Justin Sullivan/Getty Images News

Rite Aid Corp. (NYSE:RAD) “defaulted” last month because of their distressed exchange deal according to S&P. While this does not actually mean that the retail pharmacy chain is bankrupt, it does serve as a warning that they are in very serious trouble both financially and operationally. The current RAD stock price of $7.08 is effectively only a little over $0.35 after factoring in the 1-20 the 2019 reverse stock split. This article is an update from my prior articles that covers a few key issues.

Rite Aid “Defaulted” According to S&P

In June, Rite Aid had a cash exchange that purchased a total of $193.592 million principal amount of debt for $150 million cash, which reduced net debt by $43.592 million. The weighted average price was about 77.5. Most of the cash came from their 1lien revolving credit facility.

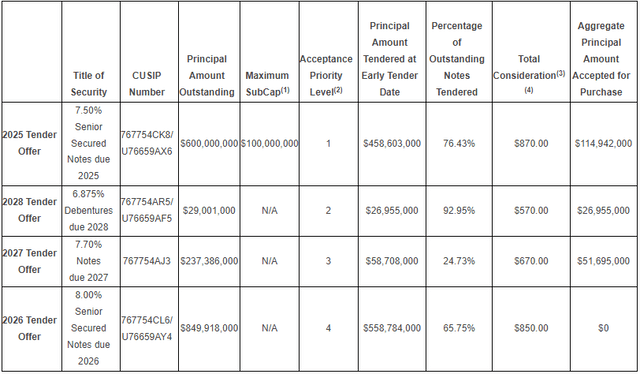

As can be seen by the results in the table below, most of the repurchased debt is 2lien and some is unsecured debt. The annual interest on the purchased debt is $14.45 million by my calculations. The interest rate on the revolver is either a “base rate” plus 0.25% to 0.75% or LIBOR plus 1.25% to 1.75% depending upon average ABL availability. So, if short-term rates soar, their effective interest savings could be very modest.

S&P considers that Rite Aid “defaulted” because of this distressed exchange. S&P also reduced their rating to SD from CC on June 30. (“A ‘SD’ rating is assigned when S&P Global Ratings believes that the obligor has selectively defaulted on a specific issue or class of obligations but it will continue to meet its payment obligations on other issues or classes of obligations in a timely manner”.)

Cash Exchange Results

Cash Exchange Results (sec.gov)

The reduction of $43.592 million in net debt is a very small amount relative to Rite Aid’s over $3 billion in debt outstanding. Some cynics might assert that the recent debt repurchase using mostly cash from the revolver was just investors moving chairs around to get better seats on the Titanic and those accepting large discounts from par were those who wanted off the ship now.

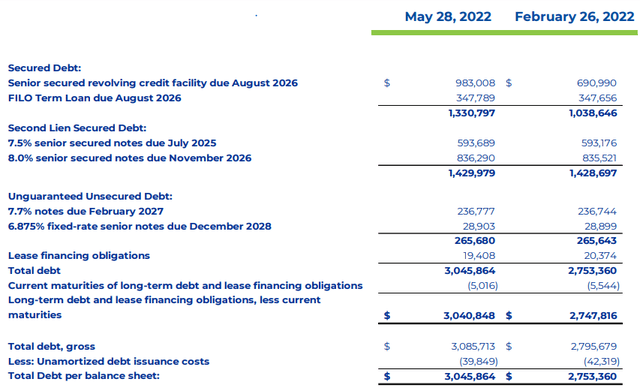

Debt Structure

(Note: These numbers are prior to the June cash exchange transaction)

After this debt repurchase, about $485 million 7.5% notes remain outstanding and mature on July 1, 2025. The “notes have a second lien on ABL collateral, which largely includes inventory, prescription files and some receivables, and a first lien on most remaining assets” according to Fitch. This note will have to be refinanced before maturity and with rising interest rates, especially for very low credit paper, they could have some serious problems trying to roll this over. If they are burning a lot of cash from paying interest on all their debt and having negative total cash flow in late 2024 and early 2025, I would expect that negations would begin for a restructuring support agreement – RSA. Since there is so much debt that would have priority for recovery over equity, I would expect no recovery for RAD shareholders.

This is why they need to get their act together immediately. While closing more unprofitable stores will help a little, the reality is they need, in my opinion, a new partner to put in a significant amount of cash to create a realistic business model and not one that just patches a few leaks on their sinking ship. Who? Good question – I don’t know who.

Selling major assets might seem like a logical idea, but I think potential buyers might wait to get a better deal in bankruptcy court under either sections 363 or 365 and that would also avoid the potential future risk of any assertions by creditors that amount Rite Aid received for the asset was “less than a reasonably equivalent value” (section 548). Lenders’ approval for sale of certain assets would also be needed. The reality is that some of these lenders may actually be “loaning to own”. They want to own some of Rite Aid’s very valuable assets via “credit bids” on their collateral during the Ch.11 bankruptcy process. These lenders would benefit from these prized assets – not RAD shareholders.

