Alexyz3d

I see nothing in space as promising as the view from a Ferris wheel.”― E.B. White

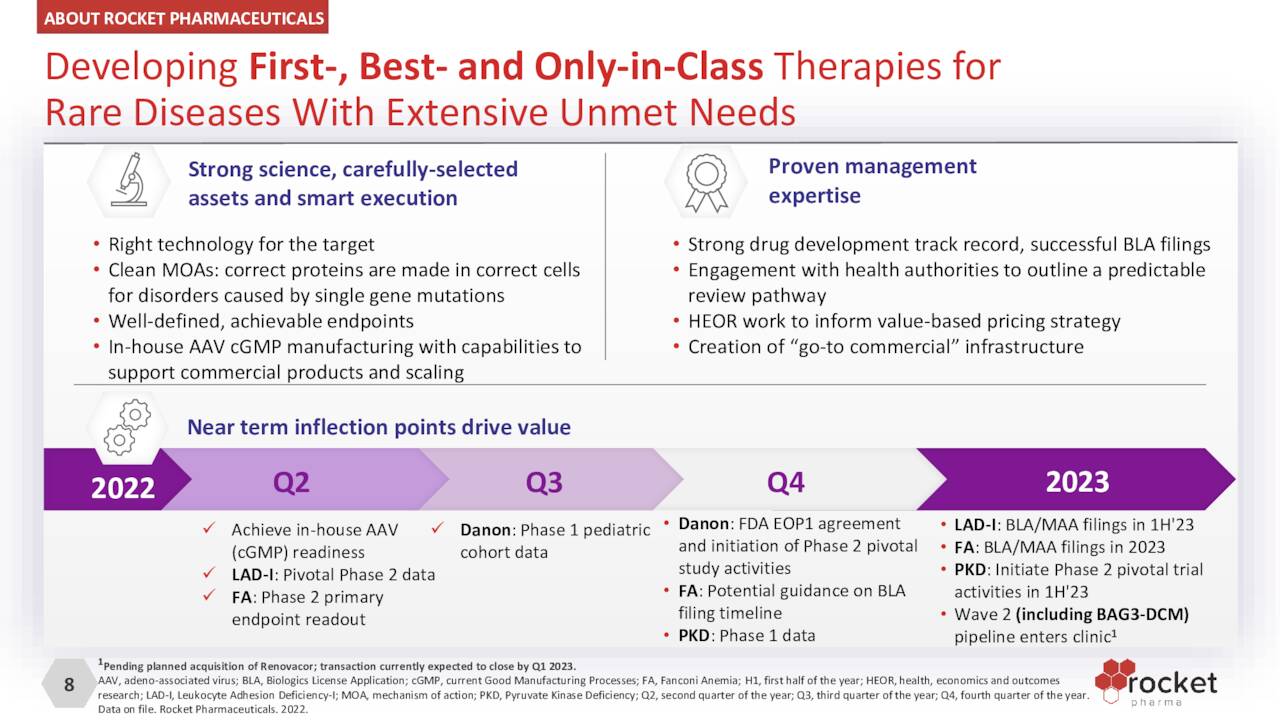

Today, we take a look at a high beta, pre-clinical developmental concern. The company and stock have intriguing potential even as the shares are likely to remain volatile. The company has recently addressed funding needs, has some potential catalysts on the horizon, strong analyst firm support and large insider buying from a beneficial owner. An analysis follows below.

October Company Presentation

Company Overview:

