Petmal/iStock via Getty Images

Main Thesis/Background

The purpose of this article is to evaluate the Schwab International Equity ETF (NYSEARCA:SCHF) as an investment option at its current market price. This fund is managed by Charles Schwab, and its objective is “to track as closely as possible, before fees and expenses, the total return of the FTSE Developed ex US Index.”

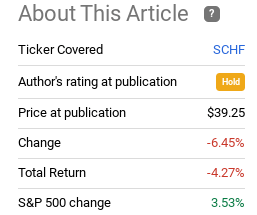

I own and write about SCHF on a regular basis, the most recent time being when Q4 was underway last year. At that time, I saw limited upside, but merit for holding on to current positions. In hindsight, this was a reasonable call, although being more bearish would certainly have been acceptable. This is because since that review, SCHF is down a bit while the S&P 500 has risen:

Article Performance (Seeking Alpha)

Given this weak performance, I wanted to take another look at SCHF to see if I should change my rating going forward. After review, I actually see a buy case emerging for overseas developed markets. This has put SCHF on my radar as a candidate I want to add to going forward, driven primarily by continued earnings strength in these markets, relatively decent valuations (compared to the U.S.), and an expectation the geo-political crisis in Eastern Europe will wind down in the second half of the year.

Markets Are Down, That’s The Time To Buy

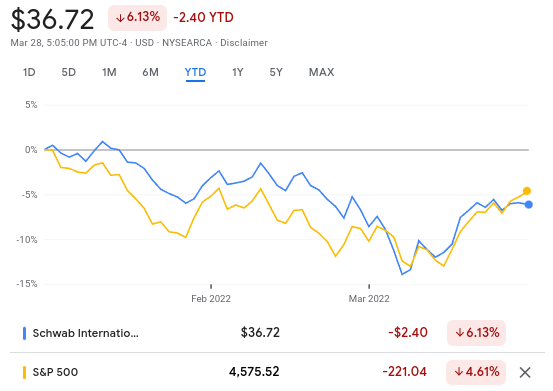

To begin, let us take stock of where we are at so far in 2022. As investors are surely aware, we have been on quite a ride already in Q1. While markets have been rebounding of late, I still see some value at current levels because stocks are down broadly year-to-date. To me, this represents opportunity, because I want to find myself putting in new cash when markets are down, not up, in order to find “alpha”. Importantly, this story is consistent across U.S. and global equities, as measured by the S&P 500 against funds like SCHF:

YTD Performance (Google Finance)

As you can see, both stories are negative, and to a similar degree. With this in mind, why would one want to look at SCHF at the moment?

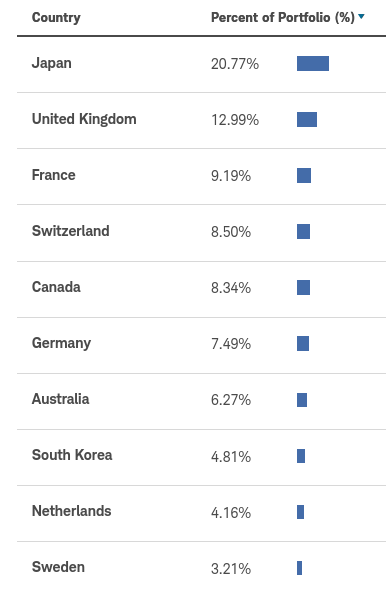

To answer this question, we should first break-down what is actually in SCHF. While this is a “developed world” ETF and does offer exposure to a lot of countries, readers should recognize it is overweight Japan and the United Kingdom specifically:

Portfolio (Charles Schwab)

Therefore, one should have a fairly bullish take on this two regions prior to buying this fund.

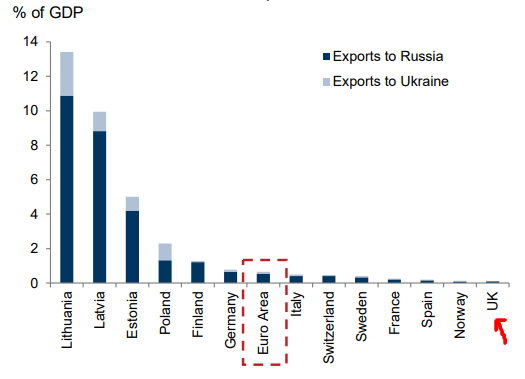

The good news is there are indeed reasons to be optimistic here. Both the U.K. and Japan are fairly isolated from the current conflict that is ongoing in Ukraine. This sets it apart from other European nations, such as Germany, Finland, or Italy. In fact, Japan’s direct exposure to Ukraine or Russia is minimal, and the U.K.’s exposure is well below the Euro-zone average:

Exposure to Russia & Ukraine (Goldman Sachs)

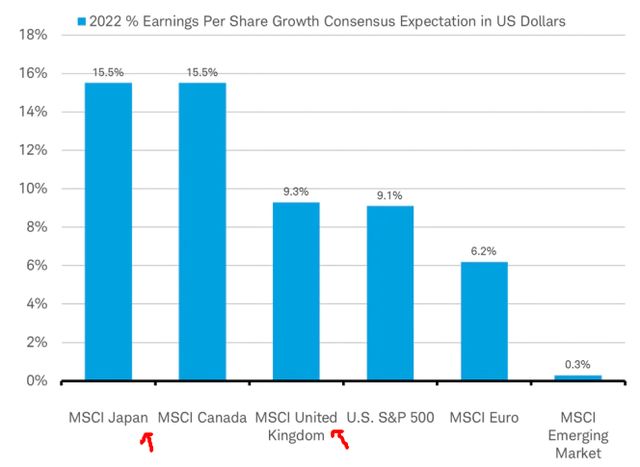

Given this reality, investors can take some comfort that this is a reasonable investment choice, especially if the Ukraine situation does not expand beyond its borders. While that is still a possibility, markets are not really pricing in that possibility for the time being. With this mindset, it is then understandable that earnings growth is expected to be in the double-digits for both Japan and the U.K. this calendar year:

Forward Earnings Estimates (Charles Schwab)

My takeaway is this all adds up to a positive backdrop. Does this mean SCHF is suddenly going to rip higher? Of course not. And certainly it is not guaranteed to do so at the expense of U.S. equities. But it does present a reasonable possibility that developed markets stocks have less downside potential and a fair amount of upside. Exposure to Eastern Europe is mild, and earnings expectations are still expected to growth at a healthy clip in SCHF’s top regions – more than the S&P 500 in fact. To me, this merits at least some consideration.

Dividend Growth Has Been Strong

Expanding on the above point, the strong economic recovery across the globe in 2021 included developed markets beyond the United States. While this year has put macro-conditions on shakier ground, the strength from last year still offers some support that large-cap companies were well positioned for the future. No place is this more evident than their ability to deliver strong cash returns to investors via dividends, which is clearly something I love to see.

While my U.S.-focused equity funds saw strong dividend growth as well, readers should be impressed by the uptick in SCHF’s December distribution, compared to the year before:

| 2020 December Distribution | 2021 December Distribution | YOY Growth |

| $.51/share | $.85/share | 67% |

Source: Charles Schwab

The conclusion here is pretty straightforward. This is very strong dividend growth, helping to push the current distribution yield over the 3% mark. Simply, I view this very positively, and it reiterates my reasoning for wanting some exposure to this fund.

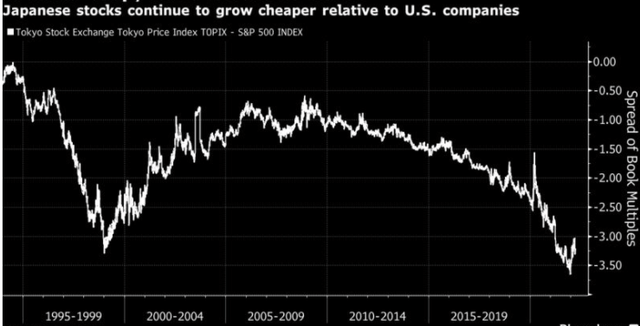

Japan In Particular Looks Cheap

While developed markets as a whole are priced reasonably well against the S&P 500, I want to zero in on Japan because this is an area that is particularly cheap. This helps to support my bullish take on SCHF specifically, since this nation is the fund’s top weighting. Japan’s under-performance has been known for some time, so I will mention again this is not a screaming buy signal. Valuation is only one metric, and what is cheap now may remain cheap tomorrow – and for years to come. But it is also true that valuation stories diverge, and Japan is historically very cheap on a relative basis right now:

Taken by itself, this doesn’t necessarily mean a whole lot. But when I couple the valuation story with Japan’s isolation from Europe and the expectation of strong earnings growth, I find some assurance that my money here will generate a positive return.

