youngnova/iStock via Getty Images

This article was coproduced with Wolf Report.

We look at plenty of real estate investment trusts (“REITs”) here at iREIT on Alpha – so looking at Safehold Inc. (NYSE:SAFE) is a logical step, as is updating on this company to make sure you understand what you’re investing in.

Safehold is a bit of an oddball in the REIT world – there are not many pure play “land lease REITs” out there – and this is what Safehold does. SAFE is New York-based, it’s externally managed (more on that later), and comes with an interesting business strategy.

Indeed, Safehold is a first mover.

It’s the only publicly traded “pure play” ground lease company available at this time. SAFE has an appealing mix of new and repeat businesses, implying there’s a massive, untapped market of potential in this field, and many of the customers are very happy, because close to 40% of customers have closed multiple deals with the company.

So, the acquiring, managing and capitalizing of ground leases is the company’s business model (or “moat”).

Under a ground lease, the tenants own their buildings, but not the land that the building is built upon. The lease involves commercial land that is leased to tenants, given the right to use the property for the duration of the lease.

The tenant owns any improvements made, such as buildings. A good example of a company that utilizes ground lease is Macy’s (M). The company’s buildings are owned by Macy’s, including things like parking, but the tenant still pays rent on the land.

Structurally and organizationally, a ground lease is very similar to any other sort of lease. The tenant makes monthly rent payments. With a ground lease REIT like Safehold, the leases are net leases, which means that tenants assume responsibility for taxes, insurance, and CapEx/OpEx for the duration of the lease.

So, why would anyone want this?

Either tenant or lessor?

There are specific situations where ground leases are attractive. Ground leases have longer lease terms than your typical other REITs. Terms under 20 years are very uncommon, with 20-40-year initial terms being quite common, and up to 100 years not being uncommon.

(Note: As a developer in my previous career, I constructed shopping centers and net lease properties on several ground leases).

Obviously, if a tenant lets the lease expire, the landlord or lessor owns the property as well as improvements made – or the tenant can be responsible for demolishing them.

Macy’s is one example of a company that uses ground leases. American Tower (AMT) is another. This REIT owns cell towers, but it usually doesn’t own the land the towers are actually built on, with a 60%+ ground lease for its U.S. business, with over 35,000 different landlords. The REIT has 28+ years on average leases left.

So again, why would anyone want this, exactly?

Well, as with many things, capital structure and location. This is a mutually beneficial relationship for both parties because it allows AMT to expand without the monumental capital outlay required to purchase both land and build the towers, not to mention the massive tax benefits because lease buyouts turn operating expenses into CapEx, better for tax.

The tenant can also get access to land that they otherwise would have no access to. This is why the model is used by retail tenants such as Macy’s, but also McDonald’s (MCD), Starbucks (SBUX), and many others.

The landlords, of course, get decades’ worth of income security and can eventually collect a lump sum payment for the property.

So, those are the mutual advantages to ground leases.

A ground lease is either subordinated or unsubordinated.

The former means that the tenant agrees to be a lower priority in terms of financing, meaning that if a ground lease tenant defaults on a loan, lenders can go after the property and land as collateral.

Unsubordinated means that a lender can go after the business assets but is prevented from taking over the property. Landlords obviously want unsubordinated leases, even if this means they charge lower rent because lenders usually don’t want loan originations where they can’t take control of the property in the event of a default.

Unsubordinated are the more common agreements here because no/few landlords or ground lease REITs want to put properties at risk. They want risk-free income, not taking a portion of the tenant’s risk.

(Note: As a developer I learned that including satisfactory “right to cure” language is a must. I will explain that in a future “lessons learned” article).

That is how ground leases work, and why they are attractive. And Safehold has been growing massively.

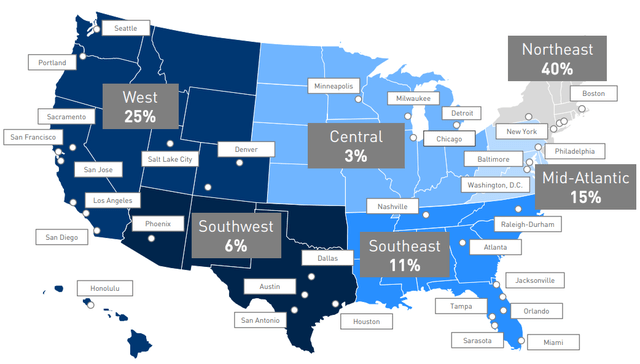

SAFE has closed over half a billion new originations with an expansion into Boston, delivered on below-4% interest unsecured debt with great sponsorship, and raised around $320M of new equity capital, in total providing the company close to a billion of levered purchasing power for new ground leases.