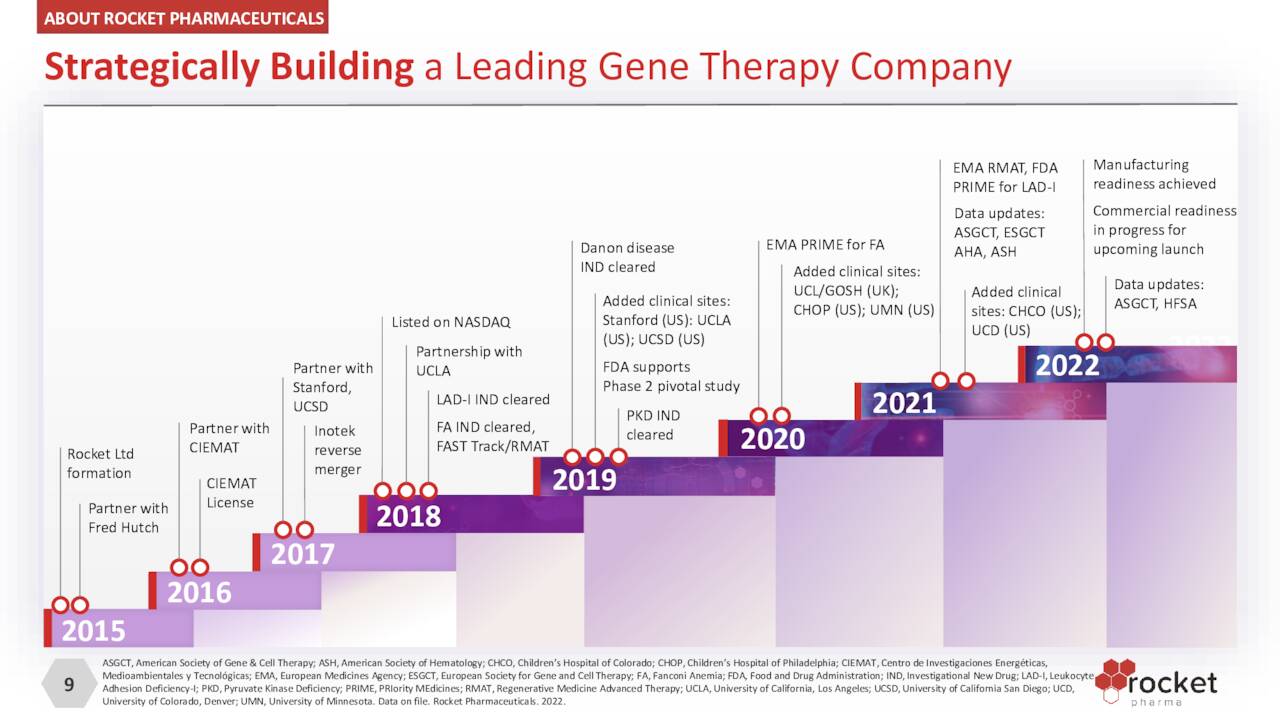

Rocket Pharmaceuticals, Inc. (NASDAQ:RCKT) is a Cranbury, New Jersey,-based clinical-stage biopharmaceutical concern focused on the development of gene therapies to treat rare diseases. The company’s two viral vector platforms have spawned five clinical programs, one of which has been discontinued. Rocket was incorporated in 2015 and went public via a reverse merger into failed ocular concern Inotek Pharmaceuticals in 2018, with its first trade executed at $10.86 a share. Shortly thereafter, the company conducted a public offering, raising net proceeds of $78.8 million at $13.25 a share.

Seeking Alpha

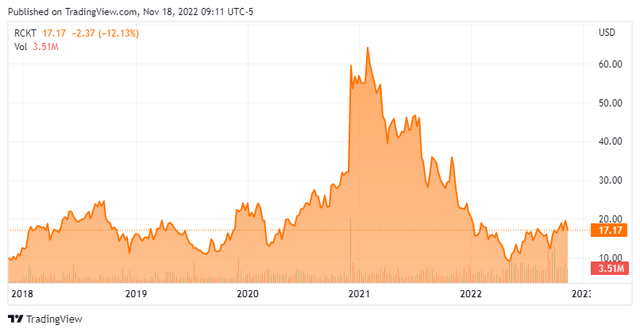

Rocket’s stock trades just over $17.00 a share, translating to a market cap of approximately $1.5 billion.

