Igor Borisenko

There are many different investment strategies out there, and there’s not one size fits all approach. However, it’s generally a good idea to fill a diversified portfolio with “best of breed” stocks. These stocks have leadership positions in their respective industries through their market share, scale, reputation, technological know-how, and any combination thereof.

This brings me to Schlumberger (NYSE:SLB) which is a moat-worthy company in the oilfield services space. In this article, I highlight why the recent sell-off presents a great buy-the-drop opportunity on this quality stock, so let’s get started.

Why SLB?

Schlumberger is the world’s largest products and services provider to the oil and gas industry, providing expertise to its clients on drilling, production, and reservoir mapping and attributes. Notably, it pioneered directional drilling in the 1980s, and today, this technology is core to the U.S. shale revolution.

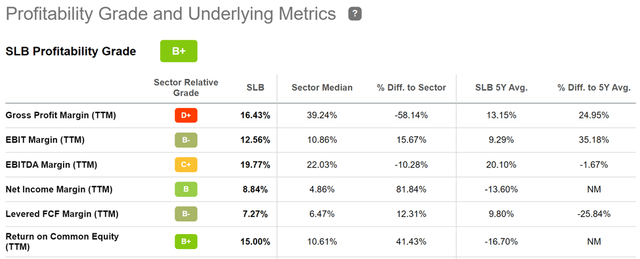

It’s also a knowledge leader in understanding oil and gas reservoirs and carries a portfolio of technology patents that serves as a moat around its business. This helps SLB to maintain above-average industry profitability. As shown below, SLB carries a B+ profitability rating, with net income margin and returns on equity that sit well above the sector median.

SLB Profitability (Seeking Alpha)

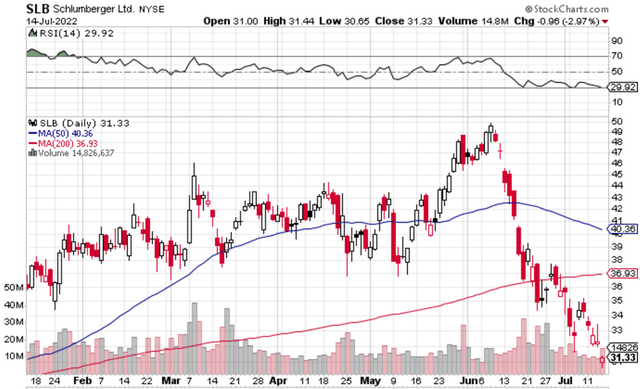

SLB’s stock, however, has seen material weakness as of late. At the current price of $31.33, SLB sits well below its 50- and 200-day moving averages of $40 and $37. As shown below, SLB now carries an RSI score of 29, indicating that it’s now in oversold territory.

SLB Stock Technicals (StockCharts)

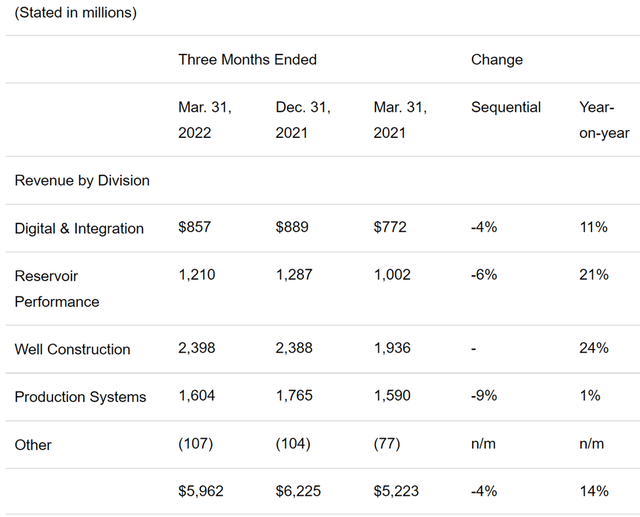

SLB’s business, however, has been on a tear with the oil and gas boom, as revenue grew by 14% YoY to $6.0 billion during the first quarter. This was driven by strong performance across three out of its top 4 business lines, digital & integration, reservoir performance, and well construction, all posting double-digit top-line growth, as shown below.

SLB Revenue (Company Press Release)

Notably, SLB saw an overall 4% decline in sequential QoQ revenues. This was due to seasonal activity decline in the Northern Hemisphere, as well as the decline in value of the ruble in Europe and Africa, and global supply chain constraints impacting production systems.

Looking forward, SLB is expected to see a ramp in business due to the war in Ukraine, as this has exacerbated an already tight oil and gas market. This will likely result in increased investments across geographies to stabilize markets and ensure energy diversification away from Russia. This sentiment was echoed by management during the recent conference call:

The energy landscape has evolved significantly over the past few months. Recent events have, on one hand, resulted in a change in the pace of demand recovery, while energy security and supply diversification have also emerged as preeminent global drivers that will shape the future of our industry, in addition to decarbonization, capital discipline, and digital transformation. This new dimension will have long-lasting positive implications for energy investment over the next few years.

Risks to the thesis include recent volatility in energy prices, which could impact the profitability of SLB’s clients. However, as noted during a recent interview, the CEO of Chevron (CVX) noted that the oil price decline may be short-lived, as the oil market remains tight. This should serve as a floor for oil prices, at least in the near term.

Nonetheless, SLB is positioned to benefit even amidst oil price declines (albeit not drastically as we saw during the early months of the global pandemic). This is because of SLB’s positioning in helping its clients to reduce the cost of extracting oil and gas, as noted by Morningstar in its recent analyst report:

Schlumberger is now applying its expertise to a somewhat different strategic focus: lowering the cost per barrel of oil and gas development via the provisioning of performance-linked services. Also, the company is prioritizing its digital capabilities, which will further support its capacity to boost efficiencies for Schlumberger and its customers.

This cost-cutting focus puts Schlumberger in an ideal position as oil producers globally are seeking to cut costs to cope with the era of lower oil prices ushered in by U.S. shale. In particular, international producers have struggled with rising costs for decades thanks to limited efficiency improvements. We think the success of Schlumberger in addressing this problem will drive market share gains in coming years.

Meanwhile, SLB maintains a strong A rated balance sheet, and the board of directors recently approved a 40% increase to the quarterly cash dividend to $0.175 per share. This puts SLB on track to eventually retake its $0.50 quarterly dividend rate from early 2020.

I see value in SLB at the current price of $31, with an EV/EBITDA of 12.3, sitting at the low end of its range since the start of last year. Both Morningstar and sell-side analysts have the same price target of $49, implying a potential one-year total return of 58% including dividends.

Investor Takeaway

Schlumberger is a market leader in its industry, with a unique focus on cost-cutting that makes it well-positioned in varying oil price scenarios. It’s also in a position to benefit from tight energy supplies due to the war in Ukraine, as this should drive increased investment in its services in other geographies. Given the above and the recent material share price decline, I believe Schlumberger is a compelling investment at the current price.

Be the first to comment