ipopba/iStock via Getty Images

It has been nearly a year since I have taken some time to take a look at Sangamo Therapeutics (NASDAQ:SGMO), which is continuing their pursuit of developing groundbreaking genomic medicines for the treatment of some of the worst diseases known to man. Sangamo is making progress across their pipeline programs with additional clinical data on the horizon, including pivotal trial results. I am dusting off my SGMO position and formulating a plan for a critical 2023.

I intend to review the company’s recent progress and will provide my views on the company’s current condition. In addition, I discuss my preliminary strategy for 2023.

ST-920 Continues To Impress in Fabry Disease

Sangamo recently publicized several promising updates that revealed they have made significant progress across their pipeline. The company’s wholly-owned Fabry disease program appears to be performing well. Sangamo’s supplementary preliminary data from their Phase I/II STAAR study has revealed sustained and elevated alpha gale activity “ranging from nearly two-fold to 30-fold of MIM normal for almost 2 years of follow-up in the longest-treated patients. All patients exhibited above normal alpha-gal activity by 5 weeks after dosing.” What is more, long-term follow-up patients have “maintained elevated alpha-gal levels for 1 year or more.” So far, ST-920 has a favorable safety profile with no patients “requiring steroids, either prophylactically or reactively and there has been no liver enzyme elevation requiring treatment.”

Looking ahead, Sangamo expects additional data from the STAAR study, including the initial data from the expansion cohort in the first half of 2023. Sangamo is planning for a potential Phase III study.

I believe the recent data validates the company’s views that ST-920 has the potential to be a one-time dosing alternative and supplant ERT infusions as the current standard of care. The fact that Sangamo continues to see patients being withdrawn from ERT and has not required resumption of ERT tells me ST-920 has a strong likelihood of making it through the FDA. It is estimated that Fabry disease impacts 1 in 40K-60K men, so there is a significant commercial opportunity for a potential cure.

BIVV003 Is Moving Forward With Sickle Cell Disease

Sangamo’s sickle cell disease “SCD” program, BIVV003, is moving forward and is currently in their Phase I/II PRECISION study which is now utilizing Sangamo’s improved manufacturing method that increases the number of long-term progenitor cells. What is more, BIVV003 now has the FDA’s RMAT designation, which includes all the benefits of the fast track and breakthrough therapy designation programs.

Looking ahead, Sangamo expects to present updated clinical data at ASH in mid-December. Sangamo is also working on their Phase III study design.

SCD has a long history of investigation and clinical labor, yet, progress towards ascertaining a cure has been sluggish, possibly due in part to SCD impacts predominantly patients living in low-income areas and/or from minority populations. Regrettably, it took until 2017 to get Global Blood Therapeutics (GBT) through the FDA with their disease-modifying therapy for SCD. Sadly, the SCD pathology is traced from a single-point mutation creating an assembly of irregular proteins leading to hemoglobin polymerization. So, we can say there is still a huge need for SCD products… and it is very likely that gene therapy could completely alleviate the symptoms of the disease.

BIVV003 is one of a handful of SCD gene therapies in development, and it has the possibility to be one of the first on the market thanks to its RMAT designation. Obviously, this could be a huge commercial opportunity for Sangamo considering there are roughly 100K people living with SCD in the United States.

Giroctocogene Fitelparvovec Is Back On Track

Sangamo and Pfizer (PFE) recently announced that the Phase III APINE trial for giroctocogene fitelparvovec in hemophilia A is back on track and they have reopened recruitment. Pfizer and Sangamo are expected to present updated clinical data from the Phase I/II ALTA study at ASH in a few weeks. Sangamo expects a pivotal readout in the first half of 2024.

Hemophilia A “classic Hemophilia” is a genetic condition in which blood is unable to clot effectively. It is triggered by a mutation or deletion in the gene that is in charge of generating blood-clotting factor VIII protein. Patients with hemophilia A experience repeated bleeding incidences, often into the joints and muscles, which can cause chronic issues. Sadly, this bleeding can be so severe that it results in death due to the failure of the blood to clot proficiently. The current standard treatment is IV factor VIII protein which is administered two to three times a week. It is estimated that there are over 30K males living with hemophilia in the United States, so it isn’t a massive commercial opportunity. Nonetheless, the prospects for a potential cure should generate high demand from patients and providers.

