Editor’s note: Seeking Alpha is proud to welcome Jakob Mayer as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Petmal/iStock via Getty Images

Investment Thesis

Despite the share price surge of over 20% since March 21, 2021, the stock still appears cheap. The company’s high-quality transition to renewable energy production is still undervalued compared to its peers.

RWE is all-in for a sustainable future and I like the bet.

By 2030, the executive board planned to have €50 billion invested in the portfolio’s expansion. The production capacity is expected to be at 50 GW and will predominantly comprise energy sources classified as sustainable.

I expect the stock to pick up pace as the ongoing transition decreases the exposure to fossil fuels and therefore makes the stock more attractive for sustainable investors. By 2030, the coal and lignite business will not generate significant amounts of revenue. I expect RWE to keep up a high single-digit growth rate after the sustainable switch is complete.

Macroeconomic Factors

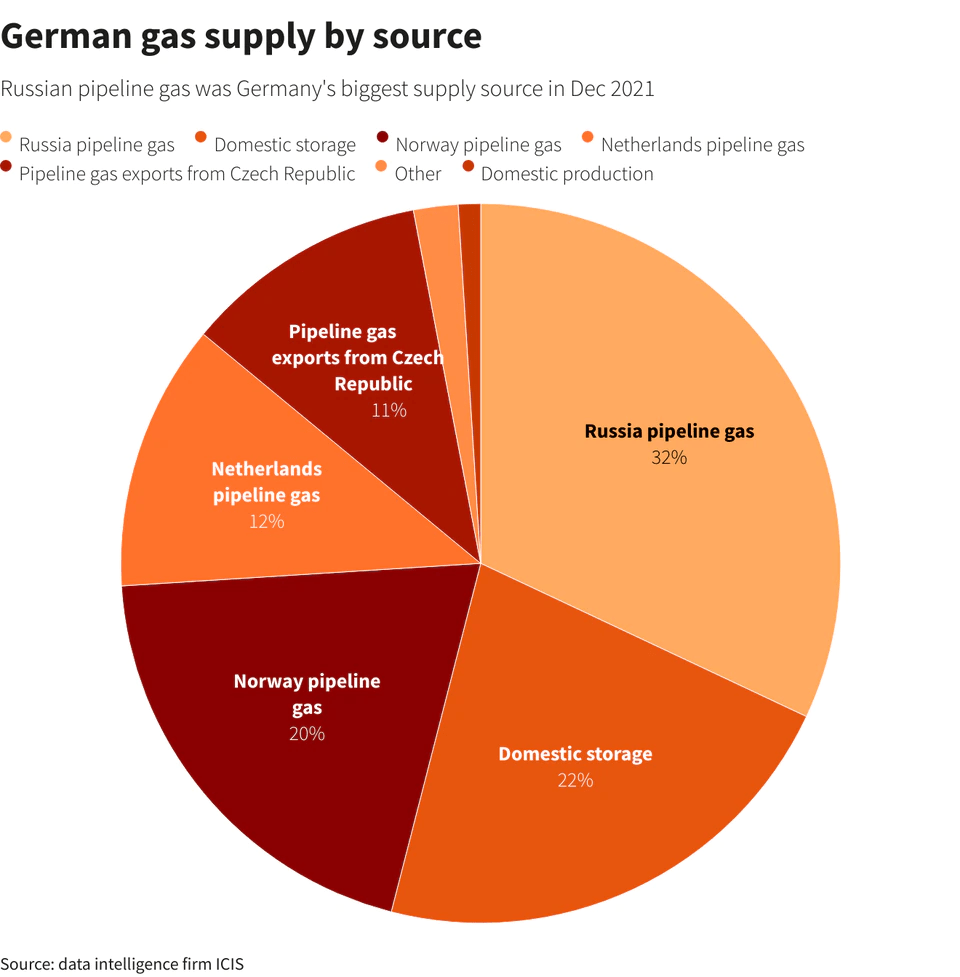

Because of the recent surprising outbreak of war in Europe, accompanied by sanctions from almost all the Western European states, the short-term energy supply for some of them might be in danger. Especially for Germany, which imported over 142 billion cubic meters of natural gas in 2021, of which 32% is of Russian origin.

German gas supply by source (www.reuters.com/world/europe/how-much-does-germany-need-russian-gas-2022-01-20/)

In other terms, the country gets about half of its industry-relevant gas from Russia as the domestic storage is mostly filled with Russian gas. Not to forget the other fossil fuels like oil and coal that are affected as well as Germany imports 35% and 50% of its demand from Russia.

