Somrerk Kosolwitthayanant

Investment Thesis

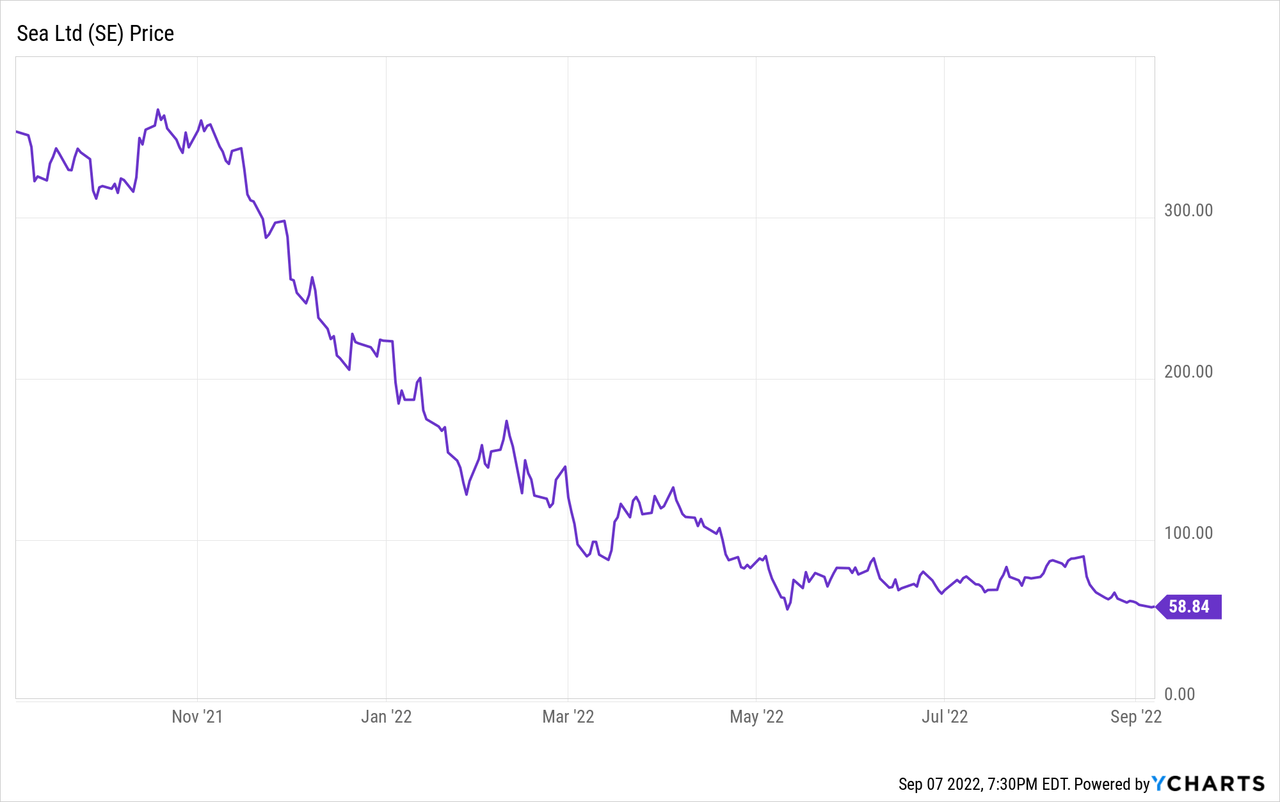

Sea Limited (NYSE:SE) was one of the best-performing companies during the pandemic, with its share price up over 800% from March 2020 to November 2021. The company has benefitted significantly from the pandemic. Its gaming, e-commerce, and fintech segment all saw substantial growth thanks to lockdowns across the globe. However, as the pandemic wanes and the lockdown eases, Sea is starting to show signs of cracks. The company’s growth rate is decelerating rapidly while the bottom line continues to worsen. The deteriorating macro environment is also putting further pressure on the company’s performance. In the recent quarterly earnings, Sea suspended its e-commerce revenue guidance for the year, citing increasing macro uncertainties. Despite falling by over 80% from its all-time high, I believe the company is likely to underperform in the future as it is facing immense headwinds. Therefore, I rate Sea as a sell at the current price.

Overview

Sea is a Singapore-based consumer tech company founded by Forrest Li in 2009. The company’s subsidiaries include e-commerce platform Shopee, gaming studio Garena and SeaMoney, its fintech division. Shopee is the leading e-commerce platform in Southeast Asia and Taiwan. It offers a wide product assortment supported by integrated payments and seamless fulfillment. Garena is a leading online games developer and publisher with a global footprint across more than 130 markets. It distributes mobile and PC games that it develops, curates, and localizes to users around the world. SeaMoney is a digital payments and financial services provider in Southeast Asia that offers mobile wallet services, payment processing, credit, and related digital financial services and products.