October Company Presentation

Market

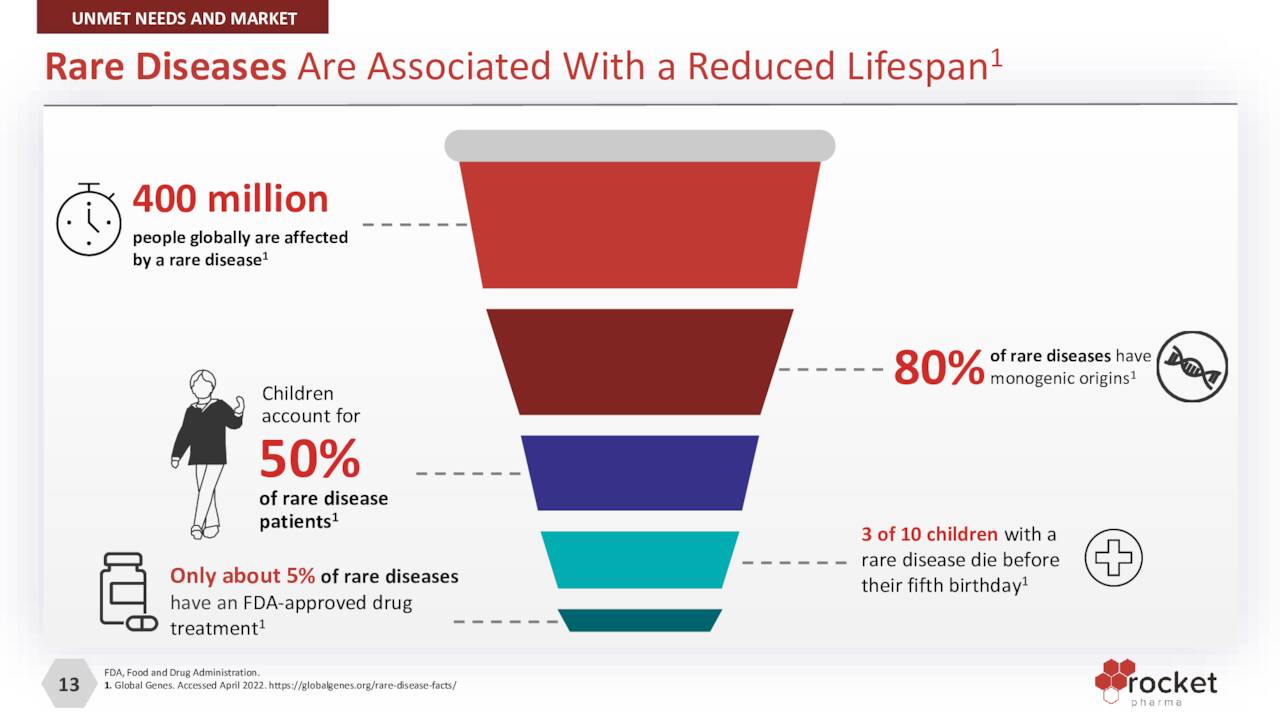

There are more than 7,000 rare diseases – defined by the FDA as afflicting less than 200,000 people – affecting more than 30 million Americans. Of that number, approximately 5% have an FDA-approved therapy. When taking into consideration that ~30% of children who contract a rare disease die before their fifth birthday, the unmet need is significant. Approximately 80% of these diseases have a monogenic origin, providing a substantial opportunity for Rocket and its gene therapies.

October Company Presentation

Platforms

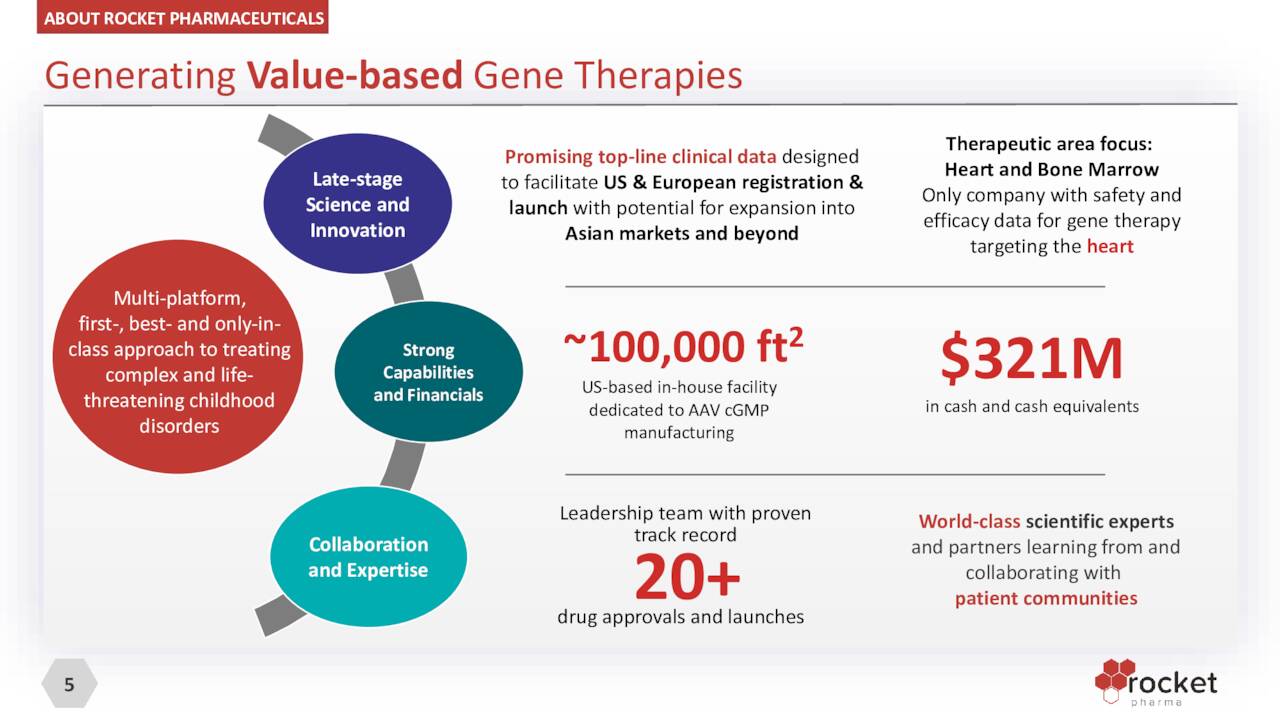

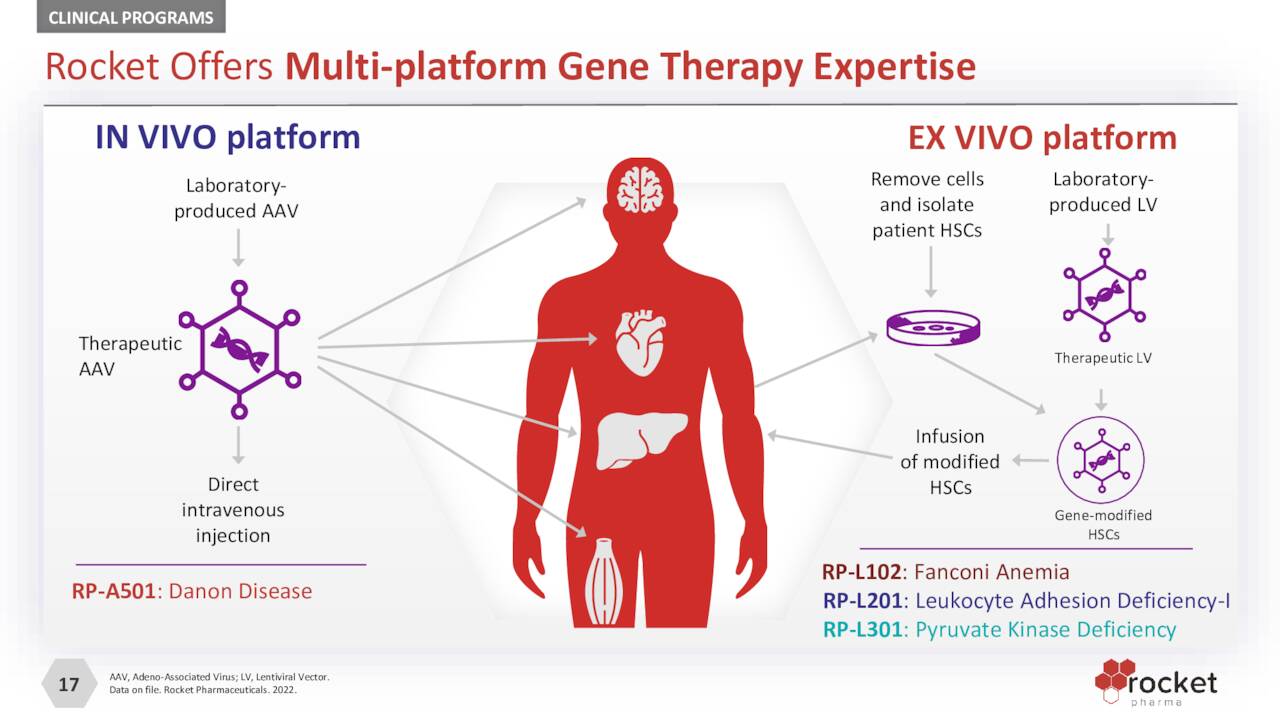

To exploit this prospect and improve the lives of many, the company employs two modified non-pathogenic viruses to penetrate cells and deliver missing and properly functioning genetic material into targeted tissues or organs: ex-vivo lentiviral vectors (LVVs), where the patient’s cells are extracted and the vector is delivered to them in a lab, with the modified cells then being reinserted into the patient; and in vivo adeno-associated viral vectors (AAVs), where the vector is injected directly into the patient. Rocket’s LVV platform is ideal for modifying hematopoietic stem cells [HSCS] to address hematologic and immune disorders, whereas its AAV platform is best suited for disorders of the heart, liver, eye, and central nervous system. Non-pathogenic viruses are well suited as delivery vehicles owing to their adeptness at invading cells. Mostly all of Rocket’s technology was in-licensed from academia.

October Company Presentation

Pipeline:

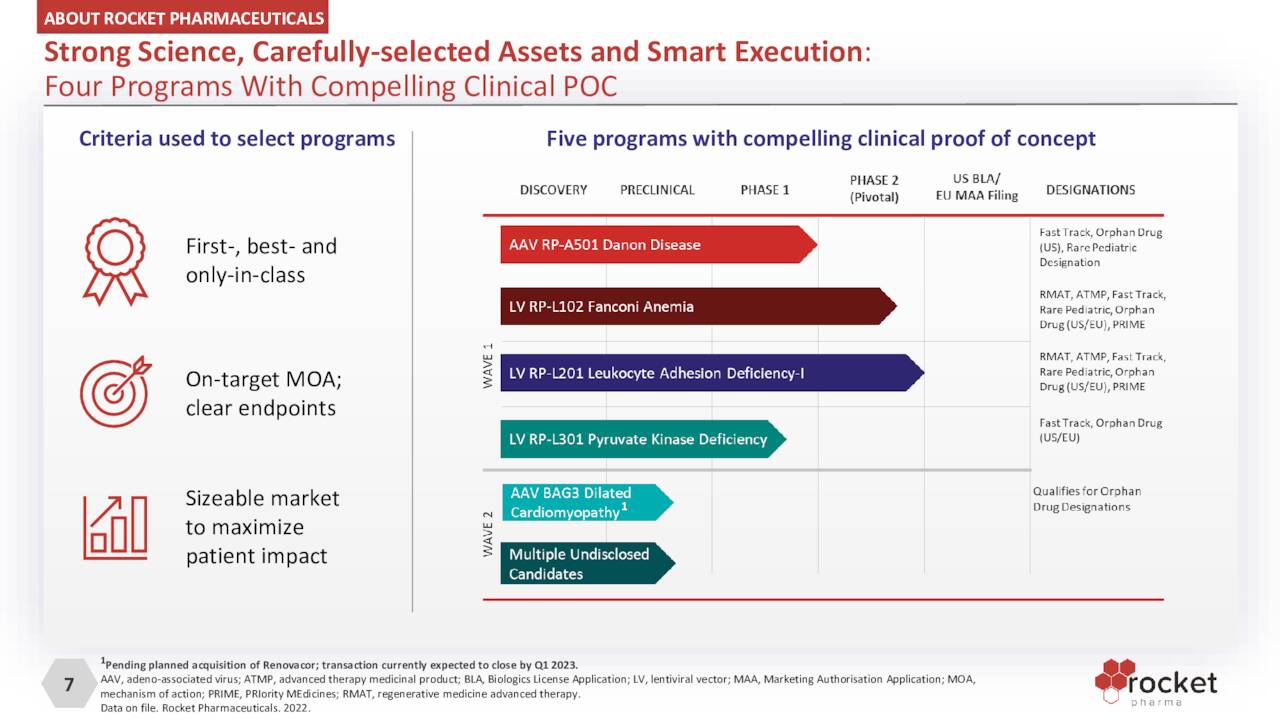

The company’s LLV delivery platform is responsible for three clinical programs, while its AAV platform accounts for one current clinical candidate.

October Company Presentation

RP-L201. Its lead asset is RP-L201, which is being investigated in the treatment of Leukocyte Adhesion Deficiency-1 (LAD-1), an ultra-rare genetic disorder of the ITGB2 gene that retards CD18 expression, which in turn impairs the ability of white blood cells known as neutrophils to enter tissues where they are needed to fight infection. Without donor HSC transplantation (HSCT), mortality in 60%-75% of severe cases occurs by age two. The moderate form of the disease results in death prior to the age of 40 in more than half those afflicted with poor quality of life characterized by recurrent infections and inflammatory lesions. The total annual incidence of LAD-1 in the U.S. and EU combined is estimated at 50 to 75 individuals, with approximately 800 to 1,000 currently alive with the disease.

The returns for RP-L201, which is essentially a single infusion of autologous HSCs transduced with LVV carrying ITGB2 transgene, have been very encouraging. In a nine-patient Phase 1/2 trial, Rocket’s therapy demonstrated 100% overall survival with all nine patients exhibiting signs of disease reversal (at three to 24 months of follow-up). CD18 expression was sustained at over 10% (median 56%) versus an average of 1%< pre-treatment. Furthermore, visits to the hospital for infections and inflammation were significantly reduced (p<0.0001) and there were no serious adverse events reported. A BLA/MAA filing is anticipated in 1H23 with another label-expansion study targeting the moderate form of LAD-1 expected to initiate sometime in 2023. RP-L201 has received fast track, rare pediatric, and regenerative medicine advanced therapy (RMAT) designations from the FDA, advanced therapy medical product [ATMP] and priority medicines (PRIME) classifications from the European authorities and orphan drug designations from both sides of the pond.