After the Russian attack, the German green Economy Minister and Vice-Chancellor Robert Habeck quickly realized the country’s vulnerability and announced plans to invest €200 billion into sustainable energy supply until 2026. According to the German newspapers, he urged making Germany independent from any kind of fossil fuels by 2035 instead of as originally planned in the year 2050. This includes doubling the current production of onshore wind energy to 110 GW and quadrupling the solar energy production to 200 GW. In RWE’s recent quarterly report, CEO Dr. Markus Krebber also reiterated the company’s aim to invest about €50 billion gross ($55.2 billion) into its sustainable energy business until 2030. This includes the expansion of wind and solar parks, as well as electrolysis and battery storage plants. As the future power supply for Germany might not even be guaranteed for 2023, this crisis is a wake-up call to speed up the transition away from fossil fuels and reduce the dependency on Russia. RWE’s transition, mainly to wind and solar parks, is supporting the government’s effort.

Renewable Energy

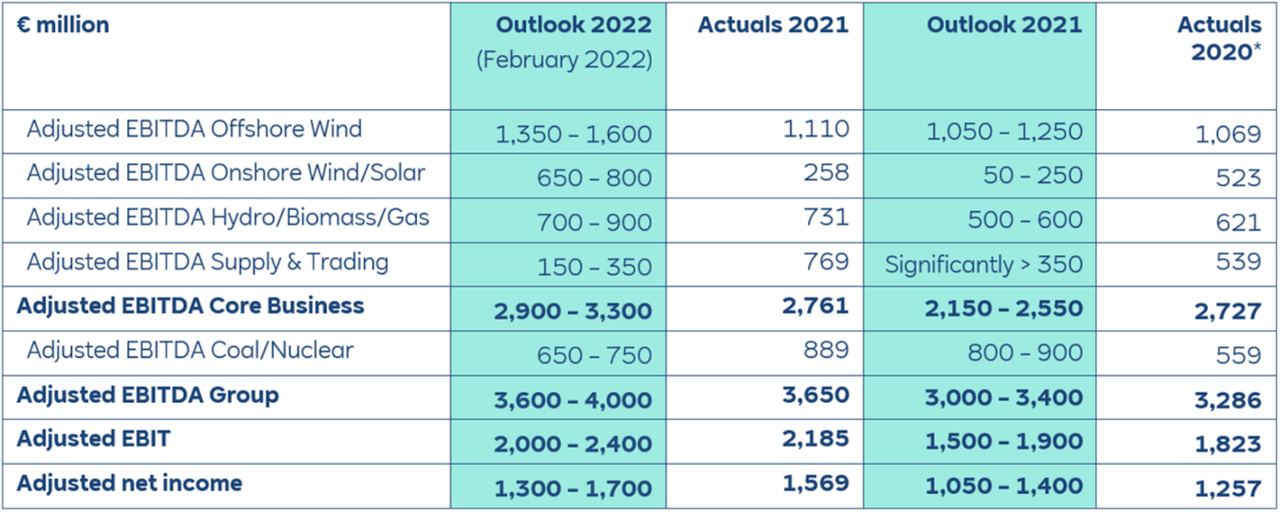

RWE generated the most net profit from its offshore wind parks and expects them to be a growth driver with a growth rate between 21.6% and 44.1% for 2022. Two more wind parks (with a combined production of 1.9 GW) on the eastern coast of the UK are currently being built and expected to finish in 2022 (Triton Knoll offshore wind) and 2026 (Sofia offshore wind farm). Five new parks are being planned at the same time.

While the offshore wind branch had a splendid development in 2021, the onshore wind and solar parks disappointed early. Because of the extreme cold in Texas in February 2021, the 21 wind parks and one solar park located there could not operate properly and therefore did not meet the production goals. As it is normal in the energy market to sell CfDs for certain amounts of electricity to hedge from price drops, RWE had to buy back those and generated losses of about €400 million, which pushed down the margin. Therefore, the expected growth for 2022 between 152% and 210% seems staggering at first sight, but is actually in line. RWE achieved adjusted EBITDA of €731 million in the segment of Hydro/Biomass/Gas, which significantly beat the previous expectations. In 2022, RWE expects this segment to close up on 2021, and therefore expects earnings of between €700 million and €900 million, which calculates in a 23.1% growth on the upper end of the expectations. The branch RWE Supply & Trading achieved an extraordinary record year by generating an EBITDA of €769 million. It trades electricity, fuel, and CO₂-certificates, which allow RWE to sell its produced energy for stable prices and limit the risks of crashes in the commodity market.

RWE’s energy production (RWE Investor relations)

As RWE usually gives out conservative guidance for the following year and has a track record of beating it, I’ll be surprised if they won’t outperform or even miss their expectations.

In 2021, RWE once again invested heavily in the expansion of its green portfolio. The company invested around €3.7 billion gross in the core business and thus around 5.6 GW of sustainable energy production capacity is currently under construction. This is 12% more than in the previous year (2020: €3.3 billion) and corresponds to the EU Taxonomy for sustainable investments.

Energy Production

RWE’s energy production by fossil fuels like lignite, coal, and nuclear fuel rods has gone down over the last year and is expected to continue this trend. The European Union has graded the use of natural gas as “green energy”, which will be the main intermediate energy source to allow a cleaner transition to completely renewable energy. Therefore, RWE even plans to extend the capacity for natural gas from 14.1 GW to 16.1 GW by 2030. Investments like this are needed, especially in Germany, which simultaneously backs out of coal, lignite, and nuclear power plants. The energy-economical institute of the University of Cologne estimates Germany has to build gas plants with a capacity of 23 GW by 2030 to sustain a stable energy supply to reach the country’s goal of a sustainable energy production rate of 65%.

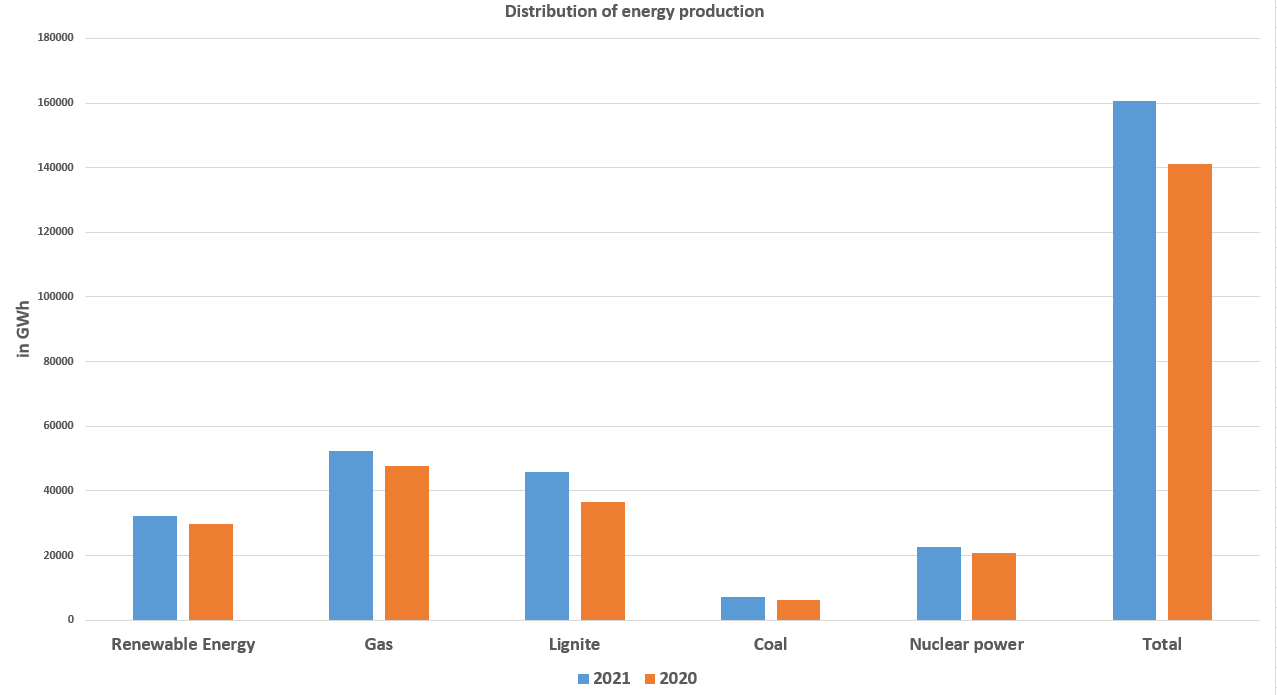

RWE produced 160,773 GWh in 2021. This is a YoY increase of 14%, despite a lower utilization of wind turbines in Europe and in North America because of unpleasant weather. In Germany, it was only at 17% (2020: 20%), while the utilization for offshore wind turbines was at 35% (2020: 40%). However, offshore wind production had an adequate result at 7,564 GWh (2020: 7,009 GWh). Considering the struggles the Onshore Wind/Solar branch had to face, the production of 16,709 GWh (2020: 16,762 GWh) shows its resilience. The hydroelectric/biogas/biomass business grew the most with a production of 7,899 GWh in 2021 (2020: 5,832). All in all, the accumulated renewable energy production was therefore 32,190 GWh (2020: 29,622), which is an increase of 8.7% YoY.

Be careful to not mix up GW with GWh.

graphic by the author (RWE)

As the column diagram above illustrates, RWE still produces the most electricity from gas and lignite. However, due to the lower margins, sustainable energy sources generated the main profit. Therefore, the transition to generating the bulk of RWE’s revenue by wind and solar parks is going to immensely increase the profit margins because of the low operating costs.

Learnings From the Q4 2021 Report

RWE’s current goal for 2030 is to increase the adjusted EBITDA from currently €3.65 billion to at least €5 billion. This will be a jump of 37%, which does not seem a lot as it is only a 4.0% CAGR. But investors should still inspect since RWE expects to fully generate its profit from sustainable energy production and plans to shut down coal, lignite, oil, and nuclear power until then. By subtracting the adjusted EBITDA generated by Coal/Nuclear, the annual growth rate is actually at a decent 7.7%. The difference, which makes companies like RWE a great pick, is that instead of companies that solely focus on renewable energy, which often have to use lots of debt capital to finance their growth as energy production is capital intensive, RWE can use the stable cash flow it still generates from its fossil energy production to finance this switch. Moreover, the company is well known, has a strong balance sheet, and can therefore cheaply get debt capital. For this reason, in June 2021, RWE collected money by selling “green bonds”. The accumulated amount was €1.85 billion, with life between seven and twelve years and a cost of debt between 0.5 % and 1.0 %. RWE created rules for green bonds to force itself to only use the money for projects regarding wind and solar energy.

Strategic Partnerships Provide Long-Term Value

Over the last few years, RWE has had a revival. The nuclear catastrophe of Fukushima in March 2011 and as a result of this, Germany’s plan to back out of nuclear power production has hit RWE’s core business hard. Looking back from today’s point of view, it turned out to be a blessing in disguise. The following sound investments in its renewable business have put the company in the European spotlight as a pioneer for CO2 neutrality, which is aspired to be consummated by 2040. However, as climate change has been the main focus of the upcoming generation, which I am a part of, most companies try to properly position themselves to appear in a good light. Because of this, several industry-leading companies like BASF (OTCQX:BASFY), Shell (OTCPK:RYDAF), and Thyssenkrupp (OTCPK:TYEKF) have made partnerships with RWE to improve their public image. This is especially good for RWE since the company is a “first-mover” and therefore a perfect contact point for those inexperienced in renewable energy.

BASF is, by revenue, the worldwide biggest chemical company. Ludwigshafen is the major site of the company. The site has 39.000 employees, its fire department, and eleven cafeterias. The bulk of chemical products and large amounts of industrial hydrogen is made in Ludwigshafen and therefore the electricity demand is huge, which is why BASF contacted RWE to start a joint-venture and build an offshore wind park in the Baltic Sea by 2030 with a capacity of 2 GW.

Shell and RWE already have a background in positive cooperation through the pioneering projects NortH2 in the Netherlands and AquaVentus in Germany. Those projects use offshore wind energy to produce green hydrogen. Hydrogen provides a sustainable energy source as the combustion does not release carbon dioxide. In addition, RWE and Shell intend to evaluate the application of green hydrogen in the mobility sector in Germany, the Netherlands, and the United Kingdom. Markus Krebber, CEO of RWE, and Wael Sawan, Director of Integrated Gas, Renewables, and Energy Solutions at Shell signed a “Memorandum of Understanding“. This MoU aims to evaluate the possibility of future collaborations and shows the interest both companies have in further projects.

Thyssenkrupp is a German steel processing company. Steel requires a lot of heat to be bendable or even liquid, which makes processing it an energy-intense process. Hence, it is reasonable to use green hydrogen to fulfill the demand. RWE is currently building an electrolysis plant with a capacity of 100 MW in Lingen and a pipeline to the Thyssenkrupp site nearby to manufacture enough hydrogen to cover about 70% of Thyssenkrupp’s energy needs. The plant will start hydrogen production by 2025.

RWE – Valuation and Peer Comparison

Valuation

At a market capitalization of €25.3 billion and cash reserves of €0.36 billion, the enterprise value calculates to €24.94 billion. I use the EV for the evaluation of RWE as it takes the financial situation into consideration. This is important because expanding the renewable energy business is extremely investment-heavy. In 2021, RWE generated an operative cash flow of €7.3 billion. Deducting the total investments in 2021 yields the free cash flow, which grew to €4.6 billion compared to the FCF in 2020 of about €1.1 billion. This surge is mainly because of high-margin payments for forwarding contracts for electricity, fuel, and CO2 certificates, but the good earnings situation and compensations paid by the German government for the phaseout of nuclear power also contributed. It gives an EV/FCF valuation of 6.1, which is cheap. In addition, RWE managed to completely reduce its €4.4 billion of debt and start 2022 with a net cash reserve of €0.36 billion. This allows them to keep up the heavy investments in their renewable energy production. Therefore, in 2021 alone, €3.7 billion gross was invested alongside 86 projects currently in development. The board stated that it expects to keep up the heavy investments and orientate themselves towards the leverage factor. It gets calculated by dividing the net debt by adjusted EBITDA. Because of the positive cash reserve, this value is currently not calculable but RWE says a factor of 3.5 by 2025 is reasonable to allow the company to keep expanding.

Comparison to peers

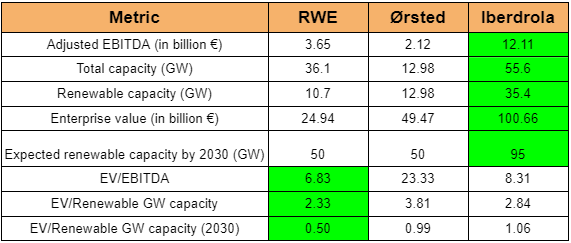

Although the comparison might not fit perfectly in a few points, I’d still like to use Ørsted (OTCPK:DNNGY), which solely focuses on renewable energy production. Ørsted is a Danish company with a similar business model and roughly double the size, with a market capitalization of €46.2 billion. It builds thermoelectric power plants as well as wind parks. The group’s EBITDA was at 15.8 billion Danish Kroner, which equals €2.12 billion, alongside a production capacity of 12.98 GW. Whereas RWE’s capacity is almost three times as much at 36.10 GW, of which 10.70 GW are renewables. Ørsted’s goal is to increase the capacity to 50 GW by 2030. At the same time, RWE plans to have the same capacity as 50 GW, but 16.1 GW is supposed to be generated by gas power plants. The advantage Ørsted has is that it solely focuses on renewables and therefore aligns to the ESG guidelines and is represented in funds and ETFs.

Another company, which is a better comparison, as it is a direct competitor to RWE, is Iberdrola (OTCPK:IBDSF). The primary focus of Iberdrola lies in operating and expanding its renewable energy portfolio and its electrical grid. At a market capitalization of €61.3 billion, it is the most valuable of the three. Exactly like RWE, Iberdrola operates onshore/offshore wind farms, solar parks, and hydroelectric power stations and their fossil fuels business containing coal and nuclear power plants. However, instead of RWE’s higher exposure to fossil fuels, Iberdrola has already generated most of its capacity from renewable energy sources: Currently, at 35.4 GW, it is planned that Iberdrola will triple its installed renewable capacity to 95 GW by 2030, highlighting growth in offshore wind and expansion into new countries such as Sweden, Australia, and Japan. According to the financial report for 2021, the adjusted EBITDA is €12.1 billion. I created a table, which helps to grasp those numbers:

graphic by the author (RWE, Ørsted, and Iberdrola)

Instead of the market capitalization, I used the enterprise value as it considers the company’s financial situation. Furthermore, I did not use common metrics like the P/E-ratio and instead calculated the EV/Gigawatt by dividing the enterprise value by the current renewable energy capacity in gigawatts. This works best for two reasons: The metric does not get influenced by short-term problems in production, which could cause lower energy (and therefore EBITDA) output. At the same time, it is affected by a company’s financial situation, which is particularly important in the investment-heavy business of renewable energy. Ørsted is currently valued at €46.23 billion and carries net debt of €3.24 billion. At a current renewable energy production capacity of 12.98 GW, the valuation is €3.81 billion per gigawatt. The goal for 2030 is to install a production capacity of 50.0 GW. By using this metric, the valuation will be at €0.99 billion per gigawatt by 2030. Currently, Iberdrola has a market capitalization of €61.3 billion but carries an enormous debt pile of €39.36 billion. Thus, the enterprise value of €100.66 billion is by far the highest but also comes with a production capacity of 35.4 GW, which equals €2.84 billion per gigawatt. Besides this, at a planned capacity of 95 GW by 2030, the company appears the most expensive of the three, with a valuation of €1.06 billion per gigawatt. RWE is my top pick for renewable energy production as the company currently has the cheapest valuation at €2.33 billion per gigawatt and also by 2030 at €0.50 billion per gigawatt.

Risks

Macroeconomic risks

For wind and solar park operators, natural calamities pose a small but persistent risk. As stated above, RWE had to make depreciations of €400 million because of the extreme cold in February 2021.

I found an interesting article discussing whether those colds will appear more frequently in the future:

“An open question is whether such events will become more frequent with climate change. […] What happened in Texas this February wasn’t the state’s first extreme cold snap, nor will it be the last.”

With that in mind, it’s important to know that the stock will probably have some dips or small crashes because of those unpredictable events and even a single extreme weather event can eat into the profits of entire business units. Unfortunately, I’m not a meteorologist, which makes it tough for me to assess the risk this might pose. Nevertheless, RWE has an excellently diversified portfolio, and therefore, as far as I can see, this threat is no big deal for long-term investments.

Company-specific risks

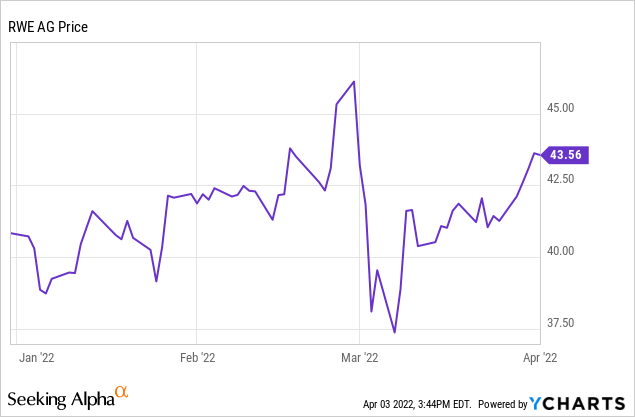

Another uncertainty, which is looming over the investment, is the risk of a further escalating war and a following energy embargo by the EU. It might scare investors that RWE cannot keep its gas plants running. This uncertainty is reflected in the chart:

Since Russia declared war on Ukraine on February 23, 2022, the stock price has remained stable but showed highly increased volatility. This is relatable as there is a lot of uncertainty in the market and it is tough to predict what the short-term effects of the war might be. According to RWE’s annual report, it currently does not have any active business activities in Russia or Ukraine but has a long-term gas purchase agreement with Gazprom (OTCPK:OGZPY). It seems like RWE’s executive board has a hard time properly assessing the threat and therefore just vaguely comments that an escalation of the war followed by imposing further sanctions could have notable consequences for its business. CEO Markus Krebber also said that he supports strict sanctions against Russia but acknowledges that an import stop of Russian gas will not be manageable for the German economy and the country’s households. Overall, the exposure to Russia includes 15 TWh of gas deliveries by 2023 and 12 million tonnes of hard coal by 2025. The company also ruled out the possibility of any new future contracts in Russia.

In the risk section of the annual report, the company stated that the highest risk it potentially has to face is a forced coal phaseout granting no compensation to the affected companies. RWE adjusted the classification of the risk from “medium” to “high” after the formation of a coalition of the Social Democrats, the Green Party, and the Free Democrats.

