Sundry Photography/iStock Editorial via Getty Images

Software stocks were all the rage coming out of the initial panic selling of the pandemic nearly two years ago. The leaders saw their share prices multiply over the space of several months, and one of those leaders was – and still is – Salesforce (NYSE:CRM).

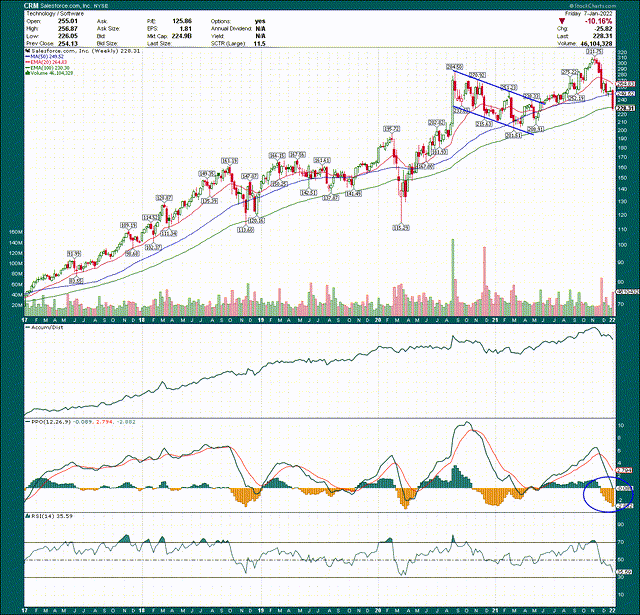

Back in July, I wrote a bullish article detailing why I thought Salesforce was headed higher. That worked out nicely as shares almost immediately began marching higher, eventually adding ~26% before the recent selling began. At the time, I noted a bull flag pattern on the weekly chart, which I’ve replicated below for an updated look.

Source: StockCharts

After the bull flag, shares took off to the upside and eventually made a new all-time high. But the selling that has taken down growth and tech stocks pummeled Salesforce, and it has unwound the entire rally and more. The stock is testing the 100-week exponential moving average, or EMA, but momentum is rapidly accelerating to the downside, so I’m not particularly confident it’s going to hold.

The PPO chart near the bottom shows the short-term line hitting the centerline, but at a rapidly-declining slope. The histogram shows a value of nearly -3, which means there’s been a massive selling episode, and a swift one, which is hardly bullish.

Let’s now briefly look at the daily chart for a closer look at what’s going on since the selling began.

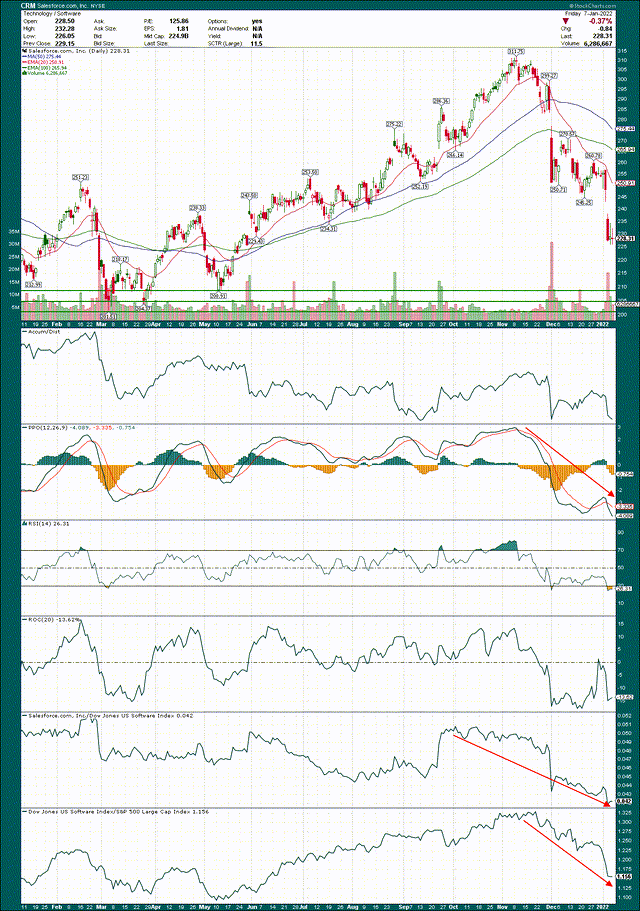

Source: StockCharts

Salesforce blew right through any moving average or price support levels in the past couple of months, and has proceeded to make relative low after relative low. There’s more critical support in the area of $202 to $209, and it looks like we might get a run at that level in the relatively near future given how growth stocks are performing. That area has to hold, or all bets are off for Salesforce in terms of finding a bottom anytime soon.