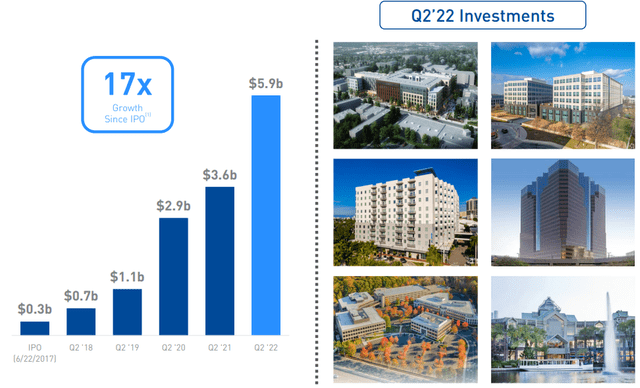

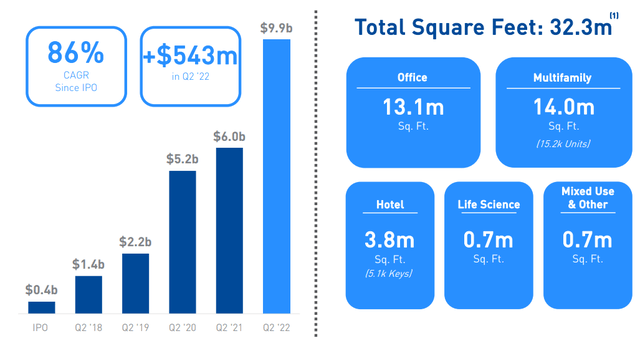

As mentioned, SAFE is the only public ground lease company currently in existence. Since its IPO only back in 2017, it has grown its portfolio at a rate of 17x, and its pipeline is actually growing, not shrinking.

As of Q2-22 SAFE’s $3.9 billion balance sheet portfolio has grown 30% from $3 billion and the yield has picked up slightly to 7.4% in Q2. The portfolio now includes over 350 investments across 8 asset classes, with a weighted average life of 18 years.

The argument for a REIT like SAFE is above-market inflation-protected cash flows from attractive lease deals that are fundamentally protected by the land involved. The company targets a 3% initial yield with 2% annual rent bumps based on 10-year CPI lookbacks and targets a 3% annual raise in today’s environment.

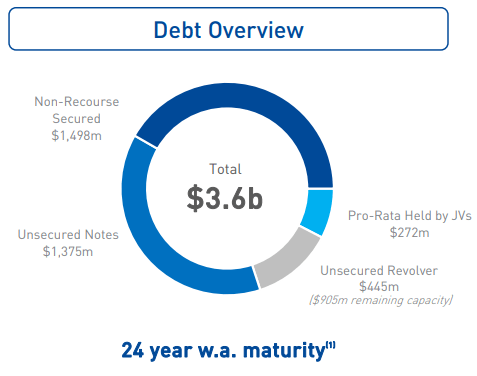

SAFE has a decent capital structure.

It has $3.4B worth of debt with a weighted average maturity of 23 years, which comes to debt at an equity market cap level of 0.9x. An effective interest rate of 3.6% and an annualized yield of 5.1% gives us an effective spread of 152 bps or 1.52%.

SAFE is BBB+ rated by Fitch and Baa1 by Moody’s confirming just how safe the market thinks this business model is.

Management here is stellar if external management can be called that. As mentioned, SAFE is externally managed by the company iStar (STAR). This brings with it dozens of billions in transactional expertise. Aside from being “just” externally managed by STAR, iStar is also the largest shareholder in SAFE.

STAR’s Balance Sheet

SAFE IR

STAR is managed by none other than Jay Sugarman, a manager with experience in fund management with many ultra-high-net-worth families. Management under his leadership and with the “skin in the game” is solid – it oftentimes actually begs the question of whether you should invest in STAR or SAFE.

Just last week STAR announced that it had filed an amended 13D, disclosing that a special committee of the Board of Directors of STAR and a special committee of the Board of Directors of SAFE are in advanced discussions with respect to a potential strategic corporate transaction and that they are proceeding to negotiate definitive agreements.

This is no surprise to us, as we have been suggesting for months that STAR and SAFE should merge, and now that STAR has sold its net lease portfolio, the bulk of the remaining STAR assets are non-core legacy assets ($414 million) and loans ($204 million).

A common mistake people do is comparing ground leases and the REIT to bonds. This is false because bond coupon payments do not have escalators or bumps – this REIT has a minimum of 2% bumps on an annual basis.