Keeping An Eye On TX-200

Sangamo is also making progress with their Phase I/II CETP study TX200 in immune-mediated rejection in HLA-A2 mismatch kidney transplantation from a living donor. Sangamo publicized that the second patient was dosed in late September candidate and that the CAR-Treg cell therapy has been well-tolerated with the first patient reaching 8-month post-infusion. Sangamo said that they will provide guidance on the timing for the dosing of the third patient once they have established a possible dosing date.

HLA matching transplants have numerous benefits over mismatched including improved graft function, a smaller number of rejection incidents, extended graft survival, and the probability of reduced immunosuppression. Mismatches are associated with repeated rejection incidents that entail amplified immunosuppression that can lead to an increase in infections and related issues. HLA mismatches also have the potential for sensitization, which can reduce the opportunity of getting a transplant and increase the wait time for a transplant. Thus, transplantation has a risk of waiting for the optimal donor verse the risk associated with a mismatched donor. TX200’s ability to regulate the immune system, which may shield the graft from immune-mediated rejection and allow for improved mismatch transplants. As a result, TX200 could be one of the first Treg cell therapies to hit the largest transplant market.

Looking Into The Future

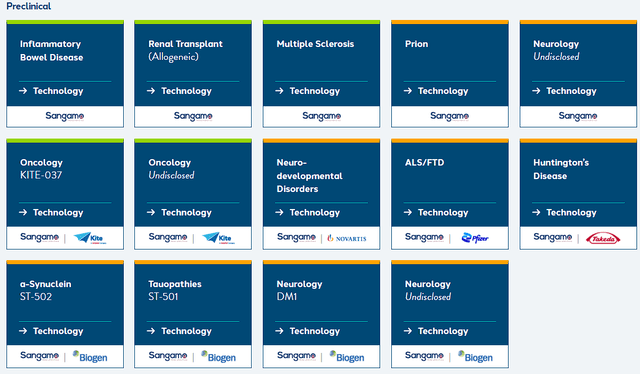

Sangamo continues to leverage their cutting-edge genomic engineering and cell therapy platforms to advance both wholly-owned and partner programs toward the clinic. Sangamo has a number of preclinical programs that utilize their proprietary zinc finger nuclease platform to engineer gene therapies, cell therapies, and genome engineering candidates.

I am keeping an eye on their prion disease program. The company reported that they have a candidate that could help with prion protein expression in the brain and was able to extend the survival in mouse models. If the company can alleviate prion diseases in humans, it would bode well for their other CNS and neurology programs.

Of course, Sangamo has numerous other preclinical programs that could change the way we treat some of the worst diseases known to man.

Sangamo Therapeutics Preclinical Pipeline Programs (Sangamo Therapeutics)

Keep in mind, most of these programs have the prospect to be a “cure” for these indications. A “cure” for inflammatory bowel disease or MS would change the world of medicine and would solidify Sangamo Therapeutics as a leader in gene and cell therapies.

Firm Financials

Being a cutting-edge gene and cell therapy company does require a lot of capital. Thankfully, Sangamo has shown their ability to be prudent capital management and expects their full-year non-GAAP OpEx to be between $280M and $290M. What is more, Sangamo has been resourceful in these tentative markets and was able to raise around $75M from their ATM program since the beginning of 2022. Keep in mind, the company has partnerships that have provided a significant source of revenue to help conserve the roughly $350M in cash, cash equivalents, and marketable securities they had at the end of Q3… which was only down $14M from Q2.

The company’s prudent approach and current cash position could allow the company makes it to a pivotal readout and potential filing without the need for massive dilutive funding.

My Views

Overall, I am pleased with the company’s accomplishments during this year and the progress Sangamo made across their pipeline and in-house manufacturing abilities. Sangamo is leaving 2022 with positive momentum and is preparing for numerous upcoming catalysts, including presentations in sickle cell disease and hemophilia A along with Fabry data in the first half of 2023. If the data is positive, we could see investors return to SGMO and price the ticker for its long-term prospects.

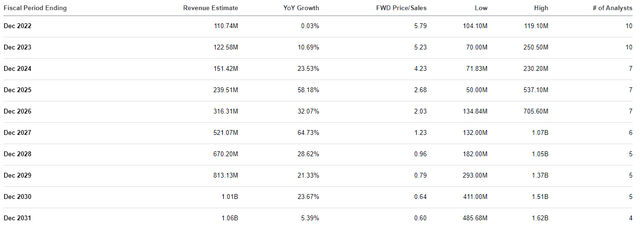

At the moment, SGMO is trading around 6x price-to-sales for its 2022 revenue estimates, which is a slight premium to the industry’s average price-to-sales of 5x. However, the Street is projecting Sangamo to report steady double-digit growth for the remainder of the decade as it collects partnership revenues and eventually revenue from their wholly-owned programs.

Sangamo Therapeutics Revenue Estimates (Seeking Alpha)

The Street anticipates Sangamo clearing $1B in 2030, which would be a 0.64x forward price-to-sales. Indeed, these are just estimates and we don’t know if Sangamo’s programs will be successful… however, these estimates do illustrate the company’s long-term upside potential.

A Leading Downside Risk

Like most speculative biotech companies, SGMO has several downside risks that investors need to consider when managing their position. For me, the biggest threat to SGMO is that it is a gene and cell therapy company, which is quickly becoming a highly competitive arena. Sangamo’s platform technologies are advanced, however, researchers around the globe are pushing to develop techniques that produce safer, more effective, durable, and cheaper therapies. It is possible that Sangamo makes it through regulators and gets on the market, but they are quickly outmatched by competitors in competitive indications. Indeed, I don’t know what the competitive landscape will look like for gene therapies, but I have to imagine there will be little room for 2nd or 3rd best gene therapies on the market as next-gen products become available.

As a result, I have assigned SGMO a conviction level of 2 out of 5.

My Plan For SGMO

Admittedly, I have been extremely conservative with my “Bio Boom” speculative positions since the beginning of this year, especially high OpEx companies that are committed to gene and cell therapies. SGMO has been in that group, but I am willing to recommence accumulating a hefty position thanks to the company’s firm financials which gives me some confidence to be involved in a speculative ticker that is still a long way out from commercialization.

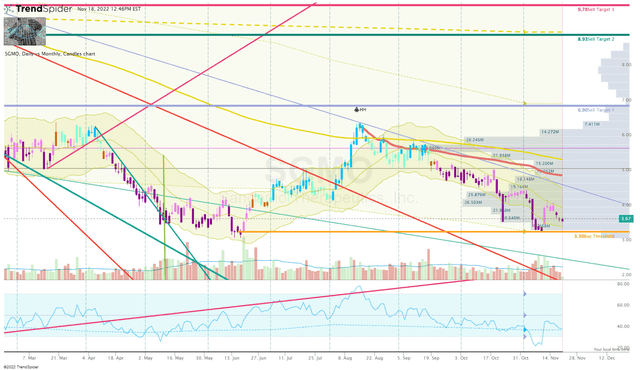

I am looking to make a small addition in the near term as the share price approaches my Buy Threshold which is around $3.30 per share.

SGMO Daily Chart (Trendspider)

SGMO Daily Chart Enhanced View (Trendspider)

After that, I will be on the lookout for strong reversal set-ups under my Buy Threshold. On the other hand, I will make equivalent sell orders near my Sell Targets in order to book profits and return my SGMO position to a “House Money” state.

Long-term, I plan on holding an SGMO position for at least five more years in anticipation the company will get several of their programs across the finish line to become a leader in gene and cell therapies.

Be the first to comment