The one bit of respite the bulls have is that Salesforce is really oversold at the moment. We saw that on the weekly chart, and it’s certainly true of the daily chart. The PPO has fallen from +3 to -4 in the space of two months, and the rate of change is right at levels where the stock has at least begun a consolidation at times in the past. None of this guarantees we’ll see a consolidation or bounce, but it does suggest the worst of the selling is over. Where it bottoms is still up for debate, but I do think that if you’re looking to buy Salesforce, you should be readying your capital to do so.

Fundamentals haven’t deteriorated

Any time a stock is pummeled the way Salesforce has been, the first thing you should do is to assess the fundamental situation to see if there’s been some sort of material deterioration in the company’s prospects. If there has been, selling is probably justified. If there hasn’t, the selling is likely an opportunity from Mr. Market to pick up a great company at a discount. In the case of Salesforce, I believe it is the latter.

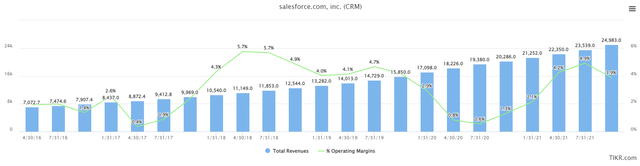

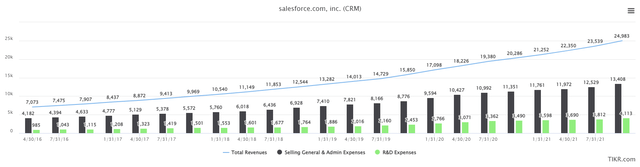

Let’s start with the long-term picture, with revenue in millions of dollars and operating margins as a percentage of revenue, both on a trailing-twelve-months basis.

Source: TIKR

Revenue has been on a smooth upward trajectory basically forever, and that’s because Salesforce has experienced reliable organic growth, but it also spends very heavily on both its own R&D and on acquisitions. Salesforce is a sort of conglomerate of software companies aimed at being a one-stop-shop for enterprises large and small. It is in the process of creating an ecosystem of top-tier apps that all work together for the customer. That’s a big part of why I like it for the long term.

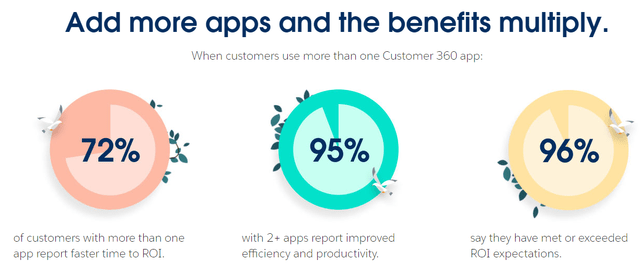

Source: Company website

Salesforce says that customers that use more than one app see synergies from doing so, and that’s exactly the point of this type of system. Salesforce has gradually pieced together what I believe is a world class suite of software products that compete well today, and will compete well far into the future. None of this is new, but it is worth reiterating given it’s so critical to the bull case.

The problem with this sort of strategy is that it requires enormous amounts of constant investment, either through SG&A, R&D, or the cost of acquisitions.

Source: TIKR

This is the same revenue chart as above but I’ve added in SG&A and R&D to show how rapidly Salesforce is spending. Of course, if revenue is being spent, it isn’t flowing to the bottom line, so profits suffer. Salesforce has taken a strategy of spending the same proportion of revenue on SG&A and R&D (give or take) year after year. In other words, SG&A is generally around 55% of revenue, and R&D is generally around 15% of revenue. The company is comfortable spending that and that’s what’s helped it grow so much over the years. You have to be okay with little or no profit as a shareholder for Salesforce on the hope that it will pay off in the years to come.

