SandRidge Energy (SD) went with a relatively minimal capex plan in 2020 to limit its cash burn amidst mediocre commodity prices. However, this is going to result in major production declines as SandRidge’s base decline rate (particularly for oil) seems very high.

By the end of 2020, SandRidge’s production may drop to 20,000 BOEPD, while its unhedged breakeven point may be as high as $70 WTI oil and $3 NYMEX natural gas despite modest interest costs. This puts its long-term future in doubt despite relatively low current debt levels.

Updated 2020 Outlook

SandRidge is guiding (at guidance midpoint) for 2.05 million barrels of oil production in 2020 and roughly 8.15 million BOE in total production. This is a relatively massive -24% decline in total production and -39% decline in oil production compared to annualized Q4 2019 levels.

Source: SandRidge Energy

At $40 WTI oil, SandRidge would deliver $125 million in revenue after hedges in 2020. It has around 22% of its oil production hedged for 2020 at an average of over $60 per barrel, with its hedges concentrated in the first half of the year.

| Type | Barrels/Mcf | $ Per Unit | $ Million |

| Oil | 2,050,000 | $36.15 | $74 |

| NGLs | 1,850,000 | $12.00 | $22 |

| Natural Gas | 25,500,000 | $0.80 | $20 |

| Hedge Value | $9 | ||

| Total Revenue | $125 |

With a $27 million capex budget, SandRidge would have around $132 million in cash expenditures, leading to $7 million in projected cash burn.

| $ Million | |

| Lease Operating Expenses | $75 |

| Production Taxes | $8 |

| Cash General & Administrative | $19 |

| Interest Expense | $3 |

| Capital Expenditures | $27 |

| Total | $132 |

This should keep SandRidge’s debt fairly low in dollar terms, as it had only $52 million in net debt (not including its working capital deficit) at the end of 2019. The $7 million in cash burn would increase its net debt to around $59 million.

However, due to SandRidge’s high lease operating expenses and G&A (as a percentage of revenue), SandRidge’s EBITDAX would be only $23 million including hedges. Thus $59 million in net debt would actually be fairly high in terms of leverage (2.6x).

Increasing Costs As A Percentage Of Revenue

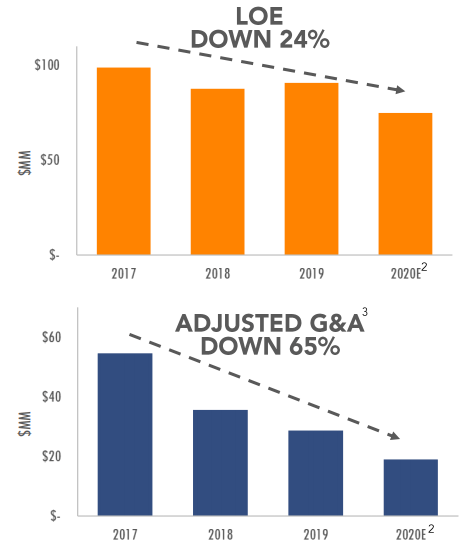

Although SandRidge is making significant progress in reducing its lease operating expenses and G&A (in total dollars), due to its declining production, the per BOE numbers for those two expenses are not reacting in the same way.

Source: SandRidge Energy

SandRidge’s lease operating expense per BOE is expected to go up 21% in 2020, while its adjusted G&A is expected to go down 3% per BOE. However, SandRidge’s oil percent is expected to decline from 29% in 2019 to 25% in 2020, lowering the average value of its BOE independent of its commodity price changes.

The Point Of No Return

SandRidge appears to be getting close to the point of no return in terms of its ability to maintain production levels without cash burn even in a more favorable pricing environment.

SandRidge’s base production decline rates (particularly for oil) are alarming. It is forecasting its average daily 2020 oil production to be around 39% lower than its average daily Q4 2019 oil production level. This also suggests that its year-end 2020 oil production level will be down even further (perhaps 50+%).

SandRidge also spent $162 million in capital expenditures to keep production relatively flat in 2019. Its maintenance capital requirements should be a fair bit lower (estimated at around $100 million) to keep its production at around late 2020 levels (around 20,000 BOEPD).

However, with SandRidge’s increasing lease operating expenses per BOE and relatively low oil percentage, I estimate that its breakeven point (to maintain production levels at late 2020 levels) will be around $70 WTI oil and $3 NYMEX natural gas.

Conclusion

Although SandRidge now has an enterprise value of only under $100 million (not including its working capital deficit), it is hard to see a good path forward for it. It appears to have a quite high base decline rate, and its existing production has low margins due to it being around 25% oil and its lease operating expenses rising to over $9 per BOE in 2020.

This means that SandRidge might need $70 WTI oil and $3 NYMEX natural gas to be able to maintain production at around 20,000 BOEPD without cash burn. The future for SandRidge is likely to involve continuing production declines and/or significant cash burn, thus I am avoiding its common stock despite its low price.

Free Trial Offer

We are currently offering a free two-week trial to Distressed Value Investing. Join our community to receive exclusive research about various energy companies and other opportunities along with full access to my portfolio of historic research that now includes over 1,000 reports on over 100 companies.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment