jasonbennee/iStock via Getty Images

Sayona Mining Limited’s (OTCQB:SYAXF) flagship Abitibi Lithium Hub Project is making steady progress towards its targeted 1Q23 production start date. The start of that project should allow Sayona to begin taking advantage of the high prices at which spodumene concentrate (“SC6”) currently trade. It will also enable the miner to both become profitable, and generate cash that will then be used to develop its other projects.

And while the company has been able to show some positive results from exploration work done at its other Canadian and Australian properties, I believe the stock’s current value depends on the company’s ability to initiate operations successfully at Abitibi. A smooth start and relatively quick ramp up to full production should allow the company to maintain its $1.6 billion market cap, but any unforeseen slowdowns may see the stock price suffer.

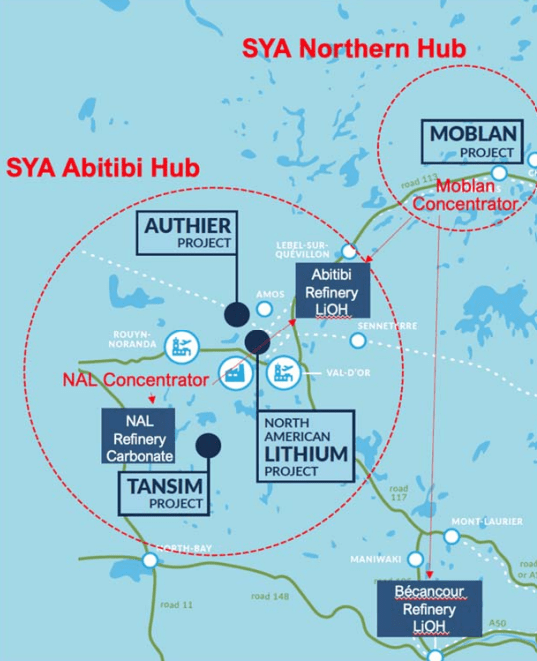

NAL/Authier Project (Abitibi Hub)

In 2021, Sayona teamed up with Piedmont Lithium Inc. (PLL) to make a joint bid for the assets of North American Lithium (“NAL”), a Quebec-based lithium miner that went bust in 2019 due to low lithium prices. As part of the deal, Sayona also included its Authier project which is a smaller lithium mine located near the NAL property. Under the terms of the agreement, Sayona Quebec Inc (“SQI”) would own the NAL and Authier assets and SQI’s ownership would be split 75/25, with Sayona getting the bigger share.

Investor Presentation

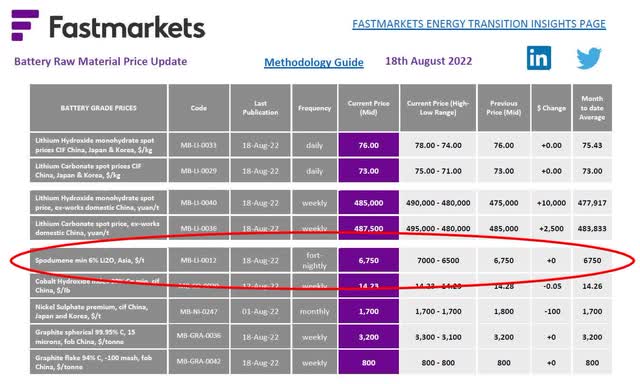

But although Sayona wound up being the majority owner, Piedmont secured an offtake agreement that allows it to purchase the greater of 113ktpa of SC6 or 50% of NAL’s production for between $500 and $900 per metric tonne. Those were the prevailing prices when the deal was struck, but they’re not the prevailing prices today as SC6 recently closed at $6,750/t.

This clause in the contract, which is the subject of a previous piece that I wrote about Piedmont, is very significant. The existing plant at the NAL property has a nameplate capacity of 220ktpa of SC6, but in a Pre-Feasibility Study released in May of last year, Sayona states that production will come in at about 168ktpa. This means that Sayona will only be netting about 55ktpa of SC6, which has a current market value of about $370 million.

Now granted, that’s not peanuts. But that’s also before production and shipping costs are included, and assumes that the mine will ramp quickly while SC6 prices remain at their current elevated levels for the foreseeable future. To factor all of that in and be conservative, let’s assume Sayona nets $3,000 per tonne on its 55k tonnes, leaving it with $165 million. If we divide that by the 8.3 billion outstanding listed on the ASX website, we get about $0.02/share on a stock currently trading at $0.19 or about 10.5x.

In comparing it to my price analysis of Sayona’s joint venture partner, Piedmont, I used more stringent assumptions which still yielded a lower multiple. I assumed a $3,000 net profit per tonne but limited Piedmont’s 2023 production allocation to 60k tonnes (instead of 113k) in order to account for a possible slow ramp to full production. Under those assumptions, the miner would make $180 million, or $10/share, and with a $60 stock price, that’s only about 6x.

It’s also worth noting, that Sayona bears much greater risk at the outset of the project as the terms of the joint venture give Piedmont Lithium preferential production allocations. Each year, the first 113k tonnes will be sold to Piedmont for between $500 and $900 per tonne, meaning that Sayona disproportionately shares the risk for any slowdowns, breakdowns or accidents.

Takeaway

This underscores my point that Sayona’s shares are fully priced at these levels. Both Sayona and Piedmont face the same operational risks on the Abitibi Hub Project, but Piedmont’s shares trade at a deeper discount relative to next year’s potential earnings. So, while I wouldn’t recommend selling Sayona stock, any investor wishing to gain additional exposure to SC6 prices would be better served in buying shares of Piedmont.

A Note on Sayona’s P/E and TTM Earnings

Some readers may be wondering, as I did, why a pre-production and pre-revenue mining company such as Sayona is currently trading at a P/E of 22 and showing earnings of almost $80 million over the course of the last year. Those amounts relate to a $108.5 million nonrecurring gain the company recognized as a result of its NAL purchase.

Sayona and Piedmont’s total paid consideration for NAL was C$196.2 million which included a C$94.4 million cash disbursement. Prior to shutting down, NAL had put over C$400 million into its operations. While the gain demonstrates how good of a deal the purchase turned out to be for Sayona, there was no cash attached to that income.

Be the first to comment