James_Gabbert/iStock Editorial via Getty Images

Rocky Mountain Chocolate Factory (NASDAQ:RMCF) is a franchisor with about 320 stores around the country and a main factory in Colorado. Its biggest franchise consists of chocolate stores that manufacture part of the chocolate in-premises. The company also owns a smaller franchise related to frozen yogurt.

The company is recovering from a very bad 2020 and showing signs that it is able to recover 2019 profitability levels, and maybe even surpass them. However, RMCF also suffers from a long-term downward trend in business that has not been solved yet.

Before addressing that pressing problem, the company has to solve conflicts among shareholder groups. RMCF recently announced a new CEO and a new chairman of the Board. Is that an indication of an agreement?

With a shareholder meeting expected in August, I maintain a hold rating, as in my previous article from January. A consensus proxy statement would be great news, and a contested one the opposite.

Note: Unless otherwise stated all information has been obtained from RMCF’s filings with the SEC.

Business recovering in 2021

RMCF operates two franchises. The first one is called Rocky Mountain Chocolate Factory and is based on chocolate stores that manufacture part of the product inside the store. According to the company’s latest 10-K, there are 156 RMCF stores in the US, 97 co-branded stores with Cold Stone Creamery (ice-cream), also in the US, and 5 stores abroad. The second franchise is called U-Swirl and sells customizable frozen yogurt. Currently 59 stores in the US and 1 abroad.

Both franchises operate in the same way, franchisees pay a one-time franchise fee, buy most manufactured products or materials from RMCF and pay a 10% gross sales fee for products sold that are not manufactured by RMCF.

RMCF has not developed other sources of revenue outside of its franchises. In 2019, the company started selling its products online through an alliance with Edible Arrangements, a seller of gift boxes. In 2020, the arrangement with Edible represented almost $3.5 million in revenues, compared with $35 million in revenues before the pandemic. However, in 2021, RMCF and Edible had disagreements and the relationship deteriorated. The company keeps selling to Edible, but in 2021 those sales represented only $1.7 million.

The pandemic really hit RMCF in 2020, with revenues falling 30% and $3 million in operating losses. The company discontinued $0.5 dividend per share and has not paid dividends since. However, fortunately RMCF had a strong balance sheet, with 0 debts and a cushion of $5 to $7 million in cash.

In 2021, sales recovered significantly, with revenues just a little below 2019 levels. Although the company presented a loss for the year, if (hopefully) one-time items like proxy-contest and CEO termination expenses are removed, RMCF generated more than $2 million in profits. This is consistent with the FCFs generated.

Other figures show improvement above 2019 levels. For example, although 2021 revenues were below 2019 levels, there were 100 stores less now than then, meaning that each store is selling more. In fact, on its latest 10-K, RMCF comments that same store sales are at least 20% higher than in 2019. Finally, as of February 2021, there were 14 stores that had been sold but not opened yet, showing some growth in franchisees.

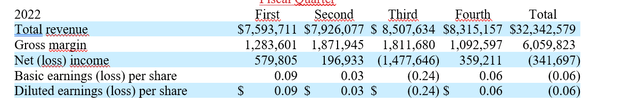

Another interesting sign is that 2021 gross margins are not significantly lower than in 2019, suggesting that RMCF has some pricing power, at least with regard to its own franchisees. The table below shows, margins falling by the end of the year, but this could be explained by seasonality factors, given that margins were much higher in 2Q21 and 3Q21 (the table says 2022 because RMCF closes its financial statements on February the 28th, therefore 2021 financials are presented as fiscal year 2022).

Simplified income statement by quarter, RMCF (RMCF’s 10-K for FY22)

Regarding the conflict with Immaculate Confection, RMCF’s operator in Canada, where RMCF claims that IC breached its trademarks, conversations are still ongoing, according to the latest 10-K. The conflict does not seem to represent a liability for RMCF, but a good agreement that keeps the business between the two companies would be interesting. Anyways IC only represented $160 thousand in revenues in 2021.

