wdstock/iStock Editorial via Getty Images

Investment thesis: Salesforce remains a great company. But a softening economic and earnings outlook combined with a weak chart indicates this is still a no.

I wrote about Salesforce, Inc. (NYSE:CRM) on February 20th. The article’s general conclusion was:

Investment thesis: despite being a great growth story, Salesforce’s stock is in a clear downtrend. Wait for a bottom to form and develop before buying.

The problem wasn’t the company. In fact, Salesforce is a great growth story. It has developed a market-dominant CRM (customer relationship manager) software and is now the largest application software company by market capitalization.

Unfortunately, since I wrote the story, this economic, company, and stock data has deteriorated keeping Salesforce off my buy list.

Let’s begin with the economic data by first noting that Salesforce is a classic growth company. It needs economic growth to support continued gross revenue growth.

Unfortunately, the macroeconomic tone has since deteriorated.

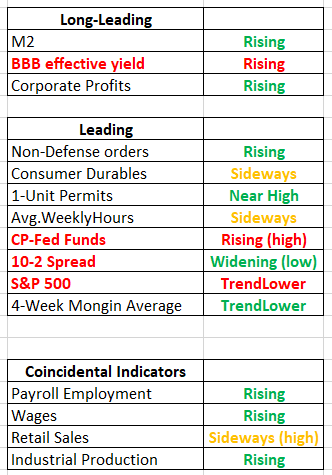

Long-leading, leading, and coincidental economic data summation (FRED; author’s short-hand)

The above table is from my personal notes and is my short-hand way of documenting the long-leading, leading, and coincidental economic indicators. The financial indicators are starting to turn neutral or bearish. These indicators typically start printing bearishly 12-18 months before a recession. This means there are now economic clouds on the horizon.

And then we have the Fed, which is clearly more hawkish:

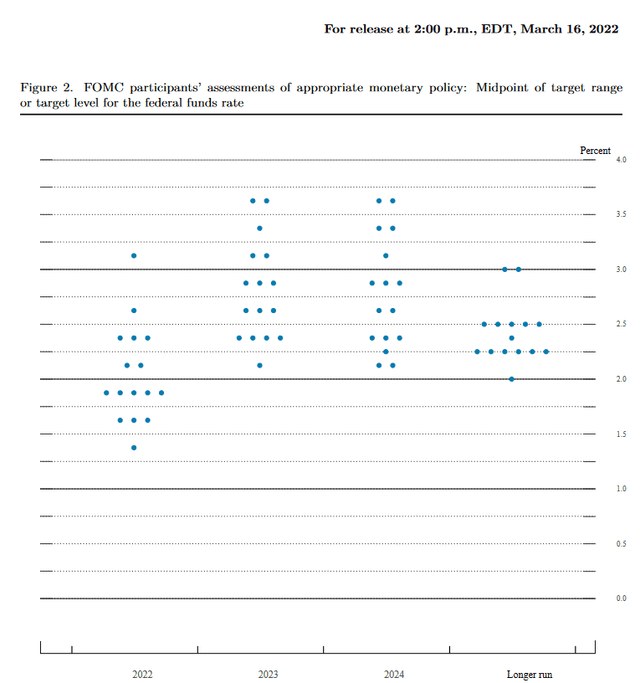

Dot Plot From the Latest Federal Reserve Meeting (Federal Reserve)

The dot plot from the latest Fed meetings shows that the central bank intends to raise interest rates to around the 2% range by year’s end. A large number of Fed presidents have recently supported a 50 basis point hike at an upcoming meeting.

This plays into the classic investment advice of, “Don’t Fight the Fed.”

Adding up the macro data, we can say authoritatively that the tone has turned more negative.

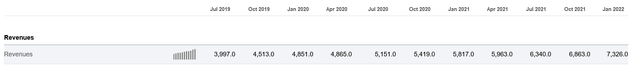

The company released its latest 10-K at the beginning of March. On the plus side, growth revenue was higher:

Salesforce quarterly gross revenue (Seeking Alpha)

The company is clearly growing at a very solid clip. Unfortunately, on the quarterly data, the operating and net margins were negative (-2.4% and .38%, respectively). This is nowhere near fatal; in fact, a growth company’s internal margins are far more volatile, sometimes dipping into negative territory. This is more about the timing — we really didn’t need soft news but got it.

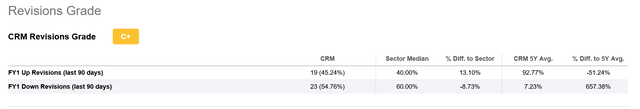

And the earnings picture continues to be soften:

Earnings projections for Salesforce (Seeking Alpha)

A majority of analysts have decreased their earnings projections for the company.

And finally, there’s the newly conservative tone to the markets. I noted the following in my most recent market summary:

- The exponential moving average for the major, index-tracking ETFs is bearish

- Market breadth is soft

- The YTD charts of the SPY, QQQ, DIA, and IWM are down while the yearly charts show consolidation around the 200-day EMA.

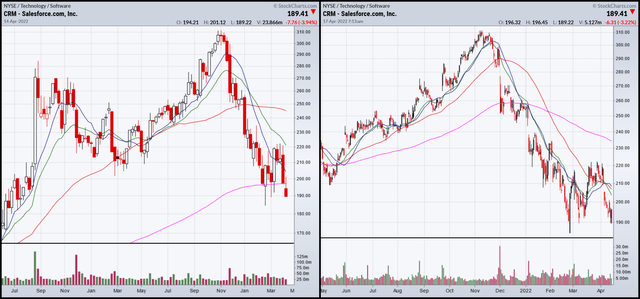

Finally, here are two charts for the company:

Weekly and daily charts for CRM (StockCharts)

The weekly chart (left) shows a strong sell-off that started at the beginning of November that is continuing. The daily chart (right) shows no clear bottoming pattern. Prices are below the 200-day EMA while the shorter EMAs are below the longer EMAs. Both are bearish.

To conclude, Salesforce is a great growth story. But the combined macroeconomic, company-specific, and chart data indicates we’re not in a growth stock environment. Hold off for now.

Be the first to comment