bottom Line

Kudos to management for addressing the company’s near-term debt issues without painful dilution for common shareholders.

While it might still take a couple of quarters for a substantial increase in profitability and cash flow generation, stars are aligning for offshore support companies like Tidewater and SEACOR with a recovery in offshore drilling activity and new tailwinds from recent geopolitical events.

Get long SEACOR Marine Holdings with a medium-term price target of $12 based on an assumed 5x EV/EBITDA run rate at the end of FY2023.

Be the first to comment