alvarez

Investment thesis

Tech stocks generally trade at a premium as they bear higher risks than the market. These stocks underperformed the market in 2022 because of the economic downturn, which led to investors dumping them due to this higher risk. However, tech stocks have started outperforming the market again as investors load up on these stocks, now trading at a discount because of the recent price plummet, in hopes of a strong rebound when the macroeconomic headwinds subside.

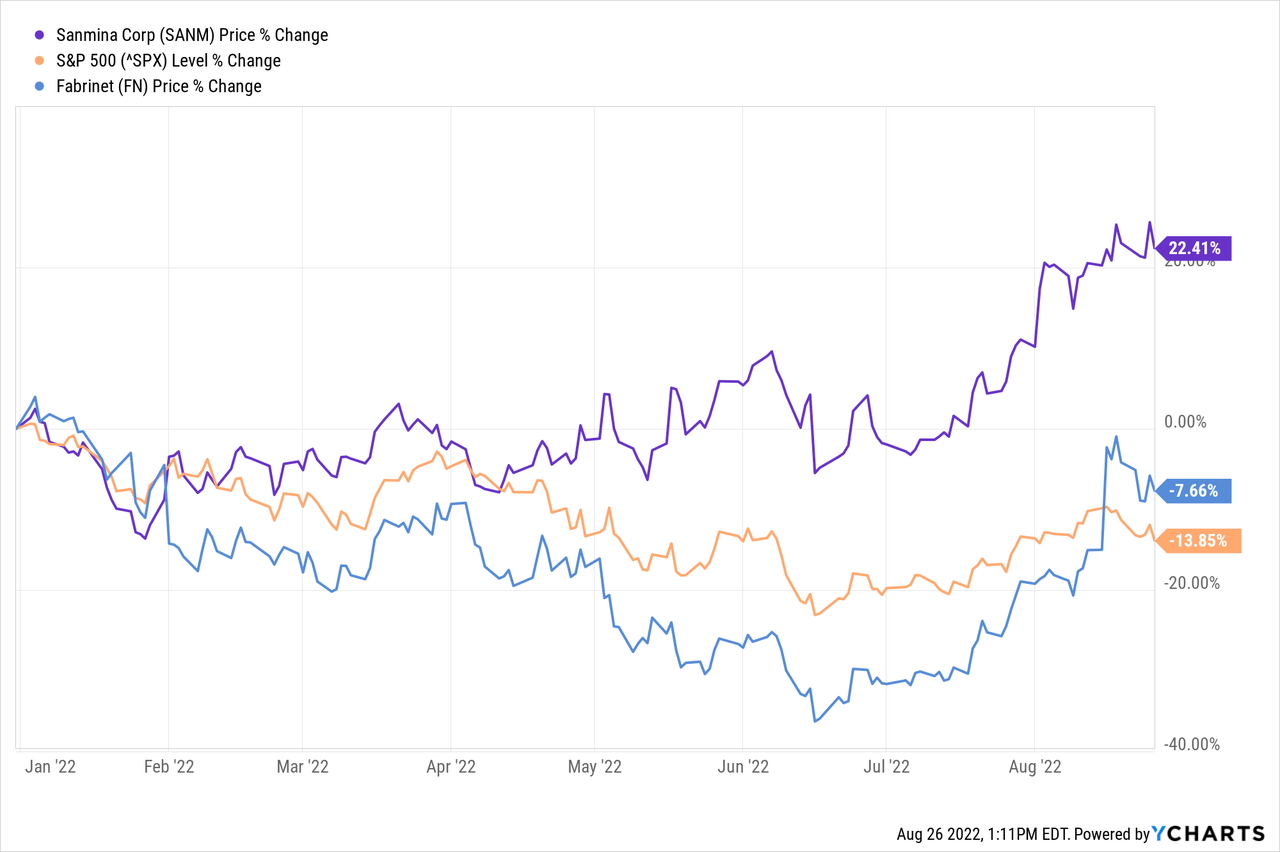

Sanmina Corporation (NASDAQ:SANM), a direct competitor of my recently covered stock, Fabrinet (FN), has outperformed the market and Fabrinet by a wide margin in the previous years, gaining over 22.5% YTD despite the macroeconomic turmoil.