SAFE also offers a ground lease platform that others consider worth investing in, namely its “Caret” platform. SAFE already sold 1.37% interest in the platform for $24M.

The estimated value of all the Unrealized Capital appreciation for the company’s portfolio above SAFE’s cost basis grew to an estimated $9.9B, a growth of 86% CAGR since the IPO.

SAFE also recently released 2Q22 earnings, where the growth continued mostly according to forecasts. The company delivered 47% of quarterly revenue growth, over $380M in originations, which turns the company’s post-IPO growth track record up to 17x.

SAFE’s current average lease terms are 94% more than 60 years, and the company has an appealing mix of property types, with 33% multifamily and 46% office property units, with a remaining mix of hotel, life science and mixed-use. SAFE uses contractual measures to capture inflation-adjusted yields and SAFE reports record levels of UCA.

All in all, 2Q22 was a good quarter.

Let’s look at valuation.

SAFE Stock’s Valuation is Tricky…

As mentioned previously, SAFE is an outlier… and because the company owns just land (with no building exposure), so the best valuation metric is core earnings, not FFO (funds from operations) or AFFO (adjusted funds from operations). I consider SAFE a de facto fixed-income investment, plain and simple.

So FFO and AFFO make no sense, since there is no depreciation on land (I learned that in Accounting 101).

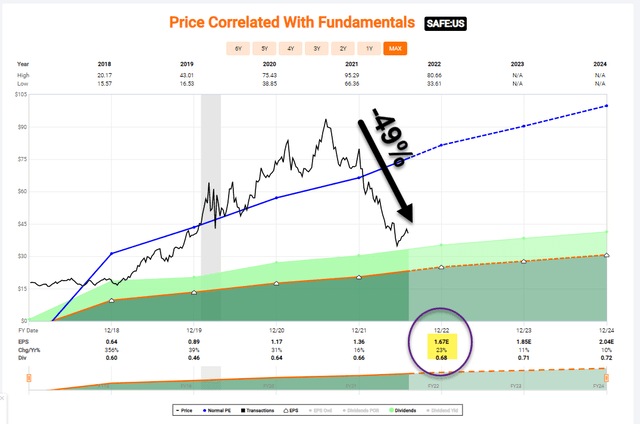

As viewed below, the previous overblown valuation was, in large part, dictated by the very bearish, interest-rate driven view on treasures and fixed income safety.

Even if we argue that SAFE isn’t a fixed-income or bond proxy, it was being viewed as such. And we all know, short-term the market isn’t so much about what is “real,” but what people think.

So, SAFE fell – and it fell hard. From the middle of July 2021 to now, the company has lost more than half its overall value.

FAST Graphs

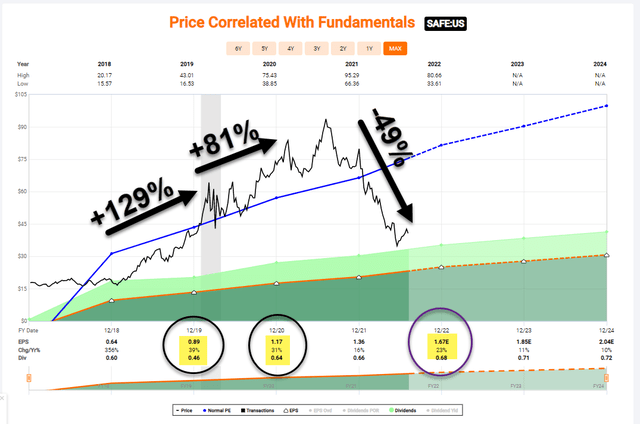

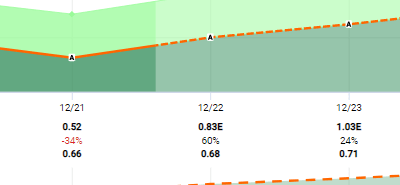

Now, what we find interesting is that SAFE was a high-flyer in 2019 (+129% total return) and 2020 (+81% total return). Of course, the primary driver for this performance was the fact that SAFE was generating some very impressive earnings and dividend growth (as seen below):

FAST Graphs

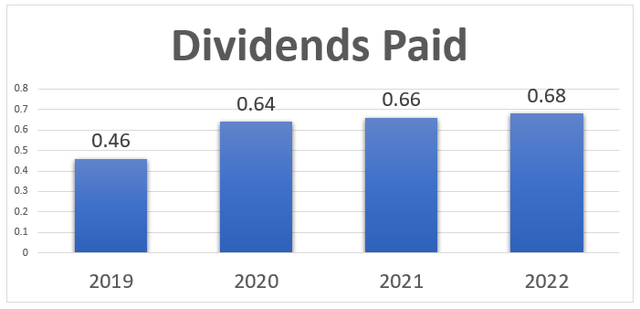

However, I consider SAFE a deep value play, not so much an income play, and while the dividend growth was impressive out of the gate (+39% in 2020) it has been extremely modest since (just ~3% in 2021 and 2022).

iREIT

Analysts are forecasting 23% growth in 2022, and 11% in 2023, and 10% in 2024 – all good numbers in REIT-dom, but the growth engine – in terms of dividend growth – seems to have cooled off.