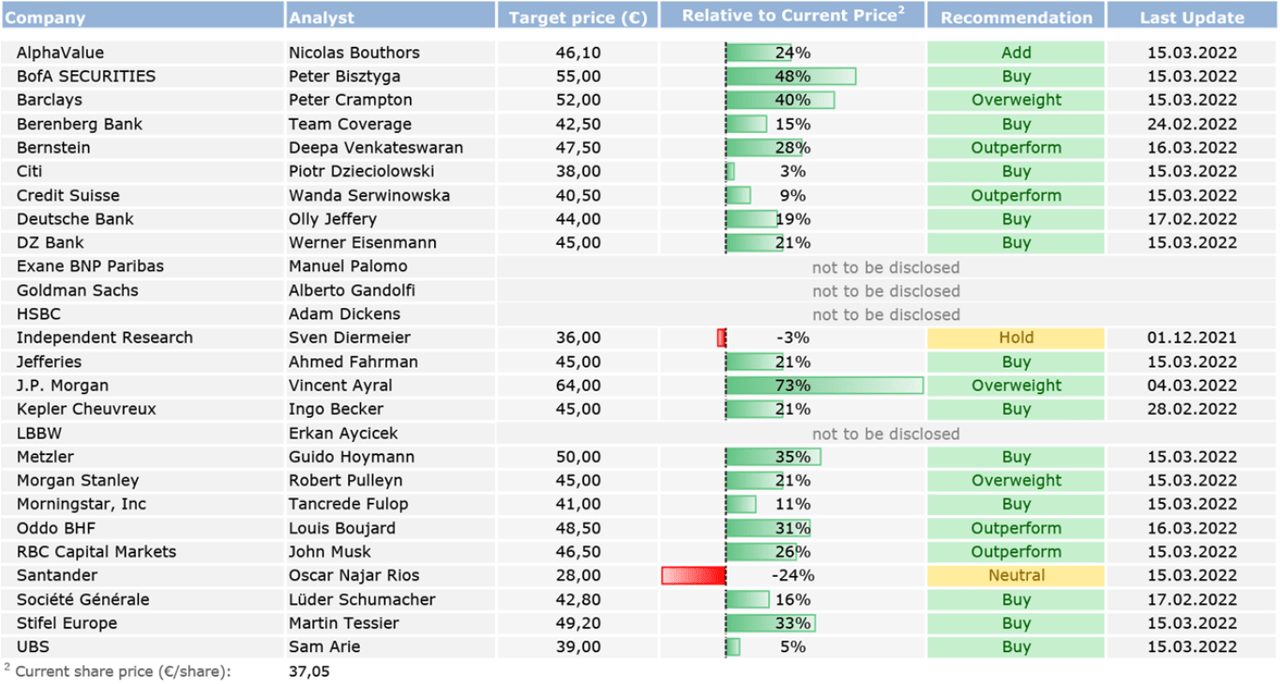

My Outlook and Analysts’ Recommendations

RWE Investor Relations

As I always do my analysis before buying a stock, I don’t overvalue the importance of analyst recommendations. However, it’s still nice to be confirmed in my bullish rating. By applying the same method of evaluation for RWE, Ørsted, and Iberdrola, the first-mentioned has the cheapest valuation, taking into consideration the current fundamentals and the expected growth until 2030. Furthermore, I did not even include the current non-sustainable business in the calculation, which also gives value to the investment. Therefore, RWE has an upside potential of over 100% until it catches up to its peers. Frankly speaking, RWE also includes LNG (liquefied natural gas) and natural gas at a capacity of 16.1 GW in the calculation for sustainable energy, because it has been classified as thus by the European Union. Nevertheless, natural gas and LNG are both not emission-free energy sources and by applying my evaluation method to the GW production without those, by 2030 I get a value of €0.736 billion €/gigawatt. Despite subtracting 16.1 GW, the stock price still has an upside potential of 34.5% (compared to Ørsted) or 44.0% (compared to Iberdrola). This puts my average price target at 39%, which equals a stock price of €52.4. RWE’s quick transition is undervalued and will be sped up by the above-stated macroeconomic factors. The target price is optimistic and I might have to cut it if RWE does not meet its growth expectations for the next few years.

Conclusion

RWE’s transition to sustainable energy production in the long term is still undervalued. The company’s already generating massive cash flows (2021: €10.76 per share) and has ambitious plans to restructure its portfolio to take part in the future of energy generation. The restructuring has already begun and is getting pushed forward by the board. I expect RWE to meet its production capacity goal of 50 GW for 2030 and, while doing so, pay out a nice dividend of ~50% of the adjusted net profit (2021: €2.32 per share & €0.90 per share). At the current valuation, RWE is looking cheap and has potential for future growth. Despite this, it is still important to regularly check on your investment case to see whether RWE can reach its goals and if it, therefore, still is intact.

Be the first to comment