Justin Sullivan

Thesis

Roku, Inc.’s (NASDAQ:ROKU) pandemic boom-and-bust story has been an eye-opener for us. We were also caught up with Street analysts during the pandemic boom believing in the company’s ability to continue driving growth as advertising continues to shift from linear TV to connected TV (CTV).

The company’s central thesis has not changed. Netflix’s (NFLX) entry into ad-supported streaming underscored the long-term secular growth story of Roku’s thesis. However, what really broke ROKU was the pandemic-fueled craze coupled with a low-margin model. As such, it became increasingly popular with short-sellers, with short interest as a percentage of float reaching nearly 9% recently.

Management’s insistence on driving investment growth despite the worsening macro uncertainties also proved unpopular with investors. Just ask Meta Platforms’ (META) CEO Mark Zuckerberg, who saw META fall to lows last seen in February 2016, knocking out nearly seven years’ worth of price gains.

We believe the bearish investors/short-sellers have set up their positions, anticipating another disastrous earnings report from Roku (due on November 2), given the recent surge in short interest. Management’s reasons for underperformance have shifted from supply chain disruptions to cuts in ad spending as the macro headwinds intensified.

Long-term investors who are still around will likely be looking for management to wise up and rein in spending or demonstrate discipline in capital allocation.

ROKU remains priced at a premium, even though growth has continued to slow. Hence, we postulate investor focus will inevitably turn toward its ability to drive incremental operating leverage moving ahead. Therefore, the company must tread carefully even at these levels. In addition, the market will be watching whether management is keenly aware of the need to manage macro uncertainties while investing for long-term growth.

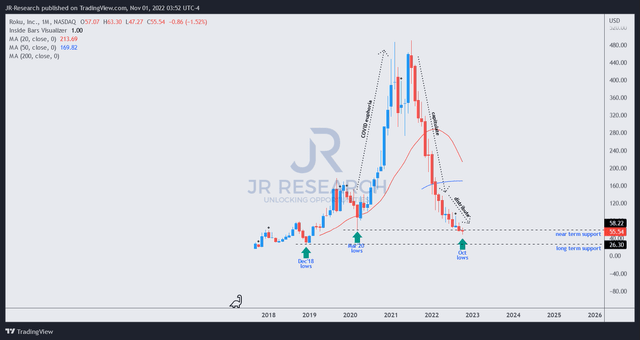

ROKU’s price action only re-tested its March 2020 lows recently. Yes, despite its nearly 90% decline from its 2021 highs. So, the round trip has wiped out all its pandemic-driven gains, and hopefully, along with the holders that chased its upside.

We gleaned that ROKU seems to be consolidating. Furthermore, despite the recent earnings disappointment from Meta and Google (GOOGL) (GOOG), the sellers have not been able to make further inroads.

Hence, we parse buyers are holding the current levels vigorously, even as short-sellers continue to pile onto the stock. Management’s guidance will be critical on whether the market could subsequently force these shorts to cover, driving a rally to retake its COVID lows decisively.

Maintain Buy, but we rein in our medium-term price target (PT) to $70, implying a potential upside of 26%.

Analysts Are Looking For A Bottom In Q3

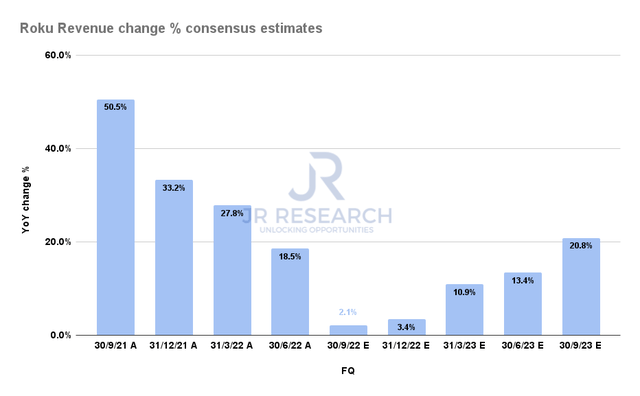

Roku Revenue change % consensus estimates (S&P Cap IQ)

From high growth to no growth. That pretty much summed up Roku’s growth story over the past year. Business executives, investors, and analysts have all been fooled into the supposed “durability” of the stay-at-home winners like Roku.

Analysts’ revised estimates suggest 2.1% YoY growth in FQ3, down significantly from last year’s 50.5% uptick. Given the recent results from its advertising peers, we believe the market had already anticipated a poor quarter for Roku. Moreover, Netflix’s earnings card has given some glimmer of hope that Roku’s forward guidance may not be as bad as what the short-sellers would want us to think.