But remember, SAFE is somewhat of a bond proxy, and you (the investor) must be comfortable with the fact that SAFE is an ultra-safe business model in which the probability of a default is extremely low.

Remember, if a tenant defaults on a ground lease, the landowner gets the building and typically these buildings are worth a lot more than the land.

Ground lease defaults are incredibly rare, no matter the economic situation you’re looking at. They usually do not happen.

So from that perspective, there are very few REITs safer than SAFE.

However, SAFE also comes with a few notations and comments that you should be aware of, though they are a bit overcomplex for most investors.

The fact that primary REIT assets, which consist of land, are not depreciated as say, a building or another more typical REIT asset might be, that mean that EPS is technically the same as FFO when looking at SAFE – and a 20x+ multiple is expensive for a REIT no matter which way you slice it.

Based on actual incoming operating cash, SAFE is more expensive than virtually any other REIT out there today.

The company’s 94% 60+ year leases mean that what appears in the filings as revenue and net income isn’t close to the actual cash that’s coming into the company.

AFFO Per Share

FAST Graphs

As you can see (above) AFFO for 2021 was $.52 per share, which does not even cover the $.66 dividend (based on AFFO). However, once again, using the AFFO metric, SAFE is well-positioned to more than cover the dividend in 2022 and 2023.

The growth is staggering…

What’s even more staggering though is that SAFE shares – after a 50% haircut – are looking even more appealing. At the current valuation, the market is completely discounting the potential of what happens if Caret is listed, and if STAR merges with SAFE.

It completely focuses on SAFE’s previous status as an appealing bond proxy.

Because of this combination of fundamental safety and growth, coupled with this catalyst for both potential dividend growth, coverage safety, and improvement, we are reiterating SAFE as a Strong Buy.

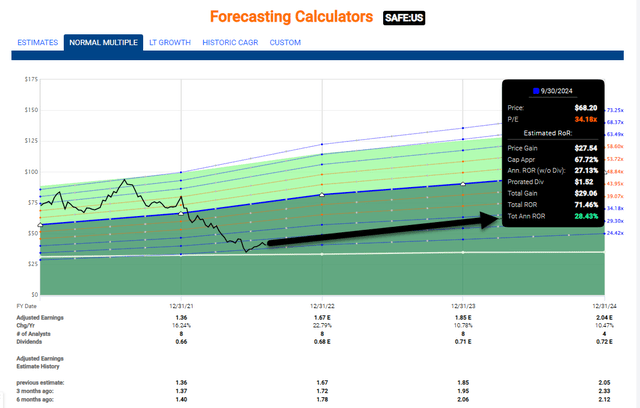

FAST Graphs

We expect an upside of over 60% until 2024E, and this is very conservative.

At iREIT on Alpha, we consider Safehold a “STRONG BUY” with a price target of $67.5, which gives the company a 39% margin of safety. The assets and the underlying safeties for SAFE are simply too conservative, and the notion of any sort of major, widespread ground lease default even in this economy is nothing that anyone expects here.

While some analysts like iStar more than SAFE, we prefer the fundamental safeties of SAFE.

We like this REIT – and we consider it an excellent way to stash money safely, even if the yield is comparatively low, and it requires you to understand some of the differences in accounting.

The most important news however is the latest 13D filing that offers us a valuable clue (emphasis added):

“A special committee of the Board of Directors of iStar and a special committee of the Board of Directors of the Issuer are in advanced discussions with respect to a potential strategic corporate transaction and are proceeding to negotiate definitive transaction agreements.

No definitive agreements with respect to the potential transaction have been executed, and there can be no assurance that definitive agreements will be executed. iStar does not intend to provide further information as to developments, if any, in the parties’ discussions until definitive transaction agreements are executed, or as may otherwise be required by law or determined in its discretion.”

As I have stated on previous occasions, a merger between SAFE and STAR could be the catalyst that Mr. Market has been looking for. I like my odds here, and this is one of the reasons I’m doubling down on this SAFE bet.

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment