jetcityimage

Dear readers,

I’m going to be updating on Rolls-Royce here (OTCPK:RYCEF). I’ve been writing about this company for over a year now, following its decline to its current levels. As of my last article, it seems that the company might have hit its trough. It’s entirely possible that from this level, we might be going in a positive trajectory, which would lend itself to start investing in one of the most famous engine manufacturers out there.

I can’t argue with the fact that Rolls-Royce is currently cheap – but I still view the company as very risky given what near-term risks exist here.

Let’s see what we have here.

Rolls-Royce – Updating on the company

Rolls-Royce is a business I’ve written about a few times over the past year and more now. I’ve always come to a lukewarm “HOLD”, despite the fact that there is a lot to like about the company. For the past couple of years, the company has been reorganizing, restructuring, and doing damage control – and this work has been continuing here.

As I’ve mentioned in my previous articles, I’m always hesitant to enter back into a “dog” sort of stock that’s been suffering from the sort of valuation decline that we’ve seen on the part of Rolls-Royce.

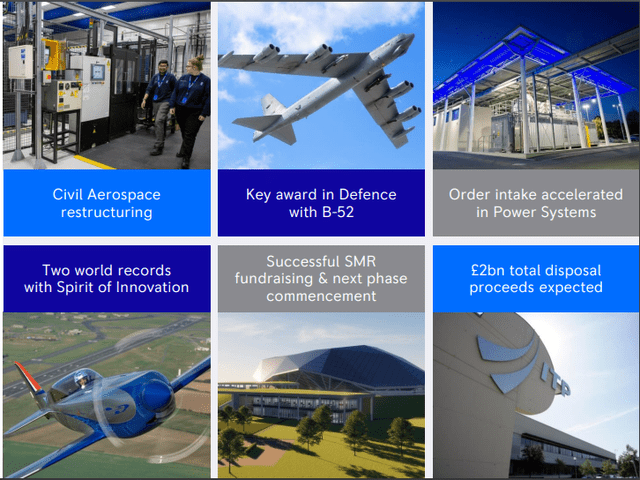

There can be a time to do it, but I do not believe the short-term pain to be over just yet – at least not unless the company can show significant improvements. Since my last article, the company has reported earnings that were in line with expectations, as well as securing a few contracts worth mentioning – one for a small nuclear reactor, and one for the U.S Navy.

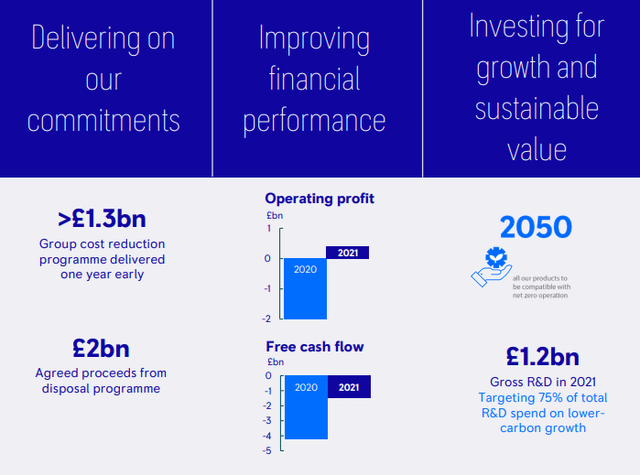

Rolls-Royce IR (Rolls-Royce IR)

The company also turned EBIT-positive last year – even if FCF continued to be negative. RYCEF is still in crisis mode – but this crisis mode is now starting to blend with an overall upside of won contracts and other positives.

Rolls-Royce IR (Rolls-Royce IR)

The company has continued to go through its restructuring, and the restructuring has actually been quite successful by every possible metric you could look at. Operating costs have seen a 35% reduction, the footprint has gone down 27% through 13 plants closed, consolidated, or sold, and investments have seen a 46% reduction across the entire company.

The company intends to win through quality, product lifetime, and existing aviation trends.

Still, Rolls-Royce remains very correlated to the overall aerospace industry, as we saw with the effects on the company as a result of the recent crash of a large jet in China. These trends aren’t the only issues Rolls-Royce has to overcome – there have been plenty of negatives in the company’s recent history.

2021 was a consensus miss, a bad year aside from returning to growth. A CEO resignation is never a good thing, and couple this with inflation in raw material costs, energy cost increases, and other macro trends, and we can see why the company’s recovery in 2022 is not exactly an easy task.

One of the company’s current main targets is the return to an investment-grade credit rating – with the pathway clear. The company will attempt to reduce uncertainty by delivering on its targets, including its disposal and reorganization programs. The company already has improved its liquidity and currently holds over £2.6B ($3.16B) in cash, with another £4.5B ($5.5B) of undrawn liquidity that it can pull on it needed. Coupled with no maturities until 2024, this puts the company in a significantly improved fundamental position, with a potential for investment-grade credit rating once its balanced its business profile and improved its results.

The main ways it intends to do this are driving down costs and growing its results. Rolls-Royce has absolutely no shortage of orders, with an order backlog of over £50B, and an improved underlying EBIT of almost half a million GBP, some improvements are already in the books. The company’s 2022 remains positive despite ongoing challenges such as the supply chain risks, rising inflation, and input cost increases.

Rolls-Royce guides for positive Free cash flow for the 2022 fiscal on the back of aerospace recovery.

The fundamentals for the company remain – and there are positives here.