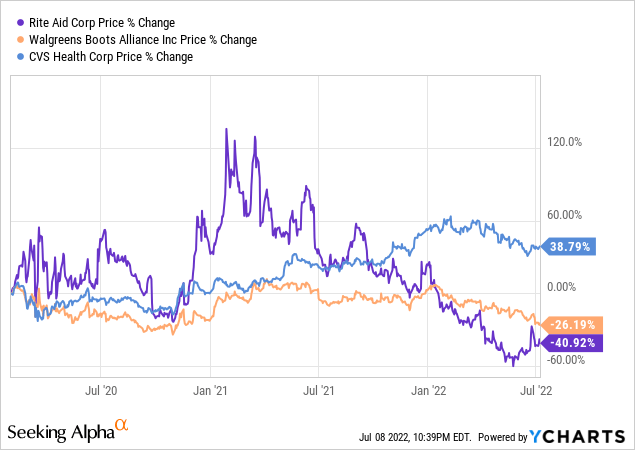

Stock Price Changes Since the Start of the Pandemic (2/1/2020)

Vendor Financing Problems Are Getting Worse

Often companies end up in Ch.11 bankruptcy because of vendor issues. Vendors worry that they may not be paid and will require prepayment or large deposits prior to shipping. Accounts payable to vendors are just unsecured claims and often receive very low or even no recovery in Ch.11 bankruptcy. There is a major exception. Those items “received” within 20 days prior to filing for bankruptcy are considered section 503(b)(9) claims and have priority for recovery under a reorganization plan. This is a major distinction. For some bankruptcy cases this is not an issue because under the terms of their negotiated DIP financing agreement all vendors are paid in a timely manner, but these special terms are not known to vendors as a company slides into bankruptcy. Often it is the vendor’s bankers that actually require stricter financing terms for the vendor’s customers with weakening financial conditions.

The vendor issue did come up in the recent conference call and management attempted to reassure analysts that they are on top of this issue. Based on one metric, it does seem that the vendor issue is starting to become a major problem. Inventories as of May 28, 2022 were financed 74% by accounts payable (Inventories/Accounts Payable). This is down from 80% on February 26, 2022 and 83% on May 29, 2021. The lower the financing by accounts payable could imply that vendors are becoming stricter in the dealings with Rite Aid. To finance these inventories, Rite Aid has been borrowing more on their revolver, which increases interest expenses and has a negative impact on cash flow. So far it is not a serious issue (yet), but RAD shareholders need to monitor this metric closely going forward.

Latest Conference Call

The June 23 conference call further reduced my confidence in management. Even a number of analysts seemed to question the numbers and statements by management.

Their new guidance was for revenue of $23.6 billion-$24 billion and EBITDA of $460 million-$500 million. I question these projections for a number of reasons. First, I think short-term rates will increase more than their 300-basis point assumption. Second, I think labor costs will increase more than they expect. Management stated that they “don’t expect to do any other additional significant wage increases”. I disagree. To keep employees, given the very high rate of inflation, they will have to pay a lot more. Third, I think they will have worse vendor issues going forward, which will mean higher interest expenses because they will have to borrow more cash to pay vendors under new stricter terms. Next, I expect supply chain problems to continue for some time. Lastly, I expect consumers to become even more price sensitive when shopping because of the high rate of inflation and Rite Aid is not a “99 Cents” store – they are often expensive even with their new loyalty program.

Rite Aid used (burned) $252.2 million cash in their latest 13-week period that was financed by borrowing $291 million additional cash from their revolver. Management asserted that they will securitize their CMS receivables later this year to raise cash. They also mentioned during the call that they are considering additional sale-leaseback deals to raise cash.

Management and the Board Are Major Negatives

Rite Aid had major management and board problems for years and those problems have continued, in my opinion. Of course, shareholders share some of the blame because they voted for the directors and shareholders are to blame for trying to defeat the purchase of Rite Aid by Albertsons (ACI) in 2018. They should have agreed, in my opinion, at the price/terms offered and moved on, reinvesting in other undervalued securities because buyers rarely are willing to pay “fair” value in M&A deals. RAD stock price has plunged since that deal was terminated.

Except for the CEO, no board member has made an open market purchase of RAD shares using their own cash during the last two years. They just get additional shares via compensation packages. The CEO, Heyward Donigan, did make a 14,350 share purchase in late 2021. That is a token amount compared to her pay. She was paid (note that I did not write “she earned”) a total of $9.912 million in 2022, while the company reported a loss of $9.46 per share. She was also paid $9.571 million in 2020 when they lost $1.87 per share and $8.619 million in 2019 when they reported a loss of $8.82 per share. Why? I just read of massive losses on Rite Aid’s income statements and lower RAD stock price. I also do not see any real strong background of individual board members that would have a dynamic positive impact on restructuring their business model.

Conclusion

This article is just an update and is not an attempt to give complete coverage of Rite Aid Corp. RAD stock price has dropped 64% since my February 26, 2021, article and dropped 45% since my November 18, 2021, article. My prior articles had sell recommendations. I am now rating RAD neutral/hold. This change is not because any improvement in their outlook, but only because the stock price has dropped so sharply. Holding at this point is like holding a lottery ticket hoping that something positive might happen, such as new dynamic management or new outside capital is injected into Rite Aid.

The reality is, however, that most lottery tickets become worthless. Their guidance numbers seem unrealistic because I am expecting much higher short-term interest rates, employee expenses will rise as inflation continues, and the vendor issues continue to get worse. I have serious doubts at this time that they can refinance their 2025 debt and will, therefore, be forced eventually into Ch.11.

Be the first to comment