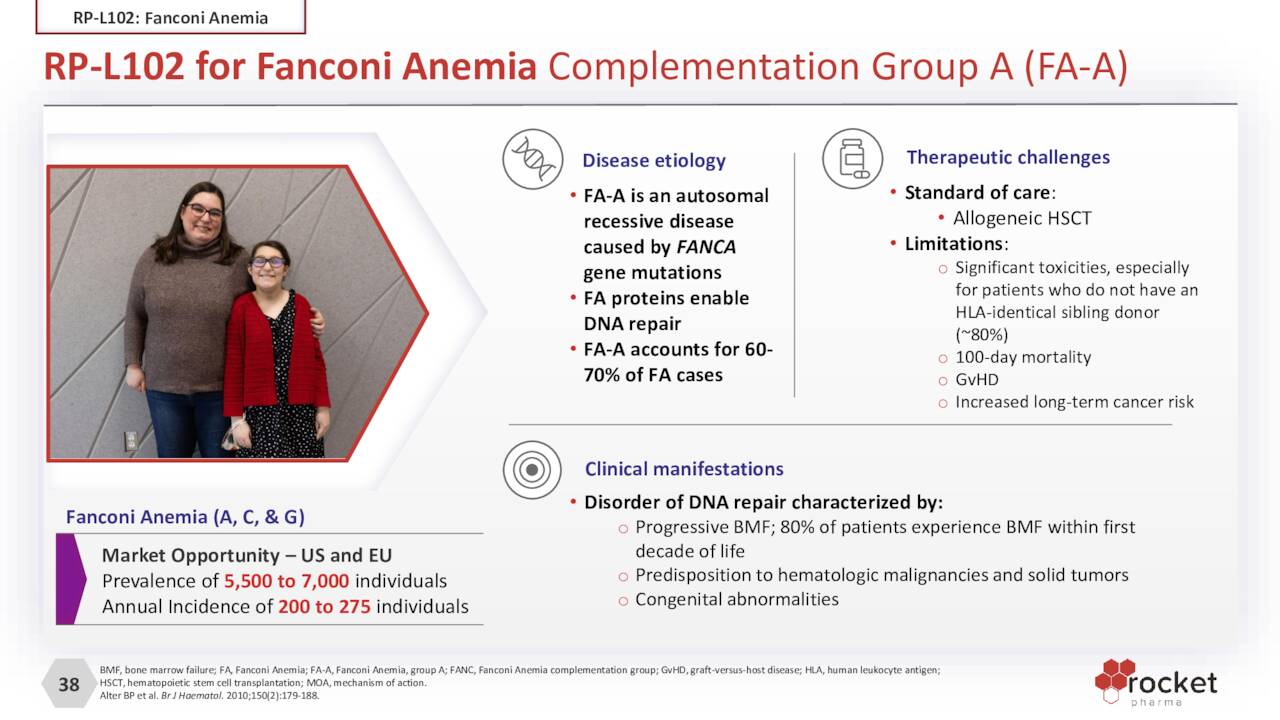

RP-L102. Right behind RP-L201 is PR-L102, which is undergoing evaluation in the treatment of Fanconi Anemia [FA), a rare (1 in ~130,000) DNA-repair disorder that causes bone marrow failure, short stature, and acute myeloid leukemia, amongst other maladies. Patients with FA have a genetic defect that prevents the normal repair of genes and chromosomes within blood cells in the bone marrow. FA generally occurs in the first two decades of life and usually manifests itself in bleeding and infections as the bone marrow can no longer produce or inadequately produces platelets and blood cells. Life expectancy for those afflicted by FA is only 30 to 40 years. Approximately 60%-70% of cases arise from mutations in the FANC-A gene – the others being FANC-C and FANC-G – which is Rocket’s first target.

October Company Presentation

The current standard of care for FA is HSCT, which has provided many patients with healthy platelets and blood cells. However, a lack of perfect donor matches can result in graft versus host disease (GvHD) with a 10%-15% 100-day mortality rate. Rocket’s gene therapy utilizes patients’ own stem cells, reducing the risk of severely toxic hematologic outcomes.

Interim results of a 12-patient Phase 1/2 trial were encouraging with six of nine patients with greater than 12 months of follow-up post-infusion demonstrating sustained peripheral blood and bone marrow genetic correction with two others trending in that direction. Only one patient progressed to bone marrow failure and underwent successful allogenic HSCT. Rejection of the null hypothesis was hurdled when a fifth patient achieved increased mitomycin-C (a DNA damaging agent in bone marrow stem cells) resistance greater than 10% at two timepoints between 12 and 36 months. Only one severe adverse event (grade 2) was observed. Additionally, none of these patients underwent cytotoxic conditioning (chemotherapy) prior to the infusion.

With RMAT, PRIME, orphan drug, rare pediatric, fast track, and ATMP designations for RP-L102, Rocket expects to huddle with the FDA in 4Q22 to discuss a BLA filing timeline.