The company’s financial position is strong, with a total debt to equity ratio of 20.56%, strong liquidity of $1.3 billion, including almost $500 million in cash, a current ratio of 1.58x, and debt to FCF of almost 17x. Similarly, its financial performance has also been strong, outperforming its guidance in the MRQ, with its net income and DEPS growing at a 3-year CAGR of 26.5% and 30.1%.

Sanmina Corp. Q3 FY22 Presentation

This indicates the resiliency of the company throughout the post-pandemic turbulent period. In the future, this is crucial because companies will need to navigate through the recession and come out victorious on the other end to deliver strong investor returns.

With the growing need for global Engineering and IT solutions, resilient stocks like SANM, which has a 60-month beta of 0.99x and is trading at a discount, offer a strong investment opportunity to long-term investors.

The Company

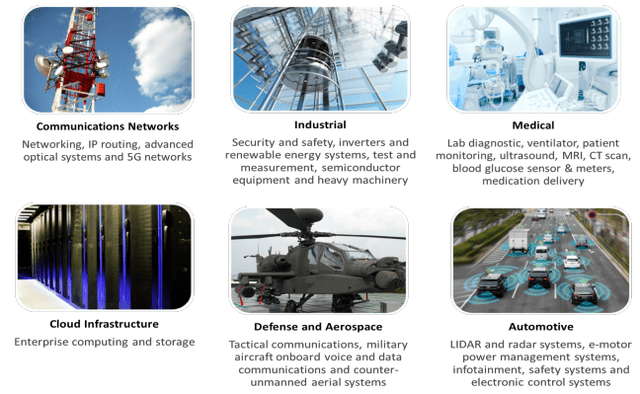

SANM is a global provider of integrated manufacturing solutions, components, products and repair, logistics, and after-market services worldwide, serving the automotive, industrial, medical, defense and aerospace, communications networks, and cloud infrastructure solutions.

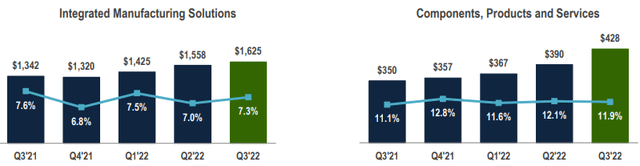

Sanmina Corp. generates revenue through 2 segments, with the Integrated Manufacturing Solutions segment accounting for 80% of the revenue for the last 9 months and the Components, Products, and Services segment accounting for 20%. Each segment reported YoY revenue growth of 15.4% and 5.5% in the same period.

Sanmina Corp. Q3 FY22 Presentation

80% of SANM’s sales are generated from non-US manufactured products because its clients manufacture them in low-cost regions like Asia, Latin America, and Eastern Europe.

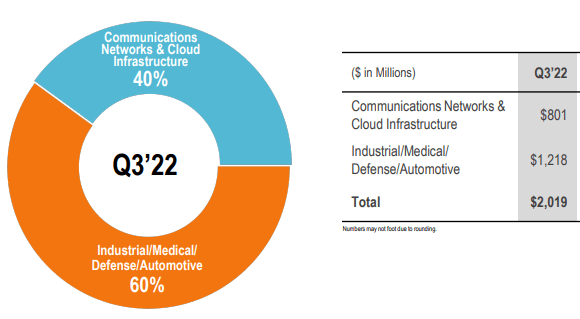

60% of its revenue in H1 was generated from industrial, medical, defense, and automotive end markets, with the remainder from communications networks and cloud infrastructure.

Sanmina Corp. Q3 FY22 Presentation

The company’s net revenue depends on a small number of clients, with its ten biggest clients accounting for around half of its revenue. Alcatel-Lucent and Nokia Siemens Networks accounted for over 10% of Sanmina’s net deals each in the previous 9 months.

Integrated Manufacturing Solutions

This segment primarily provides printed circuit board assembly and test, commonly known as PCB, the backbone of all modern-day electronic devices.

In 1936 Paul Eisler recognized the hurdles of manual circuits and presented the idea of printing conductive circuits onto a non-conductive surface. Over the years, PCBs have become more and more compact with improved efficiency used in sleek mobile devices, laptops, and other electronic equipment. With a Focus on High-Speed Technologies for Telecom, SANM provides advanced PCBs, backplanes, and flex Circuits for virtually all industries.

