claffra/iStock Editorial via Getty Images

One of the larger energy service companies on the market today is a company called Schlumberger (NYSE:SLB). Over the years, the management team at this firm worked hard to reinvent the business as a technology-oriented enterprise aimed at servicing customers in the energy markets. Unfortunately, because of a decline in the energy sector as a result of the COVID-19 pandemic, financial performance at the business has suffered on the top line. Cash flows have been more robust, but even they have suffered as a result. Fast forward to today, and analysts are anticipating a nice improvement to begin the 2022 fiscal year. If this does come to pass and if it’s indicative of a new future for the enterprise, shares might offer a nice bit of upside. But given where the company is priced at the moment, I would say that the firm is only marginally undervalued or close to fairly valued.

Schlumberger – A Diverse Energy Services Provider

According to the management team at Schlumberger, the company is a provider of technology for customers in the energy markets. At present, the firm is split up between four different segments, each of which deserves some attention. The most interesting segment is called Digital & Integration. Through this segment, the company provides a variety of offerings. One example would be its digital solutions. This involves providing proprietary software, consulting services, information management and IT infrastructure services, and more. The company also provides multi-client seismic surveys and data processing, much of which occurs through its WesternGeco subsidiary. The company also offers asset performance solutions that essentially combine its own services and products with drilling rig management and specialized engineering and project management expertise. The ultimate goal here is to offer a complete solution for customers looking for well construction and production improvements. During the company’s 2021 fiscal year, this segment accounted for 14.1% of the firm’s overall revenue and for 31.5% of its profits.

The next segment we should pay attention to is called Reservoir Performance. This unit includes reservoir-centric technologies and services aimed at optimizing reservoir performance and productivity. Specific offerings here include Wireline, which provides information that helps to facilitate the evaluation of subsurface geology and fluids with the end goal of empowering customers to plan and monitor well construction and to monitor and evaluate well production. Testing involves the exploration and production pressure and flow rate measurement services the company has developed over the years. And it also offers stimulation and intervention services that includes pressure pumping, well stimulation, and coiled tubing equipment for downhole mechanical well intervention and other related activities. This segment made up 19.7% of the company’s revenue and 17.9% of its profits last year.

Under the Well Construction segment, the company offers a wide portfolio of products and services. Examples include mud logging services, the supplying of individually engineered drilling fluid systems that helped to improve drilling performance, the design and sale of drill bits, the offering of drilling tools, and more. This segment accounted for an impressive 37.4% of the company’s revenue last year and with responsible for 33% of its profits. The last segment, meanwhile, is called Production Systems. Offerings here include its artificial lift business, which involves the use of electrical submersible pumps, gas lift equipment, and other related technologies. The company also offers completion equipment, valves, and so much more. Last year, this segment accounted for 28.8% of the company’s revenue but just 17.5% of its profits.

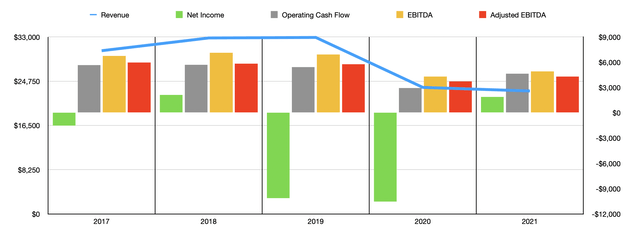

Over the past few years, financial performance achieved by Schlumberger was rather mixed. After seeing revenue rise from $30.44 billion in 2017 to $32.92 billion in 2019, it then plunged to $23.60 billion in 2020 before dropping further to $22.93 billion last year. Some of this decline was, unfortunately, caused by a significant drop in demand associated with the COVID-19 pandemic. However, not all of this decline was because of that. Though most of the decline was associated with falling demand, including a 48% drop in revenue in North America, the business did exchange off ownership of one firm for another and it sold off its North American low flow rod lift business in an all-cash transaction. Combined, these two segments made up 25% of the company’s North American revenue at that time. However, seeing as how both of these transactions were completed at the tail end of 2020, they do not make up the lion’s share of the decline.

From a profitability perspective, the picture has been even more volatile. In three of the past five years, the company generated net losses. The largest was a loss of $10.52 billion that the company incurred in 2020. This followed a $10.14 billion loss experienced in 2019. Much of this was related to impairments though, so the actual impact on the business from a cash perspective was nowhere near as bad. In 2021, the firm did see something of a rebound here, with net income totaling $1.88 billion. Other profitability metrics have been more stable. In the past five years, the peak for the company’s operating cash flow was the $5.71 billion the business generated in 2018. This dropped in 2019 to $5.43 billion before plunging to $2.94 billion in 2020. The good thing for investors is that we did see something of a recovery in 2021, with operating cash flow improving to $4.65 billion. If we adjust for changes in working capital, the general trajectory experienced by operating cash flow would have been similar. And finally, we have EBITDA. This declined each year between 2018 and 2020, eventually dropping from $7.11 billion to $4.31 billion. Then, in 2021, it came in at $4.93 billion.

On April 22nd, before the market opens, the management team at Schlumberger is due to report financial performance for the first quarter of the company’s 2022 fiscal year. Investors should pay careful attention here, especially given what we know about the energy sector and the strong demand relative to supply. Currently, analysts anticipate revenue of about $5.90 billion. That compares to the $5.22 billion the company generated the same time one year earlier. Analysts also anticipate earnings per share of $0.33. That would translate to net profit of around $461.4 million. That’s significantly higher than the $299 million the company reported for the first quarter of its 2021 fiscal year.

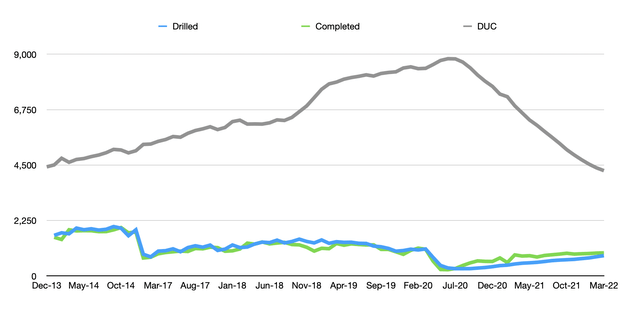

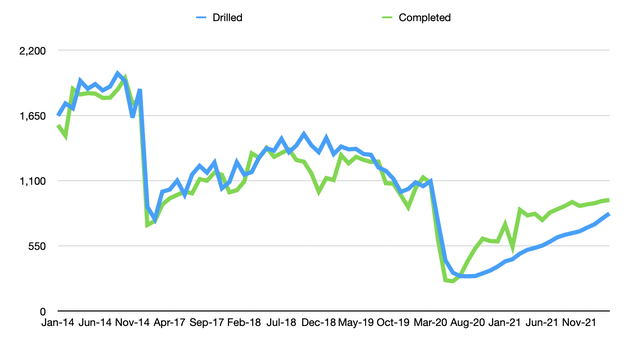

For investors who think that such a strong year-over-year performance is unlikely, I would like to point out that a big portion of Schlumberger’s fortunes are tied directly to the oil and gas market. And one thing that we have seen, courtesy of the Energy Information Administration, is a significant reduction in DUCs (Drilled but Uncompleted wells). As oil and gas production has risen, the massive inventory of wells that were drilled but not completed that had built up over the years has finally started being tapped into. At present, the number of wells that are drilled but not completed in the US total about 4,273. That compares to the 6,905 reported just one year earlier and is down from the 8,425 reported for the March 2020 timeframe. This has come as the number of wells being completed has significantly outpaced those being drilled. At some point, we will have to see additional drilling take place. And while the well completion process does leave open the opportunity for Schlumberger to make a profit, the company will also do well as additional drilling takes place.

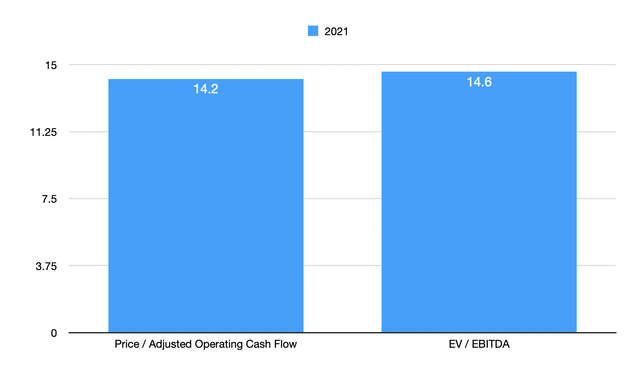

As for whether shares are attractively priced or not, I would make the case that the business might be marginally undervalued or, at worst, is fairly priced. This assumes that fundamentals don’t improve this year but, instead, match with the company achieved in 2021. Using the company’s 2021 results, we can see that it is trading at a price to adjusted operating cash flow multiple of 14.2. It is also trading at an EV to EBITDA multiple of 14.6. I decided to compare the company to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 13 to a high of 163.6. Only one of the five companies was cheaper than our prospect. Using the EV to EBITDA approach, the range was from 10.3 to 54. In this case, two of the five companies were cheaper than our target.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Schlumberger | 14.2 | 14.6 |

| Baker Hughes Company (BKR) | 13.0 | 22.0 |

| Halliburton Company (HAL) | 19.5 | 16.3 |

| Tenaris S.A. (TS) | 163.6 | 10.3 |

| NOV Inc. (NOV) | 28.2 | 54.0 |

| ChampionX Corporation (CHX) | 16.2 | 12.6 |

Takeaway

At this point in time, Schlumberger seems to be doing alright considering how difficult the past couple of years were. Fundamentally, analysts expect the business to improve this year, or at least for the first three months of the year. And given what is transpiring in the energy markets, I wouldn’t be surprised to see that be the case. Even if the firm were to stay back at the kind of performance it generated in 2021, I would argue that it is no worse off than being fairly valued. But more likely than not, it is slightly underpriced. And if the 2022 fiscal year does mark a new normal for the business, that picture could change from being slightly underpriced to being attractively underpriced.

Be the first to comment