Profitability Concerns

My main concern regarding Shopee is the lack of its own logistic network, which I believe is the critical component for any e-commerce company to be profitable. In the past few years, e-commerce companies like Amazon (AMZN), MercadoLibre (MELI), and Coupang (CPNG) have all been investing heavily in their own logistics network. While the huge initial investment may temporarily drag down financial performances in the near term, it is able to provide strong operating leverage for the company in the future as it continues to scale. The three companies mentioned above are all now posting positive adjusted EBITDA for their e-commerce segment.

On the flip side, Sea didn’t choose to invest for the long term and kept dumping money into sales and marketing instead. While the Shopee app successfully ranked high on the app store and revenue growth looked nice on paper, almost none of it translates to the bottom line. The segment’s net loss is continuing to widen every quarter. The company is currently losing $0.33 for each order made, with even worse numbers in newer markets.

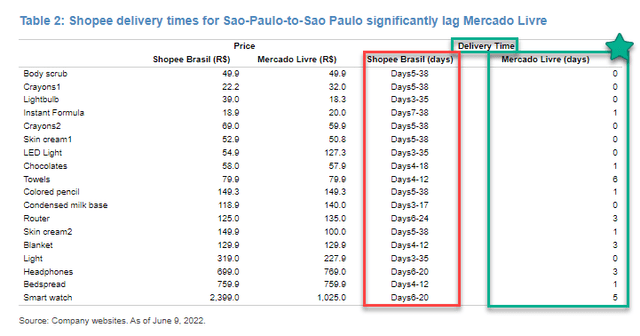

The absence of its own logistic network also put Shopee at a disadvantage as it has no control over the delivery time. It relies solely on third-party delivery services therefore delivery time and customer experience can vary significantly. It is also exposed to price increases from couriers as well. Shopee’s delivery model worked in smaller countries like Taiwan and Singapore but is unlikely to perform well in new markets such as Brazil, which has a much larger landscape. For instance, Shopee’s delivery time in Brazil is usually around 9 to 25 days while MercadoLibre’s delivery time is mostly within 24 to 48 hours.

The company has already pulled out from India and France earlier this year due to rising costs and supply chain issues. Until Sea actually starts to build out its own logistics network, I believe Shopee will continue to struggle with profitability, especially in newer markets.

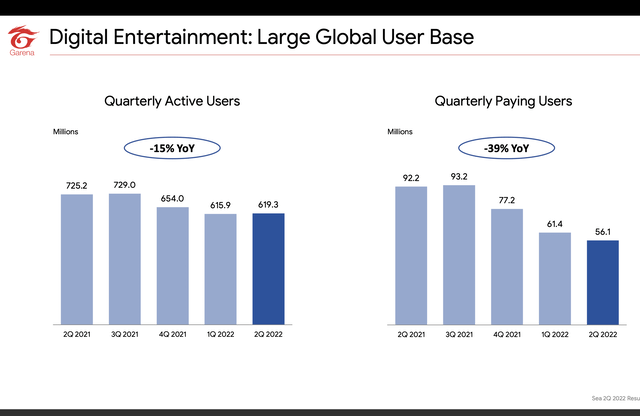

Another notable concern is the decline in its gaming business. While previously published titles like Free Fire and Arena and Valor are still currently ranking nicely on the app store, Garena has been failing to launch any new games. It hasn’t published any games in over a year and the last trending game it published was Call Of Duty mobile back in 2019.

I believe Garena’s legacy titles will surely continue to generate money but the growth rates are starting to decelerate. In fact, both Garena’s bookings and the number of paying users have dropped for the fourth consecutive quarter. Gaming has been Sea’s only profitable segment so far, with an adjusted EBITDA margin of 18.4%. Therefore if no new games are published and the growth rate continues to trend down, I believe Sea’s bottom line will be further impacted in the near term.

Financials

Sea recently reported its second-quarter earnings and also announced that the full-year guidance for e-commerce revenue will be suspended due to the highly volatile and unpredictable macro environment.

Forrest Li, CEO, on suspending guidance:

Given our strategic shifts, coupled with the various macro factors that are hard to predict as mentioned before, we believe it is prudent to maximize our focus on efficiency across our business rather than over-committing which we believe would be ill-advised at this time of uncertainty. As such, we are suspending the full-year guidance for Shopee, which we last provided in May.

On a group basis, the company reported revenue of $2.9 billion, up 29% YoY (year over year) from $2.3 billion. Gross profit increased 19% YoY from $0.9 billion to $1.1 billion. The gross profit margin was 37.9% compared to 39.1%, down 120 basis points.