Keep in mind that Salesforce could be wildly profitable if it toned down the R&D spending, and some of its SG&A spending. But this is a growth company and that’s something you need to be okay with. If you want a tech company that pays dividends, look elsewhere.

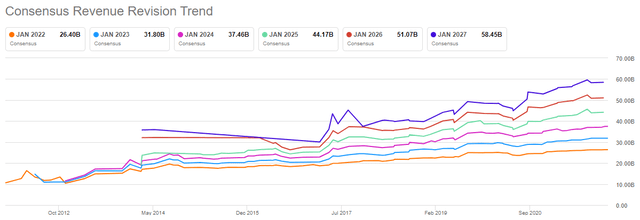

Now, a big part of the fundamental picture is a company’s estimates, so let’s begin with revenue.

Source: Seeking Alpha

We can see a beautiful upward slope to all of these lines, and one that accelerated to the upside when the pandemic began. Absolutely critically, those estimates have continued to rise out of the initial pandemic spike, indicating long-term, sustainable demand. This is not a case of a company capitalizing on temporary conditions; Salesforce has seen its long-term demand curve shift up and to the right. This chart is very bullish, particularly in light of the rapidly declining share price.

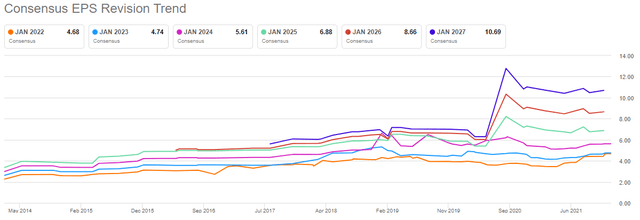

Source: Seeking Alpha

We see a similar story with EPS, although the out years are seeing larger spikes, indicating analysts believe Salesforce will begin extracting more profit from each dollar of revenue. That’s certainly not an outlandish thought given what we just looked at with SG&A and R&D; Salesforce has plenty of pulling back it could do on spending to juice profits.

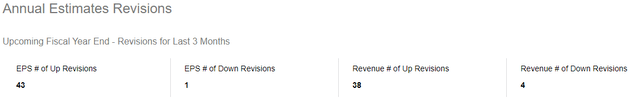

One more thing I like to look at with respect to estimates is the direction of the most recent revisions, which we can see below.

Source: Seeking Alpha

Over the past three months, there’s one solitary analyst that has moved their EPS estimates lower, while four out of 42 analysts have moved their revenue estimates lower. In other words, the community is still overwhelmingly bullish, and that’s something I think shareholders ignore at their own peril.

Just this past week, Salesforce’s rating was cut by UBS, who cited growth concerns specifically related to MuleSoft. Shares were punished as a result, but even this analyst that came out with a less-than-optimistic note sees upside to $265; such is the value proposition of Salesforce today.

Speaking of the valuation…

Let’s now take a look at the valuation of Salesforce to see what kind of value shareholders are receiving for their money today. I’ve chosen the forward P/E and plotted it for the past five years to give us some historical context.

Source: TIKR

Shares go for 55X forward earnings today, which is a lot for most companies. However, in the software space, and particularly for perpetual growers like Salesforce, that’s pretty reasonable. We can see the valuation very recently was ~80X forward earnings, and Salesforce is actually well below the average valuation for the past five years, which stands at 63X forward earnings. That includes the pandemic selloff which saw Salesforce hit a low of 39X very briefly, which I don’t think we’ll see again.

The point is that Salesforce’s valuation today is quite attractive in its own right, but in the context of ever-rising estimates, and a fundamental situation that I think is as good as it has ever been, I see Salesforce as a stock you can certainly begin accumulating.

As I said in the open, given the way growth stocks are behaving in this market, I certainly wouldn’t rule out a trip to the support levels I identified earlier just over $200. That’s still a decent trip down from current levels, so I wouldn’t rush out and commit to a 100% position just yet. But the stock is very oversold, and to my eye, has an attractive valuation, and a very long runway for future growth, so I think it’s a buy. It just may require some patience for the recovery to form.

Be the first to comment