B4LLS

Investment Thesis

Sanmina Corporation (NASDAQ:SANM) is a leading electronics and manufacturing solutions provider based out of San Jose, United States. In this thesis, I will primarily be analyzing SANM’s performance in its fiscal Q4 2022 and its future growth prospects. I will also analyze the company’s valuation and upside potential with respect to its current price levels. I believe SANM is an undervalued gem and a great buying opportunity for investors looking for growth companies at a cheap valuation.

About SANM

Sanmina Corporation is a global-integrated manufacturing solution, product and repair, components, and service provider. The company’s business can be segregated into two segments; Integrated marketing solutions, which account for 80% of the total revenues, and Components, products and services, which account for 20% of the total revenue. SANM provides end-to-end manufacturing solutions to clients from multiple industries, including communication, defense, medical and automotive. The company is also venturing into the cloud service business, which has significant growth potential in the global markets.

Q4 2022 Results

SANM recently announced fiscal Q4 2022 results, beating the market revenue and EPS estimates by 9.5% and 12.5%, respectively. SANM is on a significant growth trajectory with improving profit margins. The most positive factor was the impactful growth seen in the integrated manufacturing solutions segment, which significantly boosted the revenue.

SANM reported Q4 2022 revenue at $2.2 billion, a significant increase of 34% compared to $1.64 billion in the corresponding quarter last year. I believe the primary revenue driver was the growth experienced by the integrated manufacturing solutions segment, which grew 36% in terms of revenue compared to the corresponding quarter of the previous year. Considering that the integrated manufacturing segment accounts for 80% of the company’s total revenue, the impact of this growth is even more prominent for SANM. As per my analysis, strong consumer demand coupled with easing supply chain constraints proved to be the crucial factors in the revenue growth for the company. SANM reported a gross profit of $178 million, up 37% compared to $130 million in the same quarter last year. The gross profit margin for the quarter stood at 8.1%.

Despite the inflationary headwinds, the company managed to grow its gross profit margins for the quarter. SANM managed to keep the operating expenses in control, helping the operating income to increase from $66.7 million in Q4 2021 to $109.5 million in Q4 2022, an effective increase of 64%. The company reported diluted EPS of $1.08, up 29% compared to $0.84 in the same quarter last year. The company also repurchased shares worth $24 million in Q4 2022, taking the total value of shares repurchased in FY22 to $317 million. As a part of the share repurchase program, the company still has $167 million remaining, which the company is planning to utilize in FY23. This reflects the management’s confidence in the company and is a really positive sign for the investors with respect to the company’s future.

One of the most impressive things about the company is its low debt liability. As of 1st October 2022, the company reported long-term debt of $329 million against the cash and cash equivalent of $530 million. Low long-term debt helps any company in multiple ways. Firstly, a low debt liability doesn’t put much interest burden on the company in the current economic environment with sky-high interest rates. Apart from the interest expenses, low debt helps in keeping the balance sheet healthy, with the possibility of raising funds in the future to support and induce growth. It is quite remarkable for a growth company like SANM to have low long-term debt and high cash reserves, which I believe will help the company maintain its growth rate in the future by investing more in research and development and thus giving the company a technological edge over its competitors.

Overall, the results were quite impressive for the quarter. The company has provided strong guidance for Q1 2023, with revenue estimates in the range of $2.1-$2.2 billion and diluted EPS in the range of $1.41-$1.51. I believe the company will manage to achieve these targets and could even exceed them given the continued strong demand it is experiencing and the improvement in the global supply chain.

Key Risk Factor

High Dependency on few Clients: Sanmina Corporation relies heavily on a limited number of customers for a majority of its revenues. To put that in perspective, SANM earns almost 50% of its net sales from its ten largest customers. This reflects the company’s overdependency on a limited number of clients, exposing the company to significant risk. If any of these customers experience a downfall or volatility, it could have a significant impact on the company’s performance. The company is addressing this risk by consistently expanding its client base; however, investors should consider this risk before investing in the company.

Quant Ratings and Valuation

Seeking Alpha

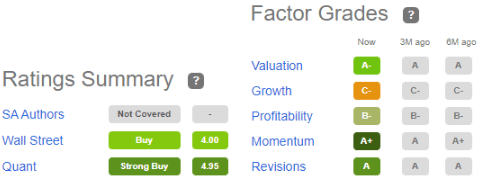

SANM has a Quant rating of strong buy, which reflects the company’s potential. It has an A grade in valuation, which I completely agree with, and I believe it reflects that the company is highly undervalued. The company has a C- grade with respect to growth; however, I think it doesn’t reflect the company’s current growth rate, and the grade will see a considerable improvement in the coming quarters. The buy rating by Wall Street reflects the analyst’s optimistic view of SANM.

SANM is currently trading at the share price of $65.37, a YTD increase of 55%. The company has a market cap of $3.8 billion. I believe the company is undervalued on multiple parameters. Let us have a look at the company’s P/E ratio. SANM is trading at a forward Non-GAAP P/E multiple of 10.9x compared to the industry standard of 19x. The company also has a forward non-GAAP PEG ratio of 0.75x compared to the industry standard of 1.55x. A PEG ratio below 1x is considered good for growth companies, and a 0.75x PEG reflects that the company is highly undervalued. I believe SANM could trade at a P/E multiple of 14x in the future, giving us a price target of $84, a 29% upside potential from current price levels.

Conclusion

SANM is on a significant growth trajectory and is consistently beating the market’s revenue and EPS estimates. The company’s financial performance in Q4 2022 is quite impressive, and the growth experienced by the integrated manufacturing segment is a big positive for the company. I believe Sanmina is highly undervalued at current price levels, and the stock price could soon witness a significant upside. It faces the risk of a high dependency on limited customers, but the company is consistently expanding its customer base and provides a favorable risk-reward profile considering all the growth and risk factors. I assign a buy rating for Sanmina Corporation.

Be the first to comment