Chris McGrath/Getty Images News

Overview

The Global X Renewable Energy Producers ETF (NASDAQ:RNRG) provides exposure to companies that produce energy from renewable sources including wind, solar, hydroelectric, geothermal, and biofuels.

The fund seeks to track the Indxx Renewable Energy Producers Index and is invested in 56 different holding as of 12/08/2022.

The fund has an expense ratio of 0.65% per annum, which is more expensive than other alternative energy exchange-traded funds (“ETFs”) (23rd cheapest among similar ETFs).

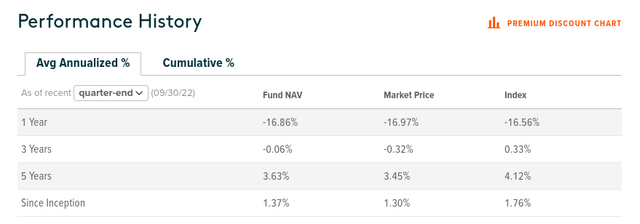

Fund performance

The RNRG fund has returned 1.30% per annum since its inception in 2015. The fund has not been able to track its benchmark index closely, with a tracking error of 0.46%.

Overall, the return has been quite poor in real terms, and when compared with the S&P 500 average return of 11.88% per annum since 1957.

Investors have not been compensated for the higher risk involved with a sector ETF.

The fund’s performance can be seen below:

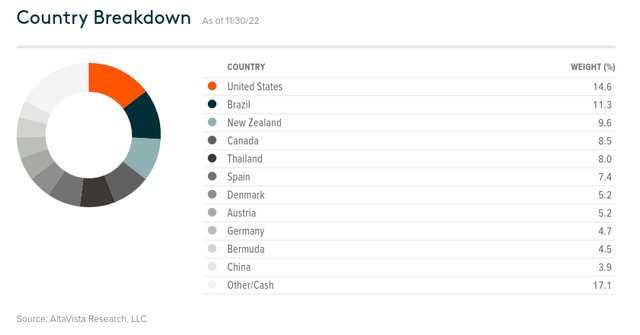

Portfolio

The fund’s portfolio exposures are regionally diversified across multiple countries. The highest country exposure is the United States at 14.6%, while China is the lowest at 3.9%.

The fund is also exposed to European countries, such as Spain, Denmark, Austria and Germany, which constitute 22.5% of the portfolio.

The fund’s country breakdown can be seen below:

One interesting aspect of the country breakdown is that the fund will benefit from the U.S. Inflation Reduction Act, the REPowerEU plan, and China’s 14th Five-Year Plan.

These three fiscal reforms have been the main drivers for an upward revision of IEA’s renewable power forecast, which we will discuss in detail in the next section.

Upward revision of IEA’s renewable power forecast

The Russian invasion of Ukraine has triggered a global energy crisis. Energy security concerns have created an unprecedented momentum for renewables, according to the International Energy Agency (“IEA”).

Disruptions in the oil and gas markets have highlighted the energy security benefits of producing renewable energy domestically.

Governments around the world have been driving energy market reforms by incentivizing the production of renewable energy locally.

Additionally, the rise in oil and gas prices has increased the competitiveness of renewable energies such as solar and wind.

Against this backdrop, the IEA has just made its largest-ever upward forecast revision for renewable power expansion.

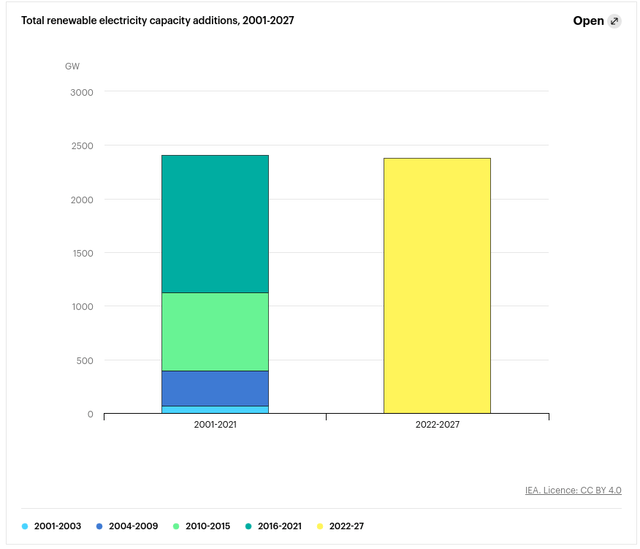

According to the IEA, the total renewable electricity capacity addition for the next 5 years is expected to be equivalent to the growth seen over the last 10 years – see chart below:

From 2022 to 2027, renewable power is expected to grow almost 2400 GW, equivalent to the entire installed power capacity of China today.

