Mindful Media/E+ via Getty Images

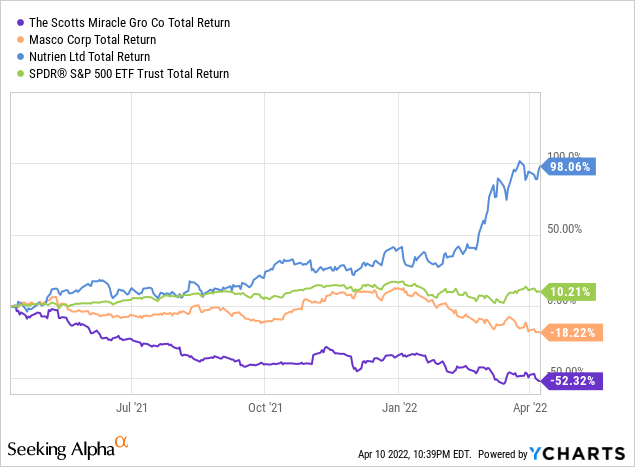

Over the last twelve months, everyone’s favorite lawn & garden provider Scotts Miracle-Gro (NYSE:SMG) has seen the erasure of over half of shareholder value. During the same time period, of course, the S&P 500 delivered a strong return of 10%. On the extreme end, peer Nutrien (NTR) almost doubled in value while Masco (MAS) fell ~18%. With such a precipitous decline in value, especially relatively, the question naturally follows whether Scotts Miracle-Gro is a “value play” or a “value trap”? Part of the reason for the poor performance is management recently lowering full year revenue guidance below the previous low end, with Hawthorne, in particular, struggling from overcapacity. The guidance for Hawthorne moved to a contraction of 10-25% y-o-y, which is stymying investor enthusiasm for the otherwise growth catalyst. Combined with the expressed reservations in making a significant acquisition this year, investors appear to be looking elsewhere for growth.

According to Seeking Alpha data, the Street is loving the pullback. 8 of 12 analysts rate the stock a “strong buy” and 2 rate it a “buy”. This sentiment is a complete reversal of where it was back in September 2020, when only ~30% of analysts rated the stock a “buy” or better. At 12.7x forward earnings, the stock looks relatively cheap with a dividend yield of 2.3% and a reasonable beta of 1.15. However, with a quick ratio of 0.7, Debt/Equity at 3.9, and narrow operating margins of 13.8%, the company is not without its risks. Nutrien is cheaper still at 10.4x and provides a 17.3% operating margin at a Debt/Equity of 0.5. Masco is also cheaper at 10.9x forward and provides 14.4% operating margins with a quick ratio of 1.1. Moreover, according to Seeking Alpha analysis, Scotts Miracle-Gro has characteristics that have been historically associated with poor stock performance, namely, decelerating/declining growth compared to industry peers. Regardless, the question remains whether this weak momentum has been materially factored into the stock price.

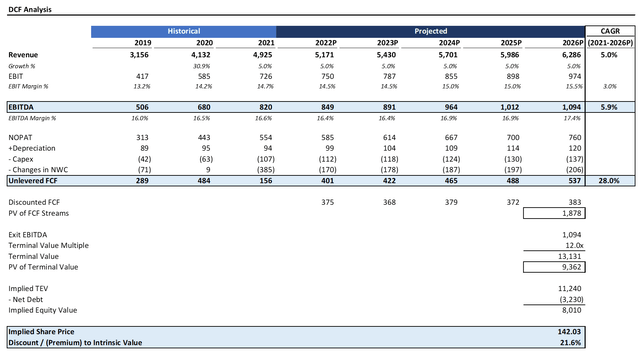

DCF Analysis Indicates Significant Upside

To get a sense of the company’s intrinsic value, I ran a DCF analysis. No DCF analysis can provide a perfect picture of future returns for shareholders; however, they can provide an illustrative “story” of the likelihood of different scenarios. I forecasted a flat conservative 5% growth into 2026. I assumed margins expanding minimally by less than 100 bps into 2026 to 15.5%. Capex, increase in net working capital, depreciation, and taxes were flat-lined for simplicity. By 2026, I have EBITDA at just shy of $1.1 billion.

Created by author using data from Yahoo! Finance

Assuming a terminal EBITDA multiple of 12x and a discount rate of 7%, the stock is more than 20% below its intrinsic value. At a time when the market is fairly overvalued and Scotts Miracle-Gro is a brand name company with market leadership, this is an incredible opportunity for investors. When you look at Scotts Miracle-Gro’s historical multiple versus where it currently is at (13.4x), it has trended around 10.5-15x. Thus, my 12x multiple, is, if anything, on the conservative end.

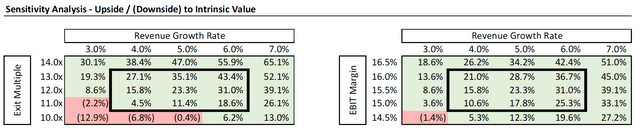

Created by author using data from Yahoo! Finance

Looking at the sensitivity analysis, you can see that there are considerably more pathways to the upside than downside. If the stock goes at the high-end of its historical multiple at 14x, there’s nearly 50% upside at just a slow growth rate of 5%. Even if growth comes to a halt at 3%, just covering inflation-the stock would still be fairly valued at the low end of its historical trading multiple rate of 11x. Thus, there is a very favorable risk-reward here. And, even if margins hold steady at 14.5% and the company just keeps up with inflation, it’s fairly valued. In other words, yes, the market is not forecasting any excess growth from the market leader. Thus, from a value standpoint, Scotts Miracle-Gro is a steal.

Upside Catalysts

The last thing you want to become is one of those investors that believes he struck gold but instead finds himself in a “value trap”. It takes several catalysts in order to close the gap to intrinsic value, especially for more “boring” names like Scotts Miracle-Gro. While consumer sentiment has shifted away from lawn & garden, I am bullish on the company’s Hawthorne segment as legalization inevitably expands. Moreover, management is taking its time to restructure the business. In my view, investors are too caught up in near-term performance and exciting tech stock names, that they miss out on investing in the long-term. In general, it’s hard to bet well over short periods, but when you stick to your guns long-term, you take much of the guesswork out of unpredictable up and down Mr. Market movements.

I am also optimistic about the company’s opportunity in lighting and M&A more generally. It recently acquired Luxx Lighting, which provides expansion into the indoor cultivation lighting market. Lighting is the #1 category where growers spend money on, and thus provides a significant runway for upside. As the leading market provider in lawn & garden, Scotts Miracle-Gro has an excellent brand image and retail base that it can leverage to entice dedicated its dedicated customer base. Management is targeting doubling the size of Scotts Miracle-Gro through both organic and acquisition activity over the next five years. Organically, the company has channeled R&D dollars into LED lighting. In regard to M&A, the company is targeting live goods and lines that will drive a higher level of consumer innovation. The company’s M&A strategy is also rolling synergies into Hawthorne. Luxx Liberty was designed with that market in mind and, combined with True Liberty, HydroLogic, and Rhizoflora, Scotts Miracle-Gro is setting itself up well to be the dominant market player in the cultivation space.

Risks

There are several reasons to be hesitant about Scotts Miracle-Gro. Firstly, the challenged labor market has put added stress on the sales force to support retailers. Congested supply chains have added pressure to pricing to the situation. At the same time, management is also restructuring its manufacturing footprint, which creates exacerbates the uncertainty about where margins may land. Going back to my sensitivity analysis, while the company is materially covered across most reasonable ranges, a 1% change in margins yields a ~10% change in intrinsic valuation.

As previously mentioned, the sock has decelerating momentum and weak growth compared to peers. Compounded with a high debt load which amounts to net debt of $2.1 billion, Scotts Miracle-Gro may be more limited in capitalizing on the growth catalysts than I acknowledge. For comparison, net debt was at $1.5 billion last year. Add in commodity price inflation and unpredictability from online entrants, and the company is definitely not a “sure bet”.

Conclusion

As a result of the pandemic, more consumers have picked up gardening, and this trend is likely to stay. Gardening is, after all, a hobby that, once picked up, tends to become a lifetime love. Scotts Miracle-Gro is the market leader with a dedicated base of gardeners. As it seeks to build up its position in lighting and other adjacencies, the upside looks inevitable. And yet the stock trades ~5% below where it was immediately before the pandemic! This is a business with strong fundamentals, a solid economic moat, and numerous synergy opportunities in M&A, product expansion adjacencies, and the legalization of cannabis. With considerably more pathways to the upside than downside, per my DCF analysis, I strongly recommend investing in this value play.

Be the first to comment