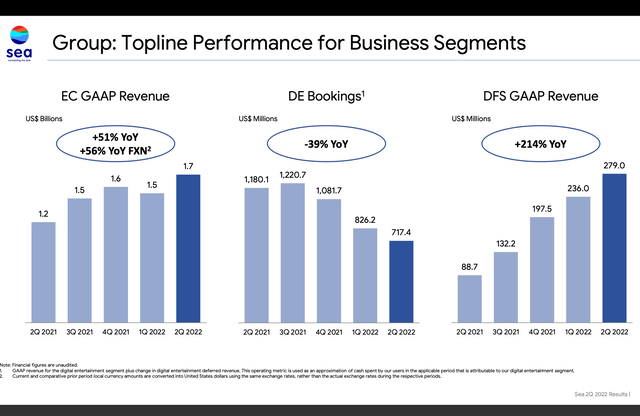

E-commerce revenue was $1.7 billion, up 51.4% YoY from $1 billion. Gross order was 2 billion while GMV was $19 billion, up 41.6% and 27.2% respectively. Adjusted EBITDA loss for the segment widened from $(579.8) million to $(648.1) million. Adjusted EBITDA loss per order improved by 21%, however, it is still losing $0.33 per order. In Brazil, the figure was even worse, with a $1.42 loss per order.

The digital entertainment segment (gaming) also saw a material decline in multiple metrics. Revenue for the quarter was $900 million, down 10% YoY from $1 billion. Bookings decreased by over 67.4% from $1.2 billion to $717.4 million. Adjusted EBITDA was US$333.6 million compared to US$740.9 million, down 55% YoY. Quarterly active users and paying users continue to drop, down 14.6% and 39.1% respectively.

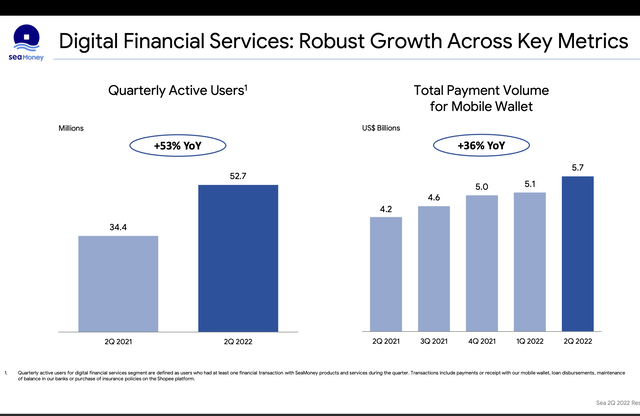

Digital financial services were the only highlight in the earnings. The segment reported revenue of $279 million, up 214.4% YoY. Quarterly active users were 52.7 million, an 53.3% increase from a year ago. Adjusted EBITDA loss also narrowed from $(155.0) million to $(111.5) million, demonstrating strong operating leverage from its large existing Shopee client base.

Forrest Li, CEO, on the fintech segment:

In the second quarter, the synergies between both Shopee and SeaMoney continued to expand, driving revenue and value across the ecosystem. With the stronger adoption of our growing portfolio of financial products and services across our Shopee and SeaMoney ecosystem, we are driving greater efficiency across platforms. As such, SeaMoney’s adjusted EBITDA losses continued to improve quarter-on-quarter.

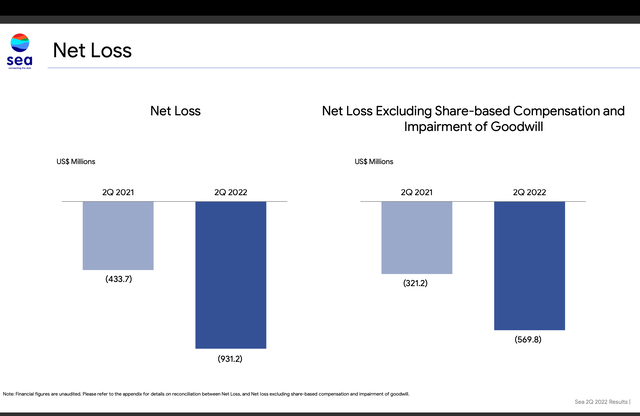

The company’s bottom line continues to deteriorate rapidly. Net loss widened over 210% from $(433.7) million to $(931.2) million. While Adjusted EBITDA loss widened by over 2,000% from $(24.1) million to $(506.3) million. This is largely due to the weakening profitability in the gaming segment. The adjusted EBITDA margin for the quarter was negative (17.4)% compared to negative (1)% a year ago.

Operating cash flow went from positive $450 million to negative $(1.2) billion, while free cash flow went from negative $(1) billion to $(2.98) billion. The company’s cash pile is also burning quickly. Cash and equivalents during the end of the quarter were $7.8 billion, down for the fourth consecutive quarter from $11.8 billion in Q3 2021.

Conclusion

In conclusion, I believe Sea will continue to struggle heavily in the near term. Shopee is showing growth; however, the bottom line remains disastrous with no profitability in sight. The company’s lack of logistics infrastructure makes it much harder to operate with leverage and compete with others on delivery time and customer experience. Garena’s profitability is also declining sharply as bookings and users continue to trend down. The segment is also only relying heavily on legacy titles as no new games are published recently. SeaMoney is the only segment performing well with triple-digit growth and narrowing EBITDA loss. However, the segment currently only accounts for a minimal portion of the total revenue. I believe Sea is not investable until it can show meaningful improvement in fundamentals and profitability. Therefore, I rate the company as a sell.

Be the first to comment