Renewable power is expected to represent over 90% of global electricity capacity expansion for the period.

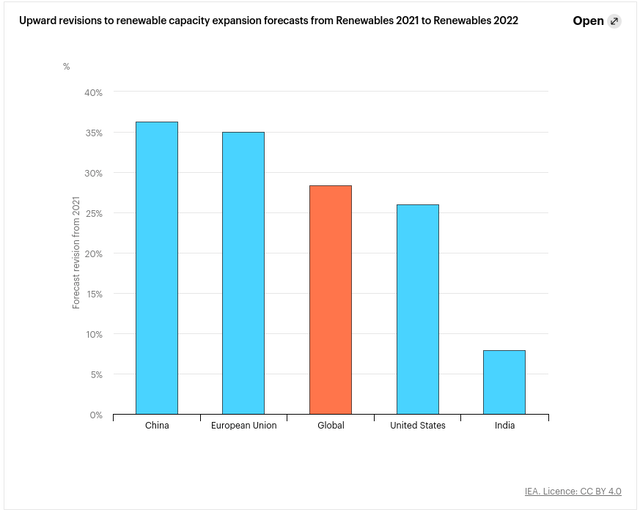

The upward revision is largely driven by policy reforms in China, the European Union, and the United States. As the fund is regionally exposed to these countries, it is likely to benefit from the policy reforms being implemented in these countries.

The chart below shows the countries supporting the upward revision of renewable energy forecasts from 2021 to 2022:

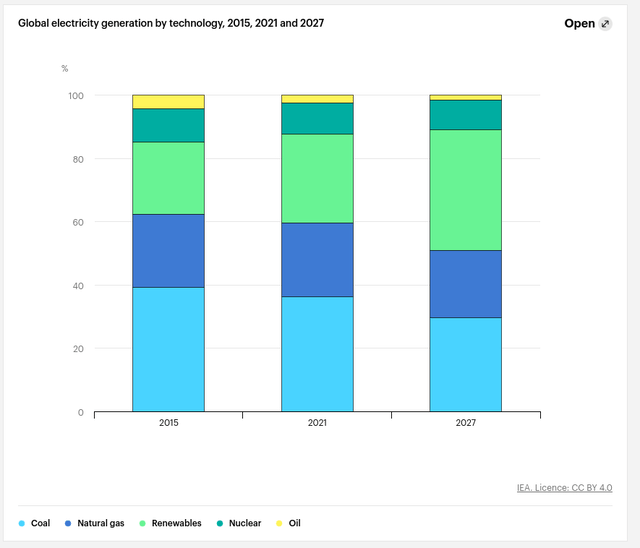

The IEA forecasts that renewable energy will change the global power mix by 2027 and is the only technology that is expected to grow, with declining shares for coal, natural gas, nuclear and oil.

Renewables are expected to surpass coal by early 2025 and become the largest source of electricity generation.

The chart below shows the global electricity generation by technology for 2015, 2021 and 2027:

Within renewables, wind and solar are expected to account for 20% of global power generation by 2027, doubling over the next 5 years.

Conclusion

The RNRG ETF is ideally positioned to benefit from the energy policy reforms being implemented in the United States, European Union and China.

Disruptions in the oil and gas markets have been a positive for renewables. The largest-ever upward forecast revision by IEA is a sign of a growing and accelerating renewable energy sector.

Following the IEA report, I am supportive of a buy for the RNRG fund as renewable energy is the future.

If you enjoyed the article, please subscribe to receive my latest articles.

Be the first to comment