High-level assembly and test: Sanmina corporation is known for integrating multiple complex technologies, including electronics, fluidics, and motion control, into complete systems. The company also provides a wide range of complex high-level assemblies, including communications systems, power inverters, industrial control systems, semi-conductor systems, ATMs, blood analyzers, MRI machines, commercial digital printers, multimedia kiosks, and smart vending machines manufactured by Sanmina.

Direct-order fulfillment: The company also offers a wide range of logistics and after-sales services, including direct order fulfillment, configuration, integration services, inventory management programs, aftermarket, and end-of-life solutions.

Diversifying Revenue Streams

Sanmina Corp. Q3 FY22 Presentation

Sanmina provides computation, cloud storage, and telecommunication rack integration for the world’s best social media, video, and cloud storage companies. In 2016, Sanmina and Nokia joined hands to deliver a wide range of data center solutions for operators leveraging the cloud. This strategic collaboration between the two companies focused on delivering cost-effective, scalable, multivendor cloud infrastructure solutions.

Similarly, in March, Sanmina agreed to engage in a Joint Venture with Reliance Industries Ltd. using its existing Indian manufacturing entity, Sanmina SCI India Pvt. Ltd., to manufacture telecommunications equipment, data center and internet, medical equipment, clean technology equipment, and other high-tech equipment.

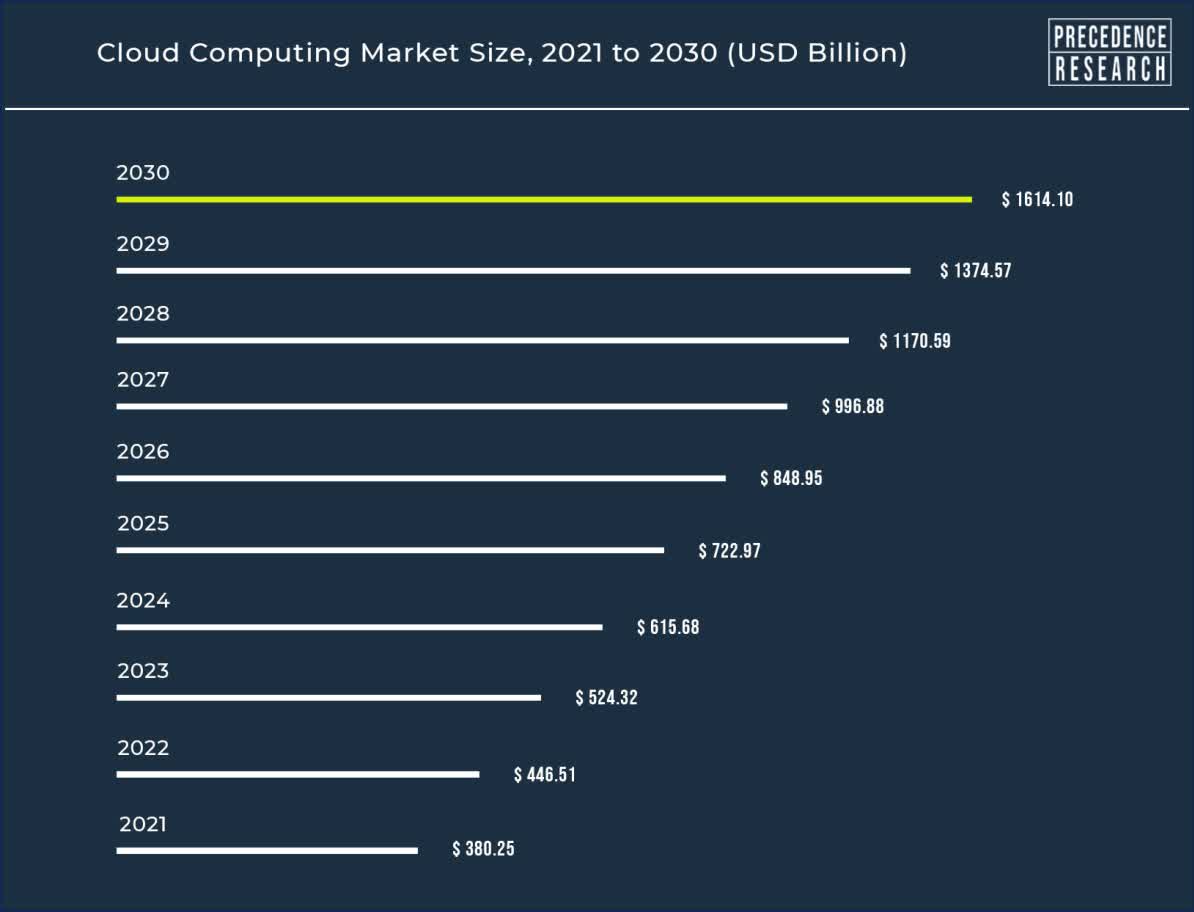

Rising popularities of modern-day advanced technologies like Artificial intelligence and Machine Learning are empowering the cloud computation market globally. Since the outbreak of COVID-19, there have been rapid advancements in cloud infrastructure technologies across developed and developing economies.

According to Precedence Research, the global cloud computing market size was estimated at $380.25 billion in 2021, with North America leading the pack with 40% of the revenue share. The cloud computing market is expected to cross $1.6 trillion by 2030, with an impressive estimated CAGR of 17.43%, outpacing the overall IT sector, which is forecasted to grow at about 7.1%.

Precedence Research

Companies like SANM and its peers use cloud computation for business growth because of its cost-effectiveness and significant growth prospects. Its revenues from the communication networks and cloud infrastructure segment grew 6% sequentially and 14% YoY, driven by optical systems, 5G networks, and cloud infrastructure.

A general idea of the growth prospects in the optical systems market can also be extracted from the Fabrinet article and the 5G market from the Nokia article, as they are closely related to SANM.

The future of cloud computing is optimistic and advantageous to both the host and the client. Cloud computing is the future, and increasing demand for its solution, from individuals to multinational companies, puts SANM in favorable conditions for business growth in the upcoming years.

Superb Financials

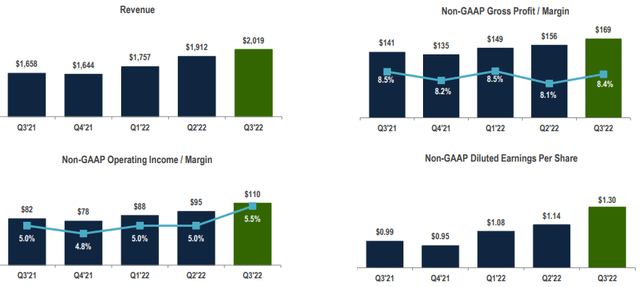

The company has faced post-pandemic turbulence like the rest of the market. Still, it has successfully recouped, achieving significant sequential topline growth in the previous 3 quarters, beating the revenue and EPS estimates each time. This was driven by strong customer demand and facilitated by successfully overcoming the global supply chain challenge.

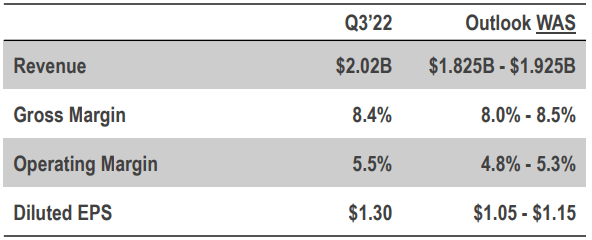

Even though the company’s gross margin slid by 100 basis points YoY during the same time due to inflation and pricing pressures from OEMs, it augmented its operating margin through operating leverage. This means that despite the strong macroeconomic pressure, the company has achieved a strong bottom line growth with its fully diluted Non-GAAP EPS exhibiting a 14.4% sequential and 31.3% YoY growth to $1.30 in the MRQ, beating its upper-end guidance by 13% and analyst estimates by 17%.

Sanmina Corp. Q3 FY22 Presentation

SANM aims to achieve a 21% YoY revenue growth in the upcoming quarter at the midpoint, generating $2 billion and a DEPS of $1.32, up 39% YoY. As per the company’s annual guidance, it expects to generate $6.76 billion in revenue and $3.97 in non-GAAP EPS. Given its recent performance and momentum, the company is likely to top this estimate and beat analyst earnings estimates of $1.33 per share.

| SANM | 12 Month Guidance | 9 Month Results | % Target Completion |

| Revenue | $6.76 billion | $5.69 billion | 84.17% |

| Non-GAAP EPS | $3.97 | $3.52 | 88.66% |

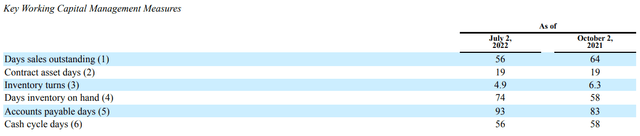

Similarly, it has also ramped up its ability to generate cash, with the levered FCF margin improving sequentially from 1.6% in Q4 2021, 2.5% in Q1 2022, and 3.4% in the MRQ, and its FCF sequentially growing from $0.67 per share to $1.07 per share during the same period. This is further facilitated by a YoY improvement of 3.4% in the company’s cash cycle days.

Meanwhile, its CapEx has also consistently evolved, over doubling in the last 9 months, from $17.4 million to $37.4 million. SANM’s earnings call indicates that the CapEx for the upcoming quarter is expected to be around $45 million, “driven by growth of new programs and to support future growth.”

The company’s book value has been gradually and consistently rising for years now, delivering value to its shareholders through efficient capital management and share buybacks. It repurchased 7.4 million shares for $293 million during the previous 9 months, including 3.1 million in the MRQ for about $124 million. It can repurchase an additional $188 million worth of shares under the current program, which I expect the company to complete within 2022.

This demonstrates that the company successfully translates its revenue into cash and profits, using it to improve shareholder returns.

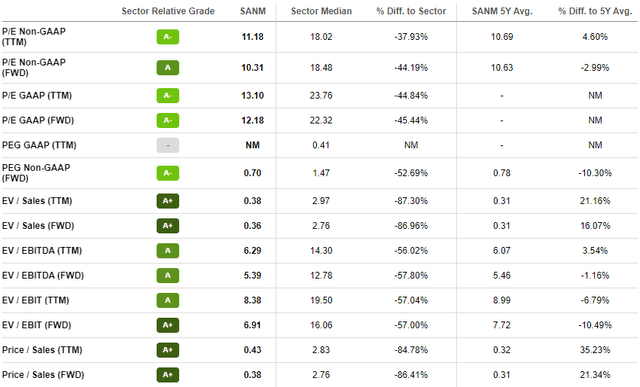

An Undervalued Stock

Despite the recent gain, the company is being traded at a significant discount to its fair value as the market has priced in more downside than upside into the stock. With a market cap of $2.91 billion, the company’s price ratios are relatively discounted with its P/E, P/S, and P/B multiples at 13.1x, 0.4x, and 1.6x, while the sector median is significantly higher at 23.8x, 2.8x and 3.1x.

Based on relative valuation metrics, the stock appears to be a steal compared to its direct competitors with companies like IPG Photonics (IPGP), a $5 billion company, and Fabrinet, a $4 billion company trading at earnings multiples of 19x and 20x.

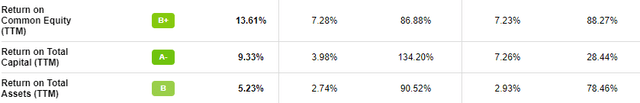

Seeking Alpha

For a company with a 60-month beta of 0.99x, a total debt to cash ratio of 0.75x, and an LT debt to total capital ratio of 15.47%, the risks don’t appear to be as high as the share price discount would indicate; even though the company has historically traded at around the same valuation metrics. The company will likely show resiliency going through the upcoming recession and macroeconomic uncertainties and, given its low valuation metrics, generate substantial returns upon market rebound.

Conclusion

Sanmina is a great investment opportunity because of its relatively cheap price tag, foreseeable guidance outperformance, and promising growth prospects. The company appears to be on the right track while prioritizing shareholder returns, as evident by its above-average management effectiveness ratios.

Seeking Alpha

Sanmina Corp. Form 10-Q

The company has low debt, high liquidity, diversified end-markets, ample growth opportunities, and great operational leverage. All these things translate to great long-term growth prospects. Given the low valuation multiples across the board, investors should consider leveraging the market to load up on their long-term investments.

SANM is definitely something to be kept on the radar, and I rate the stock as a buy because of its strong rebound prospects following the market recovery.

Be the first to comment