I last wrote about Scotts Miracle-Gro (SMG) on November 19, 2019. At the time, SMG shares were a bullish beast. The stock was trading at $102.71 on November 18, which was a 77.2% gain from the low in December 2018. In that piece, I wrote:

At 12.5 times earnings, a 2.18% dividend, insider ownership of almost 30%, and an expanding market for its products, the trend in SMG shares is extremely bullish. The overall state of the agricultural industry in the US has been problematic as the trade war between the US and China has weighed on commodity prices and producer profits. However, SMG’s business seems to be immune from the trade issue as the company is well-positioned to take advantage of the trend towards the legalization of marijuana, and other cannabis-related products.

Since then, SMG shares did well, and even after last week’s price carnage, the stock was still above its level on November 18. The company manufactures, markets, and sells consumer lawn and garden products in the United States and around the world. Scotts is no newcomer to the agricultural business as it has been around since way back in 1868. As we move into the spring season, SMG is at a time of the year when seasonality causes demand for its products to soar.

SMG shares have done well

Scotts Miracle-Gro stock continued to move higher after the mid-November 2019 article on Seeking Alpha

Source: Barchart

As the chart shows, SMG shares reached a peak at $125.27 on February 3, a rise of 22% from the time of my last piece on the company.

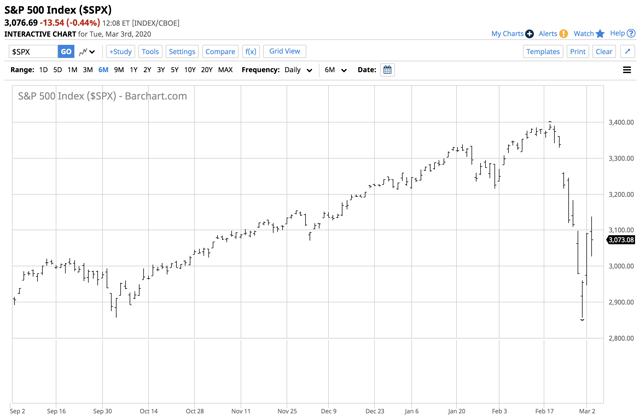

A decline with the stock market

SMG shares moved higher with the overall stock market.

Source: Barchart

The chart of the S&P 500 index illustrates that from November 18 through the high on February 19, the benchmark for the stock market rose from a low of 3,112.06 to a high of 3,393.52 or 9%. SMG shares outperformed the stock market on the upside as it posted over a double percentage gain over the period. Meanwhile, the index closed last week at 2,954.22 or 12.9% below its high, while SMG shares were at $105.99, 15.4% below its high in early February.

Safety in agriculture?

The current risk-off action in markets across all asset classes is causing more than a little anxiety for market participants. The fear and uncertainty surrounding Coronavirus and the upcoming November Presidential contest in the US are likely to keep market volatility at an elevated level. When it comes to the election, the contest will not only be a referendum on President Trump’s performance but the futures policy direction of the United States. A Democrat in the White House that adopts a progressive agenda could mean profound changes in tax, regulations, energy, climate, and a host of other policy directions.

The US has a long history as an agricultural producer. The nation is the world’s leading producer and exporter of corn and soybeans and a substantial supplier of wheat. More than a handful of states have legalized marijuana for medical and recreational uses. At the same time, Americans take great pride in their homes and gardens. Scotts supplies many of the products found in garages and basements around the nation, and all over the world as well as in the sheds and warehouses of agricultural producers.

Risk-off behavior in markets because of the virus or US politics is not likely to interfere with the spring planting season, nor will it stop the crop cycle in 2020. Agriculture could turn out to be one of the safest sectors if volatility continues to grip markets over the coming weeks and months.

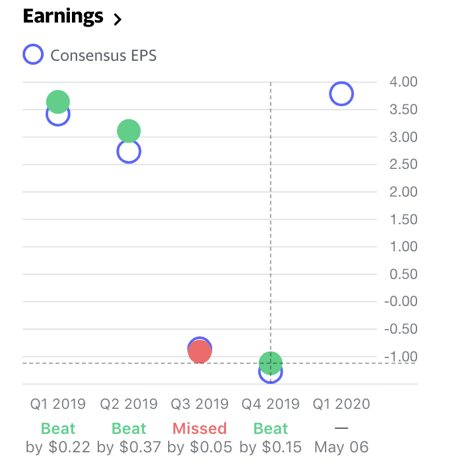

Solid earnings record and the peak season on the horizon

SMG has been around for more than a century and a half. Earnings over the past four quarters reflect the seasonal trends in the company’s business.

Source: Yahoo Finance

The chart shows that SMG tends to earn all of its annual profits during the first half of the year. In Q1 and Q2 2019, the company posted better than expected EPS of $3.64 and $3.11, respectively. After losses that were on either side of consensus forecasts in Q3 and Q4 2019, the estimates for Q1 are for EPS of $3.79 per share.

The seasonal nature of the business means that the best earnings periods are over the first half of the year. SMG has a market cap of $6.493 billion at a share price of $116.78 on March 3. The company pays shareholders a 2.02% dividend at the current stock price. SMG trades and average of 379,749 shares each day and a survey of four analysts on Yahoo Finance has a projected range of $110 to $135 per share with an average of $125.75, well above the closing price at the end of February.

Selling puts could be the optimal approach in wild conditions

I believe that the risk-off action in markets sent SMG shares back into the buying zone at the end of last week. I would be a scale down buyer of the stock, leaving plenty of room to add on the downside if the price carnage in the overall market returns.

Another approach could be using the current market volatility to your advantage when approaching SMG shares. The spike in the VIX index means that put and call options have risen to their highest level in years. Selling put options on SMG to take advantage of the high level of price variance in the stock market is an excellent way to gain an advantage. For a buyer of the stock, selling an inflated put option will either result in buying the stock at the level of the put minus the premium or keeping the premium if the shares are above the strike price at expiration of the option. For example, a June 19, 2020, $105 put option on SMG shares was $3.90 bid at $4.50 offered on Tuesday, March 3. Selling the option at $4 per share would result in a long position in the stock at $101 on June 19 if SMG is below the $105 level. If the stock is higher than $105 per share, the option will expire worthlessly, and the seller would keep the entire premium. I would not sell puts currently, but on a dip where volatility increases I would consider put sales at attractive premiums.

I am a buyer of SMG shares on a scale-down basis as the company is likely to keep on earning. At just under $117 per share on March 3, the price to earnings multiple was only 14.05, which is low even after the recent correction in the stock market.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.

Be the first to comment