Long term decay

A big problem for RMCF is that the company’s revenues, margins and franchised stores have been falling since at least 2015.

In 2015, there were 249 U-Swirl (and associated brands) stores, mostly in the US. Today there are only 59 stores. While in 2015 chocolate related revenues were $35.4 million and profits were $9.1 million (25% net margin), today the segment generates $30.5 million in revenues and profits were $7 million (20% net margin). There were 345 RMCF stores in 2015, only 258 remain in 2022.

What is the reason behind that decay?

A long-term trend might be the general stagnation of franchising in the US, with the number of establishments not growing since 2007, according to Statista.

Endogenous reasons may include an antiquated store design, as it was commented in a previous article. Also a not so beneficial business equation for franchisees, given that a RMCF store requires significant investment in space that is not used for retail but for manufacturing, in very expensive locations, like airports and malls. Employees also need to be trained to manufacture chocolate at RMCF stores, complicating HR management compared to a store that only needs regular salespeople.

This is difficult to know given that RMCF does not publish profitability figures for its franchisees. However, it is the most pressing problem for RMCF’s long-term prospects.

Movements in the board and management

In May, RMCF appointed Robert Sarlls as the new company CEO. A check on Sarlls’ background on LinkedIn shows that he comes from Wyandot Snacks, a snack contract manufacturer and private label manufacturer.

Although it is very early for any conclusion, we can speculate on Sarlls bringing some of this contract manufacturing experience to RMCF. Considering that RMCF has a production capability in the order of 5.3 million pounds per year but it is currently producing less than 2 million pounds, contract manufacturing and private labeling could represent a new business opportunity.

Last week, RMCF’s president of the Board, resigned, and is going to be replaced by Jeff Geygan, CEO and President of Global Value Investment Corp., which owns 8% of RMCF. In June last year, before the proxy contest exploded (see below), Geygan had discussed with RMCF’s board and management the possibility of issuing a tender offer for 30% of RMCF’s shares. Geygan is also the president of Wayside Technology (WSTG) since 2018, a period during which the company doubled its revenues and profits.

Is the proxy contest over?

According to the company’s latest 10-K, last year RMCF spent $1.7 million in a proxy contest between its board and a shareholder group led by AB Value Management, then representing about 14% of shareholders. As the proxy contest triggered termination payments to the company’s then CEO Merryman, another $2 million had to be expensed. As was mentioned previously, without those two expenses, totalling $3.7 million, the company would have shown a profit in excess of $2 million after taxes, instead of a $350 thousand loss.

Is this year going to be different?

Some signs point to a positive agreement. First, the board eliminated all preferred stock rights, AKA poison pill, one of AB’s requests. Another sign is the designation of a new CEO and a new President for the company, just a few months before the next shareholder meeting in August. The movement seems bold without significant shareholder consensus.

However, separate filings two weeks ago by AB and Bradley Radoff, who together own 17% of the company’s stock, indicate that they presented their own directors’ nominees for consideration at the next shareholder meeting. Also, on its latest 10-K, the company announced that it had signed a change of control employee agreement with some of its executives granting them a calculated $900 thousand in compensation in the event the board majority was replaced. The contesting group won two seats on the board last year, and has more shares this year, so it may reach the four necessary to reach majority in the seven director board.

With the next shareholder meeting scheduled for August, proxy statements should be filed this month or the next. A consensus statement with a board representing all groups would be a great signal, solidifying the recent changes to the strategic apex of the company and showing that attention will be given to recharging the company’s strategy in the future. Another contested statement would represent continuing conflict, mounting expenses, and above all, time lost for the most pressing issue, which is business strategy.

Conclusions

In a few weeks there should be news about the proxy statement (or statements) and about consensus or conflict among shareholders.

Until then, I recommend waiting, given that the company still has to solve significant issues related to its growth prospects and that it is not selling so cheap as to become a no brainer.

Be the first to comment