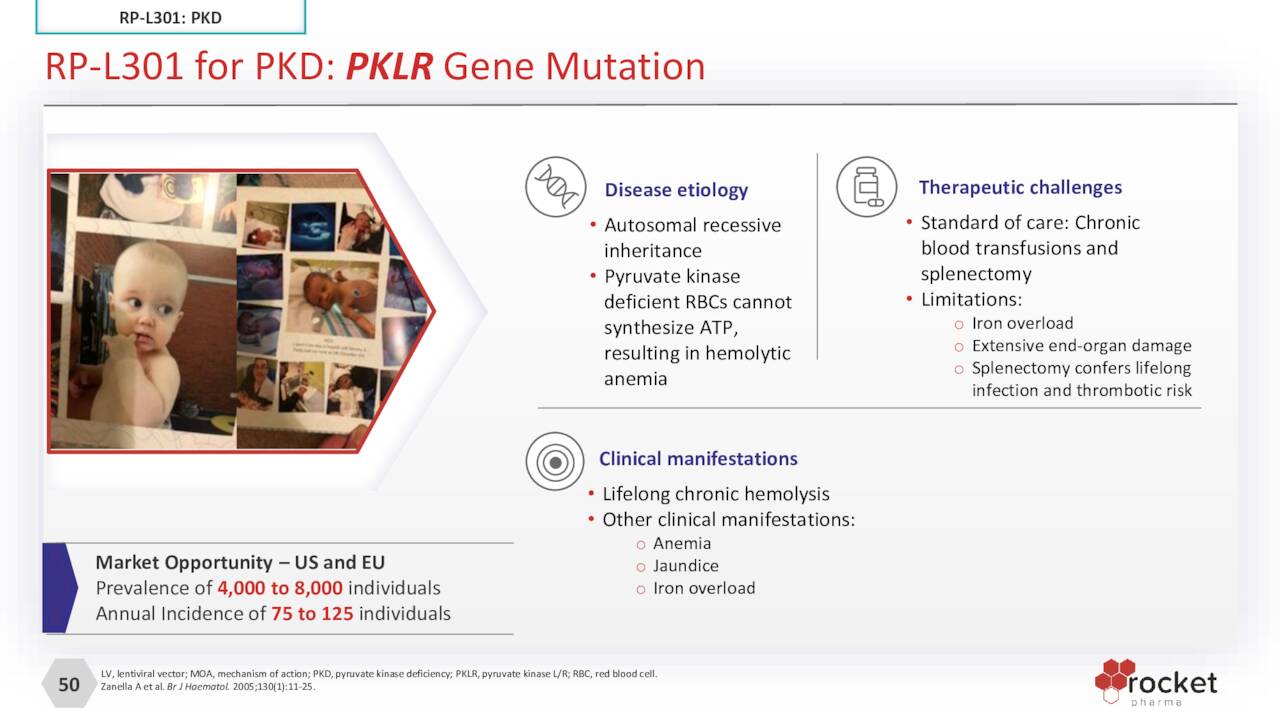

RP-L301. The company’s other LLV clinical asset is RP-L301, which is autologous HSCs transduced with LLV containing human PKLR transgene targeting pyruvate kinase deficiency [PKD]. Red blood cells deficient in PKs are oddly (non-spherically) shaped, rendering them unable to synthesize ATP, resulting in anemia. The incidence of PKD is ultra-rare, with 75 to 125 new cases across the U.S. and EU. RP-L301 is undergoing assessment in a 4 to 5-patient Phase 1 trial with data expected in 4Q22. RP-L301 has received orphan designations from both the FDA and EMA, as well as fast track and rare pediatric disease tags from the FDA.

October Company Presentation

All three of these LLV therapies were in-licensed from Centro de Investigaciones Energéticas, Medioambientales y Tecnológicas (CIEMAT) based in Madrid.

The technology for Rocket’s AAV platform was in-licensed from UC San Diego.

