JHVEPhoto

Just over eight months ago, I wrote on Ruth’s Hospitality Group (NASDAQ:RUTH), noting that while the company had a better year ahead for earnings, it wasn’t the time to buy the stock after a 30% rally from its lows to $21.20 per share. This is because the industry group was likely to remain under pressure due to being up against difficult year-over-year comps in H1 2022. Since then, gas prices have spiked, mortgage rates have doubled, and grocery costs have remained elevated, putting further pressure on consumers and leading to a sharp decline in personal savings rates.

Not surprisingly, Ruth’s Hospitality (“Ruth’s”) has suffered, sliding 15% from January levels even if it has managed to outperform the industry group’s (-) 21% year-to-date return. This outperformance can be attributed to RUTH being one of the few full-service restaurant names on track to report annual EPS in FY2022 and its ability to hold the line on margins better than its peer group. However, it appears fine dining is not completely immune from the industry-wide dip in traffic, suggesting the potential for a softer H2 than expected. Given this negative development, I don’t see enough margin of safety just yet.

Ruth’s Chris Menu Offerings (Company Presentation)

Q2 Results & Industry-Wide Trends

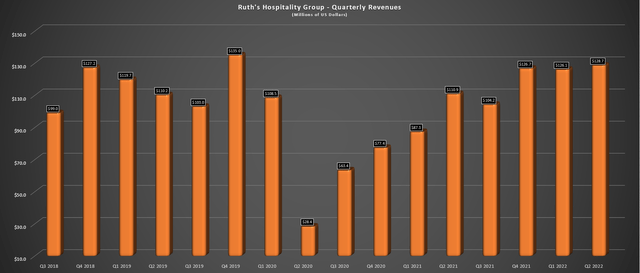

Ruth’s released its Q2 results last month, reporting quarterly revenue of $128.7 million, a record figure for its second-quarter performance. This 16% sales growth was driven by double-digit growth in restaurant sales ($120.8 million vs. $104.2 million) driven by solid same-store sales and unit growth. In Q2, Ruth’s reported same-store sales growth of 12.6% (18.6% vs. 2019), helped by high single-digit pricing and the addition of three new restaurants (151 total, 74 company-owned). However, while revenue beat estimates by $4.2 million, sales softened towards the end of the quarter, consistent with what we saw industry-wide for most brands.

Ruth’s Hospitality – Quarterly Revenue (Company Filings, Author’s Chart)

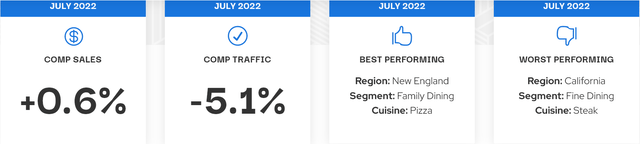

As noted in the company’s monthly sales figures, the quarter started up 24.4% year-over-year despite difficult year-over-year comps and ended at 10.3% same-store sales in June. However, in the July 2022 Black Box Intelligence figures for industry trends, traffic was down 5.1%, declining further from May and June levels, where the industry saw traffic growth of (-) 2.9% and (-) 4.8%, respectively. The surprise was that the segment of the industry that should be the least sensitive to inflationary pressures was hit the hardest: fine dining, which indexes towards more affluent consumers. In fact, fine dining and steak were the worst-performing segment/food in July.

Black Box Intelligence – July Restaurant Stats (Black Box Intelligence)

This surprise end to a streak of outperformance from the fine dining segment is not ideal for Ruth’s, which has an average check near $100.00 (FY2021: ~$90.00) and is considered fine dining. The takeaway is that some affluent guests might be less anxious to go out, feeling less affluent due to the reverse wealth effect (declining home prices & declines in equity portfolios). It’s also possible that some higher-income consumers might enjoy going out post-COVID-19 and getting back to normal but have noticed their checks are up 25% plus.

Finally, there may be some drag from work-from-home combined with inflation, with it being easier to conduct business meetings over Zoom (ZM) than in person over steak, both from a cost and scheduling standpoint. This would be a negative headwind long-term for Ruth’s Chris, even if it may have only made up a portion of weekly sales in cities like Chicago, Washington, and New York. This view is corroborated by a survey suggesting that 47% of diners who work from home go out less frequently than they did pre-COVID-19, and lunch reservations with average checks above $50.00 declined sharply vs. 2019.

Lunch reservations in the first four months of this year at restaurants with an average check of more than $50 were sharply lower than during the same period in 2019, according to data from the online reservation service OpenTable. They fell in Washington (by 38 percent), New York City (38 percent), San Diego (42 percent), Philadelphia (54 percent) and Chicago (58 percent).

– The Business Lunch May Be Going Out of Business – New York Times

The good news is that even if same-store sales growth does dip and come in weaker than expected in Q3/Q4 and this trend persists, the company will be opening three new restaurants this quarter, boosting sales in the back half of the year. Just recently, the company opened two restaurants in Worchester [MA] and Long Beach [CA], and it plans to open another in Melville [NY]. This will translate to higher system-wide sales, assuming traffic doesn’t fall off a cliff. Based on preliminary 2023 guidance, Ruth’s expects to continue its store openings at a low to mid-single-digit pace in 2023, planning to open five to six restaurants next year.

Margins & Earnings Trend

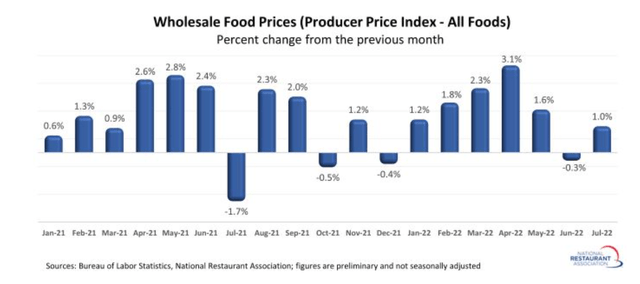

The trend we saw in Q2 was that while many restaurant companies managed to come in near or just shy of sales estimates, margin performance left much to be desired. However, Ruth’s not only beat sales estimates (albeit with help from 7%+ menu pricing), but it also posted solid margins. This was because the company saw beef deflation, a massive headwind for Ruth’s in 2021, helping to offset inflation in the rest of its commodity basket. Judging by commentary from some brands and stats from the National Restaurant Association, inflation appears to be cooling off. Still, some items continue to see extremely high year-over-year increases, including eggs (+225%), butter (+69%), flour (+22%), and cheese (+19%).

Wholesale Food Prices (National Restaurant Association, BLS)

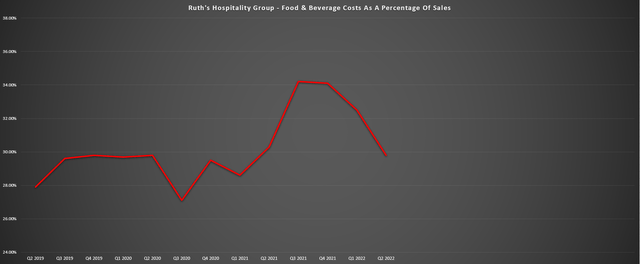

Ruth’s noted in its Q2 results that while it saw 23% inflation in the rest of its basket, it reported improved food & beverage costs year-over-year, enjoying a 60 basis point decline to 29.8%. This is a clear improvement from last year’s levels, as shown by the below trend. However, this was offset by an 80 basis point increase in labor costs, with wage growth likely to persist even if food costs moderate (assuming energy prices cool off and supply chains normalize). Still, the lack of margin compression was solid compared to other brands like Denny’s (DENN), helping RUTH to report a 22% increase in quarterly earnings per share [EPS] and a 41% improvement from 2019 levels.

Ruth’s Hospitality – F&B Costs As Percentage of Sales (Company Filings, Author’s Chart)

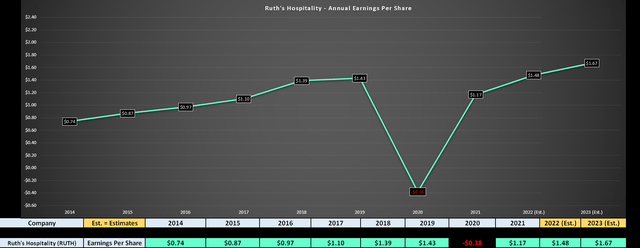

Given the solid earnings performance in Q2, Ruth’s has already reported $0.75 in EPS year-to-date and is on track to grow annual EPS by 26% year-over-year to $1.48. This is not only a solid earnings growth rate for a company in an industry facing near-unprecedented challenges, but it would also mark a new all-time high for annual EPS, a very bullish development. Notably, FY2023 annual EPS is projected to hit a new high as well based on current estimates, sitting at $1.67, and translating to another year of double-digit annual EPS growth.

RUTH Earnings Trend (YCharts.com, Author’s Chart, FactSet)

The positive earnings trend makes RUTH one of the more attractive buy-the-dip candidates industry-wide. That said, there’s no investing without valuation, and the key is ensuring a margin of safety, especially in a volatile market environment. Let’s look at the valuation below to see whether the stock is nearing a low-risk buy zone:

Valuation & Technical Picture

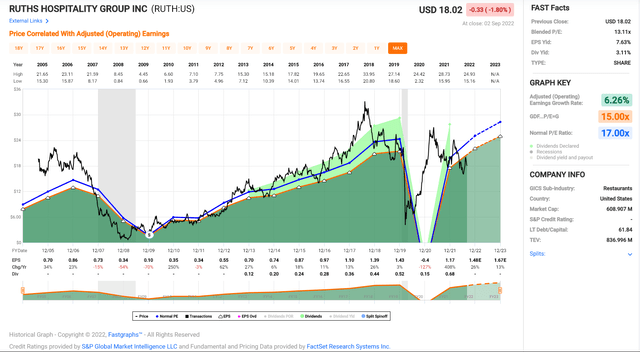

Ruth’s Hospitality has historically traded at 17x earnings, and it traded at closer to 18.5x earnings over the past decade (10-year average). Given the industry-wide headwinds combined with the recessionary environment, I believe using a more conservative multiple makes sense. This is especially true given the multiple compression we’ve seen historically in recessionary periods. Based on what I believe to be a more reasonable earnings multiple of 14.5 (15% discount to long-term average) and using FY2023 earnings estimates of $1.67, I see a fair value for the stock of $24.20, translating to a 34% upside from current levels (18-month price target).

Ruth’s Hospitality Historical Earnings Multiple (FASTGraphs.com)

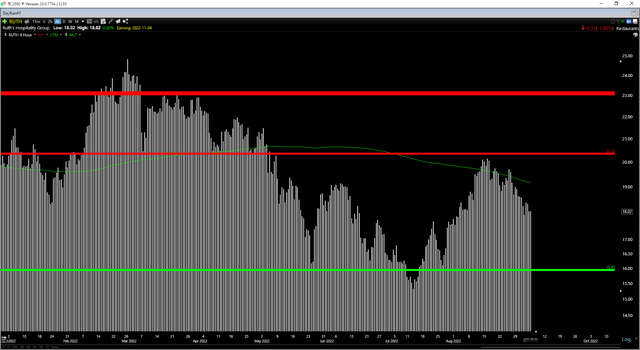

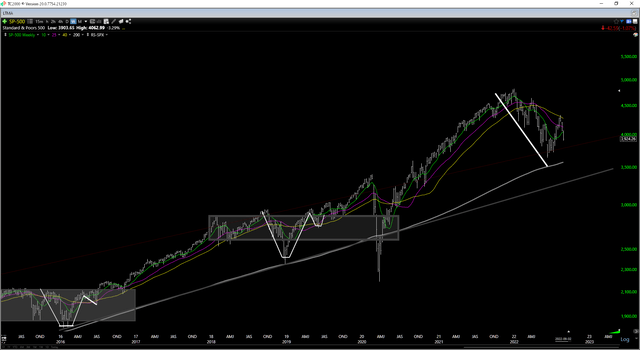

While this represents a solid upside (~24% annualized with dividends paid), I prefer to wait for a minimum 35% discount to fair value to justify entering new positions in small-cap stocks. Applying this 35% discount to fair value for Ruth’s Hospitality would translate to a low-risk buy zone of $15.75 or lower, requiring another 12% decline in the stock at a bare minimum. This doesn’t mean that the stock must drop this low. Still, in a cyclical bear market for the S&P 500 (SPY), when stocks often overshoot to the downside, this is where the stock would need to decline for me to become more interested in it from an investment standpoint.

RUTH Daily Chart (TC2000.com) S&P 500 Weekly Chart (TC2000.com)

Moving to the technical picture, Ruth’s has a new resistance level at $20.35 and no strong support until $15.95, where the stock recently found support after hitting new multi-year lows in July. Based on a current share price of $18.00, the reward/risk ratio is balanced, given that RUTH has $2.35 in potential upside to resistance and $2.05 in potential downside to support (a 1.15/1.0 reward/risk ratio). Generally, I prefer a minimum of a 6.0 to 1.0 reward/risk ratio when buying small-cap stocks, and this would require RUTH to dip below $16.55 per share. So, from both a technical and fundamental standpoint, I don’t see the stock at a low-risk buy zone just yet.

Summary

Ruth’s had a solid Q2 report and managed to buck the trend of meaningful margin compression industry-wide, benefiting from deflation in its main commodity, similar to Wingstop (WING). However, with fining dining & steak performing poorly in July and the industry not appearing to be out of the woods just yet, I think it makes sense to wait for a large margin of safety before buying, and I don’t see that available at a share price of $18.00. So, while I think RUTH is a solid buy-the-dip candidate, I would be waiting for a pullback between $15.75 – $16.50 per share at a bare minimum before entering new positions.

Be the first to comment