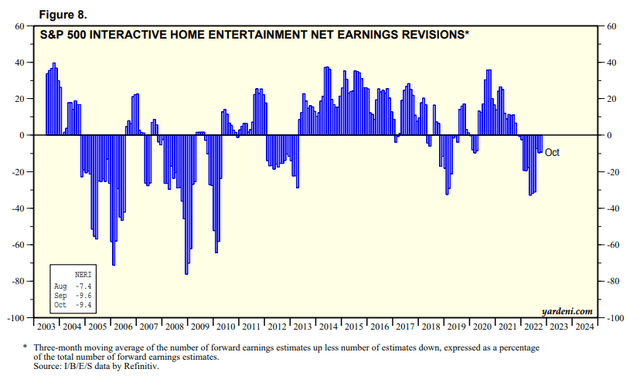

S&P 500 Interactive Home Entertainment industry net earnings revisions % (Yardeni Research, Refinitiv)

The Street expects Roku’s revenue growth to reaccelerate through FY23. Also, industry analysts have already revised their earnings estimates markedly for Roku and its peers through October, reflecting significant pessimism.

Hence, we believe Roku must deliver “not so bad” guidance for the market to kick those short-sellers out of their game and drive a massive covering rally.

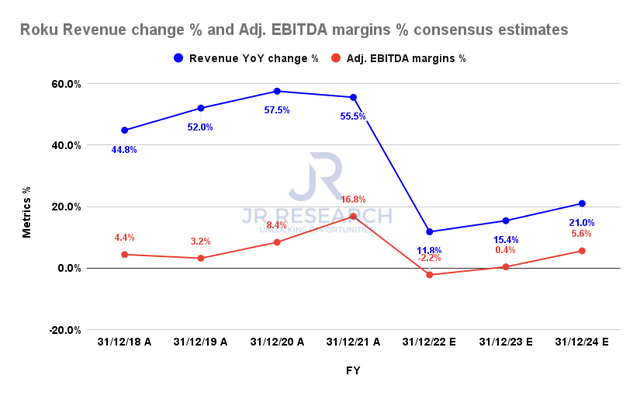

Roku Revenue change % and Adjusted EBITDA margins % consensus estimates (By FY) (S&P Cap IQ)

Netflix’s earnings indicated that streaming remains relevant. Its moves toward ad-supported streaming suggest Roku’s thesis was right after all. The Trade Desk’s (TTD) growth in CTV ads indicates that the market has enough space to accommodate the leading players.

YouTube’s gains in CTV demonstrated that consumers continue to move away from linear TV, potentially drawing more advertisers to the CTV ecosystem.

Hence, we believe a reacceleration thesis of Roku’s revenue growth through FY24 is credible. Analysts penciled in FY23 revenue growth of 15.4%, with adjusted EBITDA margins moving back into the black. Accordingly, analysts expect Roku to post an adjusted EPS growth of 20.6% in FY23.

Therefore, investors expecting ROKU to reclaim its 2021 highs quickly will be in for a massive disappointment. But, the opportunity to average down their costs looks favorable at these levels if management doesn’t disappoint in its forward guidance.

Is ROKU Stock A Buy, Sell, Or Hold?

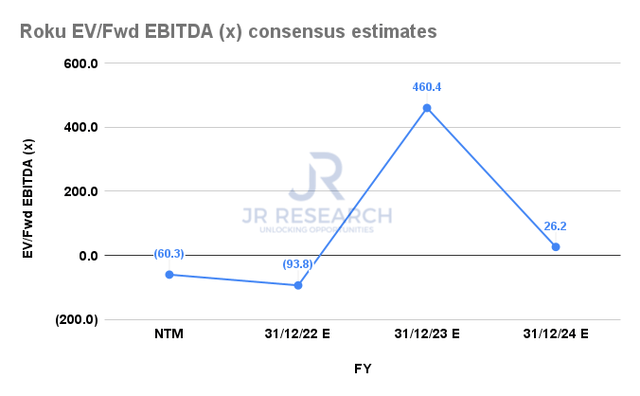

ROKU forward EBITDA multiples valuation trend (S&P Cap IQ)

ROKU last traded at an FY24 EBITDA multiple of 26x, still at a premium, despite its massive battering.

For a 20% revenue grower by FY24, we believe the market will focus more on Roku’s ability to drive operating leverage. Hence, any indication suggesting massive investments would likely cause further value compression.

ROKU price chart (monthly) (TradingView)

ROKU re-tested its March 2020 lows, as seen above. However, the price action was constructive in October, suggesting that buyers came in to stanch further downside.

There’s an opportunity for ROKU to stage a bear trap from these levels, which could drive massive short covering, helping ROKU to reclaim its near-term support decisively.

Hence, we postulate that ROKU is delicately positioned for an upward move, reflecting a favorable reward-to-risk profile. However, investors are reminded that ROKU’s earnings calls have often seen volatile moves. Hence, investors are encouraged to layer in, as the bullish reversal could take a few months to form on its long-term chart.

Maintain Buy with a medium-term PT of $70.

Be the first to comment