Dr_Microbe/iStock via Getty Images

Summary

SCYNEXIS (NASDAQ:SCYX) received an FDA approval in June of 2021 for Brexafemme for the treatment of vulvovaginal candidiasis, VVC. Sales have been extraordinarily low a year after its launch. The company has recognized this and ceased commercial promotion. They will now be focused on invasive fungal infections where premium pricing is possible. If the company succeeds in obtaining an approval in invasive fungal infections, it is not likely to occur until 2024 or 2025 and additional cash will be required to maintain operations. While there may be patients who can benefit from a novel anti-fungal this is a niche product with an unclear product profile in invasive fungal infections and Scynexis is years from profitability. If data is unfavorable, Scynexis may have a very difficult path forward.

Brexafemme in VVC

Brexafemme was approved for the treatment of VVC. Sales were .6 m USD in Q421, .7m USD in Q122 and 1.3 m USD in Q222. Cantor Fitzgerald analysts suggested sales of Brexafemme could reach $1B in annual sales. A review of the product insert revealed why the actual sales figures may be so low.

The product insert noted that “Ibrexafungerp has been shown to be active against most isolates of the following microorganism both in vitro and in clinical infections [see Indications and Usage (1)]: Candida albicans. The following in vitro data are available, but their clinical significance is unknown. Ibrexafungerp has in vitro activity against most isolates of the following microorganisms: Candida auris Candida dubliniensis Candida glabrata Candida guilliermondii Candida keyfr Candida krusei Candida lusitaniae Candida parapsilosis Candida tropicalis.”

In other words, Brexafemme has only been shown to be active in clinical infections of C. albicans. In the studies used for approval 92% and 89% of the subjects were culture-positive with C. albicans. It is notable that in clinical studies, C. albicans was by far the most common pathogen found on culture. Most cases of VVC are caused by C. albicans and physicians can use generic fluconazole which has activity against most isolates of C. albicans.

Drs. Sobel, world renown experts on the treatment of VCC noted in published literature that there are some fluconazole resistant C.albicans strains. There are women whose infections may not respond to fluconazole and Brexafemme offers an excellent alternative. This is likely a small market. Sales figures seem to support this conclusion. In addition, insurers would likely require pre-authorization and fluconazole failure to cover the $475 cost per course of treatment rather than a few dollars for generic fluconazole.

Scynexis announced that they will be “looking for partners.” Partners are highly unlikely to want to invest resources in a product producing an insignificant amount of revenue. Brexafemme appears positioned as a product for refractory cases and promotion of the product is not likely to change this.

The company noted on a recent call that trajectory of sales was not what they expected. This commercial rollout offers a critical lesson for biotech investors—it is essential to understand the realities of the commercial landscape. Competing with a generically available product which is used first line and is generally safe and effective is difficult. When a product is reserved for refractory cases, sales figures are likely to be low.

A Pivot to Invasive Fungal Infections

Scynexis is running multiple trials including the MARIO trial in invasive candidiasis, the FURI and CARES trials in invasive fungal infections and the SYNERGIA trial in Aspergilosis. Invasive fungal infections often occur in immunocompromised patients including patients in the ICU. Unfortunately, these infections have a high mortality rate. Given this, premium pricing may be appropriate due to the life-threatening nature of these infections. Treatment also continues for weeks rather than a few days.

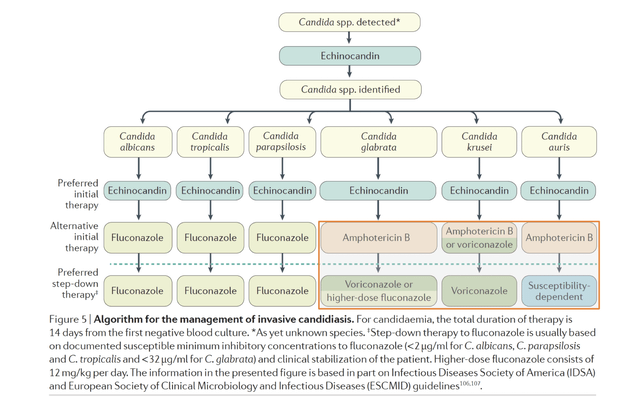

Echinocandins can be prescribed. Fluconazole has an IV formulation and can also be prescribed empirically and followed with oral therapy. Amphotericin B is IV, highly toxic but effective in the treatment of some fungal infections.

Infectious Disease Society of America (IDSA) provides guidelines for the treatment of invasive candidiasis. Patients who acquire these infections are often medically fragile, elderly and/or immunocompromised and often being cared for by an Infectious Disease specialist. In order for guidelines to change, Scynexis would likely need to produce data suggesting there is a clear advantage in a particular indication. If ibexafungerp is considered an alternative therapy rather than a preferred initial therapy, it is not likely to generate significant revenue.

It is notable that C. auris, which ibexafungerp may have activity against is a pathogen where CDC has noted significant resistance to currently available treatments. In addition, ibexafungerp may have activity against other fluconzole resistant pathogens. If effective, this may leave Scynexis an opportunity for ibexafungerp in these difficult to treat infections. Data from clinical studies is not due until 2024 and thus it is not possible to ascertain the product profile or where it may be fit into the IDSA treatment guidelines. The key risk for investors is a limited market opportunity and thus limited sales.

Finances

As of June 30, cash and cash equivalents were $118.7M. Cash burn going forward may be significantly less given the company is no longer commercially promoting the product. The company has guided that they have sufficient cash to sustain operations into 2024. Scynexis has $45 m in long-term debt. The last funding round raised $45 m at $3.00 per share and included warrants.

Conclusions

Scynexis is going to continue to burn cash while trials are ongoing. Pursuing VVC initially rather than the invasive fungal infections appears to have been an error in judgment. Scynexis has no significant revenue and now will be waiting years for data to ascertain if ibrexafungerp is efficacious, safe and offers any advantages over existing treatments for invasive fungal infections. While ibrexafungerp may be useful in the treatment of some fungal infections, where it will fit into guidelines is unclear. One trial will compare ibrexafungerp to fluconazole. A key risk for investors is that if there is no clear advantage, there may be no reason to change IDSA guidelines. Anti-fungals are generally written by Infectious Disease specialists who are well informed and most will follow IDSA guidelines which are written based on available clinical data. In addition, Pfizer, who marketed fluconazole and has deep knowledge of the anti-fungal market acquired Amplyx. Amplyx was developing Fosmanogepix for invasive fungal infections caused by many of the same pathogens (Aspergillus spp, Candida spp including Candida auris) and in invasive fungal infections. suggesting there may be competition. Similar to the situation in VVC, Scynexis may again end up with a product that is useful to a very small subset of patients. Unfortunately, there is no compelling case for investors at this time.

Be the first to comment