Rolls-Royce IR (Rolls-Royce IR)

There are few examples out there that better exemplify a company’s fall from grace. However, there are drivers for positive trends that could drive the company in the right direction here. We’re talking about the company’s investment in a total of 7 new aerospace engines, with industrial production ramp-up (similar to Airbus (OTCPK:EADSY)). COVID-19 did impact things, but the company expects the 2022-2024 period to be characterized by things like margin expansion, FCF generation and focus on the five value drivers.

Rolls-Royce has a 58% market share on the current large aerospace engine programs, and its recent contract wins confirm its positives here. It’s already delivered on more than £1.3B in cost reduction, and 7/9 Trent 1000 fixes are currently being implemented. Furthermore, the company has an 88% market-leading share of large-cabin long-range business aviation.

And this is without even going to the adjacent sectors, including Defense (50% US DoD, with increases in long-term defense spending), power systems and what we can call “new markets”, including electrical and the SMR segment, focusing on small nuclear power.

These things make Rolls-Royce, at least theoretically and technically, well-positioned for future growth.

Based on current trends, I expect that Rolls-Royce will actually be able to post growth for 2022. Current guidance calls for growth of around low-to-mid single-digit percentage growth, which is clearly below what most investors were hoping for – but it’s still decent considering where Rolls-Royce comes from.

The problems with Rolls-Royce remain though.

RYCEF is exposed highly to the absolutely weakest market segment and it’s questionable if we will see any sort of immediate improvement here. The company’s history of burning cash is well-established, and recovery here could take far longer than we might expect.

This gives the company few marks to play here. While the Widebody engine market is a duopoly, Boeing’s problems might impact RR as well, and the current limited age of its fleet means that replacement is going to be in the future.

I continue to view RR as an investment with skepticism, not because of any lack of fundamental appeal, but for the next 2-5 years. Once this company does turn around, it will be a mighty investment.

And I’m going on record here saying, that the recovery may well be closer than we expect.

Rolls-Royce Valuation

However, Rolls-Royce still has no dividend yield and can be said to be overvalued on the basis of two perspectives.

The issues with DCF valuation remain. The company, despite good expectations, hasn’t been able to perform for some time. To forecast mid or long-term growth here is a problematic venture because of this. Even assuming low sales growth, it remains a question of what exactly the company can do or perform here, or how the share price will react in the short term.

I will continue to claim that RR is undervalued by about 40% to a conservative DCF, but there’s so much uncertainty baked into the variables that I choose to heavily discount this, and not weight it all that highly when considering RR’s valuation. At this time, no higher than 15% of the complete valuation.

The second perspective is peer multiples, and the problem here is equally obvious. How do you value a company that has been a destroyer of shareholder value for over a decade at this point?

The fact remains that since 2013, investors in RR have seen their returns go negative by almost 70-80%. Valuing them to any peer that’s profitable can only be done when heavily discounting the company.

I invest in Airbus. I do not currently invest in Rolls-Royce. Peers in this segment trade at high premiums of over 20X. Rolls-Royce trades at 12.8X, but the question remains if the company deserves even this. It will, once things do turn around, but for now, I choose to discount RR by 30-40% to reflect historical underperformance, and this kneecaps the company’s average valuation down significantly.

The company is still negative on a 1-year basis, down around 10% for the time being. However, the main difference when looking at Rolls-Royce here is that some analysts are actually considering the company undervalued at this point. Trading at under a pound per share, or £0.89/share ($1.08) currently, average targets from 15 analysts put the company’s PT at £0.97/share ($1.18), implying an upside of close to 10%.

Despite this positive target though, only 3 out of 15 analysts actually give the company any sort of “BUY” or positive recommendation Most are at “HOLD” or “underperform”. This confirms my current thesis on Rolls-Royce overall on the basis of these analysts, as they seem more interested in waiting to see what happens with the company before taking the leap and investing.

As I mentioned – once this company does turn around, the turnaround will be massive. There’s plenty to like about a “good” Rolls-Royce. But when a company has failed to consistently deliver for so long, we can’t simply “go in” here without considering past performance (despite the old adage about performance).

The only time I would be willing to actually start establishing a position in RR is at a massive discount to every perspective you might look at. The company is still undervalued to my previous PT of £0.8/share ($0.97). I’m now cutting it to below £0.7/share ($0.85).

I will be curious if the valuation goes as low as this because, at such discounts, I’ll become interested in playing the reversion here, especially if quarterly results come out positive.

There’s also the very relevant matter of the current macro we’re facing. We shouldn’t be going for the Hail-Mary’s here, as I see it. Investing in a company that needs to prove that it can deliver first isn’t exactly the sort of safe long-term investment I tend to go for. There are quite literally dozens of businesses that are currently at more attractive valuations and prospects.

Hence, I stay at a “HOLD” here.

Thesis

For now, this is my Rolls-Royce thesis.

- Great business, great exposures, great duopoly player with some real nice fundamentals – but with the pressures we’re seeing, and the Ukraine war, things aren’t looking better except for the defense sector.

- No yield and low visibility make this a no-go at all but pennies on the dollar. Specifically, I’d want to pay no more than 0.5X-0.6X to NAV with a normalized EBIT as a base, which comes to around $0.85/share for the ADR. At that point, you could buy it and really be buying quality for pennies on the dollar.

- Because of that, I’m currently still at a “HOLD” – but I’m actually watching RYCEF here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Thank you for reading.

Be the first to comment