Shifting Overseas Is Not A “Cure All”

So far through this review I have painted a fairly pretty picture. It may seem like SCHF is a sure thing, so I want to caution against getting too optimistic here. Yes, I like this is a sold fund and that buying it now will prove fruitful. But that outlook comes with some assumptions. Namely, these include a resolution to the Ukraine crisis, continued global economic growth, and a moderating of inflation. If one or all of these stories don’t play out, SCHF will likely fall along with most global equities.

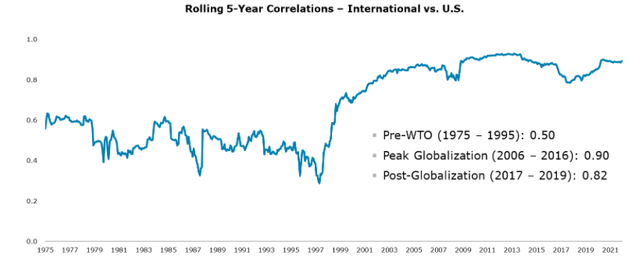

The point I am trying to make is that if investors are worried about the future, simply moving out of the U.S. and in to international equities is not going to offer as much protection as they may think. The world is very linked, to the point where problems in the Euro-zone, Asia, or North America are going to impact equities in all those regions (most likely). This is not a new phenomenon, but one that has been building over time. In fact, international stocks as a whole have a pretty strong correlation with U.S. stocks for the time being:

My point is that there is risk in this market – whether one is choosing the S&P, SCHF, or any other equity fund or theme. Does SCHF have some value here? I think so. But that doesn’t mean I am going to get too carried away with new positions right now either.

Financials To Benefit From Rising Interest Rates

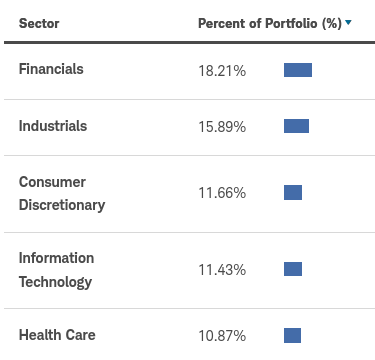

My last point reverts back to SCHF. Beyond the positive view I have on the top countries in this ETF, I also like the fund’s top sector by weighting. This is Financials, at over 18% of total assets:

Fund Sector Weightings (Charles Schwab)

I like this for two reasons. One, it helps to diversify my portfolio away from the Tech-heavy S&P 500. There is nothing wrong with the S&P’s make-up inherently, but it does exposure investors to concentration risk. This concentration has been a return amplifier over time, but it also makes for a more volatile ride at times. By contrast, Financials are not overweight in the S&P index, so buying SCHF helps me balance my holdings.

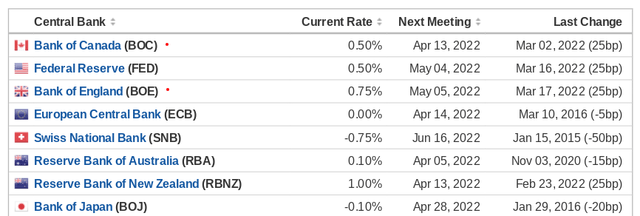

Two, the Financials sector is one that should benefit globally from persistent inflation and a gradual rising of interest rates. While central banks in Europe and Japan have not been moving on rates yet this year, other nations have. These include the U.S., Canada, and the U.K, the last two are countries that are included within SCHF:

Central Bank Interest Rates (World Bank)

In my opinion this makes for desirable exposure. While banks/financial companies are cyclical and can be disproportionately impacted by geo-political events, I view large-cap banks as a relatively stable asset class. Yes, prices will fluctuate with time, but they are flush with cash and have resilient balance sheets compared to decades past. With interest rates finally starting to creep up across the globe, I want exposure to the companies who can profit off this development.

Bottom-line

SCHF has been a disappointment over the past two quarters, but I believe better days are ahead. I will remain heavily allocated to the U.S. to be fair, but I like SCHF as a way to branch out beyond U.S. borders for some diversification. The fund’s top sector intrigues me, and the exposure to Japan and the U.K. more broadly are positive attributes. With equity valuations getting stretched again here at home, looking to international equities for value definitely has merit. As a result, I will be building on my position in SCHF in the coming days, and I suggest readers give this fund some genuine thought at this time.

Be the first to comment