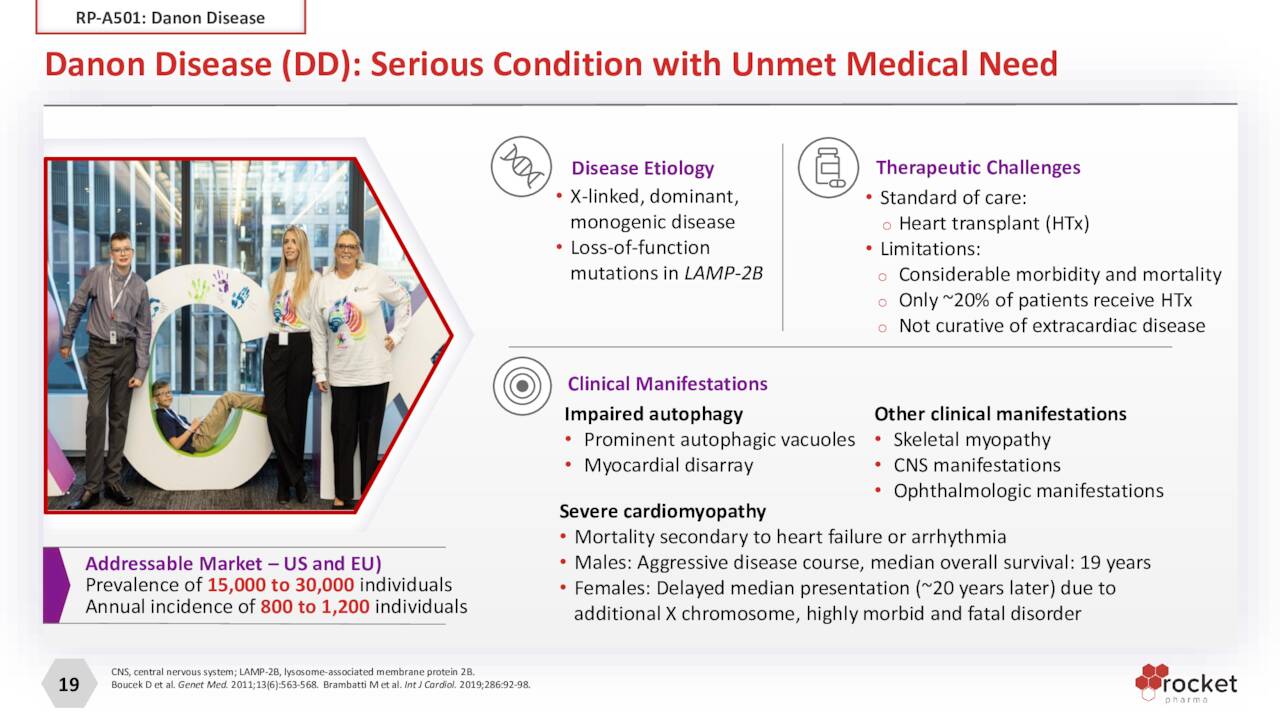

RP-A501. Rocket’s one clinical AAV therapy (RP-A501) has received the most investor attention over the past few years. It’s being studied in the treatment of Danon Disease, a genetic mutation of the LAMPB2 gene responsible for the accumulation of autophagic vacuoles, predominantly in cardiac and skeletal muscle, leading to severe myocardiopathy, liver disease, and intellectual development. Male patients typically require heart transplants and die in their teens or 20s. Danon is believed to afflict 15,000 to 30,000 in the U.S. and EU, with 800 to 1,200 new cases annually. Although certainly not huge, these numbers represent a large patient population for Rocket therapy, rendering an approval a potential blockbuster. However, concerns about the therapy were heightened when the FDA slapped a hold on its Phase 1 clinical trial in May 2021 after one young adult patient (of two) in the higher dose cohort experienced a severe adverse event. After Rocket abandoned the high-dose cohort and made other protocol modifications, the FDA lifted the hold in August 2021. Of the five patients with 12 months of follow-up, evidence of sustained cardiac LAMP2B gene expression was observed as well as qualitative improvements of vacuoles and cardiac tissue architecture. One patient with much more advanced diseased progressed and required heart transplant surgery. Overall, there is plenty of positive data/evidence to advance RP-A501 into Phase 2 study, which is expected to occur after an End of Phase 1 meeting with FDA before YE22. RP-A501 has received orphan drug, rare pediatric, and fast track designations in the U.S.

October Company Presentation

Renovacor Acquisition

Although the company elected not to go forward with its RP-L401 asset for the treatment of Infantile Malignant Osteopetrosis after an investigator-led Phase 1 study, it will pick up another program (BAG3 Dilated Cardiomyopathy) if it closes on its proposed acquisition of gene therapy concern Renovacor (RCOR) – likely in 1Q23. When the deal was announced on Sept. 19, 2022, the implied value from the exchange of 0.1676 shares of RCKT for each share of RCOR was ~$40 million.

Balance Sheet and Analyst Commentary:

To pay for the advancement of its programs, Rocket has been a serial issuer of its stock, raising net proceeds of over $620 million since the onset of 2019 through four secondaries, one private placement, and an ATM facility. The net effect has been to dilute shareholders by 63% over that period. Its most recent secondary was priced on Oct. 3, 2022, where it expects to raise net proceeds of just over $100 million at $14.75 a share. Rocket Pharmaceuticals held cash and investments of $306.5 million on Sept. 30, 2022, meaning it now has a cash runway into 2H24.

So far in November, six analyst firms including Needham and BTIG have reissued or assigned Buy/Outperform ratings to this stock. Price targets proffered range from $33 to $65 a share.

Beneficial owner RTW Investment, represented on the board by Chairman Roderick Wong, used the most recent secondary to add to its position, purchasing 1.36 million shares. RTW owns 24% of Rocket.

Verdict:

When we first visited Rocket at YE19, its stock was trading in the mid-20s. After the pandemic-induced selloff pushed shares of RCKT briefly under $10 in March 2020, they were trading over $60 nine months later, buoyed by positive FA and LAD-1 clinical trial data. A few months thereafter, the company used its elevated share price to raise $280.8 million at $56 – its last secondary until the recent raise. After a March 2021 PKD trial update was used as a profit-taking event, news of the clinical hold on RP-A501 in May 2021 didn’t hurt its stock much. The protracted slide began in July 2021, just prior to clinical hold lifting, as the biotech sector sold off significantly.

October Company Presentation

Except the small patient populations for its therapies – RP-A501 is the only current candidate with blockbuster potential – there’s not much to dislike here. Although a small sample size, there appears to be plenty of evidence to propel RP-A501 into a registrational trial around YE22. Rocket is actually reversing disease through its gene therapy concepts. There are plenty of companies developing gene therapies but there are plenty of rare diseases in need of this strategy. With likely two FDA approvals over the next 24 months validating its approach, the bet here is that some deep-pocketed big pharma company is going to buy Rocket to acquire its in-licensed viral vector platforms, and it will be at a significant multiple to its current price. Therefore, a small stake within a well-diversified biotech portfolio seems warranted.

Earth is a small town with many neighborhoods in a very big universe.”― Ron Garan

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment